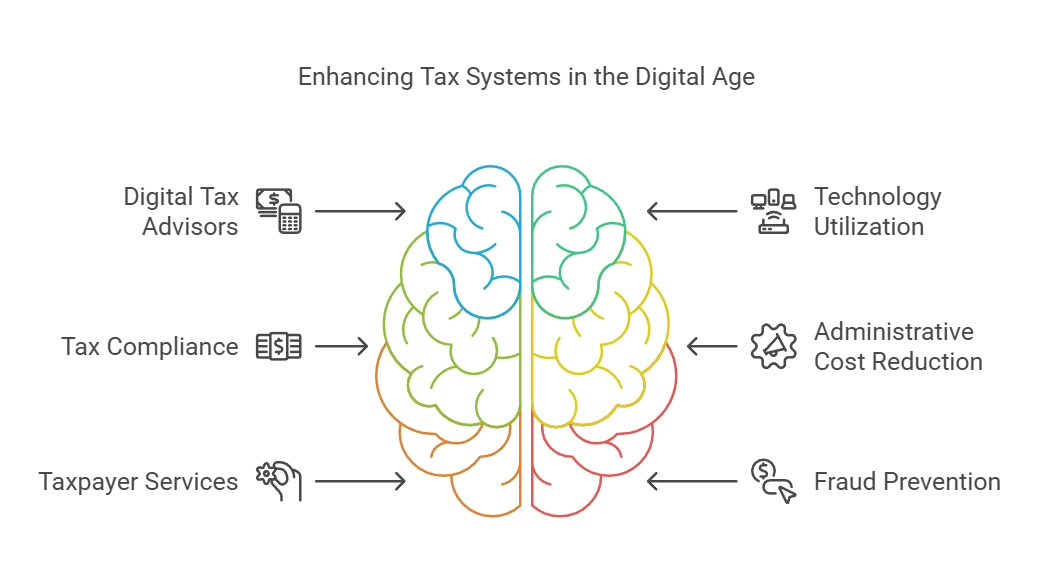

The digital age has ushered in new challenges and opportunities for tax authorities worldwide. As governments seek to modernise their revenue collection systems, the role of a Digital Tax & Revenue Collection Advisor has become increasingly vital. These specialists help public sector organisations leverage technology to improve tax compliance, reduce administrative costs, and boost overall efficiency.

Digital Tax & Revenue Collection Advisors assist tax authorities in implementing cutting-edge solutions to streamline tax administration processes and enhance revenue collection. They work closely with government agencies to develop strategies that utilise data analytics, artificial intelligence, and other digital tools to identify tax gaps, combat fraud, and improve taxpayer services.

By embracing digital technologies, tax authorities can create more user-friendly interfaces for taxpayers, automate routine tasks, and gain valuable insights from vast amounts of data. This shift towards digital tax administration not only benefits the government but also simplifies compliance for businesses and individuals, fostering a more transparent and efficient tax ecosystem.

Key Takeaways

- Digital advisors help tax authorities modernise revenue collection systems

- Technology improves tax compliance and reduces administrative costs

- Digital solutions enhance taxpayer services and combat fraud effectively

Understanding the Digital Tax & Revenue Collection Advisor (Public Sector) Role

The Digital Tax & Revenue Collection Advisor plays a crucial role in modernising tax administration systems for public sector organisations. This role combines expertise in taxation, technology, and public policy to improve revenue collection processes and enhance taxpayer experiences.

Core Responsibilities in the Public Sector

Digital Tax & Revenue Collection Advisors focus on digital transformation of tax administration. They analyse existing systems and recommend improvements to streamline tax collection processes. Key tasks include:

• Developing digital strategies for tax authorities

• Implementing automated systems for tax filing and payment

• Designing user-friendly interfaces for taxpayers

• Enhancing data analytics capabilities for audit assessments

• Improving fraud detection mechanisms

These advisors also work on integrating emerging technologies like artificial intelligence and blockchain to boost efficiency. They aim to reduce manual processes, minimise errors, and speed up refunds.

Relevant Policy and Regulatory Context

Advisors must stay updated on tax laws, regulations, and policies affecting public sector revenue collection. They need to:

• Understand national and local tax codes

• Keep abreast of changes in digital taxation policies

• Ensure compliance with data protection and privacy laws

• Align digital initiatives with government tax administration strategies

They play a vital role in translating complex regulations into practical digital solutions. This involves balancing the need for efficient revenue collection with taxpayer rights and data security concerns.

Typical Stakeholders and Decision-Making Processes

Digital Tax & Revenue Collection Advisors interact with various stakeholders in the public sector. These include:

• Senior government officials

• Tax authority leadership

• IT departments and technology vendors

• Finance ministry representatives

• Taxpayer advocacy groups

They participate in decision-making processes by presenting digital transformation proposals to key stakeholders. Advisors must build consensus among different groups and address concerns about system changes.

Collaboration with IT teams is essential to ensure smooth implementation of new digital tools. They also work closely with policy makers to align digital initiatives with broader government objectives for taxation and public services.

Key Qualities and Areas of Expertise

A Digital Tax & Revenue Collection Advisor in the public sector requires a diverse skill set. This role demands technical expertise, institutional knowledge, and adaptability to navigate complex tax systems and emerging technologies.

Technical/Subject-Matter Expertise

Digital Tax & Revenue Collection Advisors need deep knowledge of tax laws and regulations. They must stay current on digital tax innovations and emerging technologies. Key areas include:

- Advanced data analysis skills

- Proficiency in tax software and digital platforms

- Understanding of artificial intelligence and machine learning applications in tax collection

- Knowledge of cybersecurity best practices for protecting sensitive financial data

These professionals should be able to interpret complex tax codes and translate them into actionable digital strategies. They need to bridge the gap between traditional tax practices and modern technology solutions.

Institutional Knowledge and Networks

Success in this role requires a deep understanding of public sector operations. Advisors should:

- Have experience working with government agencies and tax authorities

- Understand the unique challenges of public sector digital transformation

- Maintain a network of contacts in relevant government departments and private sector partners

- Be familiar with procurement processes and budgeting in the public sector

This knowledge helps advisors navigate bureaucratic structures and implement effective solutions tailored to government needs.

Adaptability and Problem-Solving Skills

The rapidly evolving landscape of digital tax collection demands flexibility. Key skills include:

- Ability to quickly learn and adapt to new technologies

- Creative problem-solving to address unique challenges in tax administration

- Strong project management skills to oversee complex digital initiatives

- Talent for translating technical concepts for non-technical stakeholders

Advisors must be able to identify inefficiencies in current systems and propose innovative solutions. They should be comfortable working in cross-functional teams and managing change within large organisations.

Strategic Value to External Organisations

Digital tax and revenue collection advisors offer crucial support to public sector entities. They help modernise tax systems, improve compliance, and boost revenue collection efficiency.

Navigating Complex Procurement and Funding

Advisors guide organisations through intricate procurement processes for digital tax systems. They help identify suitable technology vendors and negotiate contracts. These experts assist in securing funding for large-scale digital transformation projects.

Advisors analyse cost-benefit ratios and return on investment for proposed solutions. They create compelling business cases to justify expenditure on new tax collection systems. This helps secure buy-in from key stakeholders and funding bodies.

Their expertise ensures that public sector entities make informed decisions when investing in digital tax infrastructure. This reduces the risk of costly mistakes and improves the chances of successful implementation.

Policy and Market Foresight

Digital tax advisors provide valuable insights into emerging trends and technologies. They help public sector organisations anticipate changes in tax legislation and market dynamics. This foresight enables proactive planning and strategy development.

Advisors analyse global best practices in digital tax collection. They identify innovative approaches that can be adapted to local contexts. This helps organisations stay ahead of the curve and implement cutting-edge solutions.

Their expertise covers various tax types, including VAT, income tax, and corporate tax. They offer guidance on addressing tax gaps and combating tax avoidance and evasion. This comprehensive approach ensures that policy decisions are well-informed and effective.

Enhancing Credibility and Compliance

Digital tax advisors help build trust between tax authorities and taxpayers. They design user-friendly systems that make tax compliance easier for individuals and businesses. This improves voluntary compliance rates and reduces the tax gap.

Advisors develop strategies to enhance visibility and oversight of tax collection processes. They implement robust audit trails and data analytics to detect fraud and tax evasion. This increases the credibility of tax authorities and deters non-compliance.

Their expertise helps create fair and transparent tax systems. This fosters a culture of compliance and contributes to greater social equity. It also improves the overall governance of public finances.

Leveraging Public Sector Data and Insights

Digital tax advisors help organisations harness the power of data analytics. They design systems that collect and analyse vast amounts of tax-related data. This enables more accurate revenue forecasting and targeted enforcement efforts.

Advisors develop strategies for data sharing across multiple jurisdictions. This improves the detection of cross-border tax evasion and enhances international cooperation. It also helps create a more comprehensive view of taxpayer behaviour and compliance patterns.

Their expertise in data management ensures that sensitive tax information is securely handled. They implement robust data protection measures to maintain public trust. This balanced approach maximises the value of public sector data while safeguarding privacy.

Practical Outcomes and Applications

Digital tax systems offer tangible benefits for governments and taxpayers alike. They streamline processes, boost compliance, and enhance revenue collection. These systems also provide valuable data insights for policy decisions.

Product Development and Service Enhancement

Tax agencies can create user-friendly digital tools to simplify tax filing. Mobile apps allow taxpayers to validate invoices, view e-documents, and schedule appointments. These apps make tax compliance easier for businesses and self-employed individuals.

Online portals can offer personalised tax guidance. They can use AI to answer queries and provide real-time support. This reduces the need for in-person visits to tax offices.

Digital systems can also automate tax calculations. This cuts errors and speeds up processing times. It's especially helpful for complex business taxes.

Go-To-Market and Engagement Strategies

Tax agencies must promote their digital services effectively. They can partner with business groups to reach traders and self-employed people. Social media campaigns can raise awareness among younger taxpayers.

Free workshops and webinars can teach people how to use new digital tax tools. This builds confidence and increases adoption rates.

Case studies of successful users can showcase the benefits. They can highlight time saved and improved accuracy.

Tax agencies should also engage with tax professionals. These experts can help spread the word about new digital services to their clients.

Long-Term Sustainability and Growth

To ensure long-term success, tax agencies must keep their digital systems up-to-date. Regular software updates can add new features and fix bugs.

Agencies should invest in robust cybersecurity measures. This protects sensitive tax data and builds public trust.

Modular systems allow for easier updates and integration of new technologies. This approach is more cost-effective in the long run.

Continuous staff training is crucial. It ensures tax officers can use new digital tools effectively and assist taxpayers.

Measuring Impact and ROI

Tax agencies must track key performance indicators (KPIs) to assess their digital transformation efforts. These might include:

- Increase in tax compliance rates

- Reduction in processing times

- Cost savings from automation

- User satisfaction scores

Regular surveys can gather feedback from taxpayers and businesses. This data helps identify areas for improvement.

Productivity gains should be measured. For example, how many more tax returns can be processed per hour using the new system?

Agencies should also track the impact on tax revenue. Has digital transformation led to better detection of tax evasion or increased voluntary compliance?

Frequently Asked Questions

Digital tax and revenue collection roles in the public sector involve complex responsibilities and specialised skills. The following questions address key aspects of these positions, including compensation, technology, and qualifications.

What are the typical salary ranges for a Digital Tax and Revenue Collection Advisor in the public sector?

Salaries for Digital Tax and Revenue Collection Advisors in the UK public sector typically range from £35,000 to £65,000 per year. This varies based on experience, location, and specific role requirements.

Senior advisors or those with specialised skills may earn up to £80,000 annually. Factors like budget constraints and local authority policies can impact salary offerings.

How does SAP Tax and Revenue Management for Public Sector enhance revenue collection processes?

SAP Tax and Revenue Management streamlines tax administration and improves revenue collection efficiency. It automates many manual processes, reducing errors and processing time.

The system provides real-time data insights, helping authorities identify tax gaps and improve compliance. It also enhances citizen services by offering digital self-service options for taxpayers.

What are the necessary qualifications for SAP Tax and Revenue Management roles in the public sector?

Qualifications for SAP Tax and Revenue Management roles typically include a bachelor's degree in accounting, finance, or a related field. SAP certification in relevant modules is often required or preferred.

Strong analytical skills and knowledge of tax regulations are essential. Experience with public sector financial management and digital transformation projects is valuable.

What is the minimum income threshold for mandatory digital tax reporting?

The minimum income threshold for mandatory digital tax reporting under Making Tax Digital (MTD) varies by tax type. For VAT, businesses with taxable turnover above £85,000 must comply.

For Income Tax Self Assessment, the threshold is £10,000 of business or property income. This applies to self-employed individuals and landlords.

How can one authorise a tax agent for Making Tax Digital compliance?

To authorise a tax agent for MTD compliance, taxpayers must grant them access through their Government Gateway account. This process involves logging in and adding the agent's details.

Agents need to be registered with HMRC and have an Agent Services Account. Taxpayers can specify which tax services the agent can access on their behalf.

What are the principal responsibilities of an HMRC Tax Advisor?

HMRC Tax Advisors provide guidance on tax laws and regulations to ensure compliance. They help interpret complex tax rules for both individuals and businesses.

These advisors assist with tax returns, audits, and resolving disputes with HMRC. They also stay updated on changes in tax legislation to offer current and accurate advice.