The Infrastructure and Projects Authority (IPA) plays a vital role in the UK government's efforts to deliver major infrastructure projects. As part of this work, the IPA employs Infrastructure Finance Advisors to provide expert guidance on complex financial matters. These professionals bring a wealth of experience in project finance, strategic delivery, and infrastructure development to support the successful implementation of critical initiatives across various sectors.

The role of an Infrastructure Finance Advisor at the IPA involves working closely with government departments and industry partners. They offer valuable insights on financial structuring, risk management, and funding strategies for large-scale projects. From nuclear power stations and railways to schools and hospitals, these advisors help shape the financial framework that underpins the UK's infrastructure landscape.

With salaries ranging from £95,000 to £140,000 per year, the position attracts top talent in the field. The IPA seeks individuals with a strong background in project finance and a deep understanding of government operations. These advisors work at the heart of government, reporting to both the Cabinet Office and HM Treasury, ensuring that financial decisions align with broader policy objectives.

Key Takeaways

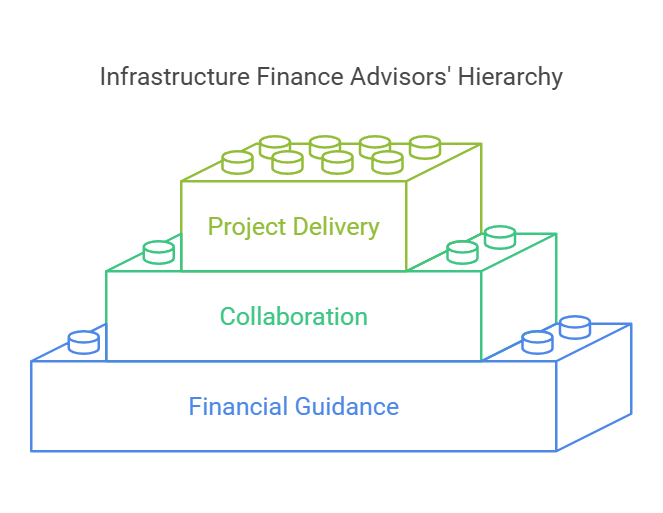

- Infrastructure Finance Advisors provide expert financial guidance for major UK infrastructure projects

- The role involves collaboration with government departments and industry partners on complex financial matters

- Advisors contribute to the successful delivery of diverse projects, from energy infrastructure to public services

Understanding the Infrastructure Finance Advisor (Infrastructure and Projects Authority) Role

The Infrastructure Finance Advisor plays a crucial role in supporting major projects and unlocking private sector investment. This position involves advising the government on financing options and engaging with investors to align project requirements with market appetite.

Core Responsibilities in the Public Sector

The Infrastructure Finance Advisor's main duties revolve around financial strategy and investor relations. They help deliver infrastructure and major projects by:

- Analysing private sector investment opportunities

- Advising on policy implications of private finance

- Developing financing strategies for large-scale projects

- Liaising with investors to understand market conditions

These professionals must have a deep understanding of both public sector needs and private sector motivations. They often work on complex, long-term projects that require careful financial planning and risk assessment.

Relevant Policy and Regulatory Context

Infrastructure Finance Advisors must navigate a complex policy landscape. Key areas include:

- Government infrastructure plans and priorities

- Public-private partnership regulations

- Procurement policies and best practices

- Environmental and social governance standards

They need to stay up-to-date with changes in legislation that may impact project financing. This role requires a balance between achieving public sector goals and creating attractive investment opportunities.

Typical Stakeholders and Decision-Making Processes

Infrastructure Finance Advisors interact with a wide range of stakeholders, including:

- Government departments and agencies

- Private investors and financial institutions

- Project developers and contractors

- Local authorities and community representatives

The Infrastructure and Projects Authority (IPA) sits at the heart of government, reporting to both the Cabinet Office and HM Treasury. This position involves participating in high-level decision-making processes, often requiring:

- Preparing detailed financial models and reports

- Presenting recommendations to senior officials

- Facilitating negotiations between public and private entities

- Contributing to policy development and strategic planning

The role demands strong analytical skills, excellent communication abilities, and a talent for building consensus among diverse stakeholders.

Key Qualities and Areas of Expertise

An Infrastructure Finance Advisor in the Infrastructure and Projects Authority needs a diverse skill set. These professionals must blend technical knowledge with institutional understanding and problem-solving abilities.

Technical/Subject-Matter Expertise

Infrastructure Finance Advisors must have deep knowledge of finance and project management. They should understand complex financial models and risk assessment techniques. Familiarity with public-private partnerships (PPPs) is crucial.

These experts need to grasp infrastructure sectors like transport, energy, and digital networks. They must stay current on market trends and financing options.

Strong analytical skills are vital. Advisors analyse project viability and financial structures. They must interpret data and create clear reports for decision-makers.

Institutional Knowledge and Networks

The Infrastructure and Projects Authority (IPA) is at the heart of government. Advisors need to understand how different departments work together.

They should know key stakeholders in government and industry. Building and maintaining professional networks is essential.

Advisors must grasp policy frameworks and regulatory environments. They need to align projects with government priorities and strategies.

Understanding procurement processes and public sector budgeting is crucial. This knowledge helps in structuring deals that work for all parties.

Adaptability and Problem-Solving Skills

Infrastructure projects often face unexpected challenges. Advisors must think on their feet and find creative solutions.

They should be able to balance competing interests. This might involve negotiating between public and private sector partners.

Advisors need to adapt their approach for different projects. Each infrastructure sector has unique needs and constraints.

Strong communication skills are vital. Advisors must explain complex ideas to various audiences, from ministers to technical experts.

Strategic Value to External Organisations

Infrastructure Finance Advisors at the Infrastructure and Projects Authority (IPA) offer crucial support to external organisations. Their expertise helps navigate complex processes, provides valuable insights, and enhances project credibility.

Navigating Complex Procurement and Funding

IPA advisors guide external organisations through intricate procurement and funding landscapes. They help identify suitable funding sources, including public-private partnerships and government grants. These experts assist in crafting compelling business cases that align with government objectives.

Advisors offer tailored strategies for different project types, from transport to energy infrastructure. They ensure compliance with UK procurement regulations and best practices.

Their support extends to contract negotiations, risk assessment, and financial modelling. This comprehensive approach helps external organisations secure funding and deliver projects efficiently.

Policy and Market Foresight

IPA advisors provide valuable insights into policy trends and market dynamics. They analyse government initiatives and economic factors that may impact infrastructure projects.

These experts forecast potential changes in regulations, funding priorities, and industry standards. This foresight helps organisations adapt their strategies and stay ahead of the curve.

Advisors also identify emerging opportunities in the infrastructure sector. They guide organisations towards innovative solutions and technologies that align with government priorities.

Their market intelligence helps external partners make informed decisions and position themselves strategically in the infrastructure landscape.

Enhancing Credibility and Compliance

IPA advisors boost the credibility of external organisations' infrastructure proposals. They ensure projects meet rigorous government standards and best practices.

These experts help align projects with national infrastructure plans and sustainability goals. Their involvement signals a commitment to quality and compliance.

Advisors guide organisations through regulatory requirements and environmental assessments. This support minimises legal and reputational risks associated with large-scale projects.

By leveraging IPA expertise, external partners demonstrate their capacity to deliver complex infrastructure initiatives effectively and responsibly.

Leveraging Public Sector Data and Insights

IPA advisors offer unparalleled access to public sector data and insights. They tap into a vast knowledge base spanning various infrastructure sectors and government priorities.

These experts analyse trends from the Government Major Projects Portfolio to inform strategic decisions. They help external organisations benchmark their projects against successful initiatives.

Advisors facilitate knowledge sharing between public and private sectors. This collaboration leads to more innovative and efficient project delivery.

Their insights help external partners align with government objectives, increasing the chances of project approval and support.

Practical Outcomes and Applications

The Infrastructure Finance Advisor role brings tangible benefits to projects and organisations. It shapes financial strategies, enhances service delivery, and drives sustainable growth. Effective advisors measure impact and ensure long-term value.

Product Development and Service Enhancement

Infrastructure Finance Advisors play a key role in shaping new products and services. They analyse market needs and financial feasibility to guide development.

Advisors help create innovative funding models. These may include public-private partnerships or green bonds for eco-friendly projects.

They also work to improve existing services. This might involve finding ways to cut costs or boost efficiency. For example, they might suggest using new technologies to streamline operations.

Advisors often collaborate with technical experts. Together, they ensure financial plans align with project goals and technical requirements.

Go-to-Market and Engagement Strategies

Effective go-to-market strategies are crucial for infrastructure projects. Finance Advisors help develop these plans to attract investors and stakeholders.

They craft compelling business cases. These showcase project benefits and financial returns to potential backers.

Advisors also design engagement plans. These aim to build support from local communities and government bodies.

Key tasks include:

- Creating investor presentations

- Organising roadshows and stakeholder meetings

- Developing marketing materials that highlight financial strengths

Advisors often work with communication teams. This ensures financial messages are clear and persuasive to all audiences.

Long-Term Sustainability and Growth

Infrastructure Finance Advisors focus on long-term project viability. They develop strategies to ensure continued funding and growth.

Key areas include:

- Risk management plans

- Revenue generation strategies

- Cost optimisation techniques

Advisors might suggest creating reserve funds. These protect against future financial shocks.

They also look for ways to diversify income streams. This could involve exploring new markets or services related to the project.

Sustainability is a growing concern. Advisors increasingly incorporate environmental and social factors into financial plans.

Measuring Impact and ROI

Measuring project success is vital. Finance Advisors develop frameworks to track financial performance and broader impacts.

They set up key performance indicators (KPIs). These might include:

- Return on investment (ROI)

- Job creation figures

- Environmental benefits

Advisors use sophisticated tools to analyse data. This helps them produce regular reports for stakeholders.

They also conduct post-project evaluations. These assess if outcomes met initial projections and identify lessons for future projects.

By measuring impact, advisors help justify public spending and attract future investment. They ensure projects deliver value for money and meet societal needs.

Frequently Asked Questions

Infrastructure Finance Advisors play a crucial role in the Infrastructure and Projects Authority. They provide financial expertise for major government projects and support infrastructure development across the UK.

What are the typical responsibilities of an Infrastructure Finance Advisor within the Infrastructure and Projects Authority?

Infrastructure Finance Advisors analyse complex financial data for large-scale projects. They provide guidance on funding options and financial structures.

These advisors also assess project risks and develop mitigation strategies. They work closely with government departments and private sector partners.

How does one pursue a career as an Infrastructure Finance Advisor at the Infrastructure and Projects Authority?

Aspiring advisors should gain experience in finance, particularly in infrastructure or project finance. Many start their careers in private sector financial institutions.

Networking and staying informed about government infrastructure initiatives can help identify opportunities. Applying for relevant Civil Service positions is often the first step.

Can you outline the progression and salary expectations for an Infrastructure Finance Advisor role?

Entry-level advisors typically start in junior positions. With experience, they can progress to senior advisor roles and eventually to project director positions.

Salaries vary based on experience and specific role. Senior advisors can expect competitive compensation packages in line with other high-level Civil Service positions.

What qualifications and experience are typically required for an Infrastructure Finance Advisor position?

Most positions require a degree in finance, economics, or a related field. Professional qualifications like ACCA or CFA are often valued.

Significant experience in project finance or infrastructure investment is crucial. Strong analytical skills and knowledge of government financial processes are essential.

How does the Infrastructure Finance Advisor contribute to the delivery of the Government Major Projects Portfolio (GMPP)?

Advisors provide financial expertise for projects in the GMPP. They help structure financing arrangements and assess financial viability.

They also support project assurance reviews to ensure projects remain on track financially. Their input is crucial for informed decision-making on major projects.

In what ways does the Infrastructure and Projects Authority support the Cabinet Office in achieving government infrastructure objectives?

The Authority provides expert advice on infrastructure financing and delivery. It helps develop and implement infrastructure investment strategies.

It also manages the UK Guarantee Scheme, supporting private investment in infrastructure. The Authority's work ensures efficient use of public funds in major projects.