Local authorities face growing financial pressures and seek new ways to generate revenue. A Local Authority Revenue Generation Consultant plays a crucial role in helping councils find innovative solutions to boost income. These experts bring valuable skills and knowledge to the table, assisting local governments in maximising their financial potential.

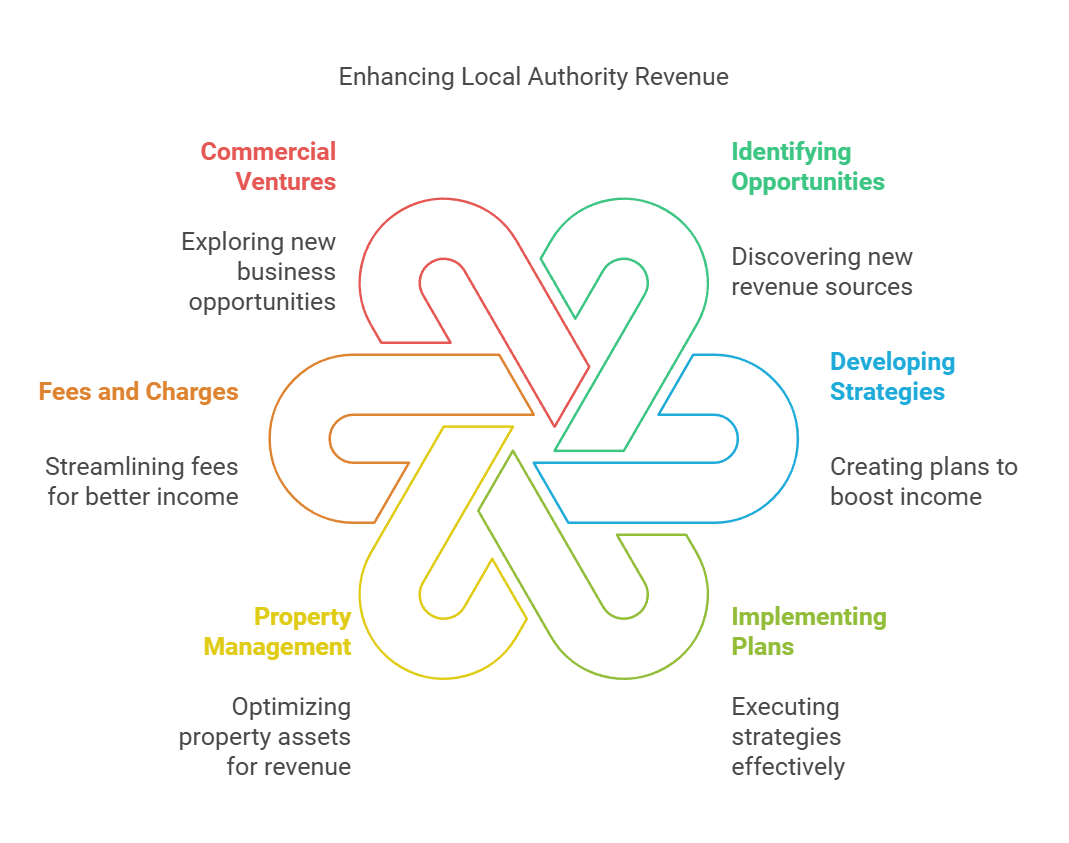

A skilled revenue generation consultant can help councils identify untapped opportunities, develop strategies, and implement effective plans to increase income streams. They analyse current revenue sources, explore new possibilities, and provide guidance on optimising existing resources. By working closely with council staff, these consultants create tailored approaches that align with each authority's unique needs and goals.

Revenue generation consultants often have expertise in areas such as property management, fees and charges, and commercial ventures. They stay up-to-date with the latest trends and best practises in local government finance, ensuring their advice is both practical and forward-thinking. With their help, local authorities can make informed decisions about revenue generation strategies and improve their financial outlook.

Key Takeaways

- Revenue generation consultants help local authorities find new income streams and optimise existing ones

- These experts bring specialised knowledge in areas like property management and commercial ventures

- Consultants work closely with council staff to develop tailored strategies for each authority's needs

Understanding the Local Authority Revenue Generation Consultant Role

Local authority revenue generation consultants play a crucial role in helping councils find new income sources. They advise on legal powers, commercial opportunities, and financial strategies to boost funding for public services.

Core Responsibilities in the Public Sector

Revenue generation consultants analyse a council's assets, services, and legal powers. They identify ways to increase income within the bounds of legislation. This may include:

• Reviewing current revenue streams

• Proposing new commercial ventures

• Advising on fees and charges for services

• Exploring property development opportunities

• Suggesting ways to maximise returns on investments

Consultants also help councils develop business cases for income projects. They assess risks, calculate potential returns, and plan implementation strategies.

Relevant Policy and Regulatory Context

Local authorities have various powers to generate income. Key legislation includes:

• Local Government Act 2003

• Localism Act 2011

• Local Government (Best Value Authorities) (Power to Trade) (England) Order 2009

The General Power of Competence, introduced by the Localism Act, gives councils broad powers to act commercially. However, consultants must ensure all revenue schemes comply with regulations on public spending and trading.

Typical Stakeholders and Decision-Making Processes

Revenue generation consultants work with various council stakeholders:

• Elected members (for policy approval)

• Finance directors (for budget planning)

• Service managers (to identify opportunities)

• Legal teams (to ensure compliance)

They present proposals to council committees for debate and approval. Public consultation may be needed for significant new ventures.

Consultants often liaise with external partners too. This might include property developers, business leaders, or other public sector bodies. Building these relationships is key to spotting joint income opportunities.

Key Qualities and Areas of Expertise

Local Authority Revenue Generation Consultants need a diverse skill set to help councils find new income streams. They must combine technical know-how, institutional understanding, and creative problem-solving to drive results.

Technical/Subject-Matter Expertise

A consultant in this field needs deep knowledge of local government finances and revenue generation methods. They should be well-versed in:

• Creating robust business plans and cases

• Conducting thorough options appraisals

• Understanding legal frameworks for council income generation

• Analysing financial data and market trends

Expertise in digital transformation and automation is crucial. Consultants must spot opportunities to boost efficiency through technology.

Strong commercial acumen helps identify viable revenue streams. This includes assessing market demand and pricing strategies for council services.

Institutional Knowledge and Networks

Effective consultants have a firm grasp of local authority structures and decision-making processes. They understand:

• Council priorities and constraints

• Key stakeholders and their roles

• Political sensitivities around revenue generation

A wide professional network is valuable. It allows consultants to:

• Share best practices from other councils

• Bring in specialist expertise when needed

• Foster collaboration between authorities

Knowledge of central government policies affecting local finances is essential. This helps consultants navigate changing regulations and funding landscapes.

Adaptability and Problem-Solving Skills

Revenue generation consultants must be flexible thinkers. They need to:

• Tailor solutions to each council's unique situation

• Pivot strategies as circumstances change

• Balance short-term wins with long-term sustainability

Innovation is key. Consultants should:

• Think creatively about untapped revenue sources

• Propose novel business models for council services

• Encourage calculated risk-taking where appropriate

Strong problem-solving skills help overcome obstacles. This includes:

• Breaking down complex issues into manageable parts

• Developing multiple options for each challenge

• Building consensus among diverse stakeholders

Resilience is crucial, as not all ideas will succeed. Consultants must learn from setbacks and refine their approach.

Strategic Value to External Organisations

Local authority revenue generation consultants offer unique insights and expertise that can greatly benefit external organisations. Their specialised knowledge spans several key areas that are crucial for success in the public sector landscape.

Navigating Complex Procurement and Funding

Consultants help external organisations understand and navigate the intricate procurement processes of local authorities. They provide guidance on bidding for contracts and securing funding opportunities. This expertise is invaluable for businesses looking to work with councils.

Consultants can:

- Interpret complex tender documents

- Advise on compliance with procurement regulations

- Identify suitable funding streams for projects

- Help craft compelling bids and proposals

Their deep understanding of local authority needs and priorities gives external organisations a competitive edge in securing contracts and partnerships.

Policy and Market Foresight

Revenue generation consultants offer valuable foresight into policy changes and market trends affecting local authorities. This knowledge helps external organisations anticipate shifts in council priorities and adapt their strategies accordingly.

Key areas of insight include:

- Changes in legislation affecting council revenue streams

- Emerging opportunities in discretionary services

- Trends in business rates and property investments

- Shifts in council approaches to commercialisation

By staying ahead of these trends, external organisations can position themselves as valuable partners to local authorities, offering timely and relevant solutions.

Enhancing Credibility and Compliance

Consultants help external organisations build credibility with local authorities by ensuring compliance with relevant regulations and standards. This is crucial for establishing trust and long-term partnerships.

Areas where consultants enhance credibility include:

- Advising on ethical considerations in public sector partnerships

- Ensuring transparency in commercial activities

- Guiding compliance with local authority trading powers

- Advising on differential charging practices

This expertise helps external organisations navigate the unique ethical and legal landscape of working with public sector entities.

Leveraging Public Sector Data and Insights

Revenue generation consultants have access to valuable public sector data and insights. They can help external organisations leverage this information to tailor their offerings and strategies to meet local authority needs.

Key benefits include:

- Understanding local demographic trends and service demands

- Identifying gaps in current service provision

- Analysing successful income generation models across councils

- Assessing the viability of commercial activities in specific areas

This data-driven approach enables external organisations to develop targeted solutions that align with local authority objectives and community needs.

Practical Outcomes and Applications

Local authority revenue generation consultants help councils boost income and improve services. Their work leads to real-world results that benefit both councils and residents. These outcomes span product creation, marketing tactics, long-term planning, and measuring success.

Product Development and Service Enhancement

Consultants guide councils in creating new offerings and improving existing ones. They might help develop:

- Paid-for business advice services

- Enhanced leisure facilities

- Premium waste collection options

These new revenue streams can offset budget cuts from austerity. Consultants ensure ideas align with council goals and resident needs. They build robust business cases to secure investment.

Improved services often result. For example, a consultant may suggest ways to boost efficiency at council-run sports centres. This could mean longer opening hours and better equipment. Residents get enhanced facilities while the council increases income.

Go-to-Market and Engagement Strategies

Once new products or services are ready, consultants help councils promote them effectively. This may involve:

• Creating marketing plans

• Designing eye-catching adverts

• Planning social media campaigns

• Training staff on sales techniques

The aim is to raise awareness and drive uptake. Consultants tailor strategies to suit local demographics and council strengths.

They also advise on pricing. This ensures new offerings are competitive yet profitable. Consultants may suggest tiered pricing or bundle deals to maximise revenue.

Engagement is key. Consultants help councils gather feedback and refine their approach. This creates a cycle of continuous improvement.

Long-Term Sustainability and Growth

Consultants take a long-term view. They help councils plan for ongoing success, not just quick wins. This involves:

- Forecasting future trends and needs

- Identifying potential risks and challenges

- Developing strategies to adapt and grow

Innovative approaches are often suggested. A consultant might propose partnering with local businesses or other councils to share costs and boost reach.

They also look at ways to reduce reliance on traditional funding sources like council tax. This could mean exploring commercial opportunities or seeking new grant funding.

Consultants help embed a culture of innovation and efficiency. This ensures councils can continue generating revenue long after the consultant's work is done.

Measuring Impact and ROI

Tracking success is crucial. Consultants set up systems to measure the impact of new initiatives. This typically includes:

- Financial metrics (e.g. revenue generated, cost savings)

- Service quality indicators

- Customer satisfaction scores

- Staff feedback

They help councils interpret this data and use it to make informed decisions. Regular reviews allow for quick adjustments if needed.

Consultants also calculate return on investment (ROI). This shows the value of their work and helps justify future projects. Clear financial results build confidence among councillors and residents alike.

Frequently Asked Questions

Local authorities face various challenges in generating revenue. They must find innovative ways to increase income while maintaining quality services. Let's explore some common questions about revenue generation for councils.

How can local authorities enhance their income streams?

Councils can boost income by making effective use of properties. This might involve leasing unused buildings or land. They can also explore shared service arrangements with other councils to reduce costs.

Charging for non-essential services is another option. Councils might introduce fees for garden waste collection or certain leisure facilities.

What innovative methods are being employed by local authorities for revenue generation?

Some councils are setting up trading companies to provide services commercially. These can generate profit for the council while operating separately.

Others are investing in renewable energy projects. This can provide long-term income and support sustainability goals.

What responsibilities do revenue and benefits officers hold within local councils?

Revenue and benefits officers manage council tax and business rates collection. They also handle housing benefit and council tax support claims.

These officers must ensure fair and efficient collection of money owed to the council. They also need to support residents who struggle to pay.

In what ways do local government financial strategies impact council service provision?

Financial strategies affect which services councils can afford to provide. Budget cuts may lead to reduced opening hours for libraries or less frequent bin collections.

On the flip side, successful revenue generation can help maintain or even improve services. It might allow councils to invest in new community facilities or programmes.

How are local authorities adapting traditional revenue sources to the modern economic climate?

Councils are digitalising services to cut costs and improve efficiency. Online council tax payments and benefit applications are now common.

Some are also reviewing business rates to ensure they reflect current property values and usage. This helps maximise income from this traditional source.

What strategies are effective for local councils to manage and optimise their revenue and benefits systems?

Regular audits of revenue and benefits systems help identify areas for improvement. Councils should also invest in staff training to ensure best practice.

Using data analytics can help target resources more effectively. For example, it can identify households likely to fall into council tax arrears.

Clear policies on conflicts of interest are crucial. This ensures decisions about revenue generation are made fairly and transparently.