Public infrastructure projects are vital for economic growth and societal well-being. These large-scale endeavours often require significant funding and expertise to bring to fruition. This is where Public Infrastructure Financing & PPP Advisors play a crucial role.

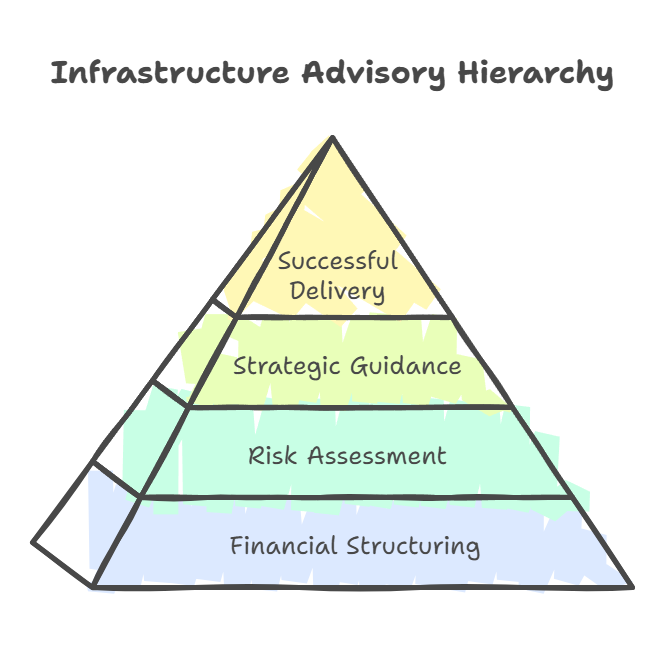

These professionals bring specialised knowledge to the table, helping both public and private entities navigate complex infrastructure deals. They provide guidance on financial structuring, risk assessment, and project procurement, ensuring that infrastructure initiatives are viable and sustainable. Their expertise spans various sectors, including transport, energy, and social infrastructure.

PPP Advisors act as a bridge between government bodies and private investors. They help develop strategies that align public needs with private sector capabilities. By fostering collaboration, these advisors contribute to the successful delivery of essential infrastructure projects that benefit communities.

Key Takeaways

- PPP Advisors facilitate complex infrastructure projects by providing financial and strategic expertise

- These professionals bridge the gap between public needs and private sector capabilities

- Their work spans various sectors and contributes to the successful delivery of essential infrastructure

Understanding The Public Infrastructure Financing & PPP Advisor Role

Public-private partnership (PPP) advisors play a crucial role in bridging the gap between public sector needs and private sector resources. They guide complex infrastructure projects from concept to completion, navigating financial, legal, and regulatory landscapes.

Core Responsibilities In The Public Sector

PPP advisors help government entities structure and implement infrastructure projects. They assess project viability, develop financing strategies, and craft tender documents. These professionals also evaluate bids and assist in negotiations with private partners.

PPP advisors conduct financial modelling to determine project costs and revenue projections. They identify potential risks and devise mitigation strategies. Additionally, they advise on optimal risk allocation between public and private sectors.

These experts often liaise between different government departments, ensuring project alignment with broader policy objectives. They may also help develop capacity within public sector teams, transferring knowledge on PPP best practices.

Relevant Policy And Regulatory Context

PPP advisors must have a deep understanding of legal and regulatory frameworks governing infrastructure development. This includes knowledge of procurement laws, environmental regulations, and sector-specific policies.

They stay abreast of national PPP policies and guidelines, ensuring projects adhere to established frameworks. Advisors may also contribute to policy development, drawing on their practical experience to inform regulatory improvements.

Understanding international best practices is crucial, as many countries look to global standards when developing their PPP programmes. Advisors often reference guidelines from organisations like the World Bank or regional development banks.

Typical Stakeholders And Decision-Making Processes

PPP advisors interact with a wide range of stakeholders throughout the project lifecycle. Key public sector stakeholders include:

- Central PPP units

- Line ministries (e.g., transport, energy)

- Local government authorities

- Regulatory bodies

Private sector stakeholders often comprise:

- Investors and lenders

- Construction companies

- Facility operators

Advisors facilitate decision-making processes, often through steering committees or working groups. They prepare briefing materials, conduct stakeholder consultations, and help build consensus among diverse parties.

Effective stakeholder engagement is critical for project success. PPP advisors develop communication strategies to keep all parties informed and manage expectations throughout the project's duration.

Key Qualities and Areas of Expertise

A successful Public Infrastructure Financing & PPP Advisor possesses a diverse skill set. They blend technical knowledge with practical experience to navigate complex projects and relationships.

Technical/Subject-Matter Expertise

PPP advisors must have deep knowledge of infrastructure financing models. This includes understanding public-private partnerships and their role in bridging financing gaps. Advisors should be well-versed in risk mitigation instruments and governance structures.

They need expertise in:

- Project finance

- Contract negotiation

- Financial modelling

- Risk assessment

- Regulatory frameworks

Strong analytical skills are crucial for evaluating project viability and structuring deals. Advisors must stay current on market trends and best practices in infrastructure development.

Institutional Knowledge and Networks

Effective advisors have a thorough grasp of public sector operations and decision-making processes. They understand the roles of key institutions like the World Bank Group and PPIAF in supporting PPPs.

Advisors should have:

- Familiarity with government procurement processes

- Knowledge of multilateral development bank policies

- A network of contacts in public and private sectors

This institutional knowledge helps advisors navigate complex stakeholder relationships and align project goals with policy objectives.

Adaptability and Problem-Solving Skills

PPP projects often face unexpected challenges. Advisors must be flexible and creative problem-solvers. They should be able to:

- Adjust strategies as project conditions change

- Mediate conflicts between public and private partners

- Develop innovative solutions to technical or financial hurdles

Strong communication skills are essential for explaining complex concepts to diverse audiences. Advisors must balance competing interests while keeping projects on track.

Climate change resilience is an increasingly important consideration. Advisors should be able to incorporate sustainability goals into project designs and financing structures.

Strategic Value to External Organisations

External organisations benefit greatly from public infrastructure financing and PPP advisors. These experts provide crucial support in navigating complex processes, offering market insights, and enhancing project credibility.

Navigating Complex Procurement and Funding

PPP advisors guide organisations through intricate procurement processes. They help structure deals that attract private sector investment. Their expertise is vital in crafting proposals that meet public sector requirements.

These professionals assist in identifying suitable funding sources. They analyse various financing options, including bonds, loans, and equity investments. This knowledge helps clients secure optimal financing terms.

Advisors also support private capital mobilisation. They create strategies to engage investors and showcase project potential. Their input often leads to increased private sector participation in public infrastructure initiatives.

Policy and Market Foresight

PPP advisors offer valuable insights into policy trends. They track regulatory changes that may impact infrastructure projects. This foresight helps clients adapt strategies to align with evolving government priorities.

Market analysis is another key service. Advisors assess demand, competition, and economic factors. They provide projections on future market conditions, helping clients make informed decisions.

These experts also identify emerging opportunities. They spot trends in sectors like renewable energy or smart cities. This knowledge gives clients a competitive advantage in securing new projects.

Enhancing Credibility and Compliance

Advisors boost project credibility through rigorous planning and analysis. They ensure proposals meet international best practices in infrastructure development. This adherence to standards increases confidence among stakeholders.

Compliance is a critical area where advisors add value. They guide clients through complex regulatory requirements. This expertise helps avoid legal pitfalls and ensures projects meet all necessary approvals.

Advisors also support transparent reporting practices. They help establish clear communication channels with stakeholders. This openness builds trust and can lead to smoother project execution.

Leveraging Public Sector Data and Insights

PPP advisors excel at accessing and interpreting public sector data. They analyse government reports, budgets, and policy documents. This information helps clients align projects with public sector priorities.

These experts forge strong relationships with government officials. They gain insights into upcoming initiatives and funding programmes. This network allows clients to position themselves advantageously for future opportunities.

Advisors also help clients navigate public-private collaborations. They understand the nuances of working with government entities. This knowledge facilitates smoother partnerships and more successful project outcomes.

Practical Outcomes and Applications

Public-private partnerships (PPPs) offer tangible benefits for infrastructure development. These collaborations enhance service delivery, promote sustainability, and improve project viability throughout the lifecycle.

Product Development and Service Enhancement

PPP projects drive innovation in infrastructure design and delivery. They blend public sector goals with private sector expertise to create better outcomes.

Private partners often bring new technologies and methods. This can lead to more efficient, sustainable infrastructure assets. For example, smart city projects may incorporate IoT sensors for real-time monitoring.

PPPs also focus on improving service quality. Private operators have incentives to meet performance targets. This can result in more reliable public services and higher user satisfaction.

Asset management is a key area where PPPs excel. Long-term contracts encourage proactive maintenance. This helps extend infrastructure lifespans and reduce lifecycle costs.

Go-To-Market and Engagement Strategies

Effective PPPs require strong stakeholder engagement. This includes government bodies, private partners, and end-users.

Clear communication is crucial. Project teams must explain benefits and address concerns. Public consultations can help build support and gather feedback.

Robust procurement processes are essential. They ensure fair competition and value for money. Transparent bidding helps attract quality private partners.

Project finance structures are critical for PPP success. These often involve complex arrangements of debt and equity. Well-structured deals can attract investors and achieve financial close.

Marketing PPP opportunities to potential partners is important. This may involve investor roadshows or industry forums.

Long-Term Sustainability and Growth

PPPs aim for sustainable infrastructure that meets long-term needs. This involves balancing economic, social, and environmental factors.

Environmental sustainability is a growing focus. Many PPPs now incorporate green technologies and practices. This can include renewable energy systems or water conservation measures.

Social sustainability is equally important. Inclusive infrastructure ensures benefits reach all segments of society. This may involve strategies to create local jobs or improve access for underserved communities.

PPPs can foster economic growth by attracting private investment. They can help governments deliver more projects with limited public funds.

Flexibility is key for long-term success. Contracts should allow for adjustments as needs change over time.

Measuring Impact and ROI

Evaluating PPP performance is crucial for accountability and improvement. This involves assessing both financial and non-financial outcomes.

Key performance indicators (KPIs) track service quality and efficiency. These might include measures like uptime, user satisfaction, or cost savings.

Financial metrics assess value for money. Return on investment (ROI) calculations compare costs to benefits over the project lifecycle.

Wider economic impacts are also important. These can include job creation, productivity gains, or improved public health outcomes.

Regular project reviews help identify lessons learned. These insights can inform future PPP strategies and policy decisions.

Data-driven analysis supports evidence-based decision-making. This can help optimise operations and guide future investments.

Frequently Asked Questions

Public-private partnerships involve complex arrangements for infrastructure development. Key considerations include efficiency gains, critical success factors, advisory support, gender integration, and financing mechanisms.

How does private sector involvement improve efficiency in public infrastructure projects?

Private sector involvement can boost efficiency in public projects. Companies bring expertise and innovative approaches. They often complete work faster and at lower cost than government agencies alone.

Private partners have incentives to finish on time and within budget. This helps avoid delays and cost overruns common in public works.

What are the critical factors for successful implementation of a Public-Private Partnership (PPP) model?

Clear goals and risk allocation are vital for PPP success. Contracts must spell out each party's responsibilities. Transparent processes build trust with stakeholders.

Strong government support is crucial. Political will helps overcome obstacles. Adequate financing and revenue models ensure project viability.

In what ways does the Public-Private Infrastructure Advisory Facility (PPIAF) support infrastructure development?

PPIAF provides technical assistance to governments. It helps create enabling environments for private investment. The facility offers policy guidance and capacity building.

PPIAF supports project preparation and structuring. It shares best practices from global PPP experiences. This knowledge transfer aids developing countries.

How does gender consideration integrate into Public-Private Partnership projects?

Gender integration in PPPs promotes inclusive development. Projects can address women's needs in design and implementation. This may include safe transport options or improved water access.

Gender-responsive procurement boosts women's economic participation. Setting targets for women-owned businesses as suppliers is one approach.

What methodologies does the Global Infrastructure Hub provide for assessing infrastructure investment needs?

The Global Infrastructure Hub offers tools to gauge investment needs. These include forecasting models and benchmarking data. Countries can compare their infrastructure gaps to peers.

The Hub provides frameworks to assess project feasibility. These help governments prioritise investments for maximum impact.

Could you explain the fundamental differences between various public infrastructure financing mechanisms?

Public infrastructure financing varies widely. Government bonds fund many projects through public debt. PPPs leverage private capital and expertise.

Concessions allow private operation of public assets. User fees often repay investments. Public service contracts may use government payments instead.