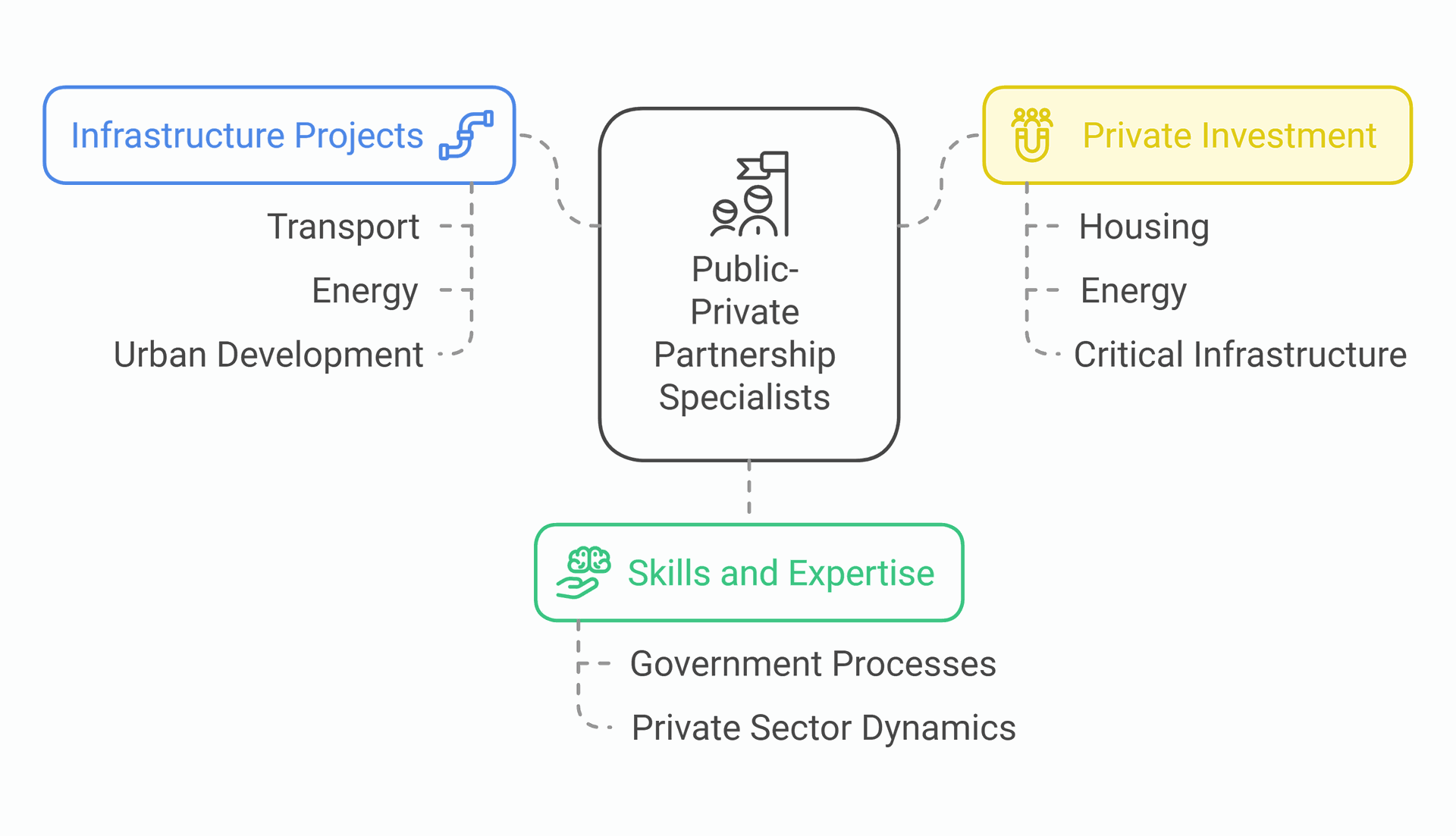

Public-Private Partnership Specialists in Infrastructure UK play a crucial role in bridging the gap between government initiatives and private sector expertise. These professionals navigate complex projects, ensuring successful collaboration between public entities and private companies. Their work is essential for delivering large-scale infrastructure projects that benefit communities across the UK.

These specialists bring a unique blend of skills to the table, combining deep knowledge of government processes with a keen understanding of private sector dynamics. They help shape policies, negotiate contracts, and oversee project implementation. Their expertise is particularly valuable in sectors like transport, energy, and urban development.

As the UK continues to invest in its infrastructure, the demand for these specialists is on the rise. They are instrumental in attracting private investment for housing, energy, and other critical infrastructure projects. Their ability to balance public interest with private sector goals makes them indispensable in today's evolving economic landscape.

Key Takeaways

- Public-Private Partnership Specialists are vital for successful infrastructure projects in the UK

- These experts combine government knowledge with private sector understanding

- Their role is increasingly important as the UK seeks more private investment in infrastructure

Understanding the Public-Private Partnership Specialist (Infrastructure UK) Role

A Public-Private Partnership (PPP) Specialist in Infrastructure UK plays a crucial role in bridging public and private sector interests. They navigate complex projects, policies, and stakeholder relationships to deliver vital infrastructure and services.

Core Responsibilities in the Public Sector

PPP Specialists oversee the planning, implementation, and management of public-private partnerships. They analyse project viability, structure deals, and ensure value for money. Key tasks include:

• Developing business cases for PPP projects

• Conducting financial modelling and risk assessments

• Negotiating contracts with private sector partners

• Monitoring project performance and compliance

These professionals must balance public interest with private sector efficiency. They often work on large-scale projects such as hospitals, schools, and transport networks.

Relevant Policy and Regulatory Context

PPP Specialists must stay current with UK government policies and regulations affecting infrastructure development. This includes:

• Understanding the Private Finance Initiative (PFI) and its successor models

• Keeping abreast of Treasury guidelines on PPPs

• Following procurement laws and EU directives

• Adhering to sector-specific regulations (e.g., energy, transport)

They must also be familiar with financial regulations and accounting standards relevant to PPPs. This knowledge helps ensure projects comply with legal and fiscal requirements.

Typical Stakeholders and Decision-Making Processes

PPP Specialists interact with a diverse range of stakeholders, including:

• Government departments and local authorities

• Private sector investors and contractors

• Legal and financial advisors

• End-users and community representatives

They facilitate decision-making processes that involve:

• Conducting stakeholder consultations

• Presenting options to steering committees

• Obtaining approvals from relevant authorities

• Coordinating between public and private partners

Effective communication and negotiation skills are essential. PPP Specialists must balance competing interests and build consensus to drive projects forward.

Key Qualities and Areas of Expertise

Public-Private Partnership (PPP) specialists in Infrastructure UK need a diverse set of skills and knowledge. They must be well-versed in technical aspects, have strong networks, and possess the ability to adapt to complex situations.

Technical/Subject-Matter Expertise

PPP specialists require deep knowledge of infrastructure investment partnerships. They should understand the intricacies of private finance and capital investment strategies. This includes:

- Expertise in financial modelling and risk assessment

- Knowledge of legal and regulatory frameworks

- Understanding of project finance structures

Specialists must be adept at analysing financial returns and evaluating the viability of projects. They should be familiar with various PPP models, including the mutual investment model.

Institutional Knowledge and Networks

Effective PPP specialists have extensive networks within both public and private sectors. This includes:

- Relationships with government agencies and departments

- Connections to private investors and financial institutions

- Understanding of procurement processes

They should be able to navigate complex bureaucracies and facilitate communication between stakeholders. Knowledge of past PPP projects and their outcomes is crucial for informing future decisions.

Adaptability and Problem-Solving Skills

PPP projects often face unforeseen challenges. Specialists must be:

- Flexible in their approach to problem-solving

- Able to think creatively to overcome obstacles

- Skilled in negotiation and conflict resolution

They should be capable of balancing public interest with private sector goals. This requires a keen understanding of political sensitivities and economic realities.

The ability to adapt to changing market conditions and policy environments is essential. PPP specialists must stay current with industry trends and innovations in raising finance for infrastructure projects.

Strategic Value to External Organisations

Public-Private Partnership (PPP) specialists offer crucial expertise to organisations seeking to navigate complex infrastructure projects. Their knowledge spans procurement, funding, policy, and regulatory compliance, making them invaluable partners in project success.

Navigating Complex Procurement and Funding

PPP specialists help external organisations tackle the intricacies of procurement and funding for large-scale infrastructure projects. They guide partners through bidding processes and investment strategies, ensuring optimal value from public assets.

These experts assist in structuring deals that balance public and private interests. They identify innovative funding sources and create financial models that support long-term project viability.

Their expertise extends to risk allocation, helping partners distribute project risks effectively between public and private sectors. This approach enhances project bankability and attracts investors.

Policy and Market Foresight

PPP specialists provide vital insights into policy trends and market dynamics affecting infrastructure development. They keep external organisations informed about regulatory changes that could impact project planning and execution.

These professionals analyse market conditions to identify opportunities for renewable energy generation and infrastructure renewal. Their foresight helps partners align projects with government priorities and sustainability goals.

They also advise on potential policy shifts that might affect governance structures or service provision models. This knowledge allows organisations to future-proof their investments and strategies.

Enhancing Credibility and Compliance

PPP specialists boost the credibility of external organisations by ensuring projects adhere to best practices and regulatory standards. They guide partners through complex compliance requirements, reducing legal and reputational risks.

These experts help create robust governance frameworks that promote transparency and accountability. Their involvement signals a commitment to ethical project delivery, enhancing stakeholder trust.

They also assist in developing performance metrics and monitoring systems. This ensures efficient use of public assets and helps demonstrate project value to government partners and the public.

Leveraging Public Sector Data and Insights

PPP specialists provide access to valuable public sector data and insights. They help external organisations interpret and apply this information to improve project outcomes and service delivery.

These professionals facilitate knowledge transfer between public and private sectors. They share lessons learned from past PPP projects, helping partners avoid common pitfalls and adopt successful strategies.

They also assist in aligning private sector innovation with public sector needs. This collaboration often leads to more efficient and effective infrastructure solutions that benefit communities.

Practical Outcomes and Applications

Public-Private Partnerships (PPPs) yield tangible results in infrastructure development. They drive innovation, improve service delivery, and create value for both public and private sectors.

Product Development and Service Enhancement

PPPs foster innovative product development and service enhancement in infrastructure projects. Private sector expertise brings fresh ideas to traditional government processes.

For example, in transport projects, PPPs have led to smart ticketing systems and real-time travel information. These improvements enhance user experience and increase efficiency.

In healthcare, PPPs have resulted in state-of-the-art medical facilities with cutting-edge technology. This leads to better patient care and improved health outcomes.

PPPs also encourage the use of sustainable materials and energy-efficient designs in construction. This reduces environmental impact and lowers long-term operational costs.

Go-to-Market and Engagement Strategies

Effective go-to-market strategies are crucial for successful PPPs. They ensure public support and smooth project implementation.

Stakeholder engagement is key. This involves clear communication with local communities, businesses, and other affected parties.

Public consultations help address concerns and gather valuable input. This can lead to project modifications that better serve community needs.

Transparency in the bidding process is essential. It builds trust and attracts high-quality private sector partners.

Marketing campaigns can highlight the benefits of PPP projects to the public. This helps gain support and manage expectations.

Long-Term Sustainability and Growth

PPPs aim for long-term sustainability and growth in infrastructure projects. This requires careful planning and risk management.

Contracts must balance public sector goals with private sector profit motives. This ensures projects remain viable over their entire lifecycle.

Regular maintenance and upgrades are built into PPP agreements. This prevents infrastructure deterioration and extends project lifespan.

PPPs often include provisions for technology updates. This allows infrastructure to adapt to future needs and technological advancements.

Capacity building programmes help develop local skills. This supports project sustainability and creates long-term employment opportunities.

Measuring Impact and ROI

Measuring the impact and return on investment (ROI) of PPPs is crucial for accountability and future planning.

Key performance indicators (KPIs) are used to assess project success. These may include:

- Service quality improvements

- Cost savings for the public sector

- User satisfaction rates

- Environmental impact reductions

Financial metrics such as Internal Rate of Return (IRR) and Net Present Value (NPV) help evaluate project profitability.

Socio-economic impact assessments measure wider benefits like job creation and economic growth.

Regular audits and performance reviews ensure PPPs meet their objectives and deliver value for money.

Frequently Asked Questions

Public-Private Partnerships play a vital role in developing infrastructure and delivering public services. These partnerships involve complex arrangements between government entities and private sector companies to fund, build, and operate major projects.

What are the primary roles and responsibilities of a Public-Private Partnership (PPP) specialist?

A PPP specialist analyses project feasibility and structures deals between public and private entities. They evaluate financial models, assess risks, and negotiate contracts. Their expertise helps ensure projects are viable and deliver value for money.

PPP specialists also monitor ongoing partnerships and resolve issues that arise during implementation. They act as intermediaries between government agencies and private companies throughout the project lifecycle.

How do Public-Private Partnerships contribute to the development of infrastructure?

PPPs leverage private sector expertise and capital to build critical infrastructure. They allow governments to undertake large projects without immediate budget impacts. Private companies often bring innovation and efficiency to design, construction, and operations.

These partnerships can accelerate project delivery and improve long-term maintenance of assets. PPPs have been used successfully in transport, healthcare, education, and other sectors to expand and modernise public infrastructure.

What are the critical success factors for Public-Private Partnerships in large-scale infrastructure projects?

Clear objectives and political support are essential for PPP success. Thorough project preparation, including detailed feasibility studies, helps avoid later problems. Transparent procurement processes build confidence among potential private partners.

Effective risk allocation between public and private sectors is crucial. Robust contract design and performance monitoring systems help ensure projects stay on track. Open communication between all stakeholders supports smooth implementation.

How can risks be effectively allocated between public and private sectors within Public-Private Partnerships?

Risk allocation aims to assign each risk to the party best able to manage it. The private sector typically takes on construction and operational risks. Governments often retain regulatory and political risks.

Demand risk may be shared or transferred depending on the project type. Financial risks are usually divided, with the private partner taking on debt repayment obligations. Clear contractual provisions outline risk responsibilities and mitigation strategies.

What key considerations should be accounted for during project preparation in Public-Private Partnerships?

Thorough technical and financial feasibility studies are essential. Environmental and social impact assessments help identify potential issues early. Market sounding gauges private sector interest and informs project structuring.

Legal and regulatory frameworks must be reviewed to ensure they support PPPs. Stakeholder consultations build public support and identify concerns. Realistic timelines and cost estimates are crucial for project success.

How does a sustainable infrastructure fund influence the implementation of Public-Private Partnership projects?

Sustainable infrastructure funds provide long-term financing for PPP projects aligned with environmental and social goals. These funds can lower the cost of capital for green infrastructure initiatives. They often set sustainability criteria that shape project design and implementation.

By offering patient capital, these funds support projects with longer payback periods. This can enable more ambitious and transformative infrastructure investments through PPPs.