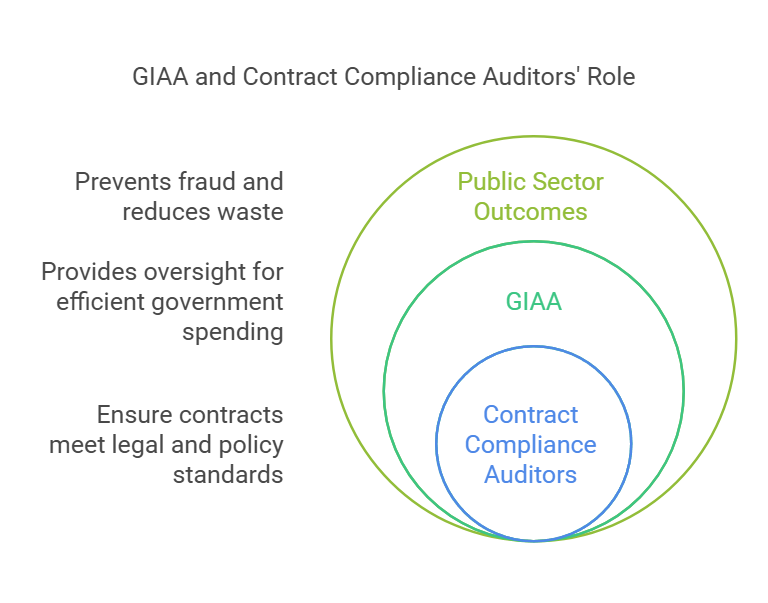

The Government Internal Audit Agency (GIAA) plays a vital role in ensuring contract compliance within the public sector. As an executive agency of HM Treasury, it provides objective insight to central government to help achieve better outcomes and value for money. Public Sector Contract Compliance Auditors are key members of this organisation, working to maintain high standards across government contracts.

These auditors use their expertise to review and analyse contracts, ensuring they meet legal requirements and align with government policies. Their work helps to prevent fraud, reduce waste, and improve efficiency in public spending. By identifying potential issues early, they allow departments to make necessary adjustments and avoid costly mistakes.

The GIAA was established in April 2015 to improve the quality of internal audit across central government. Since then, it has grown to become a trusted partner for many government departments and agencies. The role of Contract Compliance Auditors within this framework is crucial, as they help to maintain the integrity of public sector contracts and ensure taxpayers' money is used effectively.

Key Takeaways

- Contract Compliance Auditors ensure public sector contracts meet legal and policy requirements

- The GIAA provides crucial oversight to improve government spending efficiency

- Auditors' work helps prevent fraud and reduce waste in public sector contracts

Understanding the Public Sector Contract Compliance Auditor (Government Internal Audit Agency) Role

Public Sector Contract Compliance Auditors play a crucial role in ensuring financial integrity and regulatory adherence within government agencies. They conduct thorough examinations of contracts, processes, and systems to uphold standards and mitigate risks.

Core Responsibilities in the Public Sector

Contract Compliance Auditors in the Government Internal Audit Agency (GIAA) focus on reviewing and assessing contractual agreements. They examine financial records, procurement processes, and contract execution to ensure compliance with government policies and regulations.

Key duties include:

• Conducting risk assessments of contracts

• Evaluating internal controls related to contract management

• Identifying potential fraud or misuse of public funds

• Recommending improvements to contract processes

These auditors also play a vital role in promoting transparency and accountability in public spending. They work closely with various departments to enhance contract management practices and safeguard public interests.

Relevant Policy and Regulatory Context

The Public Sector Internal Audit Standards (PSIAS) guide the work of Contract Compliance Auditors in the UK. These standards set the framework for conducting audits and maintaining professional integrity.

Auditors must stay updated on:

• Government procurement policies

• Financial regulations for public bodies

• Anti-fraud and corruption measures

The regulatory landscape is complex and ever-changing. Auditors need to adapt their approaches to new legislation and evolving best practices in public sector management.

Typical Stakeholders and Decision-Making Processes

Contract Compliance Auditors interact with a wide range of stakeholders across central government departments and public bodies. They work closely with:

• Senior management in government agencies

• Procurement teams

• Finance departments

• External contractors and suppliers

Auditors provide valuable insights to inform decision-making processes. Their findings and recommendations often shape contract management strategies and risk mitigation efforts.

They must balance the needs of various stakeholders while maintaining their independence and objectivity. Effective communication skills are essential for presenting audit results and facilitating improvements in contract compliance.

Key Qualities and Areas of Expertise

Public Sector Contract Compliance Auditors require a unique blend of skills and knowledge to excel in their role. These professionals must possess technical expertise, institutional understanding, and adaptable problem-solving abilities.

Technical/Subject-Matter Expertise

Contract compliance auditors need a strong foundation in accounting principles and internal audit standards. They must be well-versed in the International Professional Practices Framework and understand how to apply it to government contracts.

Key areas of technical expertise include:

- Financial analysis and reporting

- Risk assessment methodologies

- Compliance regulations and governance structures

- Data analytics and audit software proficiency

Auditors should stay current with industry trends and regularly update their skills to maintain a high level of professionalism.

Institutional Knowledge and Networks

Effective contract compliance auditors develop a deep understanding of government operations and processes. This knowledge helps them navigate complex bureaucracies and identify potential areas of risk or non-compliance.

Important aspects of institutional knowledge include:

- Familiarity with government procurement procedures

- Understanding of public sector budgeting and financial management

- Awareness of relevant laws and regulations

Building strong networks within the Government Internal Audit Agency and across government departments is crucial. These connections facilitate information sharing and enhance the auditor's ability to provide objective insights.

Adaptability and Problem-Solving Skills

Contract compliance auditors must be flexible and resourceful in their approach to work. They often face unique challenges that require creative solutions and quick thinking.

Key problem-solving skills include:

- Analytical thinking and attention to detail

- Ability to synthesise complex information

- Effective communication with stakeholders at all levels

Auditors should be comfortable working independently and as part of a team. They must adapt their communication style to suit different audiences, from technical experts to senior management.

Strategic Value to External Organisations

The Government Internal Audit Agency (GIAA) offers crucial support to external organisations in the public sector. Its services help improve efficiency, compliance, and decision-making across government bodies.

Navigating Complex Procurement and Funding

The GIAA assists government organisations in navigating complex procurement processes. This support ensures value for money in public spending.

The agency provides guidance on funding allocations, helping local authorities make informed financial decisions. Its expertise aids in:

- Identifying cost-saving opportunities

- Streamlining procurement procedures

- Ensuring compliance with financial regulations

By working closely with HM Treasury, the GIAA aligns its auditing practices with national financial strategies. This alignment strengthens the financial management of public sector entities.

Policy and Market Foresight

The GIAA offers valuable insights into policy trends and market dynamics. These insights help government agencies adapt to changing environments.

Key areas of foresight include:

- Emerging technologies in public sector management

- Shifts in regulatory frameworks

- Economic trends affecting public spending

This foresight enables organisations to plan proactively and allocate resources effectively. It also supports the development of robust, future-proof policies.

Enhancing Credibility and Compliance

The GIAA plays a vital role in boosting the credibility of public sector organisations. Its audits ensure compliance with legal and ethical standards.

Benefits of GIAA audits include:

- Increased transparency in financial reporting

- Improved public trust in government operations

- Reduced risk of fraud and mismanagement

The agency's work aligns with the Public Sector Internal Audit Standards. This alignment ensures high-quality auditing practices across the public sector.

Leveraging Public Sector Data and Insights

The GIAA harnesses vast amounts of public sector data to generate valuable insights. These insights drive informed decision-making across government bodies.

Areas where data insights prove beneficial:

- Resource allocation in local government

- Performance benchmarking across agencies

- Identifying best practices in public service delivery

By analysing trends and patterns, the GIAA helps organisations optimise their operations. This data-driven approach leads to more efficient and effective public services.

Practical Outcomes and Applications

Public sector contract compliance auditors play a vital role in ensuring efficient use of public funds. Their work leads to improved governance, risk management, and internal controls across government agencies.

Product Development and Service Enhancement

The Government Internal Audit Agency (GIAA) constantly refines its audit services. They focus on developing innovative approaches to compliance auditing.

Artificial intelligence and data analytics help auditors spot trends and anomalies more quickly. This allows for more targeted, risk-based audits.

Feedback from client agencies shapes new audit tools and methodologies. The GIAA aims to provide services that meet evolving public sector needs.

Regular training keeps auditors up-to-date on best practices and emerging risks. This ensures high-quality, relevant audits across government.

Go-to-Market and Engagement Strategies

The GIAA uses various methods to raise awareness of its services. They host workshops and seminars for public sector leaders on contract compliance.

Clear communication of audit benefits helps agencies see the value in compliance reviews. The GIAA highlights how audits can lead to better outcomes with public money.

Tailored engagement plans for different government departments ensure audit services meet specific needs. The GIAA builds strong relationships with key stakeholders to foster trust and cooperation.

Regular updates on audit findings and recommendations keep agencies informed and engaged throughout the process.

Long-Term Sustainability and Growth

The GIAA's long-term strategy focuses on expanding its reach across government. They aim to be the go-to provider for all public sector internal audit needs.

Investing in staff development ensures a skilled workforce ready to tackle future challenges. The agency promotes a culture of continuous learning and improvement.

Partnerships with academic institutions and professional bodies keep the GIAA at the forefront of audit innovation. This helps maintain their position as a leader in public sector auditing.

Diversifying services beyond traditional compliance audits creates new growth opportunities. The GIAA explores areas like cyber security and sustainability audits.

Measuring Impact and ROI

The GIAA tracks key performance indicators to measure the impact of its audits. These include:

- Number of recommendations implemented

- Cost savings achieved

- Improved compliance rates

Client satisfaction surveys provide valuable feedback on audit quality and relevance. The agency uses this data to refine its services and approach.

Case studies highlight specific examples of how audits have led to better outcomes. These stories demonstrate the tangible benefits of the GIAA's work.

Regular reporting to Treasury and Parliament ensures transparency and accountability. This helps justify continued investment in public sector auditing.

Frequently Asked Questions

Contract compliance auditors in the public sector play a vital role in ensuring government agencies operate efficiently and ethically. The Government Internal Audit Agency (GIAA) oversees these auditors and provides crucial oversight.

What are the primary responsibilities of a contract compliance auditor in the public sector?

Contract compliance auditors review government contracts to ensure they meet legal and regulatory requirements. They examine financial records, procurement processes, and contract performance.

These auditors also identify potential fraud or misuse of public funds. They may recommend improvements to contracting procedures and internal controls.

How can the Government Internal Audit Agency be contacted?

The GIAA can be reached through their official website. The site provides contact information for different departments and services.

For general enquiries, email and phone options are available. Specific contact details for regional offices or specialised units may also be listed.

What are the standard salary expectations for a role within the Government Internal Audit Agency?

Salaries at the GIAA vary based on position, experience, and location. Entry-level auditors typically earn between £25,000 to £35,000 per year.

Senior auditors and managers can expect salaries ranging from £40,000 to £60,000 annually. Executive positions may offer higher compensation packages.

What is the significance of the 5 C's in the context of internal auditing?

The 5 C's of internal auditing are: Competence, Care, Confidentiality, Communication, and Compliance. These principles guide auditors in their work and professional conduct.

Competence ensures auditors have the necessary skills. Care promotes diligence and accuracy. Confidentiality protects sensitive information. Communication facilitates clear reporting. Compliance ensures adherence to relevant standards and regulations.

What processes are involved in the internal audit of government agencies?

Internal audits of government agencies follow a structured approach. The process begins with planning and risk assessment to determine audit scope and objectives.

Fieldwork involves gathering evidence, conducting interviews, and analysing data. Auditors then prepare reports outlining findings and recommendations.

Follow-up procedures ensure agencies implement corrective actions. The GIAA may conduct periodic reviews to assess ongoing compliance and improvements.

How does one secure a position with the Government Internal Audit Agency?

To join the GIAA, candidates typically need a relevant degree or professional qualification in accounting, finance, or auditing. The agency often advertises openings on the Civil Service Jobs website.

Applicants should highlight their analytical skills, attention to detail, and understanding of public sector operations. The GIAA may offer graduate schemes or internships for those starting their careers.

As of November 2024, the GIAA continues to recruit talented individuals to support its mission of improving government operations through effective auditing practices.