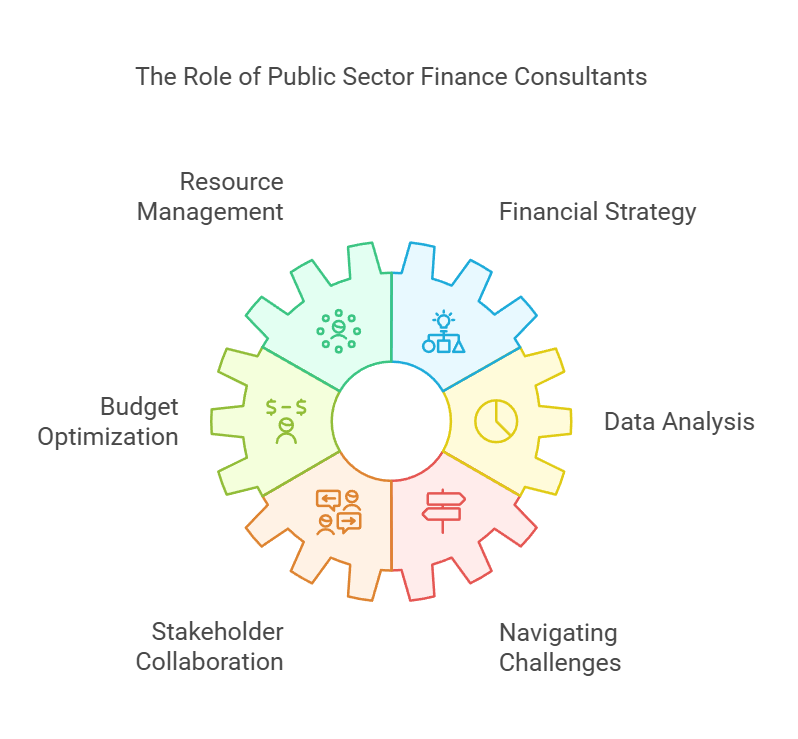

Public sector finance and budgeting consultants play a vital role in helping government organisations manage their resources effectively. These professionals bring specialised knowledge and skills to the table, assisting public entities in making sound financial decisions and optimising their budgets. Their expertise can lead to improved public services, cost savings, and more efficient use of taxpayer money.

Consultants in this field work on a range of projects, from developing financial strategies to implementing budget reforms. They analyse complex financial data, identify areas for improvement, and provide recommendations to senior leadership. Their work often involves collaborating with various stakeholders, including government officials, department heads, and finance teams.

Public sector finance and budgeting consultants help organisations navigate challenges such as budget cuts, changing regulations, and increasing public demands. They bring fresh perspectives and industry best practices to help public entities achieve their financial goals while maintaining high-quality services for citizens.

Key Takeaways

- Public sector finance consultants enhance resource management and service delivery

- They offer expertise in financial strategy, budget optimisation, and data analysis

- These professionals help navigate complex challenges and implement best practices

Understanding the Public Sector Finance & Budgeting Consultant Role

Public sector finance and budgeting consultants play a crucial role in helping government organisations manage their finances effectively. They bring expertise in financial planning, budget analysis, and strategic decision-making to improve public sector operations.

Core Responsibilities in the Public Sector

Public sector finance consultants have several key duties:

- Analysing financial data and creating budget forecasts

- Developing long-term financial strategies

- Advising on cost-saving measures and efficiency improvements

- Ensuring compliance with financial regulations and policies

- Preparing financial reports for government leaders and stakeholders

These professionals often work on implementing integrated financial management systems to streamline government operations. They may also assist in drafting budget proposals and presenting financial information to decision-makers.

Relevant Policy and Regulatory Context

Consultants must have a deep understanding of:

- Public sector accounting standards

- Government budgeting processes

- Fiscal policies and regulations

- Procurement rules and procedures

They need to stay up-to-date with changes in legislation that affect public sector financial management. This knowledge helps ensure government organisations maintain transparency and accountability in their financial practices.

Typical Stakeholders and Decision-Making Processes

Public sector finance consultants interact with various stakeholders:

- Government officials and elected representatives

- Department heads and programme managers

- Finance teams and budget officers

- External auditors and regulatory bodies

They often participate in budget planning meetings and provide expert advice to support informed decision-making. Consultants may also help facilitate communication between different government departments to align financial goals and strategies.

Their work contributes to better resource allocation and improved public services delivery. By offering independent expertise, these consultants help government organisations make sound financial decisions that benefit taxpayers.

Key Qualities and Areas of Expertise

Public sector finance and budgeting consultants need a unique blend of skills to succeed. They must be tech-savvy, knowledgeable about government operations, and able to solve complex problems.

Technical/Subject-Matter Expertise

Public finance professionals require deep knowledge of accounting, budgeting, and financial management. They must understand complex regulations and policies that govern public spending.

Expertise in digital technologies is crucial. Consultants should be skilled in:

• Data analytics and visualisation tools

• Financial modelling software

• Enterprise resource planning (ERP) systems

Knowledge of emerging tech like generative AI can provide a competitive edge. Consultants must stay current with digital transformation trends in government.

Strong quantitative skills are essential for data-driven decision-making. The ability to interpret financial data and provide actionable insights is key.

Institutional Knowledge and Networks

Successful consultants have a thorough understanding of public sector organisations. This includes knowledge of:

• Government structures and processes

• Budgeting cycles and procedures

• Procurement and contracting rules

Building relationships with key stakeholders is vital. Consultants should cultivate networks across various government departments and agencies.

Familiarity with public policy issues helps consultants provide relevant advice. They should keep abreast of political and economic factors affecting public finances.

Adaptability and Problem-Solving Skills

Public sector consultants face diverse challenges. They must be flexible and able to adapt to changing circumstances.

Strong analytical and critical thinking skills are crucial. Consultants should be able to:

• Identify root causes of financial issues

• Develop innovative solutions to complex problems

• Evaluate the impact of policy changes on budgets

Effective communication is key. Consultants must explain complex financial concepts to non-experts clearly and concisely.

Project management skills help consultants deliver results on time and within budget. They should be adept at prioritising tasks and managing resources efficiently.

Strategic Value to External Organisations

Public sector finance and budgeting consultants offer vital expertise to external organisations. They help navigate complex systems, provide market insights, enhance credibility, and leverage public sector data.

Navigating Complex Procurement and Funding

Consultants guide external organisations through the intricate public sector procurement processes. They help firms understand:

- Tendering procedures

- Contract requirements

- Funding opportunities

Their expertise saves time and resources for businesses seeking public contracts. Consultants also assist in:

• Proposal writing

• Bid strategy development

• Compliance with regulations

By streamlining these processes, they increase an organisation's chances of securing public sector contracts. This expertise is crucial for private firms looking to expand into government markets.

Policy and Market Foresight

Consultants provide valuable insights into future policy directions and market trends. They analyse:

- Government spending plans

- Policy reforms

- Sector-specific initiatives

This foresight helps external organisations prepare for changes in the public sector landscape. Consultants can:

• Identify emerging opportunities

• Predict potential challenges

• Advise on strategic positioning

Their knowledge of public sector strategy allows businesses to align their offerings with government priorities. This alignment improves the chances of successful partnerships and contracts.

Enhancing Credibility and Compliance

Public sector consultants boost an organisation's credibility in government dealings. They ensure:

- Adherence to regulatory standards

- Transparent financial reporting

- Ethical business practices

This expertise is crucial for maintaining trust with public sector partners. Consultants also:

• Conduct compliance audits

• Develop risk management strategies

• Advise on governance structures

By enhancing compliance, they reduce the risk of legal issues and reputational damage. This increased credibility can lead to more opportunities in the public sector.

Leveraging Public Sector Data and Insights

Consultants help external organisations make use of valuable public sector data. They assist in:

- Interpreting government statistics

- Analysing spending patterns

- Identifying service gaps

This analysis informs strategic decision-making and product development. Consultants can:

• Create data-driven business cases

• Spot market trends

• Tailor services to public sector needs

By leveraging these insights, organisations can develop solutions that better meet government requirements. This targeted approach increases the likelihood of successful bids and long-term partnerships.

Practical Outcomes and Applications

Public sector finance and budgeting consultants help drive tangible improvements across government operations. Their work leads to enhanced services, strategic resource allocation, and measurable impacts for citizens.

Product Development and Service Enhancement

Outcome-based budgeting helps agencies develop better products and services. Consultants guide departments to link spending to specific goals and outcomes. This approach improves:

• Education programmes

• Transport infrastructure projects

By tying budgets to results, agencies can identify which initiatives deliver the most value. They can then scale up effective services and refine or replace underperforming ones.

Consultants also help implement activity-based costing. This reveals the true cost of delivering each service. Armed with this data, agencies can streamline operations and reduce waste.

Go-to-Market and Engagement Strategies

Finance consultants support the rollout of new public services. They develop funding models and business cases to secure investment. Key activities include:

• Cost-benefit analysis of proposed services

• Forecasting demand and revenue

• Identifying efficiency savings

Consultants also devise citizen engagement plans. These ensure new services meet public needs and expectations. Strategies may involve:

• Public consultations

• User testing and feedback loops

• Targeted outreach to underserved groups

By refining services based on user input, agencies boost adoption and satisfaction.

Long-Term Sustainability and Growth

Strategic financial planning is crucial for public sector sustainability. Consultants help agencies:

• Develop multi-year budgets

• Build financial reserves

• Manage debt effectively

They also identify opportunities for revenue growth. This may involve:

• Exploring new funding sources

• Optimising existing revenue streams

• Forming public-private partnerships

Consultants factor in long-term trends like climate change and demographic shifts. This ensures agencies can adapt services and maintain fiscal health.

Measuring Impact and ROI

Robust performance measurement is vital in the public sector. Consultants design frameworks to track:

• Service quality and outcomes

• Financial efficiency

• Social and environmental impacts

Key metrics might include:

• Citizen satisfaction scores

• Cost per unit of service delivered

• Carbon emissions reduced

Advanced analytics help agencies gain deeper insights. Consultants may implement:

• Predictive modelling

• Data visualisation tools

• Real-time performance dashboards

These tools enable data-driven decision-making. Agencies can quickly identify areas for improvement and allocate resources more effectively.

Frequently Asked Questions

Public sector finance and budgeting consultancy is a complex field with many important aspects to consider. These questions cover key areas for those interested in or working in this role.

How does one become a finance and budgeting consultant within the public sector?

To become a public sector finance consultant, one typically needs a strong background in accounting or finance. A relevant degree and professional certifications are often required.

Gaining experience in public sector organisations is crucial. Many consultants start their careers working directly for government agencies or local councils before moving into consultancy roles.

In what ways can a consultant impact financial decision-making in the public sector?

Consultants can have a significant impact on public sector financial decisions. They bring fresh perspectives and specialised expertise to help organisations improve their financial practices.

These experts often analyse budgets, identify cost-saving opportunities, and suggest more efficient ways to allocate resources. Their recommendations can lead to better use of public funds and improved service delivery.

What qualifications are required for a career in public sector financial consultancy?

A bachelor's degree in finance, accounting, or a related field is typically the minimum requirement. Many consultants also hold master's degrees in public administration or business administration.

Professional certifications such as Chartered Accountant (CA) or Certified Public Finance Officer (CPFO) are highly valued. Ongoing professional development is essential to stay current with changing regulations and best practices.

How do consultancy firms support public sector entities in financial planning and budget management?

Consultancy firms offer a range of services to help public sector organisations manage their finances effectively. These may include budget analysis, financial forecasting, and advice on funding strategies.

They often provide training to staff, implement new financial systems, and help organisations adapt to changes in government policies or regulations. Consultants can also assist with long-term financial planning and risk management.

What challenges do consultants in public sector finance and budgeting typically face?

Public sector consultants often grapple with complex bureaucratic structures and tight budgetary constraints. They must navigate political sensitivities and balance multiple stakeholder interests.

Adapting private sector practices to the public sector can be challenging. Consultants need to understand the unique goals and constraints of government organisations, which may prioritise public service over profit.

Which skills are considered essential for success in public sector finance and budgeting consultancy roles?

Strong analytical skills are crucial for examining complex financial data and identifying areas for improvement. Excellent communication skills are needed to explain financial concepts to non-experts and present recommendations clearly.

Project management abilities are important for overseeing large-scale financial initiatives. Adaptability and problem-solving skills help consultants tackle unique challenges in different public sector settings.