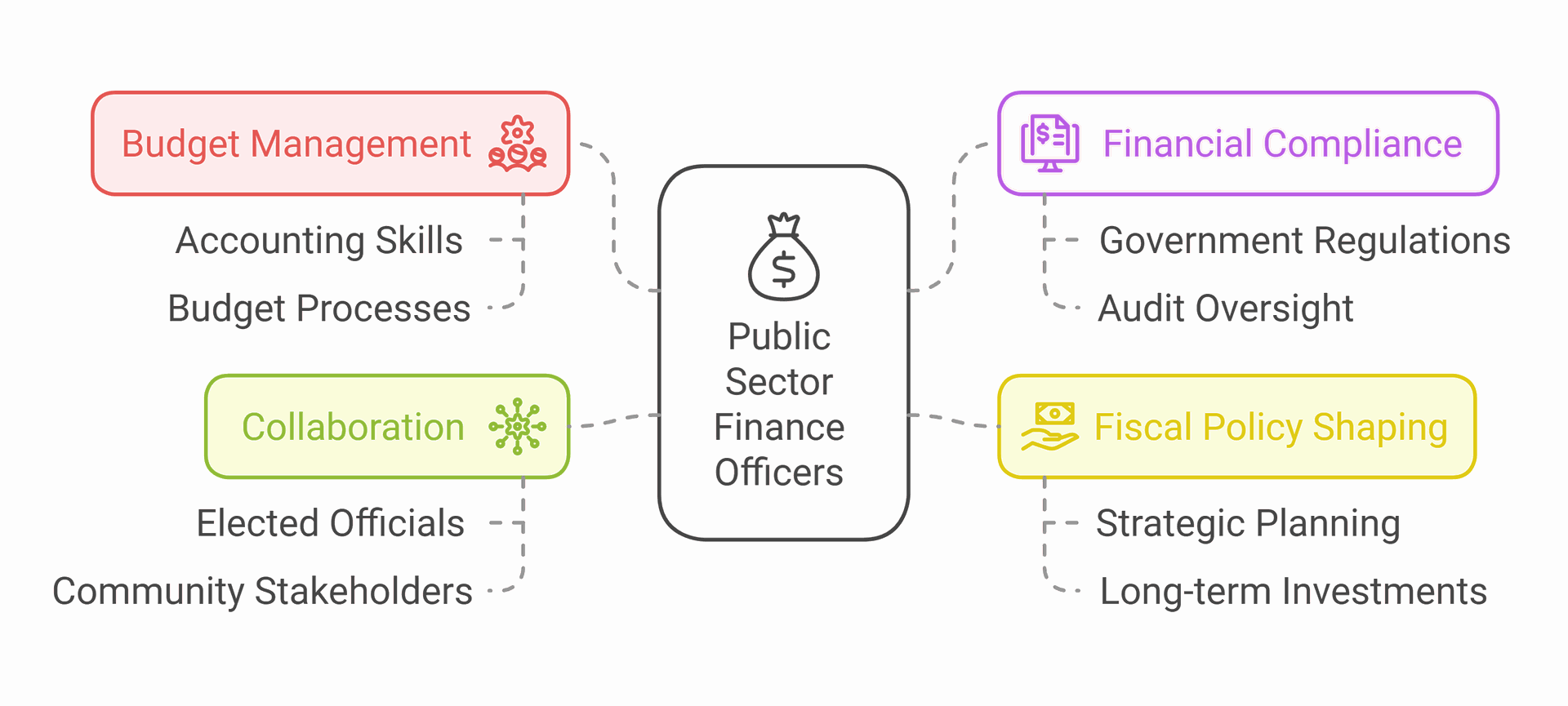

Public sector finance officers play a crucial role in local councils across the UK. These professionals manage budgets, ensure financial compliance, and help shape fiscal policies that impact communities. Their work touches every aspect of local government operations, from funding essential services to planning long-term investments.

Public sector finance officers in local councils typically need a strong background in accounting, financial management, and public administration. They must understand complex budget processes, government regulations, and the unique challenges faced by local authorities. Skills in data analysis, risk assessment, and strategic planning are also valuable in this role.

These finance experts often work closely with elected officials, department heads, and community stakeholders. They may be involved in preparing financial reports, overseeing audits, and developing strategies to maximise resources. Local council finance jobs can be found in various areas, including accounting, financial management, and budget analysis.

Key Takeaways

- Finance officers in local councils manage budgets and ensure financial compliance

- Strong accounting skills and knowledge of public administration are essential

- These roles involve collaboration with officials and community stakeholders

Understanding The Public Sector Finance Officer (Local Council) Role

The Public Sector Finance Officer plays a crucial role in managing local council finances. This position requires a deep understanding of financial regulations, stakeholder engagement, and decision-making processes specific to local government.

Core Responsibilities in the Public Sector

Public Sector Finance Officers handle various financial aspects of local council operations. They oversee financial transactions and ensure proper accounting practices are followed. Their duties include:

• Preparing annual budgets and financial reports

• Managing cash flow and investments

• Overseeing payroll and procurement processes

• Conducting financial audits and risk assessments

These officers work closely with parish councillors and the clerk to provide financial guidance. They attend council meetings to present financial updates and address queries.

Finance officers also support committee work by providing financial data for informed decision-making. They must balance day-to-day business needs with long-term financial planning.

Relevant Policy and Regulatory Context

Public Sector Finance Officers must navigate a complex regulatory landscape. They need to stay updated on:

• Local government finance regulations

• Accounting standards for public sector entities

• Audit requirements and best practices

These professionals ensure financial accountability of the council to external stakeholders. They prepare financial statements in compliance with legal requirements.

Finance officers play a key role in implementing financial policies set by the council. They must interpret and apply these policies consistently across all financial activities.

Typical Stakeholders and Decision-Making Processes

Public Sector Finance Officers interact with various stakeholders in their role. Key stakeholders include:

• Elected council members and committees

• Local residents and taxpayers

• External auditors and regulatory bodies

• Suppliers and service providers

Decision-making often involves presenting financial options to council committees. Finance officers provide expert advice to support informed choices.

They work closely with the Responsible Finance Officer (RFO) to ensure financial probity. In smaller councils, the Finance Officer and RFO roles may be combined.

Regular reporting at council meetings keeps all parties informed of the financial position. This transparency is crucial for maintaining public trust in local government finances.

Key Qualities and Areas of Expertise

Public sector finance officers need a diverse set of skills and knowledge to excel in their roles. These professionals must possess technical expertise, understand local government operations, and adapt to changing circumstances.

Technical/Subject-Matter Expertise

Finance officers must have strong accounting and financial management skills. They should be proficient in budgeting, financial reporting, and audit procedures. Knowledge of relevant software and systems is crucial.

Key areas of expertise include:

- Financial analysis and forecasting

- Risk management

- Procurement and contract management

- Tax regulations and compliance

Finance officers must stay current with changes in accounting standards and legislation affecting local government finances. This is especially important for smaller bodies like Marwood Parish Council, where resources may be limited.

Institutional Knowledge and Networks

Understanding the structure and operations of local government is vital. Finance officers should be familiar with:

- Council decision-making processes

- Funding sources and mechanisms

- Local economic factors

- Community needs and priorities

Building strong relationships with councillors, department heads, and external stakeholders is crucial. This network helps finance officers gather information and gain support for financial initiatives.

For rural parish councils, knowledge of specific local issues and funding challenges is particularly important.

Adaptability and Problem-Solving Skills

The public sector faces constant change, requiring finance officers to be flexible and innovative. They must:

- Respond to policy shifts and budget pressures

- Find creative solutions to funding challenges

- Embrace new technologies and working methods

Flexible schedules and remote work options are becoming more common, especially in smaller councils. Finance officers need to adapt to these new ways of working while maintaining productivity.

Strong communication skills are essential for explaining complex financial information to non-experts. Finance officers must present data clearly and persuasively to support decision-making.

Strategic Value to External Organisations

Public sector finance officers provide crucial expertise to external organisations. They offer unique insights into government operations and financial processes. Their knowledge helps bridge the gap between public and private sectors.

Navigating Complex Procurement and Funding

Public sector finance officers help external organisations understand complex procurement processes. They guide businesses through intricate tendering procedures and funding applications. This assistance is vital for companies seeking government contracts.

These officers explain budget cycles and fiscal policies. They clarify how public funds are allocated and spent. This knowledge allows external partners to align their proposals with government priorities.

Finance officers also advise on grant opportunities. They help organisations identify suitable funding streams. Their expertise increases the chances of successful applications.

Policy and Market Foresight

Finance officers possess valuable knowledge of upcoming policy changes. They can predict how these shifts might affect various sectors. This foresight helps external organisations plan for the future.

They analyse budget announcements and economic forecasts. This analysis allows them to spot trends that may impact businesses. Their insights help companies adapt their strategies accordingly.

These professionals also understand local economic conditions. They can provide data on regional development plans. This information is crucial for organisations considering expansion or relocation.

Enhancing Credibility and Compliance

Public sector finance officers boost the credibility of external organisations. They ensure that financial reports meet government standards. This compliance is essential for building trust with public bodies.

They advise on legal and regulatory requirements. This guidance helps organisations avoid costly mistakes. It also ensures that projects align with public sector goals.

These officers can act as references for organisations. Their endorsement carries weight in public sector circles. This support can open doors to new opportunities and partnerships.

Leveraging Public Sector Data and Insights

Finance officers have access to valuable public sector data. They can share anonymised information on spending patterns and service demands. This data helps organisations tailor their offerings to public sector needs.

They provide insights into performance management in local authorities. These insights help external partners understand how success is measured in the public sector. Organisations can then align their proposals with these performance indicators.

Finance officers also offer a unique perspective on public service delivery. They can identify gaps in current provisions. This knowledge helps organisations develop innovative solutions to address public needs.

Practical Outcomes and Applications

Finance officers in local councils play a crucial role in shaping public services and ensuring fiscal responsibility. Their work directly impacts community development, service delivery, and long-term financial stability.

Product Development and Service Enhancement

Finance officers contribute to improving council services through data-driven decision-making. They analyse financial data to identify areas for improvement and cost savings. This information helps develop new services and enhance existing ones.

For example, a finance officer might use performance management tools to track service efficiency. They could then recommend changes to streamline processes or reallocate resources.

Finance officers also play a key role in budgeting for new initiatives. They work with department heads to create realistic financial plans for proposed projects. This ensures new services are financially viable and align with council priorities.

Go-To-Market and Engagement Strategies

Finance officers help develop strategies to engage residents and promote council services. They provide financial insights to shape communication plans and outreach efforts.

These professionals create clear, accessible financial reports for the public. This transparency builds trust and helps residents understand how their tax money is spent. Finance officers might also present at community meetings to explain budget decisions.

They collaborate with marketing teams to develop cost-effective promotional strategies. This could include analysing the return on investment for different marketing channels. Finance officers ensure engagement efforts are both impactful and fiscally responsible.

Long-Term Sustainability and Growth

Finance officers are vital in planning for a council's future. They develop long-term financial strategies to ensure sustainable growth and service delivery.

These professionals forecast future revenue and expenses. They consider factors like population growth, economic trends, and policy changes. This helps councils prepare for future challenges and opportunities.

Finance officers also manage investments and reserves. They balance the need for financial security with opportunities for growth. This might involve recommending investment strategies or setting appropriate reserve levels.

They play a key role in identifying new revenue streams. This could include exploring grant opportunities or proposing new fee structures for services.

Measuring Impact and ROI

Finance officers develop systems to measure the impact of council initiatives. They create key performance indicators (KPIs) to track financial and non-financial outcomes.

These professionals use data analytics to assess the return on investment (ROI) of various projects. They might compare the costs of a new recycling programme against its environmental impact, for example.

Finance officers also conduct regular audits to ensure accuracy and compliance. They use these findings to improve financial processes and decision-making.

They create reports that link financial inputs to community outcomes. This helps councillors and residents understand the value delivered by council spending. It also informs future budget allocations and policy decisions.

Frequently Asked Questions

Finance officers in local councils play a vital role in managing public funds. Their responsibilities, qualifications, and career prospects are of interest to many.

What are the primary duties of a finance officer within a local council?

A finance officer in a local council handles the financial administration of the authority. They oversee budgets, prepare financial reports, and ensure compliance with regulations.

These professionals also advise councillors on financial matters and help shape fiscal policies. They work to maintain transparency in the council's financial dealings.

Are specific qualifications required to become a finance officer in the public sector?

Most councils require finance officers to hold a relevant degree in accounting, finance, or business. Professional qualifications from bodies like CIPFA are often preferred.

Experience in financial management is typically necessary. Some roles may demand specific knowledge of public sector finance laws and practices.

What is the typical salary range for a finance officer working for a local council?

Salaries for finance officers in local councils vary based on experience and location. Entry-level positions often start around £25,000 to £30,000 per year.

Senior finance officers or those in larger councils can earn £50,000 to £70,000 annually. Chief finance officers may command even higher salaries.

How does one secure a position as a finance officer in public sector finance?

Aspiring finance officers should tailor their CV to highlight relevant skills and experience. A strong covering letter can showcase their understanding of public sector finance.

Networking and keeping an eye on council job boards are helpful. During interviews, candidates should demonstrate their knowledge of local government finance and regulations.

Can you describe the job progression and career development opportunities for finance officers in local councils?

Finance officers can progress to senior roles such as chief financial officer or director of finance. They may also move into broader management positions within the council.

Continuous professional development is crucial. Many councils support further training and qualifications to help staff advance their careers.

What are the advantages of pursuing a career in finance within the public sector?

Public sector finance offers job stability and the chance to impact local communities. The work can be highly rewarding as it directly affects public services.

There are often good pension schemes and work-life balance benefits. Finance officers also gain valuable experience in managing large, complex budgets.