Regulatory compliance and governance consultants play a crucial role in today's complex business landscape. These professionals help organisations navigate the intricate web of regulations and ensure they operate within legal and ethical boundaries. A regulatory compliance and governance consultant provides expert guidance on risk management, internal controls, and adherence to industry standards.

Companies across various sectors rely on these consultants to stay ahead of regulatory changes and maintain robust governance structures. From financial services to healthcare, the demand for compliance expertise continues to grow. These specialists bring valuable insights and practical solutions to enhance an organisation's compliance posture.

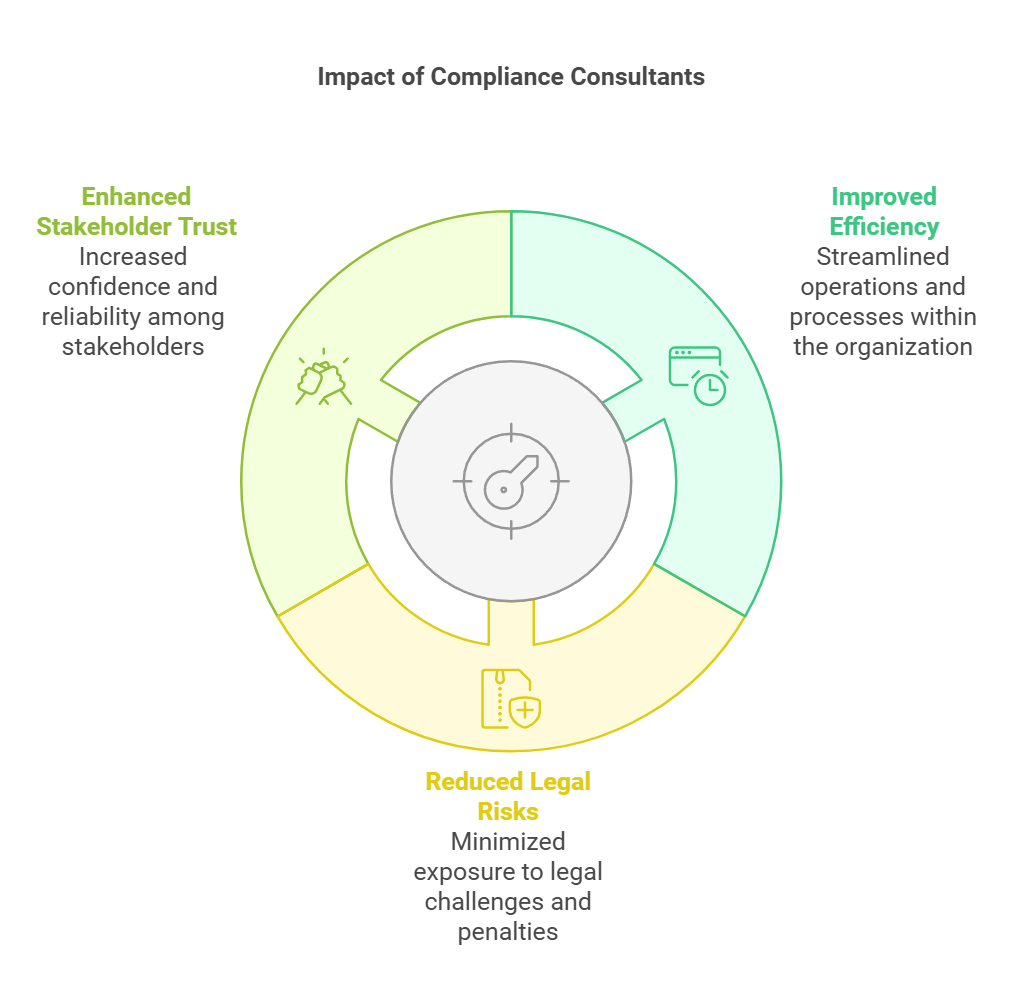

Engaging a regulatory compliance and governance consultant can lead to improved operational efficiency, reduced legal risks, and enhanced stakeholder trust. By leveraging their deep knowledge of regulatory frameworks and best practices, businesses can build resilient compliance programmes that support long-term success and sustainability.

Key Takeaways

- Regulatory compliance consultants provide expert guidance on risk management and governance

- Demand for compliance expertise spans multiple industries and continues to grow

- Engaging a consultant can improve efficiency, reduce risks, and enhance stakeholder trust

Understanding the Regulatory Compliance & Governance Consultant Role

Regulatory compliance and governance consultants play a vital role in helping organisations navigate complex regulatory landscapes. They ensure adherence to laws and regulations while promoting ethical business practices.

Core Responsibilities in the Public Sector

In the public sector, regulatory compliance consultants focus on ensuring government bodies and agencies follow established rules. They help interpret regulatory requirements and develop strategies for implementation.

Key responsibilities include:

- Conducting risk assessments

- Developing compliance policies and procedures

- Training staff on regulatory matters

- Monitoring compliance and reporting to senior management

- Liaising with regulatory bodies

Consultants often specialise in areas like financial crime prevention, data protection, or environmental regulations. They must stay up-to-date with changing laws and best practices.

Relevant Policy and Regulatory Context

The regulatory landscape for consultants is vast and ever-changing. In the UK, key regulatory bodies include:

- Financial Conduct Authority (FCA)

- Prudential Regulation Authority (PRA)

- Information Commissioner's Office (ICO)

Governance, Risk and Compliance (GRC) consultants help organisations navigate regulations like:

- Markets in Financial Instruments Directive (MiFID II)

- General Data Protection Regulation (GDPR)

- Anti-Money Laundering (AML) regulations

They must understand how these regulations impact different sectors and help clients develop robust compliance frameworks.

Typical Stakeholders and Decision-Making Processes

Regulatory compliance consultants interact with various stakeholders across organisations. These typically include:

- Board of Directors

- C-suite executives

- Compliance officers

- Legal teams

- Risk management departments

- IT and security teams

Consultants often act as strategic partners, advising on compliance matters at the highest levels. They help shape decision-making processes by:

- Presenting risk assessments and compliance reports

- Recommending policy changes

- Advising on the impact of new regulations

- Facilitating communication between departments

Their expertise helps organisations make informed decisions about regulatory matters and risk management strategies.

Key Qualities and Areas of Expertise

Regulatory compliance and governance consultants need a diverse set of skills to excel in their roles. They must possess deep technical knowledge, build strong networks, and adapt to complex challenges.

Technical/Subject-Matter Expertise

Compliance consultants require extensive knowledge of regulatory frameworks and industry standards. They must stay current with evolving laws and regulations affecting their clients' sectors.

Key areas of expertise include:

• Financial regulations (e.g. FCA, SEC)

• Data protection laws (e.g. GDPR)

• Anti-money laundering policies

• Risk assessment methodologies

Consultants should be able to interpret complex rules and apply them to real-world business scenarios. This expertise allows them to provide accurate guidance and develop effective compliance strategies.

Technical skills in data analysis and reporting are also crucial. Consultants often need to review large datasets to identify compliance issues and prepare detailed reports for clients and regulators.

Institutional Knowledge and Networks

Successful consultants build deep institutional knowledge of regulatory bodies and industry practices. This understanding helps them navigate complex regulatory landscapes and anticipate future changes.

Key aspects include:

• Relationships with regulators

• Knowledge of enforcement trends

• Understanding of industry best practices

Strong networks within the compliance community are valuable. These connections allow consultants to stay informed about emerging issues and share insights with peers.

Familiarity with specific regulatory bodies, such as the Financial Conduct Authority in the UK, is often essential. This knowledge enables consultants to provide tailored advice and represent clients effectively in regulatory matters.

Adaptability and Problem-Solving Skills

Creative problem-solving is crucial in compliance consulting. Consultants face unique challenges that require innovative solutions tailored to each client's needs.

Key abilities include:

• Analysing complex situations quickly

• Developing practical compliance strategies

• Adapting to changing regulatory environments

Consultants must be flexible in their approach, as compliance issues can vary greatly between industries and organisations. They need to think critically and consider multiple perspectives when addressing problems.

Strong communication skills are essential for explaining complex regulations to non-experts. Consultants should be able to present their findings and recommendations clearly to clients at all levels of an organisation.

Strategic Value to External Organisations

Regulatory compliance and governance consultants offer crucial support to external organisations. They help navigate complex regulatory landscapes, provide market insights, and enhance credibility.

Navigating Complex Procurement and Funding

Consultants guide organisations through intricate procurement processes and funding regulations. They help firms secure contracts and grants while ensuring compliance with strict rules.

In the public sector, consultants assist in developing robust procurement strategies. These strategies align with government policies and regulatory requirements.

For private companies, consultants offer expertise in:

- Bid preparation

- Contract negotiation

- Compliance documentation

This support is vital for organisations seeking to work with government bodies or access public funding.

Policy and Market Foresight

Regulatory consultants provide valuable insights into future policy changes and market trends. They help organisations prepare for shifts in the regulatory climate.

Key areas of focus include:

- ESG regulations

- Banking sector reforms

- Cryptocurrency governance

Consultants analyse proposed legislation and industry trends. They then offer strategic advice to help firms adapt their business models.

This foresight allows organisations to:

- Plan for regulatory changes

- Identify new market opportunities

- Mitigate potential risks

Enhancing Credibility and Compliance

Regulatory consultants boost an organisation's credibility by ensuring robust compliance frameworks. They help firms meet stakeholder expectations and regulatory standards.

Consultants conduct thorough audits of existing practices. They then develop tailored compliance programmes that address:

- Governance structures

- Risk management processes

- Reporting mechanisms

By implementing these programmes, organisations demonstrate their commitment to ethical practices. This enhances their reputation with regulators, investors, and customers.

Leveraging Public Sector Data and Insights

Consultants help organisations make effective use of public sector data and insights. They guide firms in accessing and interpreting valuable government information.

Key areas include:

- Economic forecasts

- Industry reports

- Regulatory updates

Consultants assist in:

- Analysing public data sets

- Interpreting policy documents

- Applying insights to business strategy

This expertise helps organisations make informed decisions. It also ensures they remain aligned with the evolving regulatory environment.

Practical Outcomes and Applications

Regulatory compliance and governance consulting delivers tangible benefits for organisations. It enhances operational efficiency, mitigates risks, and fosters a culture of ethical business practices.

Product Development and Service Enhancement

Compliance consultants help firms create products and services that meet regulatory standards. They review existing offerings and suggest improvements to align with current rules.

Compliance solutions often include tools for monitoring transactions and detecting suspicious activities. These tools aid in anti-money laundering (AML) efforts and fraud prevention.

Consultants also assist in developing robust policies and procedures. These documents guide staff in their day-to-day activities, ensuring consistent compliance across the organisation.

Go-to-Market and Engagement Strategies

Regulatory experts support firms in crafting compliant marketing strategies. They review promotional materials to ensure they meet industry standards and regulatory requirements.

Consultants help design customer engagement processes that protect consumer rights. This includes clear communication of terms and conditions, and fair handling of complaints.

They also advise on data protection measures for customer information. This helps firms build trust with clients and avoid hefty fines for data breaches.

Long-Term Sustainability and Growth

Regulatory compliance consulting aids in building sustainable business models. It helps firms anticipate and adapt to changing regulations, ensuring long-term viability.

Consultants assist in creating governance structures that support ethical decision-making. This fosters a positive corporate culture and enhances the firm's reputation.

They also help firms implement risk management frameworks. These systems identify and mitigate potential threats to the business, supporting stable growth.

Measuring Impact and ROI

Compliance consultants help firms track the effectiveness of their compliance programmes. They establish key performance indicators (KPIs) to measure success.

Common metrics include:

- Number of regulatory breaches

- Time to resolve compliance issues

- Cost savings from avoided fines

- Employee compliance training completion rates

Consultants also conduct regular audits to assess the effectiveness of compliance measures. These reviews identify areas for improvement and demonstrate the value of compliance investments.

Frequently Asked Questions

Regulatory compliance and governance consultants play a vital role in helping organisations navigate complex legal and ethical landscapes. Their expertise spans risk management, corporate culture, and regulatory frameworks.

What are the main responsibilities of a regulatory compliance and governance consultant?

Consultants in this field ensure organisations follow laws and regulations. They create policies, conduct audits, and manage risk. They also help build a strong compliance culture.

Their work often includes anti-money laundering efforts. They may review financial transactions and set up systems to detect suspicious activity.

How does one train to become a consultant in regulatory compliance and governance?

Training typically involves a mix of education and experience. Many consultants have degrees in law, business, or finance. On-the-job training is crucial too.

Aspiring consultants often start in entry-level compliance roles. They may work under former regulators who bring valuable insights from their past roles.

What role does a consultant play within a governance, risk, and compliance framework?

Consultants help design and implement these frameworks. They assess current practices and suggest improvements. They also train staff on compliance matters.

Their role includes identifying and mitigating risks. They work with various departments to ensure a cohesive approach to compliance.

What constitutes a well-structured governance, risk, and compliance framework in an organisation?

A strong framework has clear policies and procedures. It includes regular risk assessments and audits. It also has a system for reporting and addressing issues.

The framework should be integrated into the organisation's culture. It needs support from top leadership and buy-in from all employees.

What qualifications are necessary for a career in governance, risk, and compliance within the UK?

In the UK, relevant degrees and professional certifications are valuable. Compliance officers often have backgrounds in law, accounting, or business.

Certifications from bodies like the International Compliance Association are well-regarded. Experience in the specific industry sector is also important.

In terms of industry best practices, how should a regulatory compliance consultant approach their duties?

Consultants should stay up-to-date with changing regulations. They need to be proactive in identifying potential compliance issues.

Clear communication is key. Consultants must be able to explain complex regulations in simple terms. They should also foster a culture of compliance throughout the organisation.