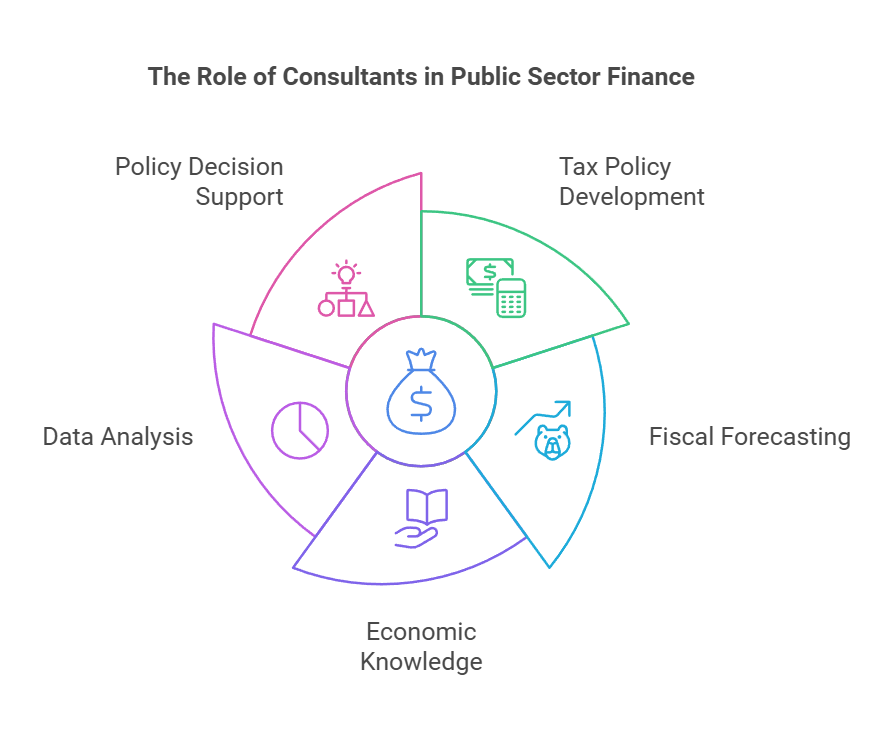

Tax policy and fiscal forecasting consultants play a vital role in shaping public sector finances. These professionals provide expert guidance on tax strategies and financial projections to government bodies and other public organisations. Their work helps ensure sound fiscal management and informed decision-making.

A skilled tax policy and fiscal forecasting consultant combines in-depth knowledge of economics, public finance, and data analysis to deliver valuable insights. They use complex models to predict future revenue and spending trends, helping policymakers plan for various economic scenarios. Their expertise is crucial for developing effective tax policies and maintaining fiscal stability.

Public sector organisations rely on these consultants to navigate complex financial challenges. From local councils to national government departments, their input shapes budgets, informs policy decisions, and supports long-term financial planning. By providing clear, data-driven advice, these professionals help ensure public funds are used wisely and efficiently.

Key Takeaways

- Tax policy and fiscal forecasting consultants provide crucial financial guidance to public sector organisations

- They use advanced analytical skills to predict economic trends and inform policy decisions

- Their expertise helps ensure responsible management of public finances and supports long-term planning

Understanding the Tax Policy & Fiscal Forecasting Consultant (Public Sector) Role

Tax policy and fiscal forecasting consultants play a crucial role in shaping public finances and economic planning. They analyse complex financial data, develop tax strategies, and provide expert advice to government bodies.

Core Responsibilities in the Public Sector

Tax policy and fiscal forecasting consultants have several key duties:

- Analysing tax revenues and forecasting future income

- Assessing the impact of policy changes on public finances

- Developing models to predict economic outcomes

- Advising on fiscal targets and debt management

- Evaluating public spending and departmental budgets

These professionals work closely with HM Treasury to analyse income tax, corporation tax, and National Insurance contributions. They also examine trends in council tax, business rates, and fuel duty to inform policy decisions.

Relevant Policy and Regulatory Context

Consultants must stay up-to-date with UK tax laws and fiscal policies. Key areas include:

- Annual spending reviews and budget announcements

- Public sector net debt and borrowing limits

- Fiscal rules and targets set by the government

- Tax policy changes and their economic impact

They need to understand how fiscal policy impacts the economy and use analytical tools to assess potential outcomes. Familiarity with the Office for Budget Responsibility's role in fiscal forecasting is essential.

Typical Stakeholders and Decision-Making Processes

Tax policy and fiscal forecasting consultants interact with various stakeholders:

- Government ministers and policymakers

- HM Treasury officials

- Office for Budget Responsibility analysts

- Economists and financial experts

- Public sector finance teams

They contribute to decision-making by:

- Providing data-driven insights for policy formulation

- Presenting fiscal forecasts to inform budget planning

- Assessing the impact of tax changes on different sectors

- Recommending strategies to manage public debt and spending

Consultants must balance political priorities with economic realities to offer impartial, evidence-based advice.

Key Qualities and Areas of Expertise

Tax policy and fiscal forecasting consultants in the public sector need a unique mix of skills and knowledge. They must be experts in finance, understand government operations, and adapt to changing circumstances.

Technical/Subject-Matter Expertise

Fiscal consultants must have deep knowledge of tax policies, financial management, and forecasting methods. They should be well-versed in:

• Economic and fiscal outlook preparation

• Value for money assessments

• Inflation and interest rate impacts

• Tax base analysis

Proficiency with statistical tools and economic models is crucial. Consultants need to interpret complex data and create accurate forecasts. They must stay current on economic trends and policy changes that affect government finances.

Institutional Knowledge and Networks

Understanding the inner workings of government is vital. Consultants should be familiar with:

• The Office for Budget Responsibility (OBR)

• Charter for Budget Responsibility

• Government departments and agencies

Strong networks within the public sector are important. These connections help consultants gather information and navigate bureaucracies. They must also grasp the political landscape and how it shapes fiscal decisions.

Adaptability and Problem-Solving Skills

Public finance professionals need to be flexible and creative. They often face complex problems with no clear solutions. Key skills include:

• Analysing multiple scenarios

• Adapting forecasts to changing conditions

• Finding innovative ways to raise revenue

Consultants must balance competing priorities like economic growth and austerity measures. They should be able to explain complex ideas in simple terms to non-experts. Clear communication of findings and recommendations is essential.

Strategic Value to External Organisations

Tax policy and fiscal forecasting consultants bring vital expertise to public sector organisations. They help navigate complex financial challenges and provide valuable insights for decision-making.

Navigating Complex Procurement and Funding

Public sector bodies face intricate procurement processes and funding structures. Consultants assist in developing robust investment decision-making frameworks. They analyse funding options and create models to optimise resource allocation.

These experts help organisations adapt to changing economic conditions. For instance, during the COVID-19 pandemic, consultants aided in restructuring budgets to meet urgent healthcare needs.

They also guide public services in securing funds for long-term projects. This includes initiatives to combat climate change, such as renewable energy infrastructure.

Policy and Market Foresight

Consultants provide crucial evidence-based strategy and policy development. They analyse market trends and economic indicators to forecast future scenarios.

This foresight helps public sector entities prepare for potential challenges. For example, consultants assessed the impact of the Energy Price Guarantee on government finances.

They also evaluate the economic effects of global events. The war in Ukraine prompted analysis of its implications for UK public spending and policy priorities.

Consultants use advanced modelling techniques to predict outcomes of policy changes. This aids in crafting effective strategies for public services delivery.

Enhancing Credibility and Compliance

External consultants bring an independent perspective to financial matters. This enhances the credibility of public sector organisations' fiscal projections and tax policies.

They ensure compliance with complex regulatory frameworks. Consultants stay up-to-date with changing legislation and best practices in public finance.

Their expertise helps build trust with stakeholders, including the public and oversight bodies. Accurate financial forecasting and transparent reporting are key elements of this trust-building process.

Consultants also assist in developing robust governance structures. These frameworks support ethical decision-making and efficient use of public funds.

Leveraging Public Sector Data and Insights

Tax policy and fiscal forecasting consultants excel at data analytics. They harness vast public sector datasets to generate valuable insights.

These experts create sophisticated models to analyse spending patterns and revenue trends. Their work helps identify areas for efficiency improvements in public services.

Consultants also use data to assess the impact of policy changes on different demographic groups. This supports more equitable and targeted service delivery.

They collaborate with government agencies to improve data collection and management practices. Enhanced data quality leads to more accurate forecasting and better-informed policy decisions.

Practical Outcomes and Applications

Tax policy and fiscal forecasting consultants help governments make informed decisions about public finances. Their work leads to better budgets, smarter spending, and improved services for citizens.

Product Development and Service Enhancement

Consultants use data and models to shape new tax policies and refine existing ones. They analyse how changes might affect revenue and economic growth. This helps create fair, effective tax systems.

Improved forecasting tools allow more accurate budget predictions. Public sector organisations can plan spending with greater confidence. Better data also supports the design of targeted social programmes.

Consultants may recommend ways to streamline tax collection. This can reduce costs and improve compliance. They might also suggest new digital services to make paying taxes easier for citizens and businesses.

Go-to-Market and Engagement Strategies

Clear communication is key when introducing new tax policies. Consultants help craft messages that explain changes to the public. They may create simple guides or online tools to help people understand new rules.

Engaging stakeholders early in the process is crucial. Consultants organise workshops and consultations with business groups, unions, and community leaders. This builds support and helps refine policies before launch.

Public sector consulting firms often use social media and other digital channels to reach younger taxpayers. They might develop apps or interactive websites to educate the public about fiscal issues.

Long-Term Sustainability and Growth

Consultants help governments plan for the future. They model long-term trends in demographics, technology, and the economy. This informs strategies for sustainable public finances.

Recommendations might include:

- Diversifying revenue sources

- Building fiscal buffers for economic shocks

- Investing in infrastructure to boost growth

- Reforming pensions and healthcare to manage ageing populations

Consultants also advise on capital investment strategies. They help balance short-term needs with long-term fiscal health.

Measuring Impact and ROI

Tracking the success of tax policies and forecasts is vital. Consultants develop key performance indicators (KPIs) to measure outcomes. These might include:

- Revenue collected vs. targets

- Economic growth rates

- Changes in income inequality

- Business formation rates

They use sophisticated models to estimate the return on investment (ROI) for different policy options. This helps governments prioritise spending and justify decisions to the public.

Regular reviews and adjustments are important. Consultants help set up monitoring systems to catch issues early. They also provide ongoing training to keep government staff up-to-date on best practices.

Frequently Asked Questions

Tax policy and fiscal forecasting consultants in the public sector play a vital role in shaping government finances. Their work requires specialised knowledge, skills, and ongoing professional development to navigate complex economic landscapes.

What qualifications are required for a career in tax policy and fiscal forecasting within the public sector?

A strong academic background is essential. Most positions require a master's degree in economics, public policy, or finance. Some roles may accept candidates with bachelor's degrees and significant relevant experience.

Forecasting skills are crucial. Proficiency in statistical analysis and econometric modelling is often necessary. Many employers value professional certifications in accounting or financial analysis.

How does one advance in a tax policy and fiscal forecasting consultancy role in the public sector?

Advancement often comes through demonstrating expertise and impact. Consultants who contribute to successful policy outcomes or accurate forecasts may receive promotions.

Networking within government and policy circles can open doors. Pursuing additional qualifications or specialisations can also lead to career progression.

What are the primary responsibilities of a consultant specialising in public sector tax policy and fiscal forecasting?

These consultants analyse economic data and tax policies. They create financial projections to inform government decision-making.

They often advise on potential impacts of policy changes. Preparing reports and presentations for policymakers is a key part of the role.

Which consulting firms are recognised for their expertise in public sector tax policy and fiscal forecasting?

Large multinational firms like PwC, Deloitte, and KPMG have dedicated public sector practices. Boutique consultancies specialising in government advisory services also exist.

Think tanks such as the Institute for Fiscal Studies are respected for their policy research and analysis.

What are the current trends in public sector fiscal policy that consultants must stay abreast of?

Digital transformation in tax administration is a major trend. Consultants need to understand how technology affects tax collection and compliance.

Climate change policies are increasingly impacting fiscal planning. Consultants must consider environmental factors in their forecasts.

How does public sector fiscal forecasting differ from private sector practices?

Public sector forecasting often has a longer-term focus. Government budget cycles and multi-year spending reviews require extended projections.

Political considerations play a larger role in public sector forecasting. Consultants must account for potential policy shifts and their economic impacts.