UK-EU regulatory alignment and compliance consultants play a crucial role in helping businesses navigate the complex landscape of regulations between the United Kingdom and European Union. These experts possess in-depth knowledge of both UK and EU regulatory frameworks, enabling them to guide companies through compliance challenges effectively.

Compliance consultants offer full regulatory support for FCA regulated firms, ensuring they meet all necessary requirements. Their expertise spans various sectors, including financial services, manufacturing, and technology. By staying up-to-date with the latest regulatory changes, these consultants help organisations adapt their strategies and operations to maintain compliance.

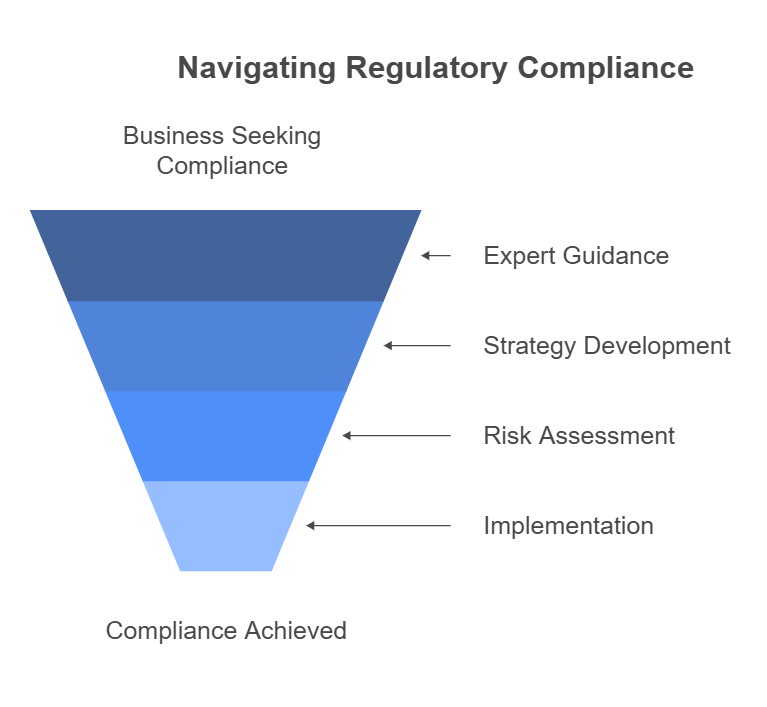

Businesses seeking to operate in both UK and EU markets can benefit greatly from the services of regulatory alignment consultants. These professionals assist in developing comprehensive compliance strategies, conducting risk assessments, and implementing necessary changes to meet regulatory standards. Their guidance can help companies avoid costly penalties and maintain smooth operations across borders.

Key Takeaways

- Regulatory alignment consultants possess expertise in both UK and EU regulatory frameworks

- These professionals help businesses navigate complex compliance challenges across various sectors

- Compliance consultants provide strategic value by ensuring organisations meet regulatory standards and avoid penalties

Understanding The UK-EU Regulatory Alignment & Compliance Consultant Role

The UK-EU regulatory landscape is complex and ever-changing. Compliance consultants play a crucial role in navigating this terrain, helping organisations adapt to new rules and maintain alignment where needed.

Core Responsibilities In The Public Sector

Compliance consultants in the public sector focus on:

- Analysing regulatory divergence between the UK and EU

- Advising on implications of new UK legislation

- Ensuring adherence to retained EU law

- Facilitating cross-border cooperation

They work closely with government departments to interpret and implement regulations. This often involves breaking down complex legal texts into actionable guidance.

Key tasks include:

- Conducting regulatory impact assessments

- Drafting compliance frameworks

- Training staff on new procedures

- Liaising with EU counterparts on shared standards

Relevant Policy And Regulatory Context

The UK's regulatory landscape has shifted since Brexit. Compliance consultants must stay abreast of:

- The EU-UK Trade and Cooperation Agreement

- UK plans for regulatory divergence or alignment

- EU regulations affecting UK businesses

- Mutual recognition agreements

They need to understand concepts like active and passive divergence, managed divergence, and dynamic alignment. The Carbon Border Adjustment Mechanism is a key area where UK-EU regulatory cooperation is crucial.

Typical Stakeholders And Decision-Making Processes

Compliance consultants interact with a wide range of stakeholders:

- Government ministers and civil servants

- Regulatory bodies (e.g. FCA, CMA)

- Industry associations

- European Commission representatives

- Legal experts and academics

Decision-making often involves:

- Identifying areas of potential divergence

- Assessing impact on trade and businesses

- Consulting with affected parties

- Recommending alignment or divergence strategies

- Implementing new processes or standards

Consultants must navigate complex political and economic considerations. They need strong analytical and communication skills to influence policy outcomes.

Key Qualities and Areas of Expertise

UK-EU regulatory alignment consultants need a diverse skillset to navigate complex compliance landscapes. They must stay current on evolving regulations while offering practical guidance to clients.

Technical/Subject-Matter Expertise

Consultants require deep knowledge of UK and EU regulatory frameworks. This includes understanding legislation from bodies like the Financial Conduct Authority (FCA) and Competition and Markets Authority (CMA). Expertise in sector-specific rules is crucial, such as financial services or data protection.

Strong analytical skills help consultants interpret new policies. They must grasp technical details and explain impacts clearly to clients. Keeping up with regulatory changes through ongoing training is essential.

Consultants should be able to conduct thorough compliance audits. They need to spot potential issues and suggest practical solutions. Knowledge of best practices in regulatory reporting is also valuable.

Institutional Knowledge and Networks

Effective consultants have a solid grasp of UK and EU governmental structures. They understand how different regulatory bodies interact and make decisions. This insight helps predict policy shifts and their effects on businesses.

Building a network of contacts in key institutions is vital. Relationships with regulators, industry groups, and policymakers provide valuable intelligence. Consultants use these connections to stay ahead of regulatory trends.

Experience working with or within regulatory bodies is highly beneficial. It offers inside knowledge of enforcement priorities and decision-making processes. This background helps consultants give more nuanced advice to clients.

Adaptability and Problem-Solving Skills

The regulatory landscape is always changing. Consultants must be flexible and quick to learn new rules. They need to adjust strategies as UK-EU regulatory alignment evolves.

Creative problem-solving is key when helping clients navigate complex regulations. Consultants should find innovative ways to ensure compliance while supporting business goals. They must balance legal requirements with practical operational needs.

Strong communication skills are essential. Consultants translate technical jargon into clear guidance for clients. They should be able to present complex information in accessible formats like flowcharts or decision trees.

Strategic Value to External Organisations

Regulatory alignment and compliance consulting offer crucial advantages to external organisations navigating UK-EU trade relations. These services provide essential support across multiple areas of business operations and strategy.

Navigating Complex Procurement and Funding

Compliance consultants help organisations understand and meet regulatory requirements for UK-EU trade. They guide businesses through the intricacies of procurement processes, ensuring adherence to post-Brexit regulations.

Consultants assist in identifying funding opportunities and preparing compliant applications. This is particularly vital for sectors heavily reliant on EU funding, such as research and development.

They also provide expertise on the UK Internal Market Act, helping businesses navigate different regulatory regimes across the UK's nations.

Policy and Market Foresight

Regulatory consultants offer valuable insights into future policy directions. They analyse trends in UK-EU relations, helping organisations anticipate regulatory changes.

These experts monitor developments in trade agreements, sanctions, and market access conditions. This foresight allows businesses to adapt strategies proactively.

Consultants also provide analysis on sector-specific issues, such as food safety regulations and their impact on UK-EU agri-food trade.

Enhancing Credibility and Compliance

Compliance consultants bolster an organisation's credibility with regulators and stakeholders. They ensure businesses meet the standards required for market access in both the UK and EU.

These experts help companies develop robust compliance frameworks. This includes creating policies, procedures, and training programmes tailored to post-Brexit regulatory landscapes.

Consultants also assist in dispute resolution, helping organisations navigate disagreements related to regulatory compliance or trade issues.

Leveraging Public Sector Data and Insights

Regulatory consultants have extensive knowledge of public sector data and processes. They help organisations interpret and utilise government publications on regulatory changes.

These experts can navigate complex government websites and databases, extracting valuable information for their clients. This includes analysing regulatory reform programmes and their potential impact on businesses.

Consultants also facilitate engagement with regulatory bodies, helping organisations build constructive relationships with relevant authorities in the UK and EU.

Practical Outcomes and Applications

UK-EU regulatory alignment impacts businesses across various sectors. It affects product development, market strategies, long-term growth, and return on investment. These areas require careful consideration for companies operating in both markets.

Product Development and Service Enhancement

Regulatory alignment influences how firms create and improve their offerings. Companies must adapt their products and services to meet both UK and EU standards. This often leads to:

• Streamlined design processes

• Cost-effective compliance measures

• Enhanced product safety features

Technical negotiations between the UK and EU on competition investigations affect business strategies. Firms must stay informed about these developments to ensure their products remain compliant.

Digital services face unique challenges. They must adhere to data protection rules in both regions. This may require:

• Localised data storage solutions

• Tailored privacy policies

• Regular audits of data handling practices

Go-To-Market and Engagement Strategies

Market entry tactics differ based on regulatory alignment. Businesses must consider:

• Varying certification requirements

• Labelling and packaging differences

• Distinct marketing regulations

Import and export procedures play a crucial role. Companies need to navigate customs processes efficiently. This might involve:

• Updating supply chain management

• Revising logistics plans

• Training staff on new procedures

Engagement with civil society organisations can be beneficial. These groups often provide valuable insights into local regulatory landscapes. Firms can leverage their knowledge to:

• Refine market approaches

• Build trust with local communities

• Address ESG concerns effectively

Long-Term Sustainability and Growth

Sustainable growth relies on adapting to evolving regulations. Companies must:

• Monitor regulatory changes in both the UK and EU

• Invest in flexible business models

• Develop agile compliance systems

Environmental protection measures are increasingly important. Firms should:

• Implement eco-friendly practices

• Invest in sustainable technologies

• Align with both UK and EU green initiatives

Economic growth strategies must account for regulatory differences. This may include:

• Targeted expansion plans for each market

• Tailored product lines for UK and EU consumers

• Strategic partnerships to navigate regional complexities

Measuring Impact and ROI

Assessing the impact of regulatory alignment is crucial. Companies should track:

• Compliance costs

• Market share changes

• Customer satisfaction levels

ROI calculations must factor in regulatory expenses. This includes:

• Initial compliance investments

• Ongoing monitoring costs

• Potential fines for non-compliance

Inflation affects ROI measurements. Firms must adjust their financial models to account for:

• Changing currency values .

• Fluctuating material costs .

• Wage pressures in different regions

Data-driven decision making is essential. Companies should:

• Implement robust analytics systems

• Regularly review key performance indicators

• Adjust strategies based on quantitative insights

Frequently Asked Questions

Brexit has significantly impacted UK-EU regulatory alignment. Companies face new challenges in maintaining compliance across borders. Key issues include diverging standards, mutual recognition, and sector-specific impacts.

How does Brexit affect UK compliance with EU regulations?

Brexit ended the UK's automatic compliance with EU regulations. UK firms must now follow separate UK and EU rules. This creates extra work and costs for businesses operating in both markets.

UK regulators can now set different standards from the EU. But many UK rules still mirror EU ones to maintain market access.

What are the current requirements for UK businesses to maintain alignment with EU standards?

UK businesses exporting to the EU must meet EU standards for those products. For some goods, the UK accepts EU certifications. But others need separate UK approvals.

Services face more barriers. UK qualifications aren't always recognised in the EU now. Financial firms have lost automatic "passporting" rights to operate across the EU.

Which sectors are most impacted by changes in UK-EU regulatory alignment?

Financial services face major changes. UK firms have lost EU passporting rights. Chemicals, pharmaceuticals and food producers also see big impacts.

Car makers must deal with new rules of origin. Tech firms face different data protection regimes. Professional services struggle with qualification recognition.

How should UK companies prepare for changes in EU regulatory compliance post-transition period?

Companies should track the UK-EU regulatory divergence. They may need separate UK and EU compliance processes. Firms should review their supply chains and contracts.

Getting expert advice is crucial. Compliance consultants can help navigate the new landscape. Companies may need to set up EU entities to maintain market access.

What is the UK Government's approach to regulatory divergence from the EU?

The UK aims for a "Brexit dividend" through smarter regulation. It's keeping EU rules for now in many areas. But it plans gradual divergence where beneficial.

The government is reviewing inherited EU laws. It wants to cut red tape while maintaining high standards. But changes must balance sovereignty with EU market access.

Are there any mechanisms for mutual recognition of regulations between the UK and EU?

The Trade and Cooperation Agreement allows some mutual recognition. This covers areas like product safety assessments. But it's limited compared to EU membership.

Talks continue on financial services equivalence. Professional qualifications have some mutual recognition. But many areas still lack clear frameworks for alignment.