Government spending affects everyone in the UK. It shapes our public services, infrastructure, and daily lives. The way this money is managed and accounted for is crucial.

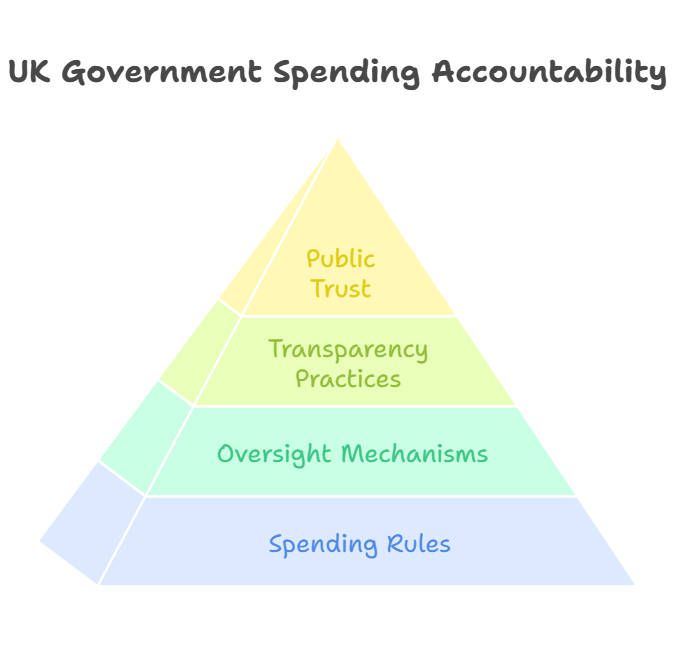

Accountability in government spending ensures that public funds are used properly and efficiently. This means clear rules, checks, and balances. It also means being open about how decisions are made and money is spent.

The UK has a system to make sure public spending is done right. This includes laws, guidelines, and watchdogs. But it's not always perfect. There are still challenges and hard choices to make about where money goes and how it's tracked.

Key Takeaways

- Managing Public Money sets the rules for how government handles funds

- Regular checks and reports help keep spending on track

- Clear communication about spending choices builds public trust

Fundamentals of Government Accountability

Government accountability ensures proper use of public funds and upholds trust in public institutions. It involves clear roles for officials and mechanisms to oversee spending.

Defining Accountability and Its Significance

Accountability in government means officials are responsible for their actions and decisions. It's vital for democracy and good governance. Accountability helps prevent misuse of power and ensures public money is spent wisely.

Key aspects of accountability include:

• Transparency in decision-making

• Regular reporting on activities and spending

• Independent audits of government accounts

• Mechanisms for public scrutiny

Effective accountability builds trust between citizens and government. It allows people to see how their taxes are used and hold officials responsible for results.

Roles and Responsibilities of Public Servants

Public servants have a duty to act in the public interest. This includes:

• Following rules and procedures for handling public money

• Making decisions based on evidence and expert advice

• Being honest and impartial in their work

• Avoiding conflicts of interest

Officials must keep accurate records of their actions and spending. They should be ready to explain their decisions to Parliament, auditors, and the public.

Senior leaders have extra responsibilities. They must set a culture of accountability in their departments. This means creating clear processes for decision-making and spending approval.

Mechanisms of Accountability in Public Spending

The UK government uses several key methods to ensure proper oversight of public funds. These include designated officials, parliamentary scrutiny, and clear delegation of financial authority.

Accounting Officers and Their Assessments

Accounting officers play a vital role in managing public money. These senior civil servants are personally responsible for their organisation's spending and accounting.

They must ensure:

• Value for money

• Proper use of public funds

• Accurate financial records

Accounting officers conduct assessments on major projects and spending decisions. These evaluate risks, benefits, and value for money. If concerns arise, they may seek a formal direction from their minister.

Parliamentary Oversight and Accountability to Parliament

Parliament holds ultimate authority over public spending in the UK. It approves budgets and scrutinises how money is used.

Key aspects of parliamentary oversight include:

• Regular committee hearings

• Departmental reports to MPs

• National Audit Office reviews

The Public Accounts Committee plays a crucial role. It examines government spending and holds officials to account for financial decisions.

Delegated Authority and Decision-Making

Government departments use a system of delegated authority for financial decisions. This allows for efficient operations while maintaining control.

Senior officials receive delegated authority letters. These set out:

• Spending limits

• Areas of responsibility

• Reporting requirements

Lower-level staff may receive sub-delegated authority. This creates a clear chain of accountability for all spending decisions.

Proper use of delegated authority helps ensure public money is spent wisely and in line with government priorities.

Managing Public Money

Managing public money involves strict guidelines and practices to ensure responsible use of taxpayer funds. It requires careful oversight and strategic planning to achieve good governance and value for money.

Financial Management and Good Governance

Managing public money is a crucial aspect of government operations. It involves proper budgeting, accounting, and reporting of public funds. Good governance in financial management includes:

• Transparent decision-making processes

• Regular audits and assessments

• Clear lines of accountability

Public servants have a duty to use resources wisely. They must follow principles set out in official guidance documents. These rules help prevent misuse and ensure public money is spent properly.

Good financial management also involves risk assessment. Officials must identify potential issues and plan accordingly. This helps protect public funds from waste or fraud.

Strategies for Value for Money

Achieving value for money is a key goal in managing public funds. Strategies include:

- Competitive tendering for contracts

- Regular performance reviews

- Benchmarking against best practices

Officials must consider cost-effectiveness in all spending decisions. This means looking at both short-term and long-term impacts of expenditures.

Innovation can play a big role in improving value for money. New technologies or processes may offer better results at lower costs.

It's also important to measure outcomes, not just outputs. This helps ensure that spending actually achieves desired goals.

Special Severance Payments and Public Funds

Special severance payments require extra scrutiny when using public funds. These are payments made to employees outside normal statutory or contractual requirements.

Key points about special severance payments:

• They must be approved at high levels

• There must be a clear business case

• They should not be used to avoid proper processes

Public bodies must be very careful with these payments. They can be seen as rewarding failure if not handled properly.

Clear policies and procedures help manage risks around special severance payments. Regular reporting on such payments aids transparency and accountability.

Guidance and Regulations

The UK government has established clear rules and guidelines for managing public funds. These aim to ensure proper spending and accountability across all departments and agencies.

Cabinet Office and HM Treasury Directives

The Cabinet Office and HM Treasury play key roles in setting guidance for public spending. They issue directives that all central government departments must follow.

These directives cover budgeting, accounting, and reporting practices. They also outline proper procedures for procurement and contract management.

Departments must adhere to strict financial controls. This includes getting approval for major spending decisions. The goal is to prevent waste and misuse of taxpayer money.

Guidance for Accounting Officers

Accounting Officers are senior officials responsible for an organisation's finances. They must ensure proper use of public funds.

Key duties include:

- Ensuring value for money

- Maintaining proper financial records

- Safeguarding public assets

- Complying with Treasury rules

Accounting Officers face personal responsibility. They can be called to explain decisions to Parliament.

Regular training helps them stay up-to-date on best practices and regulations.

Template for Delegated Authority Letters

Delegated Authority Letters set out spending limits for officials. These letters are crucial for maintaining financial control.

A typical template includes:

- Name and role of the official

- Specific spending powers granted

- Financial limits for different types of expenditure

- Reporting requirements

- Duration of the authority

The letters are usually issued annually. They can be revised if an official's responsibilities change.

Proper use of these templates ensures clear accountability. It helps prevent unauthorised spending across government departments.

Transparency, Monitoring, and Evaluation

Effective oversight of government spending relies on open access to information, careful tracking of expenditures, and rigorous assessment of outcomes. These practices help ensure public funds are used wisely and achieve intended goals.

Public Financial Management Systems

Public financial management systems play a crucial role in promoting transparency and accountability in government spending. These systems track the flow of public money from budgeting to expenditure. They help officials make informed decisions and allow citizens to see how their taxes are used.

Robust monitoring mechanisms are essential for effective public financial management. This includes clear reporting standards, regular audits, and accessible financial data.

Modern technology has improved these systems. Digital platforms now make it easier to record transactions and share financial information with the public. This increased openness helps build trust between the government and citizens.

Evaluating Economic Growth and Public Expenditure

Evaluating the impact of public spending on economic growth is vital for effective governance. It helps policymakers understand which programmes deliver value for money and contribute to national prosperity.

Evaluation supports accountability by showing Parliament and the public how government spending affects the economy. It also helps improve future policies by identifying what works and what doesn't.

Key areas for evaluation include:

- Job creation

- Infrastructure improvements

- Education and skills development

- Innovation and research funding

Rigorous evaluation methods, such as cost-benefit analysis and impact assessments, are crucial for measuring the true effects of public expenditure on economic growth.

Combatting Corruption through Transparency and Accountability

Transparency and accountability are powerful tools in the fight against corruption in government spending. Open access to financial information makes it harder for officials to misuse public funds.

Effective anti-corruption measures include:

- Clear procurement processes

- Whistleblower protection laws

- Independent oversight bodies

- Regular public reporting of spending

The UK government has committed to improving evaluations and strengthening its capacity to assess spending impacts. This helps ensure public money is used effectively and ethically.

Citizens also play a crucial role in holding the government accountable. Easy access to spending data allows the public to scrutinise government actions and report suspected misuse of funds.

Case Studies and Best Practices

Evaluation evidence helps governments understand which approaches work best for public spending. Several countries have developed effective practices to improve accountability and value for money.

The UK government uses spending reviews to assess programme effectiveness. These reviews examine costs, benefits and outcomes of different spending areas.

Canada employs a results-based management approach. This links budgets to specific performance targets, ensuring better financial management.

New Zealand has implemented an integrated financial management system. It provides real-time data on spending across government departments, enhancing transparency.

The Netherlands uses 'policy reviews' to assess the effectiveness of policies. These reviews inform future budget decisions and improve good governance.

Some key best practices include:

- Regular performance audits

- Clear performance indicators

- Public reporting of results

- Independent evaluation of major programmes

These practices help ensure public funds are used efficiently and achieve intended outcomes. They also support accountability by allowing scrutiny of government spending decisions.

Challenges and Difficult Decisions

Government spending faces complex issues and tough choices. Officials must balance public needs with limited funds while meeting high expectations.

Addressing Complex Issues in Public Spending

Public spending decisions often involve difficult trade-offs. Officials must choose between competing priorities with limited resources.

For example, they may need to decide between funding healthcare or education. Both are vital, but budgets are tight.

Another challenge is long-term planning. Some investments take years to show results. This can clash with short-term political pressures.

Transparency is key. The public deserves to know how their money is spent. But some spending, like defence, requires secrecy.

Balancing Public Expectations with Financial Realities

The public often wants more services without higher taxes. This creates a gap between expectations and what's possible.

Officials must make tough choices. They may need to cut popular programmes to balance the budget.

Clear communication is crucial. The government should explain its decisions and the reasons behind them.

Innovative solutions can help. Public-private partnerships or new technologies might stretch limited funds further.

But care is needed. Complex modern government can make it hard to track spending and ensure value for money.

Frequently Asked Questions

Government spending accountability involves financial transparency, oversight mechanisms, and citizen participation. Independent audits and compliance monitoring play crucial roles in ensuring responsible fiscal practices.

How is financial transparency maintained in public sectors?

Public sectors maintain financial transparency through online publication of spending documents. Central government publishes items over £25,000, while local government discloses spending over £500.

This openness allows citizens to scrutinise accounts and identify potential overspending. Regular reporting and disclosure of financial statements also contribute to transparency.

What mechanisms are in place to hold politicians accountable for fiscal decisions?

Politicians are held accountable through parliamentary oversight. The accountability framework outlines how government manages public funds and reports to Parliament.

Select committees examine spending and policies. Ministers must answer questions about their departments' expenditures during parliamentary sessions.

In what ways can citizens oversee government expenditure?

Citizens can oversee government spending by accessing published financial documents online. They can review central and local government spending data.

Engaging with local councillors, attending public meetings, and participating in consultations are other ways citizens can monitor expenditures. Freedom of Information requests can also be used to obtain specific financial information.

What role do independent audits play in ensuring responsible governmental financial practices?

Independent audits are crucial for verifying the accuracy of government financial reports. They assess whether public funds are used efficiently and effectively.

Auditors examine financial statements, evaluate internal controls, and identify areas of risk or non-compliance. Their findings help improve financial management and ensure accountability.

How are government spending and procurement activities monitored for compliance with regulations?

Government spending is monitored through internal controls and external oversight. Departments have finance teams that ensure compliance with Treasury guidance.

Procurement activities are subject to strict regulations. The Complex Grants Advice Panel reviews high-value or complex grant schemes to ensure they meet standards.

What steps are taken when discrepancies in government spending are identified?

When discrepancies are found, they are investigated promptly. The relevant department or agency must explain the issue and propose corrective actions.

In serious cases, parliamentary committees may conduct inquiries. Disciplinary measures or legal action can be taken against individuals responsible for misuse of public funds.