Public sector funding shapes our communities and daily lives. It affects everything from schools and hospitals to roads and social services. The government faces tough choices about where to allocate limited resources.

Public sector funding per resident in England remains 19% below 2010 levels, despite recent increases. This has put pressure on local councils to deliver services with tighter budgets. At the same time, some areas are seeing more investment. The government is boosting funding for priorities like healthcare and education.

Looking at how public money is spent can reveal a lot about a country's values and goals. It shows which issues leaders think are most important. Analysing these priorities helps citizens understand government decisions and hold officials accountable.

Key Takeaways

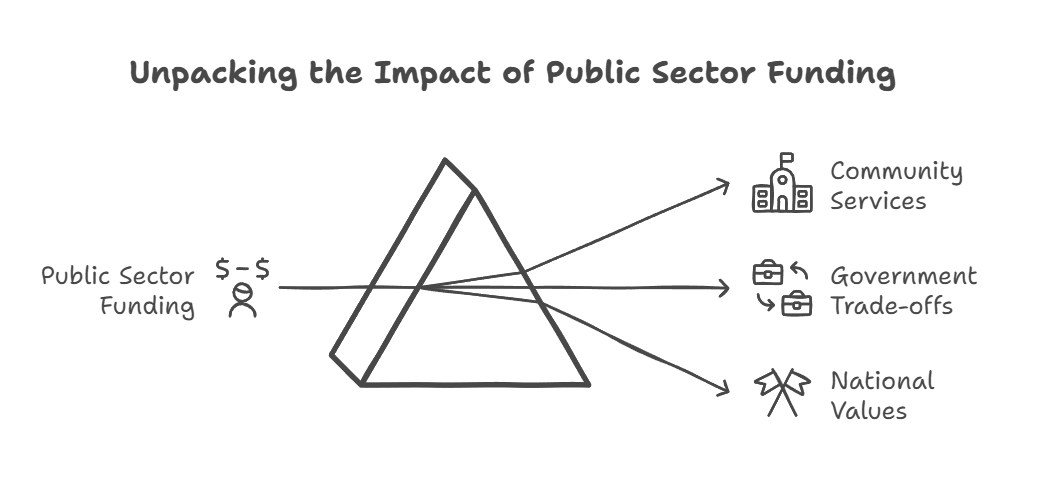

- Public sector funding affects many aspects of daily life and community services

- Government faces difficult trade-offs when allocating limited resources

- Analysing spending priorities reveals insights into national values and goals

Overview of Public Sector Funding

Public sector funding in the UK is complex and vital to the nation's economy. It involves careful planning and oversight to ensure resources are allocated effectively.

Fundamentals of Public Sector Economics

Public sector economics focuses on how the government manages its finances. The UK government's spending accounts for a large portion of the country's GDP. This spending covers essential services like healthcare, education, and defence.

The government raises funds through taxes and borrowing. It must balance its income with expenditure to maintain a healthy fiscal position. Budget decisions impact national income and economic growth.

Public sector funding aims to provide public goods and services that benefit society as a whole. This includes infrastructure projects, social programmes, and other initiatives that private markets may not adequately supply.

Role of HM Treasury and Office for Budget Responsibility

HM Treasury plays a crucial role in managing public finances. It oversees government spending and sets fiscal policy. The Treasury works to ensure the UK's economic stability and growth.

The Office for Budget Responsibility (OBR) provides independent analysis of public finances. It forecasts economic trends and assesses the government's performance against fiscal targets.

The OBR's reports help inform budget decisions and promote transparency. Its work is essential for holding the government accountable for its financial management.

Together, HM Treasury and the OBR shape the UK's fiscal strategy. They aim to maintain sustainable public finances while supporting economic development.

Budgeting and Revenue Generation

The UK government relies on various sources to fund public services. Budget allocation involves careful planning to meet diverse needs. Revenue generation comes from taxes and other contributions.

Public Budget Allocation Process

The UK government's budget allocation process is complex. It starts with a spending review, where departments submit funding requests. The Treasury then assesses these requests against available resources.

Political and economic factors influence decisions. The Chancellor presents the budget to Parliament for approval. Once approved, funds are distributed to different sectors.

Departments must justify their spending plans. They need to show how they'll use money efficiently. The process aims to balance competing priorities and ensure value for money.

Revenue Streams of the UK Government

The UK government has several key revenue streams. Income tax is a major source, with higher earners paying more. National Insurance contributions fund social security and the NHS.

Businesses pay corporation tax on their profits. Council tax funds local services. Other important sources include:

- Value Added Tax (VAT) on goods and services

- Fuel duty on petrol and diesel

- Business rates on commercial properties

The government also earns from selling assets and borrowing. These diverse streams help fund public services and infrastructure projects.

Budgeting for Schools and NHS

Schools and the NHS are priority areas in UK public spending. For schools, the government sets a national funding formula. This aims to distribute money fairly across the country.

Local authorities receive a dedicated schools grant. They then allocate funds to individual schools. Factors like pupil numbers and deprivation levels affect funding.

NHS budgeting is more centralised. The Department of Health sets the overall budget. This is then divided among various NHS organisations.

Both sectors face ongoing funding challenges. They must balance rising costs with limited resources. Efficient budget management is crucial to maintain service quality.

Expenditure and Cost Analysis

Public sector funding involves careful analysis of spending patterns and budget allocations. This process helps ensure efficient use of resources and alignment with policy priorities.

Departmental Budgets and Spending Reviews

The UK government conducts spending reviews to set departmental budgets. These reviews examine capital investment and day-to-day spending across ministries.

Departments must justify their funding needs and show how they align with government goals. The Treasury uses this information to allocate resources.

Spending reviews typically cover 3-4 year periods. This allows for long-term planning whilst maintaining flexibility to adjust to changing needs.

Capital investment often receives special focus. The government aims to boost infrastructure spending to drive economic growth.

Healthcare and Social Security Expenditures

Health spending forms a large part of the UK budget. The NHS receives significant funding to provide free healthcare services.

Social security benefits are another major expense. These include pensions, disability benefits, and unemployment support.

Adult social care is a growing concern. An ageing population has increased demand for these services.

The government must balance these costs with other priorities. This often involves difficult trade-offs between different areas of public spending.

Efficiency measures aim to control costs whilst maintaining service quality. These may include technology investments or process improvements.

Fiscal Policy and Government Spending

The UK government sets fiscal rules and a framework to guide public spending. Economic forecasts and borrowing levels shape budget decisions and spending priorities across sectors.

Fiscal Framework and Rules

The fiscal framework establishes guidelines for managing public finances. The Prime Minister and Cabinet set fiscal rules to control borrowing and debt. These rules aim to keep public sector net borrowing below certain thresholds.

Current fiscal rules target debt reduction as a percentage of GDP. They also limit welfare spending and set public sector net investment goals. The government reviews these rules periodically to ensure they align with economic conditions.

Adhering to fiscal rules helps maintain economic stability. It also builds credibility with investors and credit rating agencies. The Office for Budget Responsibility (OBR) monitors compliance with the rules.

Economic Evaluation and Spending Pressures

The OBR provides economic forecasts that inform fiscal policy decisions. These projections cover GDP growth, inflation, and employment. They also estimate future tax revenues and public spending needs.

Spending pressures come from various sectors. Healthcare, education, and social care often require increased funding. Defence and infrastructure projects can also drive up costs. The government must balance these needs against available resources.

Economic shocks or crises may lead to temporary rises in borrowing. For example, the COVID-19 pandemic caused a spike in public sector spending. The government may adjust fiscal rules during such periods to allow for necessary support measures.

Long-term demographic changes also influence spending patterns. An ageing population increases demand for health and pension services. This creates ongoing pressure on public finances.

Resource Allocation Strategies

Public sector organisations face complex decisions when distributing limited funds. Effective strategies balance local needs with national priorities and long-term investments.

Budget Allocations to Local Authorities

Local government funding in the UK follows a formula-based approach. The central government provides block grants to councils based on population, deprivation levels, and service needs.

Councils have some discretion in how they spend these funds. They must balance statutory services like social care with local priorities.

Key challenges include:

- Uneven distribution of resources between affluent and deprived areas

- Balancing short-term needs with long-term planning

- Responding to changing demographics and service demands

Some local authorities have adopted zero-based budgeting. This approach reviews all spending annually rather than using incremental increases.

Capital Budgets and Public Sector Investments

Public sector net investment focuses on infrastructure and assets that provide long-term benefits. Key areas include:

- Transport networks

- Hospitals and schools

- Social housing

- Digital infrastructure

Capital budgets are often separate from day-to-day operational spending. This allows for multi-year planning of major projects.

Councils use various tools to prioritise investments:

Tool

Cost-benefit analysis

Risk assessment

Public consultation

Housing investment is a critical area for many local authorities. They must balance new builds with maintenance of existing stock.

Transparency, Accountability, and Outcomes

Public spending requires openness and clear metrics. These help ensure taxpayer money is used wisely and achieves intended goals.

Importance of Transparency in Public Spending

Transparency in the public sector is vital for good governance. It allows citizens to see how their money is spent. Open budgets and clear reports help build trust.

Transparent spending practices reduce corruption risks. They also help identify waste and inefficiency. When spending data is public, it's easier to spot unusual patterns.

Evidence-based spending relies on transparency. Decision-makers need accurate information to allocate funds well. Open data helps researchers analyse spending impacts.

Metrics and Accountability in Funding Allocation

Metrics are key for measuring public sector performance. They help track if spending achieves desired outcomes. Good metrics focus on value for money and health gains.

Accountability means officials answer for their decisions. Clear spending envelopes set limits. Regular audits check if funds are used properly.

Outcome-based metrics are best. They measure real-world impacts, not just money spent. For example, health programmes might track improved life expectancy.

Data-driven approaches improve accountability. They allow comparisons across departments and over time. This helps identify which programmes give the best results.

Impact of Fiscal Policies

Fiscal policies shape public sector funding and have far-reaching effects on the economy and citizens' lives. These policies influence both the cost of living and public sector wages, while also determining investment in essential services and infrastructure.

Effects on the Cost of Living and Public Pay

Fiscal policies play a crucial role in managing inflation and the cost of living. When the government increases spending or cuts taxes, it can boost economic activity but may also drive up prices. This impacts households' purchasing power and living standards.

Public sector pay is directly affected by fiscal decisions. In times of budget constraints, pay rises may be limited, potentially leading to recruitment and retention challenges in vital services.

The fiscal year 2024-2025 has seen modest increases in public sector wages, aiming to balance employee welfare with budgetary pressures. However, these increases have not fully kept pace with inflation, resulting in real-terms pay cuts for many workers.

Investment in Public Services and Infrastructure

Fiscal policies determine the level of investment in public services and infrastructure, which is critical for long-term economic growth and societal well-being. Capital departmental expenditure limits set the boundaries for infrastructure spending.

Recent fiscal measures have prioritised investment in healthcare, with increased funding for NHS trusts to improve productivity and reduce waiting times. Education has also seen targeted investment, particularly in early years and skills training.

Transport infrastructure has received significant attention, with major projects aimed at improving connectivity between regions. However, some local services have faced budget cuts, leading to reduced provision in areas such as libraries and youth centres.

Funding Initiatives and Grants

The UK government employs various mechanisms to allocate funds across different sectors and regions. These initiatives aim to address local needs and promote equitable development throughout the nation.

Local Government Finance Settlement

The Local Government Finance Settlement is a crucial funding mechanism for councils in England. It determines the distribution of central government grants to local authorities.

For the 2024-25 financial year, the settlement includes a £64 billion core spending power for councils. This represents a 6.5% increase from the previous year.

Key components of the settlement include:

- Council Tax: Local authorities can raise council tax by up to 3% without a referendum

- Social Care Grant: £4.7 billion allocated to support adult and children's social care

- Services Grant: £483 million to help councils manage inflationary pressures

Despite these increases, funding per resident remains 19% below 2010 levels. Councils continue to face financial pressures, particularly in social care and children's services.

Devolved Administration Funding via the Barnett Formula

The Barnett Formula is used to calculate funding allocations for devolved administrations in Scotland, Wales, and Northern Ireland. It adjusts funding based on population changes and the extent of devolved responsibilities.

Key features of the Barnett Formula include:

- Baseline: Funding is adjusted from a historical baseline

- Population: Changes in relative population affect allocations

- Comparability: Funding reflects the degree of devolved responsibilities

For the 2024-25 financial year, the Barnett consequentials resulted in:

- Scotland: £41.2 billion block grant

- Wales: £18.4 billion block grant

- Northern Ireland: £15.1 billion block grant

These allocations aim to ensure that devolved administrations can fund public services in line with their specific needs and priorities.

Social Welfare and Protection Schemes

The UK government allocates significant funds to social welfare and protection programmes. These schemes aim to support citizens' health and financial wellbeing through various initiatives and benefits.

Public Health England and Health Services Funding

Public Health England plays a crucial role in promoting and protecting the nation's health. The organisation receives substantial funding to carry out its mission. This money supports disease prevention, health improvement, and addressing health inequalities.

NHS funding is a major component of health services spending. The government has pledged to increase NHS budgets annually. This extra money helps reduce waiting times and improve care quality.

Public health services also receive dedicated funding. Local authorities use these funds for programmes like smoking cessation, obesity prevention, and sexual health services.

The Welfare System and Benefit Allocations

The UK welfare system provides financial support to various groups. Universal Credit is a key benefit, combining six previous payments into one. It helps those on low incomes or out of work.

Disability benefits form another crucial part of the system. These include:

- Personal Independence Payment (PIP)

- Attendance Allowance

- Employment and Support Allowance (ESA)

The state pension is a significant welfare expense. It provides income for retirees and is funded through National Insurance contributions.

Benefit rates are reviewed annually. The government uses various factors to determine increases, including inflation and wage growth.

Planning and Strategic Direction

Public sector organisations need clear financial plans and strategic direction. This helps them use money wisely and meet goals. Good planning lets groups make smart choices about spending.

Drafting the Annual Financial Statement

The annual financial statement is a key document. It shows how a public body plans to use its money for the year ahead. The statement lists expected income and planned spending. It covers staff costs, projects, and day-to-day running costs.

Managers look at past years to help make the new statement. They think about what worked well and what didn't. The statement must match the group's bigger aims. It needs to be clear so everyone can understand it.

Good statements help with funding allocation. They show where money is most needed. This helps leaders make tough choices when funds are tight.

Creating a Strategic Plan for Future Spending

A strategic plan looks further ahead. It sets out goals for the next few years. The plan shows how the group will use its money to reach these aims. It helps guide decisions about spending over time.

The plan should be flexible. Things can change quickly in the public sector. Good plans let groups adjust when needed. They also help when asking for additional funding.

Leaders use the plan to check if spending matches priorities. They can see if money is going to the right places. This helps them make better choices about where to put resources.

Regional Distribution of Funds

Public sector funding in England varies across regions. Local government services face unique challenges in different areas. Spending pressures impact core services differently based on location.

Allocation to England's Public Sector

England's public sector receives a large share of UK government spending. In 2019-20, £541 billion was allocated to England. This amounts to £9,650 per person.

About £185 billion went to social security benefits. These include:

- State pension

- Universal credit

- Disability benefits

The rest funded public services like:

- Healthcare

- Education

- Transport

Funding levels differ by region. Urban areas often get more per person than rural ones. This is due to higher costs and greater needs in cities.

Investments in Local Government Services

Local councils provide key services. These include social care, waste collection, and roads. Their funding comes from:

- Central government grants

- Council tax

- Business rates

Core spending power varies by area. It reflects the money councils have for services. Some areas face more spending pressures than others.

Factors affecting local funding include:

- Population size and makeup

- Deprivation levels

- Rural vs urban location

The government has special funds to address regional gaps. These aim to 'level up' less prosperous areas. Examples are the Towns Fund and Levelling Up Fund.

Frequently Asked Questions

Public sector funding in the UK involves complex decisions about resource allocation and service provision. These questions explore key aspects of how funding priorities are set and their impacts.

How are spending priorities determined within the UK's public sector?

Spending priorities in the UK public sector are set through a mix of political and economic factors. The government outlines its agenda in manifestos and policy statements. These are then translated into specific funding allocations.

Stakeholder input also plays a role, with advisory groups often consulted. Economic forecasts and fiscal targets further shape decisions on public spending.

What constitutes a public service in the context of the United Kingdom?

Public services in the UK encompass a wide range of government-funded activities. These include healthcare through the NHS, education, policing, and social care.

Local councils provide many services like waste collection and road maintenance. Some utilities, transport, and infrastructure projects are also considered public services in the UK.

Why is the Spending Review period significant for UK public sector funding?

The Spending Review sets budgets for government departments. It typically covers multiple years, allowing for longer-term planning.

During this period, departments must justify their spending plans. The Treasury assesses these against government priorities and available resources. The outcome shapes public sector funding for years to come.

What impacts can public service cuts have on society in the UK?

Cuts to public services can affect many aspects of life in the UK. Reduced funding for healthcare might lead to longer waiting times for treatments.

Education cuts could result in larger class sizes or fewer resources for schools. Social care reductions might leave vulnerable people with less support. These impacts can widen inequalities and affect quality of life.

In what ways does public sector net borrowing affect government funding for services?

Public sector net borrowing influences the amount available for government spending. Higher borrowing can provide more immediate funds for services.

However, it also increases debt which must be repaid with interest. This can limit future spending options. The government must balance current service needs with long-term fiscal sustainability.

How do public sector funding strategies differ from those in the private sector in the UK?

Public sector funding in the UK focuses on providing services for societal benefit. It relies mainly on tax revenue and government borrowing.

Private sector funding aims to generate profit. Companies raise funds through sales, investments, and loans. Public-private partnerships sometimes blend these approaches for large projects.

Public sector decisions often involve wider stakeholder consultation. They must consider social impacts alongside financial factors.