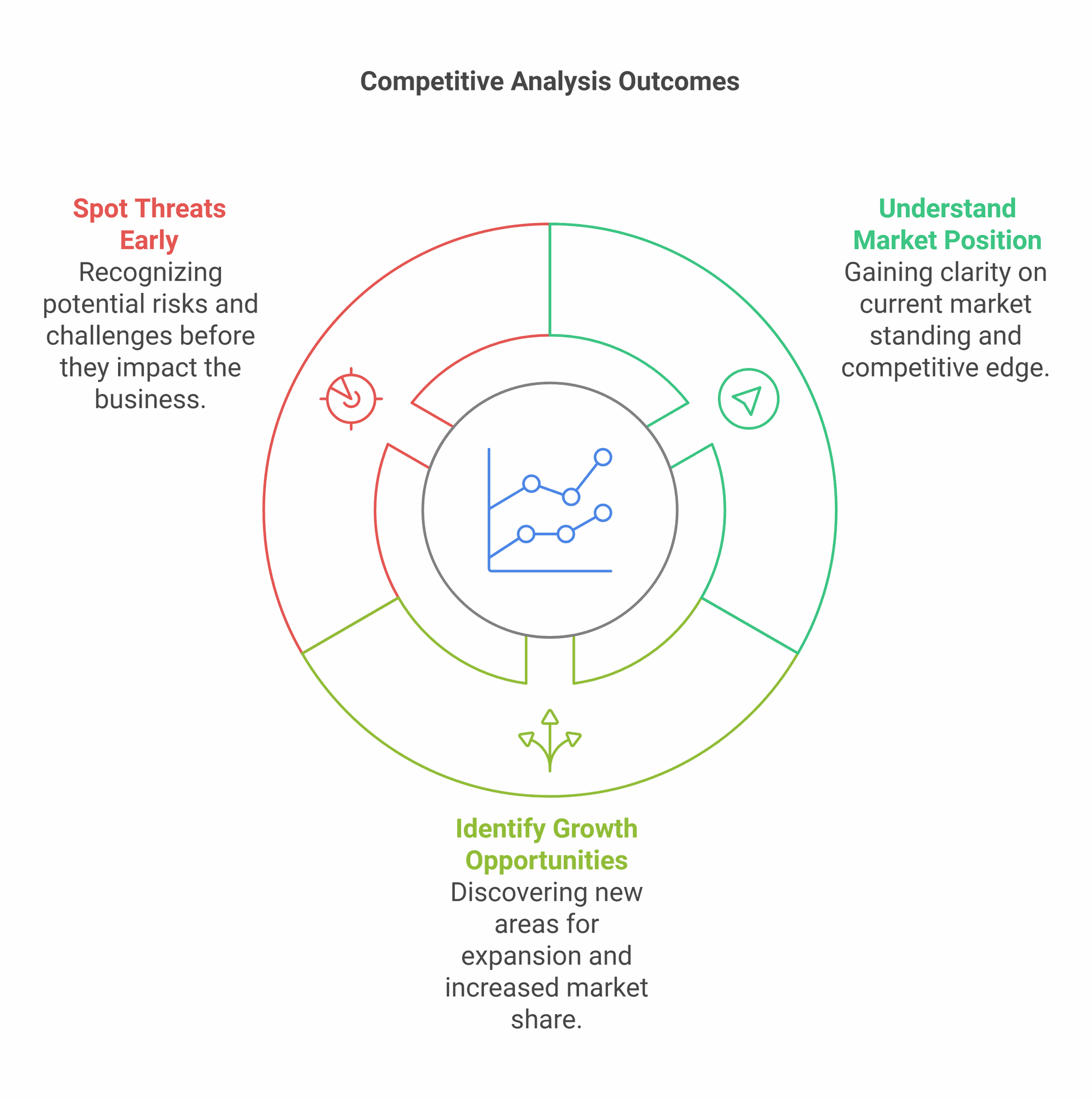

Competitive analysis for suppliers is a crucial tool for businesses to stay ahead in today's market. It helps companies understand their position in the supply chain and make informed decisions. By looking at competitors, market trends, and customer needs, firms can improve their strategies and offerings.

A thorough competitive analysis can reveal gaps in the market and opportunities for growth that suppliers might otherwise miss. This process involves examining various factors such as pricing, product quality, service levels, and innovation. By doing so, suppliers can find ways to stand out from their rivals and attract more customers.

Suppliers who regularly conduct competitive analyses are better equipped to face industry challenges. They can spot potential threats early on and adapt their approaches accordingly. This proactive stance helps businesses maintain their edge and thrive in a competitive landscape.

Key Takeaways

- Competitive analysis helps suppliers understand their market position and make better decisions

- Regular assessments of competitors and market trends can reveal new growth opportunities

- Proactive analysis allows suppliers to spot threats early and adapt their strategies quickly

Understanding Competitive Analysis

Competitive analysis is a vital tool for suppliers to gain insights into their market position and develop effective strategies. It involves examining competitors, market trends, and industry dynamics to make informed business decisions.

Definition and Purpose

Competitive analysis is the process of evaluating competitors' strengths, weaknesses, and strategies to identify opportunities and threats in the market. Its purpose is to help businesses understand their competitive landscape and make strategic choices.

For suppliers, this analysis involves:

- Identifying key competitors

- Assessing product offerings and pricing

- Evaluating market share and customer base

- Analysing marketing and sales strategies

By gathering this information, suppliers can position themselves more effectively and develop unique selling propositions.

Key Frameworks

Several frameworks aid in conducting competitive analysis:

-

Porter's Five Forces: This model examines industry competitiveness through five factors:

- Competitive rivalry

- Threat of new entrants

- Supplier power

- Buyer power

- Threat of substitutes

- SWOT Analysis: This tool evaluates internal strengths and weaknesses alongside external opportunities and threats.

- Competitor Profiling: This involves creating detailed profiles of key competitors, including their products, pricing, and market positioning.

These frameworks provide structured approaches to analysing the competitive landscape and developing strategic insights.

Importance of Competitive Analysis in Strategic Planning

Competitive analysis plays a crucial role in strategic planning for suppliers. It helps businesses:

- Identify market gaps and opportunities

- Develop differentiation strategies

- Anticipate competitor moves

- Improve product offerings and services

By understanding the competitive landscape, suppliers can make informed decisions about pricing, product development, and market entry strategies. This knowledge enables them to allocate resources effectively and focus on areas where they can gain a competitive advantage.

Regular competitive analysis also helps suppliers stay agile and adapt to changing market conditions. It provides valuable insights for long-term planning and helps businesses maintain their competitive edge in dynamic markets.

The Basics of Supplier Analysis

Supplier analysis is key for businesses to understand their supply chain. It helps firms make smart choices about who they work with and how to negotiate.

Evaluating Supplier Power

Supplier power is a big part of Porter's Five Forces framework. It looks at how much control suppliers have over prices and terms. Strong suppliers can ask for higher prices or set strict rules. Weak suppliers have less say.

To gauge supplier power, firms look at:

- Number of suppliers

- Cost to switch suppliers

- Importance of the supplier's product

- Threat of suppliers moving into the buyer's market

A company with few supplier options may face higher costs. But if a firm can easily change suppliers, it has more control.

Influence of the Supplier on Industry Structure

Suppliers shape how industries work. They can affect:

- Prices in the market

- Quality of goods

- Speed of innovation

Powerful suppliers might slow down an industry's growth. They could raise prices, cutting into buyers' profits. On the flip side, suppliers who struggle might push for innovation to stay relevant.

The balance of power between suppliers and buyers sets the tone for the whole industry. It impacts how firms compete and grow.

Supplier Segmentation and Categorisation

Grouping suppliers helps firms manage them better. Common ways to segment include:

- Strategic importance

- Spend amount

- Risk level

- Product or service type

A simple matrix might look like this:

| Importance | High Spend | Low Spend |

|---|---|---|

| Strategic | Key | Leverage |

| Tactical | Bottleneck | Routine |

This helps firms focus on the most crucial suppliers. It also shows where to look for cost savings or where to build stronger ties.

Supplier Differentiation and Impact

Suppliers stand out in many ways. Some offer unique products. Others might have special skills or tech. The more different a supplier is, the more power they might have.

Ways suppliers differ:

- Product quality

- Service level

- Innovation rate

- Geographic location

Supplier differentiation can greatly impact a buyer's business. A supplier with a one-of-a-kind product might be hard to replace. This can lead to higher costs or reliance on that supplier.

Firms must weigh the benefits of unique suppliers against the risks of dependence. The goal is to find a balance that supports the company's needs and growth plans.

Examining Market Factors

Market factors play a crucial role in competitive analysis for suppliers. Understanding these elements helps businesses navigate the complex landscape of supplier relationships and industry dynamics.

Assessing Market Share and Position

Market share and position are key indicators of a supplier's strength in the industry. Suppliers with larger market shares often have more influence over pricing and terms. To assess market share, companies can look at sales data, customer base, and brand recognition.

A supplier's position is not just about size. It also includes factors like:

• Product quality

• Innovation capabilities

• Customer service

• Brand reputation

Suppliers in strong positions may have more bargaining power. This can affect their ability to set prices or influence supply chain decisions.

Impact of Industry Growth on Suppliers

Industry growth significantly affects supplier dynamics. In rapidly growing industries, suppliers often benefit from increased demand and opportunities to expand their customer base.

Fast growth can lead to:

• Higher profits for suppliers

• More investment in research and development

• Increased competition among suppliers

Conversely, in slow-growth or declining industries, suppliers may face challenges. They might need to compete more aggressively on price or differentiate their offerings to maintain their position.

Barriers to Entry and Exit Barriers

Barriers to entry and exit shape the competitive landscape for suppliers. High barriers to entry can protect existing suppliers from new competition. These barriers might include:

• Large capital requirements

• Strict regulations

• Strong brand loyalty to established suppliers

Exit barriers also affect market dynamics. When it's difficult for suppliers to leave an industry, competition can intensify. This might lead to price wars or reduced profitability for all players.

Threats Posed by New Entrants and Substitute Products

New entrants and substitute products can disrupt the supplier landscape. New entrants bring fresh competition, potentially offering lower prices or innovative solutions. This can pressure existing suppliers to adapt or risk losing market share.

Substitute products pose a different kind of threat. They can reduce demand for a supplier's offerings by providing alternative solutions. For example, renewable energy sources might threaten traditional fuel suppliers.

To address these threats, suppliers might:

• Invest in innovation to stay ahead of new entrants

• Diversify their product range to compete with substitutes

• Build strong relationships with customers to increase loyalty

Analysing these threats helps suppliers develop strategies to maintain their competitive edge in the market.

Industry-Specific Factors

Different industries face unique competitive pressures. These pressures shape supplier relationships and market dynamics in distinct ways across sectors.

Case Study: Airline Industry Analysis

The airline industry provides a compelling example of intense competitive forces. Tough competition drives airlines to focus on cost reduction and efficiency. High fixed costs and perishable inventory (empty seats) increase pressure.

Airlines compete fiercely on price and routes. They must also contend with:

- Powerful suppliers (aircraft manufacturers, airports)

- Threat of new low-cost carriers

- Substitute travel options (trains, cars)

Fuel costs greatly impact profitability. Economic downturns can sharply reduce demand. Yet some airlines thrive through smart route planning, loyalty programmes, and operational excellence.

Role of Direct and Indirect Competitors

Direct competitors offer similar products or services. In the tech industry, Apple and Samsung compete directly in smartphones. Indirect competitors fulfill the same need differently.

For example:

- A cinema faces direct competition from other cinemas

- Streaming services are indirect competitors

Both types shape the competitive landscape. Analysing competitive forces helps firms understand their position. It guides strategy on pricing, marketing, and product development.

Firms must watch for new entrants and substitutes. These can quickly disrupt established markets.

Competitive Forces in Different Industries

Competitive forces vary greatly across sectors. Some key factors:

- Number of competitors

- Industry growth rate

- Product differentiation

- Exit barriers

Fast-growing industries may see less rivalry as firms exploit new opportunities. Mature industries often face intense price competition.

Supplier concentration affects bargaining power. Few suppliers can lead to higher input costs. Many suppliers typically benefit buyers.

Regulatory environment also plays a role. Heavily regulated industries may have less competitive pressure but face other constraints.

Economics of Scale and Buyer Power

Economies of scale give large firms cost advantages. This impacts competitive dynamics significantly. In retail, big chains can negotiate better terms with suppliers.

Buyer power depends on:

- Number of buyers

- Size of purchases

- Switching costs

- Price sensitivity

Strong buyer power can squeeze supplier margins. Weak buyer power allows suppliers more control over pricing and terms.

Industry concentration on both sides matters. A fragmented supplier base facing few large buyers often struggles with profitability.

Strategic Analysis Components

Strategic analysis components help suppliers assess their competitive position and make informed decisions. These tools provide insights into market dynamics, competitor strategies, and customer needs.

Assessing Competitive Rivalry and Industry Landscape

Competitive analysis examines the intensity of rivalry within an industry. Suppliers must evaluate the number of competitors, their strengths, and market share. They should also consider barriers to entry and exit.

Key factors to analyse include:

- Competitor pricing strategies

- Product differentiation

- Brand loyalty

- Switching costs for customers

Suppliers can use Porter's Five Forces model to assess the competitive landscape. This framework evaluates:

- Threat of new entrants

- Bargaining power of buyers

- Threat of substitutes

- Bargaining power of suppliers

- Rivalry among existing competitors

By understanding these forces, suppliers can identify opportunities and threats in their industry.

Growth-Share Matrix Application

The Growth-Share Matrix, developed by the Boston Consulting Group, helps suppliers categorise their products or business units. This tool assesses market growth rate and relative market share.

The matrix divides products into four categories:

- Stars: High growth, high market share

- Cash Cows: Low growth, high market share

- Question Marks: High growth, low market share

- Dogs: Low growth, low market share

Suppliers can use this matrix to allocate resources effectively. They should invest in Stars, milk Cash Cows for profits, carefully evaluate Question Marks, and consider divesting Dogs.

Strategic Group Analysis and Benchmarking

Strategic group analysis identifies clusters of companies with similar strategies within an industry. This helps suppliers understand their position relative to competitors.

Steps in strategic group analysis:

- Identify key competitive dimensions (e.g., price, quality, distribution)

- Plot competitors on a map using these dimensions

- Identify groups of companies with similar strategies

- Analyse mobility barriers between groups

Benchmarking complements this analysis by comparing a supplier's performance against industry leaders. It helps identify best practices and areas for improvement.

Customer Needs and Distribution Channels

Understanding customer needs is crucial for suppliers to maintain a competitive edge. They should conduct market research to identify:

- Key buying factors

- Customer preferences

- Unmet needs in the market

Suppliers must also analyse their distribution channels. This includes evaluating:

- Channel efficiency

- Coverage of target markets

- Channel partner relationships

- Potential for direct sales

By optimising distribution channels, suppliers can improve market access and customer satisfaction. They should consider both traditional and digital channels to reach their target audience effectively.

Marketing and Positioning

Marketing and positioning are vital for suppliers to stand out in a competitive landscape. These strategies help build brand recognition, attract customers, and communicate value propositions effectively.

Brand Identity and Awareness

A strong brand identity helps suppliers differentiate themselves from competitors. It includes visual elements like logos and colour schemes, as well as the company's values and personality. To boost brand awareness, suppliers can:

- Develop a consistent brand voice across all marketing materials

- Create engaging content that showcases expertise

- Participate in industry events and trade shows

- Leverage social media platforms to reach a wider audience

Brand identity should align with the target market's preferences and expectations. For example, a supplier of eco-friendly products might use green colours and natural imagery in their branding.

Pricing Models and Price Sensitivity

Suppliers must carefully consider their pricing strategies to remain competitive while maintaining profitability. Common pricing models include:

- Cost-plus pricing

- Value-based pricing

- Dynamic pricing

- Tiered pricing

Understanding price sensitivity helps suppliers set optimal prices. Factors affecting price sensitivity include:

- Product uniqueness

- Availability of substitutes

- Buyer's budget constraints

- Perceived value of the product

Suppliers can conduct market research to gauge customer willingness to pay and adjust prices accordingly.

Customer Journey Mapping

Customer journey mapping helps suppliers understand the steps customers take before making a purchase decision. Key stages include:

- Awareness: Customer discovers a need

- Consideration: Customer researches options

- Decision: Customer chooses a supplier

- Purchase: Customer completes the transaction

- Post-purchase: Customer evaluates satisfaction

By mapping the customer journey, suppliers can identify pain points and opportunities to improve the buying experience. This insight allows for targeted marketing efforts at each stage of the journey.

Marketing Channel Efficacy

Suppliers must choose the most effective marketing channels to reach their target audience. Popular channels include:

- Email marketing

- Content marketing (blogs, whitepapers, case studies)

- Search engine optimisation (SEO)

- Pay-per-click (PPC) advertising

- Social media marketing

- Trade shows and exhibitions

To measure channel efficacy, suppliers should track key performance indicators (KPIs) such as:

- Conversion rates

- Return on investment (ROI)

- Customer acquisition cost (CAC)

- Engagement metrics (clicks, shares, comments)

Regularly analysing these metrics helps suppliers allocate marketing budgets more effectively and refine their marketing strategies.

Operational Dynamics and Innovation

Suppliers can gain a competitive edge through innovation and strategic operational choices. These factors shape profit potential and business success in the long term.

Role of Innovation in Competitive Advantage

Innovation is crucial for suppliers to stay ahead in the market. It allows them to offer unique products or services that set them apart from competitors.

Innovative suppliers often become preferred partners for customers. They can provide cutting-edge materials and technologies that help their clients excel in their own markets.

By focusing on innovation, suppliers can:

- Develop new products or improve existing ones

- Streamline production processes

- Create more efficient supply chain solutions

These innovations can lead to stronger customer relationships and increased loyalty. This, in turn, can result in more stable demand and better long-term business prospects.

Assessing the Profit Potential

Suppliers must carefully evaluate their profit potential within the industry. This involves analysing market trends, customer needs, and competitive landscape.

Key factors to consider include:

- Market size and growth rate

- Pricing power

- Cost structure

- Customer bargaining power

Strong supplier influence can lead to better pricing and terms. However, it's essential to balance this with maintaining positive customer relationships.

Suppliers should also assess their ability to scale operations. This can significantly impact profitability as the business grows.

Cost Leadership as a Business Strategy

Cost leadership is a powerful strategy for suppliers to gain a competitive advantage. It involves becoming the lowest-cost producer in the industry.

To achieve cost leadership, suppliers can:

- Optimise production processes

- Leverage economies of scale

- Invest in efficient technologies

- Streamline supply chain management

Cost leaders can offer lower prices while maintaining profitability. This can attract price-sensitive customers and increase market share.

However, cost leadership requires constant vigilance. Suppliers must continually seek ways to reduce costs without compromising quality. This often involves significant upfront investments in technology and process improvements.

Building Sustainable Competitiveness

Companies can create lasting success by focusing on long-term strategies, fostering customer loyalty, and gaining competitive insights. These elements work together to build a strong foundation for ongoing growth and market leadership.

Long-Term Business Strategies

Developing sustainable business strategies is crucial for long-term success. Companies should focus on innovation and adaptability to stay ahead in the market. This may involve investing in research and development, exploring new technologies, or diversifying product offerings.

Sustainable competitive advantage often stems from a company's ability to anticipate and respond to market changes. Firms should regularly assess their strengths and weaknesses, adjusting their strategies accordingly.

Effective resource management is also key. Companies must allocate funds wisely, balancing short-term needs with long-term goals. This might include investing in employee training or upgrading infrastructure to improve efficiency.

Developing a Durable Competitive Landscape

Creating a lasting competitive edge requires a deep understanding of market dynamics. Companies should analyse their rivals' strengths and weaknesses to identify opportunities for differentiation.

Fostering sustainability innovations can set a firm apart from competitors. This might involve developing eco-friendly products or implementing green manufacturing processes.

Building strategic partnerships can also strengthen a company's position. Collaborating with suppliers, distributors, or even competitors can lead to shared resources and expanded market reach.

Continuous improvement is essential. Regularly reviewing and refining business processes can help maintain a competitive edge over time.

Maintaining Customer Loyalty

Customer loyalty is a cornerstone of sustainable competitiveness. Companies should focus on delivering consistent, high-quality products or services to meet customer expectations.

Personalised customer experiences can foster strong relationships. This might involve using data analytics to tailor marketing messages or offering customised product recommendations.

Effective communication is crucial. Companies should keep customers informed about new products, services, or company updates through various channels.

Loyalty programmes can incentivise repeat business. These might include point systems, exclusive discounts, or early access to new products.

Identifying and Leveraging Competitive Insights

Gathering and analysing competitive intelligence is vital for sustainable success. Companies should monitor market trends, competitor activities, and customer feedback to inform decision-making.

Supplier evaluation strategies can provide valuable insights into supply chain efficiency and potential areas for improvement. This might involve assessing supplier performance, reliability, and sustainability practices.

Leveraging data analytics can uncover hidden patterns and opportunities. Companies should invest in tools and expertise to turn raw data into actionable insights.

Regular benchmarking against industry leaders can highlight areas for improvement. This process should be ongoing, allowing companies to continuously refine their strategies and maintain their competitive edge.

Frequently Asked Questions

Competitive analysis for suppliers involves several key steps and components. It requires careful planning and execution to gain valuable insights into the competitive landscape.

How can one effectively structure a competitive analysis for suppliers?

A well-structured competitive analysis starts with clear goals. Identify the specific aspects of suppliers you want to compare. Create a framework that includes categories like pricing, quality, delivery times, and customer service.

Use a spreadsheet or matrix to organise data. This allows for easy side-by-side comparisons of different suppliers across multiple criteria.

What essential elements should be included in a competitor analysis framework?

A robust framework should include supplier evaluation questions. These cover areas such as financial stability, production capacity, and quality control measures.

Other crucial elements are market positioning, unique selling points, and customer feedback. Don't forget to assess the supplier's technology and innovation capabilities.

Could you outline the five key steps involved in conducting a competitive analysis?

- Define your objectives and scope.

- Identify your competitors and gather data.

- Analyse the collected information.

- Compare strengths and weaknesses.

- Draw conclusions and develop strategies.

Each step requires thorough research and careful consideration. The process may need to be repeated regularly to stay up-to-date with market changes.

What methodologies are recommended for writing a comprehensive competitive analysis?

SWOT analysis is a popular method. It examines Strengths, Weaknesses, Opportunities, and Threats for each supplier.

Porter's Five Forces model is another useful tool. It looks at competitive rivalry, supplier power, buyer power, threat of substitution, and threat of new entry.

In what way does competitive analysis fit into a business plan?

Competitive analysis forms a crucial part of the market analysis section in a business plan. It helps identify market gaps and opportunities for differentiation.

This analysis informs strategy development and resource allocation. It can guide decisions on pricing, product development, and marketing approaches.

How do the four components of competitor analysis differ and complement each other?

The four components typically include market share, cost structure, objectives, and strategies. Market share provides a quantitative measure of a supplier's position.

Cost structure reveals pricing strategies and operational efficiency. Objectives highlight future plans and potential threats. Strategies show how suppliers aim to achieve their goals.

These components work together to provide a comprehensive picture of the competitive landscape. They help businesses make informed decisions about supplier selection and partnership strategies.