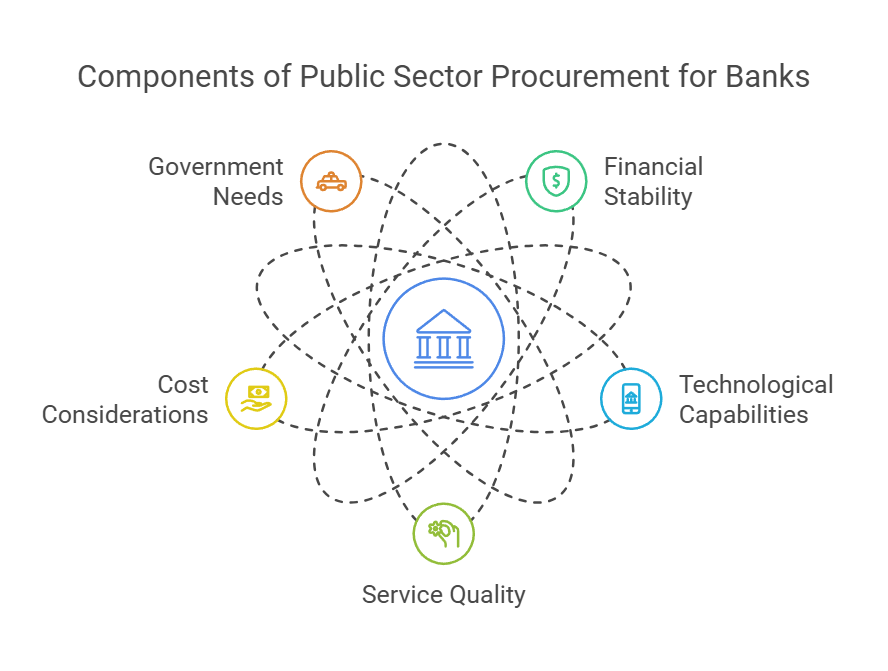

Public sector procurement for banks plays a crucial role in ensuring efficient financial services for government entities. The process involves careful evaluation of banking institutions to meet specific criteria and operational requirements. Banks must demonstrate their ability to handle large-scale transactions, maintain security protocols, and offer competitive rates to be considered for public sector contracts.

Evaluating public sector procurement for banks requires a thorough understanding of both financial regulations and government policies. The assessment typically includes factors such as a bank's financial stability, technological capabilities, and track record of serving similar institutions. This rigorous evaluation helps ensure that public funds are managed responsibly and effectively.

The procurement process for banks in the public sector often involves multiple stages, including initial screening, detailed proposal reviews, and final negotiations. Throughout these stages, procurement teams must balance cost considerations with the need for high-quality, reliable banking services that meet the unique needs of government organisations.

Key Takeaways

- Public sector procurement evaluates banks on financial stability, technology, and service quality

- The process involves multiple stages to ensure thorough assessment of banking capabilities

- Procurement teams must balance cost with the specific needs of government organisations

Understanding Public Sector Procurement

Public sector procurement involves complex regulations and procedures. It aims to ensure fairness, transparency, and value for money in government purchasing.

Procurement Legislation Overview

Procurement legislation in the UK sets rules for how public bodies buy goods and services. It covers government spending at all levels, from local councils to national agencies.

Key principles include:

• Open competition

• Equal treatment of suppliers

• Transparency in processes

• Value for money

The legislation aims to prevent corruption and ensure efficient use of public funds. It requires public bodies to follow specific procedures for different types of contracts.

Recent updates have focused on simplifying processes and promoting innovation. The rules also encourage consideration of social and environmental factors in procurement decisions.

The Public Contracts Regulations 2015

The Public Contracts Regulations 2015 implement EU procurement directives in UK law. They apply to public sector contracts above certain thresholds.

Key features include:

• Mandatory electronic communication

• Simplified procedure for smaller contracts

• Promotion of SME participation

The regulations define different procedures for awarding contracts. These include open, restricted, and competitive dialogue processes.

They also set out rules for technical specifications and award criteria. This helps ensure fair competition and best value for the public sector.

The Procurement Act 2023

The Procurement Act 2023 represents a significant change in UK procurement law. It aims to create a simpler and more flexible system post-Brexit.

Key changes include:

• A single regulatory framework for all procurements

• New procedures for innovative or complex projects

• Greater focus on social value and net zero goals

The Act introduces a new concept of "public good" in procurement decisions. It also strengthens rules around excluding suppliers for misconduct.

Implementation is expected to take place gradually over several years. Public bodies will need to adapt their processes to comply with the new rules.

The Procurement Process for Banks

Banks follow a structured procurement process to acquire goods and services efficiently. This process involves careful planning, transparent tendering, and thorough financial assessments to ensure value for money and mitigate risks.

Initiation and Planning

The procurement process starts with identifying the bank's needs. Procurement teams work with departments to define requirements and specifications. They create a procurement strategy that outlines timelines, budgets, and evaluation criteria.

Banks conduct market research to understand available options and potential suppliers. This helps in setting realistic expectations and budgets.

A business case is developed to justify the procurement. It includes cost-benefit analysis and risk assessments. Senior management reviews and approves the business case before proceeding.

Publishing Tenders and Managing Responses

Banks publish tender notices to invite bids from suppliers. These notices include detailed specifications, submission guidelines, and evaluation criteria.

Tender documents are prepared with clear terms and conditions. They may include technical requirements, pricing templates, and contract terms.

Banks use e-procurement systems to manage the tendering process. These systems help in distributing documents, receiving bids, and ensuring fair competition.

A Q&A period allows suppliers to seek clarifications. Banks provide responses to all bidders to maintain transparency.

Should Cost Modelling and Financial Viability Risk Assessment

Should cost modelling helps banks estimate fair prices for goods or services. It involves analysing market data, supplier costs, and internal benchmarks.

Banks use this model to evaluate bids and negotiate with suppliers. It helps identify unrealistic or inflated pricing.

Financial viability risk assessments are crucial for long-term contracts. Banks analyse suppliers' financial health to ensure they can deliver throughout the contract period.

This assessment includes reviewing financial statements, credit ratings, and market position. It helps banks avoid disruptions due to supplier failures.

Evaluation Criteria for Banking Procurements

Banks use specific criteria to assess bids for procurement. These criteria help ensure value for money, quality, and sustainability in the selection process. They also consider the economic standing of suppliers and social value.

Assessing Quality and Technical Merit

Quality and technical merit are key factors in evaluating banking procurements. Evaluators look at the technical specifications of proposed solutions. They check if bids meet the bank's requirements.

Important aspects include:

• Functionality of systems

• Security features

• Scalability

• Integration with existing infrastructure

Banks may use a scoring system to rate these elements. Higher scores go to bids that exceed minimum requirements. Technical experts often review this part of the bid to ensure accuracy.

Evaluating Economic and Financial Standing

The economic and financial standing of suppliers is crucial. Banks need to know that a supplier can deliver the project and stay in business long-term.

Key factors include:

• Financial stability

• Credit rating

• Revenue and profit trends

• Liquidity ratios

Banks might ask for financial statements or credit reports. They may also look at the supplier's track record with similar projects. This helps gauge the supplier's ability to handle the contract's financial demands.

Social Value and Sustainability Considerations

Banks increasingly factor in social value and sustainability. These elements show a supplier's commitment to wider societal benefits.

Sustainability criteria may include:

• Environmental policies

• Carbon footprint reduction plans

• Use of renewable energy

Social value might cover:

• Local employment opportunities

• Diversity and inclusion practices

• Community engagement initiatives

Banks may assign points for these factors in the overall evaluation. This approach helps select suppliers that align with the bank's corporate social responsibility goals.

Operational Considerations in Banking Procurements

Banking procurements involve crucial operational aspects that ensure efficiency, security, and compliance. These considerations help financial institutions navigate complex procurement processes whilst managing risks and maintaining regulatory standards.

Contracting Authority and the Sourcing Playbook

The contracting authority plays a vital role in banking procurements. It is responsible for overseeing the entire procurement process and ensuring compliance with regulations. The sourcing playbook serves as a guide for best practices in procurement.

Key elements of the sourcing playbook include:

- Defining clear evaluation criteria

- Establishing a fair and transparent selection process

- Identifying potential risks and mitigation strategies

Banks must appoint qualified evaluators to assess bids. These evaluators should have expertise in the specific areas being procured.

Risk Management and Security

Risk management is paramount in banking procurements. Financial institutions must identify, assess, and mitigate potential risks associated with procurement activities.

Common risks include:

- Cyber threats

- Regulatory non-compliance

- Operational disruptions

To address these risks, banks implement robust security measures. These may include:

- Encrypting sensitive data

- Conducting thorough background checks on suppliers

- Implementing multi-factor authentication systems

Regular security audits help ensure the ongoing effectiveness of these measures.

Supplier Registration Service and Framework Agreements

Supplier registration services streamline the procurement process by pre-qualifying vendors. This approach saves time and reduces risks associated with supplier selection.

Benefits of supplier registration services:

- Centralised database of qualified suppliers

- Simplified vendor management

- Reduced administrative burden

Framework agreements are another valuable tool in banking procurements. These agreements establish long-term relationships with suppliers, offering benefits such as:

- Consistent pricing

- Faster procurement cycles

- Improved supplier performance

Banks can leverage these agreements to achieve better value for money and reduce procurement costs over time.

Best Practices for Public Sector Procurement in Financial Services

Public sector procurement in financial services requires careful planning and execution. Key practices include using playbooks, robust scoring methods, and strategic contract frameworks.

The Consultancy Playbook

The Consultancy Playbook provides guidance for public sector organisations when engaging financial consultants. It emphasises the importance of clearly defining project scopes and deliverables.

The playbook recommends conducting thorough market engagement before tendering. This helps identify potential suppliers and understand current market capabilities.

It also advises on setting realistic timelines for procurement processes. This ensures adequate time for both the public sector body and potential suppliers to prepare high-quality bids.

Best Practice Scoring Methodology

A robust scoring methodology is crucial for fair and transparent evaluations. It should align with the specific requirements of the financial services being procured.

Key elements of a good scoring system include:

- Clear evaluation criteria

- Weighted scoring based on importance

- Defined scoring scales (e.g. 1-5 or 1-10)

- Consistent application across all bids

Evaluators should be trained in the scoring methodology to ensure consistency. Documentation of scoring decisions is essential for transparency and potential audit purposes.

Framework Agreements and Contract Tiering

Framework agreements offer flexibility in public sector procurement for financial services. They allow for multiple suppliers to be pre-approved, streamlining future purchases.

Contract tiering helps manage risk and performance. It typically involves:

- Bronze tier: Basic services

- Silver tier: Enhanced services

- Gold tier: Premium services

The contract tiering tool helps determine appropriate tiers based on contract value and complexity. This approach ensures proportionate management and oversight for different levels of financial services contracts.

Legal and Compliance Aspects

Public sector procurement for banks involves strict legal requirements and compliance measures. Banks must navigate complex regulations while maintaining confidentiality and adhering to specific procedural steps.

Understanding Compliance Requirements

Banks must comply with the Public Contracts Regulations 2015 (PCR) when engaging in public sector procurement. These regulations ensure fairness, transparency, and non-discrimination in the procurement process.

The PCR outlines specific procedures for different types of contracts. For some services, a 'light touch' regime applies, including certain financial and legal services.

Banks must design their evaluation methodology in line with PCR principles. This includes:

- Equal treatment of all bidders

- Proportionality in requirements

- Transparency throughout the process

Failure to comply with these regulations can lead to legal challenges and reputational damage.

Maintaining Confidentiality

Confidentiality is crucial in public sector procurement for banks. Non-public information shared during the procurement process must be treated as confidential.

Banks must implement robust systems to protect sensitive data. This includes:

- Secure data storage

- Limited access to confidential information

- Non-disclosure agreements with staff and partners

Breaches of confidentiality can result in legal action and loss of trust. Banks must balance transparency requirements with the need to protect sensitive information.

The Standstill Period and Competitive Dialogue

The standstill period is a critical phase in public sector procurement. It allows unsuccessful bidders to challenge the decision before the contract is finalised.

Banks must:

- Provide clear feedback to all bidders

- Allow sufficient time for potential challenges

- Be prepared to justify their decision-making process

Competitive dialogue is a procurement procedure used for complex contracts. It allows banks to discuss requirements with potential suppliers before finalising specifications.

Key aspects of competitive dialogue include:

- Multiple rounds of discussions with bidders

- Refinement of requirements based on feedback

- Evaluation of final tenders against agreed criteria

This process can lead to more innovative solutions but requires careful management to ensure fairness and compliance.

Awarding Public Banking Contracts

When awarding public banking contracts, government agencies follow specific processes to ensure fairness and value for money. These include evaluating bids, moderating decisions, and providing feedback to suppliers.

Evaluation Process and Award Criteria

The evaluation process for public banking contracts starts with clear award criteria. These criteria typically include:

• Financial stability

• Service quality

• Technical capabilities

• Cost-effectiveness

Evaluators use a scoring system to assess each bid against these criteria. They might assign points or percentages to different aspects of the proposals.

For example, a typical scoring breakdown could be:

- Financial stability: 30%

- Service quality: 25%

- Technical capabilities: 25%

- Cost-effectiveness: 20%

This ensures a balanced assessment of each bid, focusing on both quality and value for money.

Moderation and Final Decision Making

After individual evaluations, a moderation process takes place. This involves:

- Comparing scores across evaluators

- Discussing discrepancies

- Reaching consensus on final scores

A panel of experts usually oversees this process. They review the evaluations and may ask for clarifications from bidders if needed.

The panel then makes a final decision based on the moderated scores and any additional factors. These might include:

• Compliance with regulations

• Alignment with government policies

• Potential risks or benefits

The decision-making process must be transparent and well-documented to withstand scrutiny.

Notification and Feedback to Suppliers

Once a decision is made, all bidders receive notification of the outcome. The contract award notice includes:

• Name of the winning bidder

• Contract value

• Brief description of services

Unsuccessful bidders have the right to request feedback. This feedback should:

- Explain their scores

- Highlight strengths and weaknesses

- Suggest areas for improvement

Providing detailed feedback helps suppliers improve future bids and maintains a competitive market. It also demonstrates transparency in the procurement process.

Procurement Documentation and Due Diligence

Banks must carefully manage procurement documentation and due diligence when working with public sector clients. This involves creating detailed specifications, conducting thorough background checks, and handling security matters properly.

Developing Specification Documents

Specification documents are crucial for public sector procurement. They outline the exact requirements for goods or services. Banks need to create clear, detailed specs that leave no room for misunderstanding.

Key elements to include:

- Precise product or service descriptions

- Quality standards

- Delivery timelines

- Performance metrics

It's vital to use plain language and avoid jargon. This helps ensure all bidders understand the requirements fully.

Banks should also consider sustainability and social value in their specs. These factors are becoming more important in public sector contracts.

Thorough Due Diligence Processes

Due diligence is a critical step in public sector procurement. Banks must carefully check potential suppliers to reduce risks.

This process typically includes:

- Financial health checks

- Compliance with regulations

- Past performance reviews

- Reputation assessments

Banks should use reliable data sources for these checks. They may need to invest in specialised due diligence tools or services.

It's important to document all due diligence activities. This creates an audit trail and helps justify procurement decisions if questioned later.

Subscription and Security Documentation

Security is paramount when banks handle public sector contracts. Proper documentation of security measures is essential.

Key security documents include:

- Data protection policies

- Cybersecurity protocols

- Business continuity plans

- Disaster recovery procedures

Banks must also manage subscription documentation carefully. This includes contracts, service level agreements, and renewal terms.

It's crucial to keep all security and subscription documents up to date. Regular reviews and updates help ensure ongoing compliance with public sector requirements.

Aligning Banking Procurement with Government Policies

Banks play a crucial role in supporting government policies through their procurement practices. By aligning their procurement strategies with public sector goals, banks can contribute to economic growth and policy implementation.

Supporting Economic Growth

Banks can boost economic growth through strategic procurement. They may prioritise local suppliers and small businesses in their purchasing decisions. This approach helps create jobs and stimulate regional economies.

Banks can also invest in innovative technologies and services. By doing so, they support the development of new industries and enhance their own operational efficiency.

Collaborating with government agencies on joint procurement initiatives can lead to cost savings. It also ensures banks are in sync with national economic priorities.

Outsourcing Playbook Adherence

The Outsourcing Playbook provides guidelines for effective outsourcing in the public sector. Banks can adopt these principles to improve their procurement processes.

Key areas of focus include:

- Risk assessment and management

- Vendor selection and due diligence

- Contract design and performance metrics

- Ongoing supplier relationship management

By following these guidelines, banks can reduce risks and improve outcomes in their outsourcing arrangements.

Regular audits and reviews help ensure compliance with the Outsourcing Playbook. This promotes transparency and accountability in banking procurement practices.

Implementation of Procurement Policies

Effective implementation of procurement policies is essential for aligning with government objectives. Banks should establish clear procurement guidelines that reflect public sector priorities.

Training programmes for procurement staff help ensure understanding and compliance. Regular updates keep team members informed about changes in government policies and regulations.

Banks can use technology to streamline procurement processes. E-procurement systems enhance transparency and efficiency in vendor selection and contract management.

Sustainability should be a key consideration in procurement decisions. Banks can support government environmental policies by choosing eco-friendly products and services.

Regional Considerations for Public Procurement in Banking

Public procurement practices for banks vary across regions in the UK. England and Wales have distinct approaches and regulations that shape how financial institutions engage with government contracts.

Public Procurement in England

In England, public procurement for banks follows specific guidelines. The Crown Commercial Service oversees many procurement activities. Banks must register on the government's procurement portal to bid on contracts.

Key regulations include the Public Contracts Regulations 2015. These rules aim to ensure fair competition and transparency. Banks need to demonstrate value for money and meet strict criteria.

English procurement often uses framework agreements. These allow multiple banks to be pre-approved for certain services. This can streamline the process for both banks and public bodies.

Sustainability is becoming more important in English procurement. Banks may need to show their environmental and social policies when bidding.

Procurement Regulations in Wales

Welsh public procurement for banks has some unique features. The Welsh Government has its own procurement policy, emphasising local economic benefits.

The Wales Procurement Policy Statement guides public spending. It focuses on social value and supporting Welsh businesses. Banks must show how they contribute to these goals.

Welsh language requirements can affect procurement. Banks may need to provide some services in both English and Welsh.

The National Procurement Service in Wales centralises some contracts. This can affect how banks engage with Welsh public bodies.

Community benefits are a key part of Welsh procurement. Banks might need to offer apprenticeships or support local projects as part of their bids.

After Procurement: Ensuring Contract Deliverability

Once a public sector bank has selected a supplier, the focus shifts to ensuring contract deliverability. This crucial phase involves monitoring and managing the contract to achieve desired outcomes.

For services contracts, banks should establish clear key performance indicators (KPIs). These metrics help track supplier performance and ensure value for money.

Construction contracts require careful oversight of timelines and budgets. Regular site visits and progress reports are essential to identify and address any issues promptly.

Contract value plays a significant role in determining the level of scrutiny required. High-value contracts often warrant more intensive monitoring and may benefit from dedicated contract managers.

To enhance deliverability, banks should:

- Conduct regular performance reviews

- Maintain open communication channels with suppliers

- Document any deviations from agreed terms

- Implement a robust change management process

It's important to note that public bodies must report annually on supplier performance against published KPIs. This transparency helps ensure accountability and drives continuous improvement.

By focusing on contract deliverability, banks can maximise the value of their procurement efforts and better serve the public interest.

Capacity and Capability Evaluation

Banks need to assess suppliers' abilities and resources to ensure successful procurement. This includes looking at supplier skills, financial health, and the expertise of commercial staff.

Assessing Supplier Capability

Supplier capability refers to a company's skills and resources to meet contract requirements. Banks should evaluate suppliers' technical expertise, experience, and track record.

Key areas to assess include:

- Quality management systems

- Production capacity

- Delivery capabilities

- Staff qualifications

- Past performance on similar projects

Banks can use supplier capability frameworks to rate suppliers across different criteria. This helps identify strengths and weaknesses.

Supplier site visits and reference checks provide valuable insights. Banks should also review certifications and industry accreditations.

Financial Capacity of Suppliers

A supplier's financial health is crucial for long-term project success. Banks must assess if suppliers have the funds to fulfil contracts.

Key financial indicators to examine:

- Liquidity ratios

- Profitability

- Debt levels

- Cash flow

- Working capital

Banks should review audited financial statements and credit reports. They may set minimum requirements for revenue or net worth.

Requiring performance bonds or bank guarantees can reduce financial risks. For large contracts, banks might ask for proof of project financing.

Enabling Capability of Commercial Professionals

Bank staff managing procurement need the right skills to evaluate suppliers effectively. Commercial professionals play a key role in this process.

Important capabilities for procurement staff include:

- Contract management

- Negotiation skills

- Risk assessment

- Market analysis

- Supplier relationship management

Banks should invest in training programmes to build these skills. Offering certifications like CIPS can improve staff expertise.

Creating clear job descriptions and competency frameworks helps. Regular performance reviews can identify areas for improvement.

Banks may need to hire specialists for complex procurements. Building a mix of in-house talent and external consultants is often effective.

Public Procurement and the Financial Sector

Public procurement plays a crucial role in the financial sector. It involves the purchase of goods and services by government entities and public institutions. This process affects banks and other financial organisations in significant ways.

Banks often participate in public procurement as service providers. They may offer financial products or services to government bodies. These can include lending, cash management, and payment processing.

The Sourcing Playbook is a key resource for UK public sector procurement. It provides guidance on assessing suppliers' financial standing. This is important when evaluating bids from banks and other financial institutions.

Contracting authorities must carefully evaluate the financial health of potential suppliers. This helps ensure the stability of public services. The UK government's corporate financial distress guidance assists in this process.

Financial institutions bidding for public contracts face strict scrutiny. They must demonstrate:

- Financial stability

- Regulatory compliance

- Ability to deliver services

Public procurement can impact the broader financial sector. It can influence market competition and innovation in financial services. Well-designed procurement processes can promote efficiency and value for money in public spending.

Technical Evaluation for Banking Contracts

Technical evaluation plays a crucial role in assessing banking contract bids. It involves a structured process to analyse tender submissions and determine the most suitable provider for the bank's needs.

Bid Evaluation Process

The bid evaluation process for banking contracts starts with setting clear criteria. These criteria often include technical capabilities, security measures, and financial stability. A panel of experts reviews each bid against these standards.

The panel uses a scoring system to rate different aspects of the bids. They might assign points for factors like:

- System functionality

- Data protection measures

- Integration capabilities

- Scalability

Sub-criteria help break down complex requirements. For example, under 'security', sub-criteria might include encryption methods and access controls.

The evaluation team must document their findings clearly. This ensures transparency and helps justify the final decision.

Analysing Tender Submissions

When analysing tender submissions, evaluators look beyond the surface claims. They seek concrete evidence of a bidder's abilities and track record.

Key areas of focus include:

- Technical specifications

- Implementation plans

- Support and maintenance offerings

- Cost breakdown

Evaluators often use comparison tables to assess bids side-by-side. This helps highlight strengths and weaknesses across different proposals.

It's vital to check that submissions meet all mandatory requirements. Bids that fall short on essential criteria may be disqualified early in the process.

The analysis should also consider the long-term value of each proposal, not just the upfront costs. This includes factors like future upgrades and ongoing support.

Frequently Asked Questions

Public sector procurement for banks involves complex processes and evaluation methods. These FAQ address key aspects of assessing effectiveness, structuring bid evaluations, and maintaining transparency in procurement activities.

What methods are employed to assess the effectiveness of procurement processes in the banking sector?

Banks use various methods to evaluate procurement effectiveness. These include cost-benefit analysis, supplier performance metrics, and procurement strategy reviews. They also track delivery times, quality of goods and services, and compliance with regulatory requirements.

Benchmarking against industry standards helps identify areas for improvement. Regular audits and feedback from stakeholders provide valuable insights into process efficiency.

How is the bid evaluation process structured within banks' procurement activities?

The bid evaluation process in banks typically follows a structured approach. It begins with establishing clear evaluation criteria aligned with procurement objectives. A panel of experts then reviews submitted bids against these criteria.

The process often includes technical and financial evaluations. Bids are scored based on predetermined weightings for each criterion. This ensures a fair and transparent selection of suppliers.

Can you detail the key evaluation criteria typically used in procurement by financial institutions?

Financial institutions commonly use several key criteria in procurement evaluations. These include:

- Price competitiveness

- Technical capability and expertise

- Financial stability of the supplier

- Quality of proposed solutions

- Compliance with regulatory requirements

Additional factors may include innovation, sustainability practices, and past performance records. The specific weightings of these criteria can vary based on the nature of the procurement.

What are the essential principles guiding public procurement that banks should adhere to?

Banks engaging in public procurement should follow key principles to ensure integrity and effectiveness. These include:

- Transparency in all processes

- Fair competition among suppliers

- Value for money in acquisitions

- Accountability in decision-making

- Ethical conduct throughout the procurement cycle

Adhering to these principles helps maintain public trust and ensures efficient use of resources.

How are tender responses scored and evaluated by banks to ensure fair selection?

Banks use structured scoring systems to evaluate tender responses fairly. Each response is assessed against predefined criteria, with points awarded for meeting or exceeding requirements. Evaluators often use a balanced scorecard approach to consider multiple factors.

Scores are typically weighted based on the importance of each criterion. This method allows for objective comparison between different bids, ensuring a fair selection process.

What steps are involved in a comprehensive procurement evaluation to maintain transparency and integrity?

A comprehensive procurement evaluation involves several key steps:

- Clearly defining evaluation criteria before inviting bids

- Forming an impartial evaluation committee

- Conducting thorough technical and financial assessments

- Documenting all decisions and rationales

- Providing feedback to unsuccessful bidders

Regular audits and external reviews help maintain integrity. Publishing evaluation results and selection criteria enhances transparency in the procurement process.