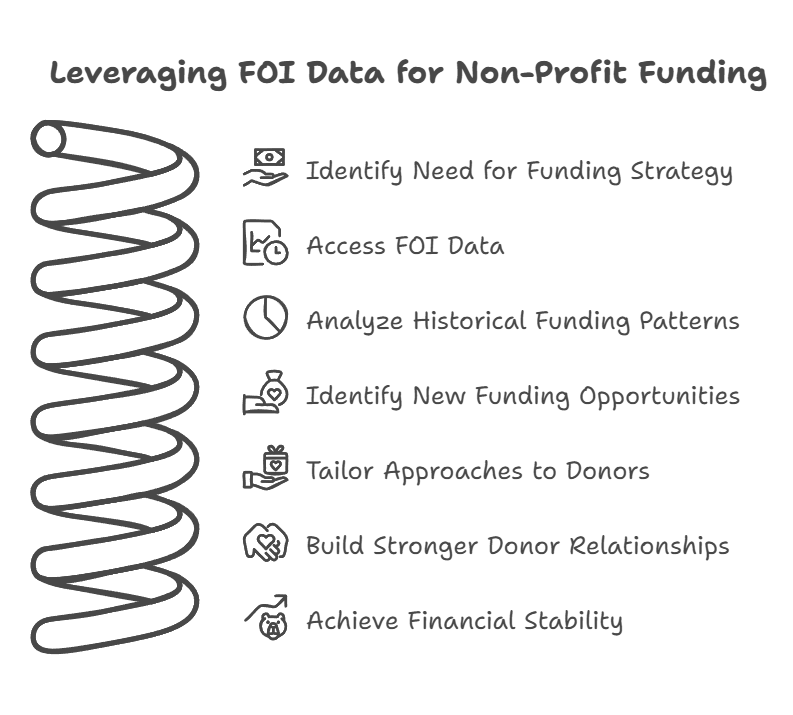

Non-profit organisations face unique challenges in securing funding and maintaining financial stability. Freedom of Information (FOI) data can be a valuable tool for developing effective funding strategies. By leveraging this public information, charities and other non-profits can gain insights into potential donors, government grants, and funding trends.

Developing a funding strategy is crucial for non-profit organisations to ensure their sustainability and success. FOI data can provide a wealth of information on past funding allocations, successful grant applications, and donor preferences. This data can help non-profits identify new funding opportunities, tailor their approaches, and make informed decisions about resource allocation.

Using FOI data strategically can also help non-profits build stronger relationships with donors and stakeholders. By analysing historical funding patterns and understanding the priorities of potential supporters, organisations can create more targeted and compelling pitches. This approach can lead to more successful fundraising efforts and long-term financial stability.

Key Takeaways

- FOI data offers valuable insights for developing effective non-profit funding strategies

- Strategic use of public information can help identify new funding opportunities and tailor approaches

- Analysing historical funding patterns can lead to stronger donor relationships and improved financial stability

Understanding FOI Data in the Context of Non-Profits

Freedom of Information (FOI) data plays a crucial role in shaping funding strategies for non-profit organisations. It provides valuable insights into public spending and government priorities, helping charities align their efforts with available resources.

Basics of Freedom of Information

FOI laws give the public the right to access information held by public authorities. In the UK, the Freedom of Information Act governs this process. Non-profits can use FOI requests to gather data on:

• Government funding allocations

• Policy decisions affecting the charity sector

• Public spending in relevant areas

This information helps non-profits understand the funding landscape and identify potential opportunities. It also promotes transparency and accountability in public institutions.

Importance of FOI Data for Financial Strategies

FOI data is a powerful tool for developing funding strategies in non-profit organisations. It provides:

- Insights into government priorities

- Information on successful funding applications

- Data on sector-specific spending

By analysing this data, non-profits can:

• Tailor their programmes to align with government objectives

• Craft more compelling funding proposals

• Identify gaps in service provision that may attract funding

This strategic approach helps organisations maximise their chances of securing vital resources.

Data Protection and Compliance

While FOI data offers valuable insights, non-profits must handle it responsibly. Key considerations include:

• GDPR compliance: Ensure any personal data obtained through FOI requests is processed lawfully

• Sensitive information: Be cautious when dealing with confidential or sensitive data

• Data management: Implement robust data management practices to protect information

Non-profits should also be aware of their own obligations under FOI laws if they receive public funding. This includes maintaining proper records and being prepared to respond to FOI requests themselves.

Formulating a Funding Strategy

A solid funding strategy helps non-profits secure resources and achieve financial stability. It involves assessing funding sources, implementing effective fundraising methods, and creating a balanced revenue mix.

Assessment of Funding Sources

Non-profits must identify diverse funding options to build a strong financial base. Common sources include:

- Individual donations

- Corporate partnerships

- Government grants

- Foundation grants

- Membership fees

- Earned income

Organisations should evaluate each source's potential and alignment with their mission. This assessment helps prioritise efforts and allocate resources effectively.

A SWOT analysis can reveal strengths and weaknesses in current funding. It also highlights opportunities for growth and potential threats to financial stability.

Implementing Fundraising Strategies

Effective fundraising requires a tailored approach. Non-profits should select strategies that suit their size, mission, and target audience.

Popular fundraising methods include:

- Online campaigns

- Events (galas, auctions, fun runs)

- Direct mail appeals

- Major donor cultivation

- Grant writing

- Peer-to-peer fundraising

Developing a diverse fundraising plan helps organisations reach different donor groups. It's crucial to track results and adjust tactics as needed.

Building strong donor relationships is key. Regular communication and showing impact can increase donor retention and support.

Creating a Sustainable Revenue Mix

A balanced funding strategy reduces reliance on any single source. This approach enhances financial stability and flexibility.

Ideal revenue mixes vary by organisation. A typical breakdown might include:

- 30% individual donations

- 25% grants

- 20% corporate sponsorships

- 15% earned income

- 10% events

Non-profits should aim for a mix that provides steady income and allows for growth. Regular review and adjustment of the revenue mix is essential.

Developing new funding models can open up fresh opportunities. Social enterprise ventures or impact investing partnerships are innovative options to consider.

Different Avenues for Non-Profit Funding

Non-profit organisations have several funding options to support their missions. These diverse sources help create financial stability and sustain important work.

Government Grants and Public Sector Funding

Government grants offer significant support for non-profits. These funds come from local councils, national agencies, and international bodies. Grants often target specific causes or projects.

Non-profits must meet strict criteria to qualify. The application process can be complex and time-consuming. However, government funding can provide substantial, long-term support.

Public sector contracts are another avenue. Non-profits may deliver services on behalf of government agencies. This can create a steady income stream while serving community needs.

Foundation Grants and Philanthropy

Charitable foundations play a crucial role in non-profit funding. These organisations provide grants to support various causes. Some focus on specific areas like education or health.

Developing a funding strategy is key to securing foundation grants. Non-profits must align their goals with the foundation's mission.

Philanthropic donations from wealthy individuals or families can be transformative. These gifts often support large-scale projects or long-term initiatives. Building relationships with philanthropists is essential for securing such donations.

Corporate Sponsorships and Partnerships

Businesses often partner with non-profits to show social responsibility. Corporate sponsorships can provide funding, resources, or expertise.

Non-profits benefit from financial support and increased visibility. Companies gain positive public relations and employee engagement opportunities.

Partnerships may involve:

- Event sponsorships

- Cause-related marketing campaigns

- Employee volunteer programmes

- In-kind donations of goods or services

Individual Giving and Major Donors

Individual donations form the backbone of many non-profit funding strategies. Small, regular gifts from many donors create a stable income base.

Non-profits use various methods to encourage individual giving:

- Online donation platforms

- Direct mail campaigns

- Fundraising events

- Monthly giving programmes

Major donors can make significant contributions. These individuals often require personalised engagement. Non-profits must cultivate relationships and demonstrate impact to secure large gifts.

Peer-to-Peer Fundraising and Community Engagement

Peer-to-peer fundraising harnesses the power of social networks. Supporters raise funds on behalf of the non-profit, reaching new donors.

This approach works well for:

- Charity runs or walks

- Social media challenges

- Personal fundraising pages

Community engagement events build awareness and support. These may include:

- Charity auctions

- Benefit concerts

- Local fairs or festivals

Such events not only raise funds but also strengthen community ties.

Earned Income Strategies

Earned income can provide financial stability for non-profits. This involves selling goods or services related to the organisation's mission.

Examples include:

- Museum gift shops

- Charity shops selling donated items

- Training or consulting services

- Membership programmes with benefits

Earned income reduces reliance on grants and donations. It can also help non-profits weather funding fluctuations.

Some non-profits create social enterprises. These businesses generate profit to support the organisation's charitable work.

Building and Maintaining Donor Relations

Strong donor relationships are key to a non-profit's funding success. Effective strategies focus on engagement, events, and clear communication to foster lasting connections with supporters.

Engagement and Stewardship Strategies

Donor relations involve more than just asking for money. It's about creating a bond between the donor and the organisation's mission. Non-profits should personalise their approach, recognising each donor's unique motivations and interests.

Regular updates on the impact of donations help donors see the value of their support. This could include progress reports, success stories, or invitations to see projects first-hand.

Donor recognition programmes can range from simple thank-you notes to naming opportunities. The key is to match the level of recognition to the donor's preferences and contribution size.

Leveraging Fundraising Events

Events offer a powerful way to connect with donors in person. They provide an opportunity to showcase the non-profit's work and allow supporters to meet beneficiaries and staff.

Popular event types include:

- Galas and dinners

- Charity auctions

- Fun runs or walks

- Community festivals

Each event should have clear goals, whether it's raising funds, attracting new donors, or deepening existing relationships.

Post-event follow-up is crucial. Thank attendees promptly, share event highlights, and outline how their support will make a difference.

Effective Communication with Funders

Clear, consistent communication builds trust with funders. Non-profits should tailor their messages to each funder's interests and preferred communication style.

Key elements of effective funder communication:

- Regular progress updates

- Transparent reporting on fund use

- Prompt responses to queries

- Invitations to relevant events or site visits

Collecting and analysing donor data helps non-profits understand their supporters better. This insight can inform communication strategies and guide future fundraising efforts.

Digital tools like customer relationship management (CRM) systems can help manage donor information and track interactions. This ensures a coordinated approach across the organisation.

Leveraging Data for Strategic Development

Data-driven approaches enable non-profits to make informed decisions and enhance their impact. By analysing internal data, learning from peers, and maintaining transparency, organisations can develop robust funding strategies.

Data Analysis for Decision-Making

Non-profits can use data analysis to guide their strategic choices. By examining funding patterns, donor behaviours, and programme outcomes, organisations gain valuable insights. This information helps identify effective fundraising methods and areas for improvement.

Data analytics can drive insights into donor behaviour and programme efficiency. For example, a non-profit might analyse donation data to determine which campaigns resonate most with supporters. This knowledge allows for tailored outreach strategies.

Organisations can also use data to assess the impact of their programmes. By tracking key performance indicators, non-profits can demonstrate their effectiveness to funders and identify areas for growth.

Benefiting from Peer Organisations' Experiences

Learning from other non-profits' successes and challenges can inform strategy development. Organisations can study peer funding models, partnership approaches, and programme designs to gather ideas.

The ProPublica Nonprofit Explorer is a valuable tool for this research. It provides access to financial data and tax filings for thousands of non-profits.

By examining this information, organisations can:

- Identify potential funding sources

- Compare financial structures

- Assess programme spending ratios

This benchmarking helps non-profits set realistic goals and adopt best practices in their sector.

Annual Reports and Transparency

Publishing detailed annual reports fosters trust with donors and the public. These documents showcase an organisation's achievements, financial health, and future plans.

Transparent reporting includes:

- Clear financial statements

- Programme impact metrics

- Donor recognition

By sharing this information, non-profits demonstrate accountability and build credibility. This openness can attract new funders and strengthen relationships with existing supporters.

Regular reporting also helps organisations track their progress over time. By comparing year-on-year data, non-profits can identify trends and adjust their strategies accordingly.

Innovating to Stay Ahead

Non-profits must embrace change and find new ways to secure funding. This means rethinking old approaches and trying fresh ideas to keep up with today's fast-moving world.

Adapting to Changing Fundraising Landscapes

The fundraising world is shifting quickly. Non-profits need to keep up. Digital tools are now key for reaching donors. Social media and online platforms help spread the word about causes. Many groups now use data to drive their fundraising efforts. This helps them target the right people with the right message.

Mobile giving is on the rise. Non-profits should make it easy for people to donate on their phones. Crowdfunding is another trend to watch. It lets charities tap into wider networks of support.

Driving Innovation in Funding Models

Non-profits are getting creative with how they raise money. Some are trying new business models. They might sell products or services to support their cause. This can help them rely less on traditional donations.

Partnerships with companies are becoming more common. These can bring in funds and raise awareness. Impact investing is growing. It lets non-profits use money to make positive changes while also earning returns.

Grant makers are changing too. Many now look for innovative ideas that can scale up. They want to fund projects that can make a big difference.

Risks and Challenges

Non-profit organisations face several risks and challenges when developing funding strategies. These can impact their financial stability and ability to achieve their mission.

Managing Revenue Concentration

Revenue concentration poses a significant risk for non-profits. Relying too heavily on a single funding source can leave organisations vulnerable to sudden changes.

Diverse fundraising plans are crucial for reducing this risk. Non-profits should aim to balance their income streams across multiple sources.

Grants, individual donations, and corporate partnerships can all play a role in a well-rounded strategy. This approach helps protect against the loss of any single funding source.

Non-profits should regularly review their revenue mix. They can use tools like the Herfindahl-Hirschman Index to measure concentration levels.

Navigating Financial Challenges and Solutions

Financial challenges can threaten a non-profit's sustainability. Organisations must be prepared to face and overcome these obstacles.

One common issue is cash flow management. Non-profits often struggle with irregular income patterns. Creating a cash reserve can help smooth out these fluctuations.

Cost recovery is another critical area. Many non-profits underestimate their true costs, leading to financial strain. Accurate budgeting and negotiating fair overhead rates with funders are essential.

Non-profits should also consider diversifying their revenue through social enterprise activities. This can provide more stable, unrestricted funding.

Regular financial health checks and risk assessments are vital. These help identify potential issues before they become critical.

Conclusion

FOI data plays a vital role in shaping effective funding strategies for non-profit organisations. By leveraging this information, non-profit leaders can make informed decisions about resource allocation and fundraising efforts.

Access to FOI data opens up new avenues for identifying potential funding opportunities. It provides insights into government spending patterns and priorities, allowing non-profits to align their programmes accordingly.

Transparency in funding allocation becomes easier with FOI data. Non-profit leaders can use this information to demonstrate accountability to donors and stakeholders, building trust and credibility.

FOI data also helps in diversifying revenue streams. By analysing trends and patterns, organisations can explore untapped funding sources and create more robust financial strategies.

Ultimately, the strategic use of FOI data empowers non-profits to:

- Improve decision-making processes

- Enhance programme effectiveness

- Strengthen donor relationships

- Increase overall financial sustainability

Non-profit leaders who embrace FOI data in their funding strategies position their organisations for long-term success and impact.

Frequently Asked Questions

Non-profit organisations often have queries about using Freedom of Information (FOI) data for their funding strategies. These questions cover topics like data utilisation, exemptions, response times, financial information access, request templates, and applicability to non-public bodies.

How can non-profit organisations utilise FOI data to inform their funding strategies?

Non-profits can use FOI data to gain insights into public funding trends and priorities. This information helps them identify potential funding sources and tailor their strategies accordingly.

FOI requests can reveal details about past grant allocations and budgets. This data allows organisations to align their proposals with government focus areas.

What exemptions exist that may restrict access to information relevant for non-profit funding strategy?

Certain exemptions may limit access to sensitive financial information. These can include data related to ongoing policy development or commercial confidentiality.

Personal information and national security matters are also typically exempt. Non-profits should be aware of these limitations when planning their FOI requests.

What are the timeframes within which public authorities must respond to FOI requests pertinent to funding?

Public authorities usually have 20 working days to respond to FOI requests. This timeframe applies to requests about funding information as well.

In some cases, authorities may extend this period if the request is complex. They must inform the requester if an extension is needed.

What type of financial information can a non-profit legally obtain about other organisations through an FOI request?

Non-profits can request information about public funding received by other organisations. This may include grant amounts, project details, and evaluation reports.

However, access to detailed financial records of private entities is often restricted. Public bodies must balance transparency with protecting sensitive commercial information.

Are there any specific templates recommended for submitting an FOI request concerning non-profit funding development?

While there's no mandatory template, clear and concise requests are most effective. Non-profits should specify the exact information they need about funding.

Including a date range and relevant departments can help. Some public bodies offer guidance on their websites for submitting FOI requests.

Does the obligation to provide information under FOI extend to non-public bodies receiving public funding?

The FOI Act primarily applies to public authorities. However, some non-public bodies that receive significant public funding may be subject to FOI requests.

This varies depending on the organisation's status and the nature of its funding. Non-profits should check the specific regulations in their area.