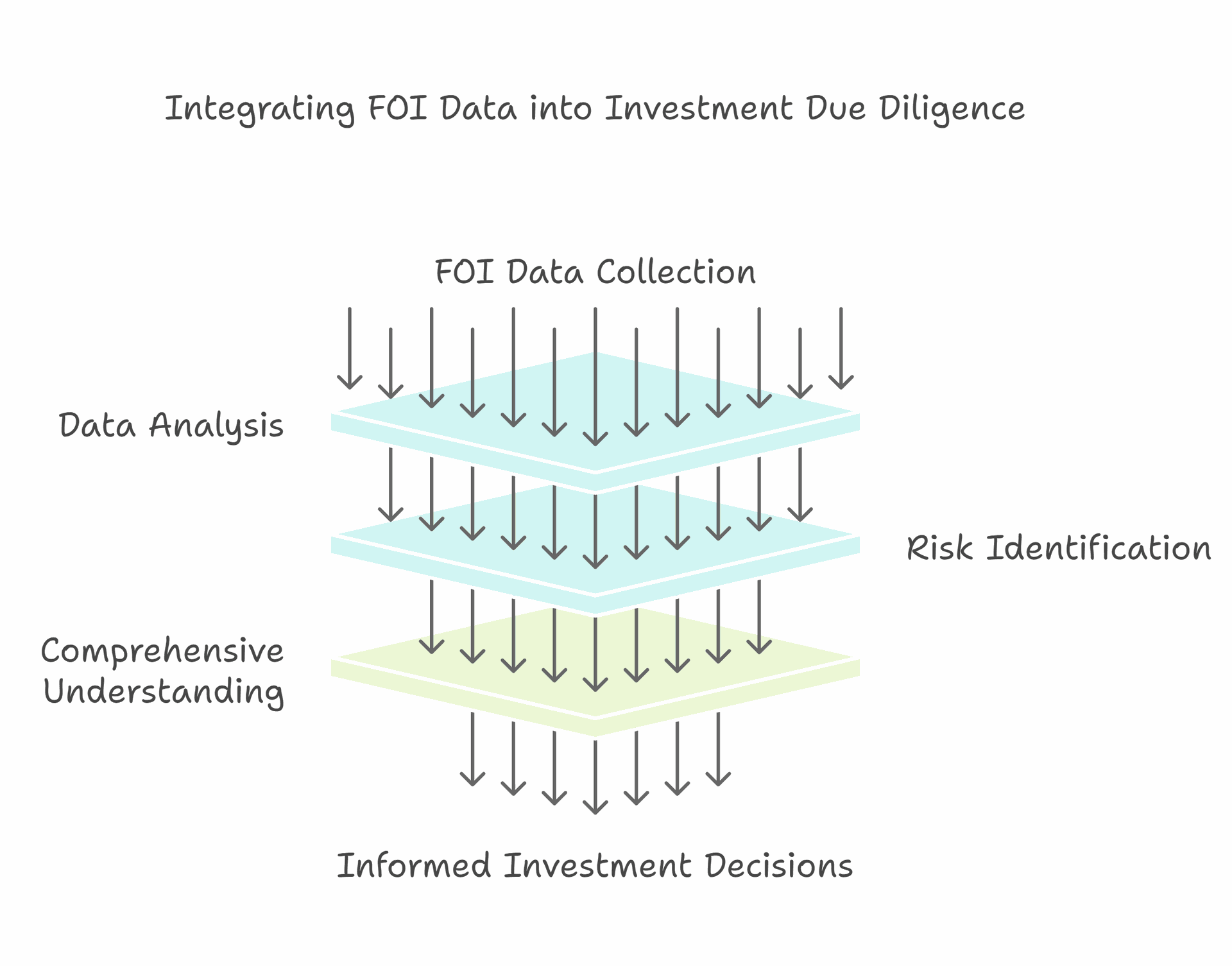

Investment due diligence is a vital process for making informed financial decisions. It involves gathering and analysing data to assess potential risks and rewards. FOI (Freedom of Information) data can be a valuable tool in this process, providing access to government-held information that may not be readily available elsewhere.

FOI data can offer unique insights into investment opportunities, helping investors uncover hidden risks and potential red flags. This information can include regulatory compliance records, government contracts, and environmental impact assessments. By incorporating FOI data into their due diligence process, investors can gain a more comprehensive understanding of the companies or projects they're considering.

Using FOI data for investment due diligence requires careful planning and execution. Investors need to know how to submit effective FOI requests and interpret the information received. It's also important to understand the limitations of FOI data and use it in conjunction with other sources of information.

Key Takeaways

- FOI data provides valuable insights for investment due diligence

- Proper use of FOI information can help identify hidden risks and opportunities

- Effective due diligence combines FOI data with other information sources

Understanding FOI in Investment Due Diligence

Freedom of Information (FOI) requests play a crucial role in investment due diligence. They provide valuable insights into public entities and help investors make informed decisions. This process involves regulatory compliance, data protection, and privacy considerations.

The Role of Freedom of Information Requests

FOI requests are powerful tools for investors conducting due diligence. They allow access to information held by public authorities, offering transparency and accountability. Investors can gather critical data on potential investments, including financial records, contracts, and decision-making processes.

These requests help in:

- Assessing risk factors

- Uncovering potential liabilities

- Verifying public statements

- Identifying market trends

FOI data enhances the due diligence process by providing a more comprehensive view of the investment landscape. It allows investors to spot red flags and make well-informed choices.

Regulatory Compliance and Non-Compliance

Compliance with FOI regulations is essential for public entities. They must respond to requests within set timeframes and provide accurate information. Non-compliance can lead to:

- Legal penalties

- Reputational damage

- Loss of investor confidence

Investors should be aware of an entity's compliance history. Frequent non-compliance might indicate poor governance or lack of transparency. This information is vital for assessing the overall risk of an investment.

Data Protection and Privacy Considerations

While FOI promotes transparency, it must balance with data protection laws. Investors need to be mindful of privacy rights when using FOI data. Key considerations include:

- Personal data protection

- Commercial confidentiality

- National security concerns

Investment offices must handle FOI data responsibly. They should have clear protocols for storing and using sensitive information. This ensures compliance with data protection regulations and maintains ethical standards in the investment process.

Evaluating Investment Opportunities

Proper evaluation of investment opportunities is crucial for making informed decisions. Using FOI data can provide valuable insights into a company's financial health and future prospects.

Assessing Financial Health Through FOI Data

FOI data offers a wealth of information for assessing a company's financial health. Investors can examine key financial metrics such as revenue, profit margins, and debt levels. This data helps identify potential red flags or strengths in a company's financial position.

Analysing cash flow statements is particularly important. They reveal how well a company manages its money and if it can cover its expenses. Strong cash flow often indicates good financial health.

Investors should also look at balance sheets to assess assets and liabilities. A healthy balance between the two suggests financial stability.

Valuation and Financial Projections

Accurate valuation is key to making sound investment choices. FOI data can help investors calculate important ratios like price-to-earnings (P/E) and price-to-book (P/B). These ratios provide insights into a company's current value relative to its peers.

Financial projections are crucial for estimating future growth. Investors should analyse past performance data to make realistic forecasts. It's important to consider industry trends and economic factors that might impact future results.

Comparing projections to industry benchmarks can help gauge their reliability. Overly optimistic projections should be scrutinised carefully.

By combining FOI data with thorough analysis, investors can make more informed decisions about potential opportunities.

Risk Management in Investments

Risk management is crucial for protecting investments and ensuring ethical practices. It involves careful analysis and proactive steps to safeguard assets and uphold human rights standards.

Identifying and Mitigating Investment Risks

Investment due diligence focuses on both quantitative and qualitative factors. Quantitative aspects include track record verification and performance analytics. Qualitative factors involve collecting necessary documentation and assessing risk management frameworks.

Key risks to consider:

- Market volatility

- Liquidity issues

- Regulatory changes

- Operational risks

To mitigate these risks, investors should:

- Diversify portfolios

- Conduct thorough due diligence checks

- Monitor investments regularly

- Implement robust risk assessment tools

Regular review of investment relationships is essential. This helps identify potential issues early and allows for timely action to protect assets.

Human Rights Due Diligence and Ethical Investment

Ethical investment practices are becoming increasingly important. Human rights due diligence is a crucial part of this process.

Steps for human rights due diligence:

- Identify potential human rights impacts

- Assess risks and opportunities

- Integrate findings into decision-making

- Track and report on performance

Investors should look for companies with:

- Strong human rights policies

- Transparent reporting practices

- Engagement with stakeholders

Ethical investment can lead to better long-term performance and reduced reputational risks. It also helps ensure compliance with evolving regulations and standards in the investment industry.

Enhancing Decision-Making with AI and Digital Tools

AI and digital tools are transforming investment due diligence. These technologies offer new ways to analyse data and make informed decisions quickly and accurately.

The Impact of AI on Investment Due Diligence

AI is revolutionising how investors conduct due diligence. It can process vast amounts of data in seconds, uncovering insights that humans might miss. AI-enhanced due diligence tools can save hours in deal processing, allowing for faster decision-making.

AI algorithms can:

- Analyse financial statements

- Predict market trends

- Assess risk factors

- Identify potential red flags

These capabilities help investors make more informed choices. AI can also improve the quality of insights generated, leading to better investment outcomes.

Incorporating Digital Tools in Analysis

Digital tools complement AI in the due diligence process. They streamline data collection and analysis, making it easier for investors to evaluate opportunities.

Key digital tools include:

- Data visualisation software

- Cloud-based collaboration platforms

- Automated reporting systems

These tools help investors process complex datasets and gain deeper insights. They also facilitate better communication among team members, ensuring all stakeholders have access to crucial information.

By combining AI and digital tools, investors can enhance their decision-making process. This leads to more efficient and effective due diligence, ultimately improving investment outcomes.

Legal and Governmental Aspects

Understanding legal and governmental aspects is crucial for effective investment due diligence in Scotland. This involves navigating official documents, grasping local funding structures, and comprehending environmental information regulations.

Navigating Scottish Government Documents

Scottish government documents play a vital role in investment due diligence. These papers often contain key information about policies, regulations, and economic plans that can impact investments.

Investors should focus on official publications like white papers, strategy documents, and legislative proposals. These can provide insights into upcoming changes that might affect business operations or market conditions.

It's important to review both current and historical documents to understand policy trends. The Scottish government's website offers a searchable database of publications, making it easier to find relevant information.

Careful analysis of these documents can help identify potential risks and opportunities in the Scottish market.

Understanding Grants and Local Authority Data

Grants and local authority data are essential components of the investment landscape in Scotland. They can significantly influence the financial viability of projects and businesses.

Local authorities often provide detailed information about available grants, tax incentives, and development plans. This data can be crucial for assessing the potential support for an investment in a specific area.

Investors should examine:

- Grant eligibility criteria

- Funding amounts and timelines

- Local development priorities

It's wise to engage directly with local authorities to get the most up-to-date information. Many councils have dedicated economic development teams that can provide valuable insights.

Understanding this data helps investors make informed decisions about location, timing, and potential government support for their investments.

EIR and the Investment Landscape

The Environmental Information Regulations (EIR) significantly impact the investment due diligence process in Scotland. These regulations ensure public access to environmental information held by public authorities.

For investors, EIR can be a valuable tool for gathering data on:

- Environmental assessments

- Planning permissions

- Land use restrictions

This information is crucial for evaluating potential risks associated with investments, particularly in sectors like energy, infrastructure, and real estate.

Investors should be aware that EIR requests can sometimes be time-consuming. It's important to factor this into the due diligence timeline. Understanding how to make effective EIR requests can streamline the process and yield more relevant information.

Strategic Relations and Agreements

FOI data plays a crucial role in building investment relationships and crafting business agreements. It provides valuable insights that can shape negotiations and partnerships.

Building Investment Relationships

FOI data can help firms build stronger investment relationships. It offers insights into potential investors' interests and past dealings. This info lets companies tailor their pitches and align with investor goals.

Key points to consider:

- Use FOI data to research investor history and preferences

- Tailor communication based on investor profiles

- Highlight relevant aspects of your business that match investor interests

FOI insights can reveal trends in investor behaviour. This knowledge helps firms predict future investment patterns. It also aids in targeting the right investors for specific projects or sectors.

Crafting Business Agreements with FOI Insights

FOI data can guide the creation of robust business agreements. It provides context on industry standards, regulatory concerns, and market conditions.

Benefits of using FOI data in agreements:

- Identify potential risks and address them in contracts

- Understand typical terms and conditions in your sector

- Spot opportunities for unique or advantageous clauses

Due diligence is crucial when drafting agreements. FOI data can reveal past issues or successes of potential partners. This info helps firms negotiate better terms and safeguard their interests.

By using FOI insights, companies can craft agreements that are fair, comprehensive, and aligned with industry best practices. This approach builds trust and sets the stage for successful partnerships.

Due Diligence in Corporate Transactions

Due diligence plays a crucial role in corporate transactions, especially in mergers and acquisitions. It involves thorough research and analysis to assess potential risks and opportunities. FOI responses can provide valuable insights for investor relations during this process.

Mergers and Acquisitions: A Due Diligence Perspective

Due diligence in corporate transactions is a critical step in mergers and acquisitions. It helps buyers gather essential commercial, financial, and legal information about the target company. This process informs negotiations, identifies risks, and assists with future planning.

The scope of due diligence varies based on:

• Transaction type and size

• Buyer's needs

• Access to information and management

Key areas examined include:

• Financial statements

• Legal contracts

• Operational processes

• Market position

Thorough due diligence can uncover hidden liabilities or opportunities that may impact the transaction's value. It also helps buyers develop integration strategies and set realistic post-acquisition goals.

FOI Response Analysis for Investor Relations

FOI (Freedom of Information) responses can be a valuable tool for investor relations during due diligence. These responses provide access to public sector information that might not be readily available through other channels.

Analysing FOI responses can offer insights into:

• Regulatory compliance

• Government contracts or grants

• Environmental impact assessments

• Public sector partnerships

For investor relations teams, this information helps:

• Assess potential risks or opportunities

• Gauge public sector engagement

• Understand regulatory landscapes

When reviewing FOI responses, it's important to consider:

• The context of the information

• Any data limitations or gaps

• The relevance to the specific transaction

Incorporating FOI data into due diligence can enhance the overall understanding of a target company's position and potential future challenges or opportunities.

Guidance and Best Practices

Proper due diligence is crucial for informed investment decisions. Key practices include thorough risk assessment and human rights considerations.

Guidance on Due Diligence Processes

Due diligence guidance often focuses on risk assessment and best practices. Investors should conduct thorough checks on business partners, transactions, and goods. This includes reviewing financial records, operational processes, and compliance with regulations.

Red flags for circumvention should be identified early. These may include unusual transaction patterns or inconsistencies in documentation. Investors need to stay alert to potential risks throughout the investment lifecycle.

Regular updates to due diligence processes are essential. This ensures they remain effective as regulations and market conditions change. Investors should also document their due diligence steps carefully.

Preventing Human Trafficking Through Informed Investment

Human rights risks must be a key focus in investment due diligence. This includes assessing the risk of human trafficking in supply chains and operations.

Investors should look for red flags such as labour exploitation or restrictive working conditions. They need to examine labour practices, recruitment methods, and worker living conditions.

Engaging with companies on their human rights policies is crucial. Investors can encourage stronger safeguards and reporting on these issues. Regular monitoring and follow-up are necessary to ensure ongoing compliance.

Collaboration with experts and NGOs can provide valuable insights. This helps investors stay informed about emerging human rights risks and best practices.

Frequently Asked Questions

Due diligence for investments involves careful examination of financial, legal and operational aspects. Key considerations include data protection, regulatory compliance and transparency in information sharing.

What are the essential components of a due diligence report for investment purposes?

A comprehensive due diligence report covers business processes, organisational structure, and risk management. It also examines financial statements, market position and growth potential.

Data security and regulatory compliance form critical parts of the assessment. The report should highlight any red flags or areas of concern for potential investors.

How does one conduct financial due diligence for mergers and acquisitions?

Financial due diligence for M&A scrutinises the target company's financial records. This includes analysing historical financial statements, cash flow patterns and revenue sources.

Auditors review accounting practices and assess the quality of earnings. They also examine working capital requirements and debt obligations.

What considerations are necessary when sharing personal data with third parties under GDPR?

GDPR mandates strict controls on personal data sharing. Organisations must have a lawful basis for transferring data to third parties.

Data subjects should be informed about the sharing. The receiving party must provide adequate data protection safeguards.

What does a due diligence questionnaire for data protection typically include?

A data protection due diligence questionnaire covers data handling practices. It enquires about data storage, access controls and retention policies.

Questions often address data security measures and compliance with relevant regulations. It may also probe incident response plans and staff training on data protection.

How do data subject rights impact the sharing of customer data for due diligence?

Data subject rights under GDPR affect how customer data can be shared. Individuals have the right to be informed about data sharing.

Organisations must consider rights of access, rectification and erasure. They should have processes to honour these rights during due diligence.

What are the legal implications of data sharing between public bodies for investment analysis?

Public bodies must comply with Freedom of Information laws when sharing data. They need to balance transparency with protecting sensitive information.

Data sharing agreements should outline the purpose, scope and duration of sharing. Public bodies must ensure they have the legal authority to share specific data sets.