Government contracts play a vital role in the UK economy, providing opportunities for businesses to work with public sector organisations. These contracts cover a wide range of goods and services, from construction projects to IT solutions. The UK government's Contracts Finder is a valuable resource for companies looking to explore these opportunities.

Analysis of government contract growth reveals important trends in public spending and economic development. By examining data on contract awards and performance, we can gain insights into which sectors are expanding and where the government is focusing its resources. This information is crucial for businesses planning their strategies and for policymakers assessing the impact of procurement decisions.

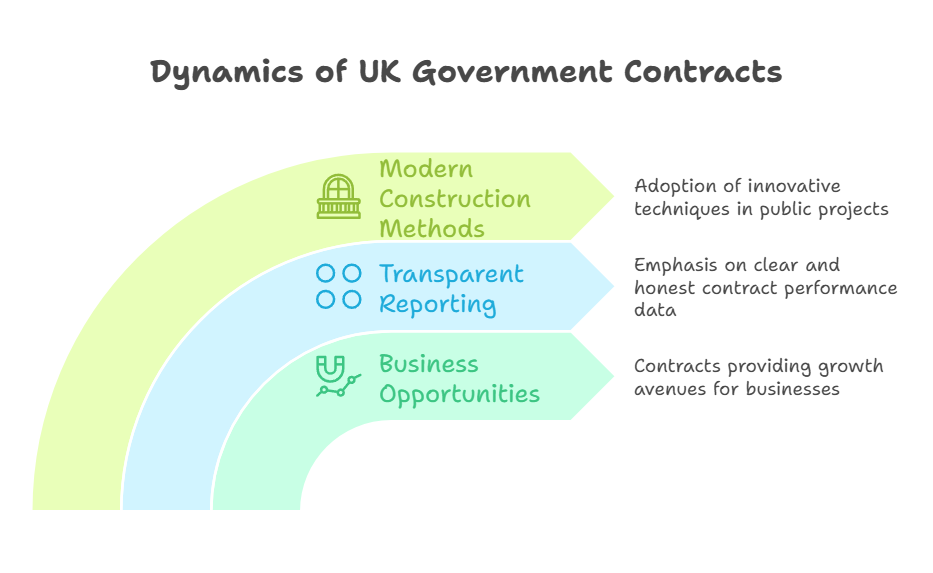

Recent developments in government contracting include a push towards more transparent reporting of key performance indicators (KPIs) for major contracts. This approach aims to improve accountability and ensure that taxpayers receive value for money. Additionally, there's a growing emphasis on using modern methods of construction (MMC) in public sector projects, which could reshape the landscape of government contracts in the coming years.

Key Takeaways

- Government contracts offer significant business opportunities across various sectors

- Transparent reporting of contract performance is becoming increasingly important

- Modern construction methods are being prioritised in public sector contracting

Overview of Government Contracting

Government contracting involves complex processes and significant expenditure. It spans federal and civilian agencies, with each playing distinct roles in procurement. Understanding the landscape and procedures is crucial for businesses seeking to engage with public sector contracts.

Procurement Landscape

The government procurement landscape is vast and diverse. In fiscal year 2023, federal contract spending reached £759 billion, a substantial increase from previous years. This growth reflects the expanding needs of government agencies across various sectors.

Key areas of procurement include:

- Defence and national security

- Information technology

- Healthcare services

- Infrastructure projects

- Research and development

Government contracts range from small purchases to multi-billion pound projects. The size and scope of these contracts can vary greatly, offering opportunities for businesses of all sizes.

Roles of Federal and Civilian Agencies

Federal and civilian agencies play distinct roles in government contracting. The Department of Defence (DOD) is a major player, with the 2024 National Defence Authorization Act setting priorities for expedited procurement and strengthened supply chains.

Civilian agencies, such as:

- Department of Health and Human Services

- Department of Energy

- NASA

These bodies also contribute significantly to procurement activities. Each agency has unique requirements and focuses, shaping the contracting landscape.

Public Sector Procurement Processes

Public sector procurement follows strict guidelines to ensure fairness and transparency. The process typically involves:

- Identification of need

- Market research

- Solicitation of bids

- Evaluation of proposals

- Contract award

- Contract management

Sustainability has become increasingly important in government contracting. Agencies now consider environmental impact and long-term sustainability when awarding contracts.

Contractors must navigate complex regulations and compliance requirements. This includes adhering to labour laws, cybersecurity standards, and specific agency mandates.

The use of data analytics and artificial intelligence is growing in procurement processes. These tools help agencies make more informed decisions and improve efficiency in contract management.

Types of Contracts in Public Sector

The public sector utilises various contract types to procure goods, services, and expertise. These contracts are tailored to meet specific needs and ensure efficient use of public funds.

Goods and Services Procurement

Government bodies frequently engage in procurement of goods and services. This category includes everyday items like office supplies, furniture, and IT equipment. It also covers services such as cleaning, catering, and maintenance.

Contracts for goods often involve fixed-price agreements. These set a specific cost for a defined quantity of items. Service contracts may use fixed-price or time-and-materials models. Time-and-materials contracts pay for labour hours and materials used.

Framework agreements are common in this area. They allow multiple purchases over time without repeated tendering. This approach saves time and resources for both buyers and suppliers.

Infrastructure and Construction Projects

Infrastructure and construction contracts form a significant portion of public sector spending. These projects include roads, bridges, schools, hospitals, and other public facilities.

Design-bid-build is a traditional model. It separates design and construction phases. Design-build contracts combine these phases under one contractor. This can speed up project delivery.

Public-private partnerships (PPPs) are increasingly popular. They involve long-term agreements between government and private firms. PPPs can help share risks and leverage private sector expertise.

Cost-plus contracts are sometimes used for complex projects. They reimburse the contractor's costs plus a predetermined profit percentage.

Professional Services Engagement

Government bodies often require specialised expertise. This leads to contracts for professional services. These include consulting, financial services, and legal advice.

Time-and-materials contracts are common in this area. They suit projects where the scope is not fully defined upfront. Fixed-price contracts may be used for well-defined, short-term engagements.

Framework agreements are also prevalent in professional services. They allow quick access to pre-approved suppliers. This is useful for recurring or urgent needs.

Performance-based contracts are gaining popularity. They tie payment to specific outcomes or deliverables. This approach aims to ensure value for money in professional services engagements.

Strategic Sourcing and Supply Chain

The UK government relies on strategic suppliers and efficient supply chain management to deliver value. Proper oversight of key contracts and streamlined processes are crucial for maximising public funds.

Importance of Strategic Suppliers

Strategic suppliers play a vital role in government procurement. These are companies that provide critical goods and services across multiple departments. In the 2023-2024 fiscal year, seven strategic suppliers had direct public sector revenue exceeding £1 billion.

Central government remains the top customer for these suppliers. Six central government bodies allocated over 30% of their procurement budgets to strategic suppliers.

Working with strategic suppliers offers benefits:

- Consolidated purchasing power

- Consistent service delivery

- Streamlined contract management

Supply Chain Management in Government Contracts

Effective supply chain management is critical for government contracts. It ensures timely delivery of goods and services whilst minimising risks.

Key aspects include:

- Supplier relationship management

- Performance monitoring

- Risk assessment and mitigation

The government emphasises prompt payment throughout the supply chain. This supports smaller suppliers and maintains cash flow.

For complex projects, expert contract managers oversee critical agreements. They use tools like balanced scorecards to track performance and outcomes.

Efficiency and Value for Money

Procurement efficiency is paramount in government contracting. The 'LEAN sourcing process' helps save time and costs.

Strategies for improving value for money include:

- Publishing requirements pipelines

- Using the Find a Tender service

- Focusing on strategic performance outcomes

Analytical technologies are increasingly important. They enable data-driven decisions at various stages of the supply chain, from sourcing to inventory optimisation.

By leveraging these tools and approaches, the government aims to maximise the impact of public spending whilst maintaining transparency and fairness in the procurement process.

Regulation and Compliance

Government contracts are subject to strict rules and oversight. Regulatory frameworks ensure fairness, transparency, and value for money in public procurement. Compliance and accountability are key to maintaining public trust.

Understanding the Procurement Act

The Public Contract Regulations 2015 set out the rules for public sector procurement in the UK. These regulations aim to create a level playing field for suppliers and ensure efficient use of public funds.

Key aspects of the Act include:

- Open and fair competition

- Transparent tender processes

- Equal treatment of bidders

- Value for money considerations

Public bodies must follow specific procedures when awarding contracts above certain thresholds. This includes advertising opportunities and conducting fair evaluations.

The Act also promotes innovation and sustainability in procurement. It allows for pre-market engagement and dialogue with potential suppliers.

Compliance with Legal Frameworks

Compliance is crucial in government contracting. Public bodies must adhere to strict legal and ethical standards.

Key compliance areas include:

- Anti-corruption measures

- Conflict of interest policies

- Data protection and privacy

- Environmental regulations

The Cabinet Office provides guidance on best practices for compliance. Regular audits and reviews help ensure adherence to regulations.

Non-compliance can lead to serious consequences, including legal action and reputational damage. Proper training and clear internal policies are essential for maintaining compliance.

Accountability in Public Sector Organisations

Accountability is a cornerstone of public sector procurement. Government bodies must demonstrate responsible use of public funds.

Measures to ensure accountability include:

- Transparent reporting of contract awards

- Regular performance reviews

- Clear lines of responsibility

The Regulatory Policy Committee plays a role in scrutinising regulatory proposals. This helps ensure that new regulations are evidence-based and proportionate.

Public sector organisations must maintain detailed records of procurement decisions. These records may be subject to scrutiny by auditors, parliamentary committees, or the public.

Effective accountability mechanisms help build trust in government contracting processes.

Economic Impact and Government Revenue

Government contracts play a major role in economic growth and revenue generation. They influence spending patterns, create jobs, and shape industry trends.

Government Contract Spending Analysis

Government contract spending has grown steadily over the years. In the UK, public sector procurement accounts for about £290 billion annually. This spending covers various sectors, including defence, healthcare, and infrastructure.

The impact of this spending is far-reaching. It creates jobs and stimulates economic activity. For example, a large defence contract can support thousands of jobs in manufacturing and related industries.

Contract spending also drives innovation. Many technological advances come from government-funded research and development projects. This leads to new products and services that benefit the wider economy.

Revenue Generation Through Contracts

Government contracts generate revenue in several ways. Firstly, they create taxable income for businesses and employees. This increases government tax receipts.

Secondly, contracts often include fees and charges paid directly to the government. For example, licensing fees for using government-owned intellectual property.

Thirdly, successful government projects can lead to increased economic activity. This, in turn, boosts overall tax revenue. A new transport infrastructure project, for instance, might increase trade and commerce in an area.

Trends in Government Contracting

Recent trends show a shift towards more strategic contracting. Governments are focusing on value for money rather than just lowest cost. This approach aims to improve long-term outcomes.

There's also a growing emphasis on sustainability. Many contracts now include environmental and social responsibility clauses. This reflects broader public concerns about climate change and social issues.

Digital transformation is another key trend. Governments are investing heavily in IT and data management contracts. This aims to improve public services and reduce costs through automation.

Lastly, there's a trend towards more collaboration between government and private sector. Public-private partnerships are becoming more common for large infrastructure projects. This helps share risks and leverage private sector expertise.

Technology Integration in Government Contracts

The government contracting landscape is rapidly evolving with the adoption of cutting-edge technologies. These advancements are reshaping procurement processes, enhancing security, and improving service delivery.

Artificial Intelligence Implementation

AI is transforming government contracts by automating complex tasks and improving decision-making. Electronic bidding systems powered by AI algorithms can quickly evaluate proposals and identify the most suitable contractors.

Machine learning models analyse vast amounts of data to predict project outcomes and costs. This helps agencies make more informed choices when awarding contracts.

AI chatbots are streamlining communication between agencies and contractors. They provide instant responses to common queries, reducing administrative burdens.

Natural language processing tools assist in contract drafting and review. They can flag potential issues and ensure compliance with regulations.

Cybersecurity Measures

As government contracts often involve sensitive data, robust cybersecurity is crucial. Blockchain technology is being integrated to enhance security and transparency in procurement processes.

Secure data encryption methods protect classified information shared between agencies and contractors. Multi-factor authentication systems are now standard to prevent unauthorised access to contract management platforms.

Continuous monitoring tools detect and respond to potential security threats in real-time. This proactive approach helps safeguard critical infrastructure and sensitive data.

Regular security audits and penetration testing are mandatory for contractors handling government data. This ensures compliance with strict cybersecurity standards.

Cloud Computing Services

Cloud-based solutions are revolutionising how government contracts are managed and executed. Unified cloud Enterprise Resource Planning (ERP) platforms offer centralised contract management and improved collaboration.

Cloud storage enables secure, scalable document management for contract-related files. This facilitates easier access and version control for all stakeholders.

Cloud-based project management tools enhance coordination between agencies and contractors. Real-time updates and shared dashboards improve project visibility and accountability.

Software-as-a-Service (SaaS) solutions tailored for government contracting are becoming more prevalent. These offer cost-effective, easily updatable tools for contract lifecycle management.

Notable Government Contractors

Several major companies dominate the government contracting landscape. These firms secure large contracts and play crucial roles in defence and aerospace projects.

In-Depth Look at BAE Systems

BAE Systems is a key strategic supplier to the UK government. The company specialises in defence, security, and aerospace. BAE Systems has a diverse portfolio of contracts across multiple government agencies.

Their work includes:

- Naval ship construction

- Combat vehicle manufacturing

- Electronic warfare systems

BAE Systems consistently ranks among the top defence contractors globally. The firm's strong relationship with the UK Ministry of Defence underpins its success. BAE Systems also exports its products and services to other allied nations.

Lockheed Martin's Market Position

Lockheed Martin stands out as a leading aerospace and defence contractor. The company's expertise spans aircraft, missiles, and space technologies. Lockheed Martin's F-35 fighter jet programme is one of its most high-profile projects.

Key areas of Lockheed Martin's government work:

- Military aircraft production

- Satellite systems

- Cybersecurity solutions

The firm's consistent growth in defence contracts highlights its strong market position. Lockheed Martin's innovative technologies keep it at the forefront of the defence industry.

Boeing's Contract Portfolio

Boeing, known for commercial aviation, also holds a significant place in government contracting. The company's defence division secures major contracts for military aircraft and space systems. Boeing's diverse portfolio helps it maintain a strong presence in the sector.

Boeing's government contract areas include:

- Military transport aircraft

- Fighter jets

- Unmanned systems

The company's long-standing relationships with defence agencies contribute to its success. Boeing's ability to adapt to changing government needs ensures its continued relevance in the contracting space.

Future Outlook on Government Contract Growth

Government contracting is poised for significant expansion in the coming years. Key factors driving this growth include increased defence spending, technological advancements, and a focus on infrastructure development.

Predictive Market Intelligence

The use of data analytics and artificial intelligence is transforming market intelligence in government contracting. Firms are leveraging these tools to forecast contract opportunities and spending patterns. This allows them to align their strategies with future government needs.

AI-powered platforms are analysing historical contract data to identify trends. These insights help contractors make informed decisions about which bids to pursue. Predictive analytics also assist in estimating project costs and timelines more accurately.

Companies are investing in specialised software to track upcoming contract renewals. This proactive approach helps them prepare competitive bids well in advance.

Opportunities and Contracting Backlog

The government contracting sector is experiencing a surge in opportunities. Defence spending is set to increase, creating new prospects for contractors in areas like cybersecurity and advanced weapons systems.

Infrastructure projects are also on the rise, with significant investments planned for roads, bridges, and public transport. This is expanding the backlog of contracts available to construction and engineering firms.

• Key growth areas:

- Cybersecurity

- AI and machine learning

- Sustainable energy solutions

- Healthcare technology

Many contractors are reporting increased revenue and optimism about future prospects. Small businesses, while facing challenges, are finding opportunities in subcontracting and specialised services.

Enhancing Public Sector Efficiency

Government agencies are increasingly focused on improving efficiency and reducing costs. This drive is creating opportunities for contractors who can offer innovative solutions.

Modern construction methods are being promoted to improve project delivery. Contractors adopting these techniques are gaining a competitive edge.

Digital transformation is a key priority. Agencies are seeking partners to modernise IT systems and implement cloud-based solutions. This is opening up new contract opportunities in the tech sector.

Sustainability is becoming a crucial factor in government procurement. Contractors offering eco-friendly products and services are seeing increased demand. This trend is expected to accelerate in the coming years.

Frequently Asked Questions

Government contract growth analysis involves examining trends, factors, and data related to public sector procurement. Understanding key aspects can help businesses navigate the contracting landscape and identify opportunities.

How can businesses analyse trends in UK government contract awards?

Businesses can track contract awards through the Contracts Finder portal. This tool allows firms to search for current and past tenders, analyse spending patterns, and identify potential opportunities.

Companies may also use specialised data providers to gain deeper insights into contract trends and market dynamics.

What are the key factors influencing the growth of strategic suppliers to the UK government?

Strategic suppliers often benefit from a track record of successful contract delivery. Past performance plays a crucial role in winning new contracts and expanding business with government agencies.

Compliance with regulations, ability to meet specific requirements, and competitive pricing are also important factors.

In what ways has the Contracts Finder portal facilitated transparency in contract awards?

The Contracts Finder portal has improved transparency by providing free access to contract information. It allows businesses to view tender details, award notices, and contract values.

This openness helps level the playing field for small and medium-sized enterprises (SMEs) seeking government work.

What methodologies do reports such as Tussell implement for government contract growth analysis?

Reports often use data aggregation and statistical analysis to identify trends. They may examine factors such as contract values, award frequencies, and sector-specific growth rates.

Some reports also incorporate qualitative analysis, such as expert interviews and case studies, to provide context to the data.

Which sectors have seen significant growth in government contracting post the increased need for PPE?

The healthcare and medical supply sectors experienced substantial growth due to increased demand for personal protective equipment (PPE). Technology and digital services also saw expansion as remote work became more prevalent.

Logistics and distribution sectors grew to support the movement of essential goods and services.

What have been the largest government contracts awarded in recent years and their impact on sector growth?

Large contracts in recent years have included infrastructure projects, IT system upgrades, and defence procurement. These contracts often lead to sector growth by creating jobs and stimulating supply chains.

They may also drive innovation and investment in specific industries aligned with government priorities.