Private equity firms are increasingly turning to data analytics to gain a competitive edge. By leveraging government data, these firms can make better investment decisions and create more value for their portfolio companies. Data-driven strategies in private equity can lead to improved due diligence, more accurate valuations, and enhanced operational efficiency.

Many PE firms are now collecting various types of data to drive reporting and use cases. This includes portfolio company financial data, customer and supplier information, workforce insights, and ESG metrics. By analysing this data, firms can identify trends, predict market movements, and spot potential risks or opportunities.

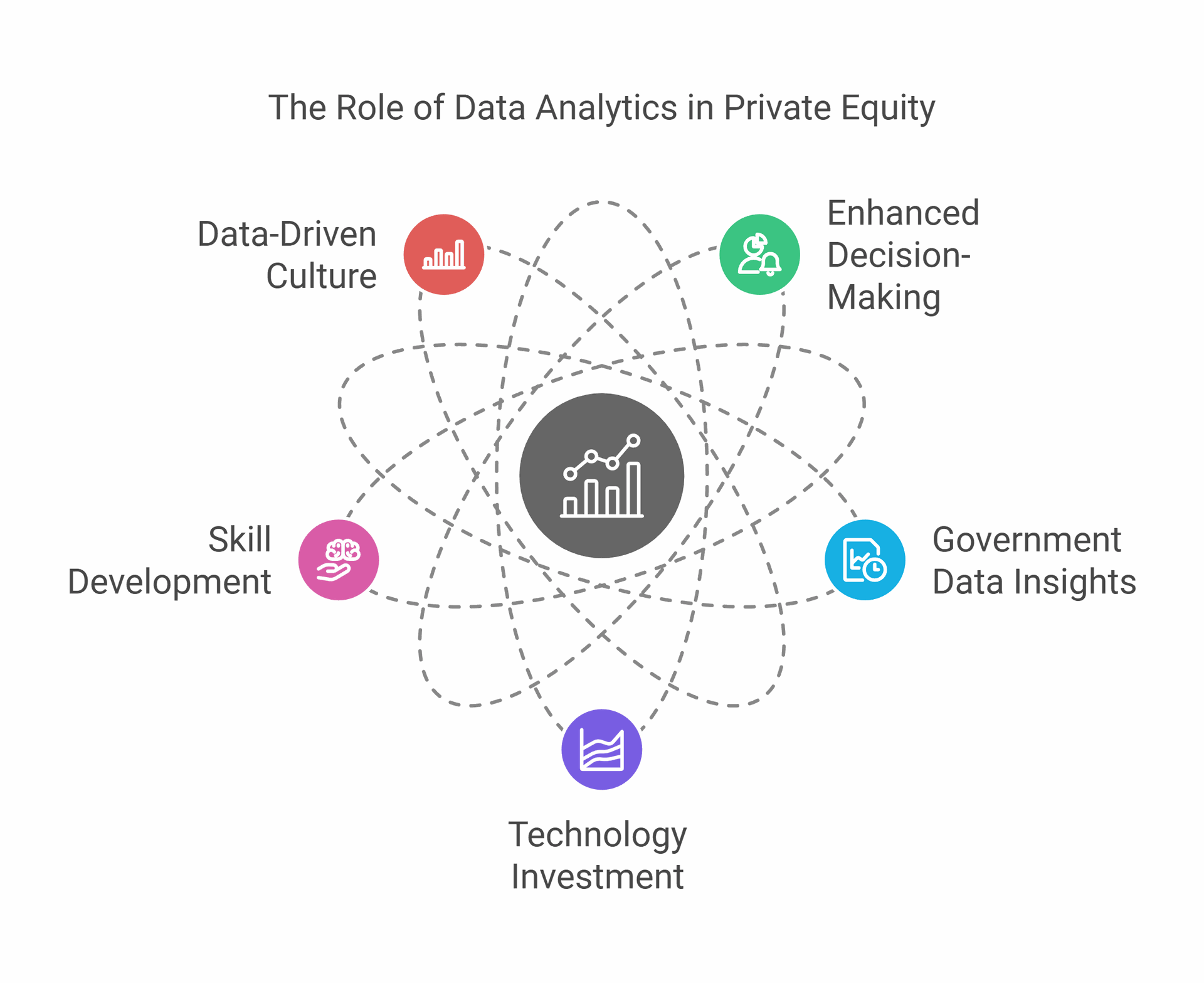

The use of government data analytics in private equity is not without its challenges. Firms must invest in the right technology, develop data analytics skills, and create a data-driven culture. However, those that successfully implement these strategies can gain a significant advantage in a highly competitive market.

Key Takeaways

- Data analytics enhances decision-making and value creation in private equity

- Government data provides valuable insights for investment strategies and portfolio management

- Successful implementation of data analytics requires investment in technology and skills Human: write the next section about "The Role of Data Analytics in Private Equity"

The Role of Data Analytics in Private Equity

Data analytics plays a crucial role in modern private equity firms. It helps investors make smarter choices and spot hidden opportunities. Advanced tools give firms an edge in a competitive market.

Importance of Data in Investment Strategies

Private equity firms use data to guide their investment choices. They look at market trends, company financials, and industry patterns. This helps them find the best deals and avoid risky bets.

Data-driven strategies give firms an edge. They can:

• Spot emerging markets early

• Find undervalued companies

• Predict future performance

Firms that use data well often see better returns. They can act faster and with more confidence.

Enhancing Due Diligence with Advanced Analytics

Advanced analytics boosts the due diligence process. Firms can dig deeper into potential investments and uncover hidden risks or value.

Key benefits include:

• Faster analysis of large datasets

• More accurate financial modelling

• Better understanding of market position

Data and analytics tools help firms assess:

• Customer behaviour

• Operational efficiency

• Growth potential

This thorough approach leads to smarter investment decisions. It also helps firms plan better strategies for their portfolio companies.

Decision-Making and Value Creation

Data analytics empowers private equity firms to make smarter choices and boost value across their portfolios. It provides deep insights into company performance, market trends, and growth opportunities.

Strategic Decisions for Operational Improvements

Private equity firms use data to pinpoint areas for operational enhancements in portfolio companies. They analyse financial metrics, supply chain data, and customer feedback to spot inefficiencies. This allows them to make targeted improvements.

For example, data might reveal high inventory costs. Firms can then work with management to optimise stock levels. Or analytics could show underperforming sales regions, prompting a review of local strategies.

AI-driven tools are increasingly used to process vast amounts of data quickly. This speeds up decision-making and helps identify issues human analysts might miss.

Identifying Value Creation Opportunities

Data analytics helps private equity firms uncover hidden value in their investments. They use market data to spot emerging trends and untapped customer segments.

Firms analyse competitor data to find gaps in the market. This informs product development and marketing strategies. They also use predictive models to forecast future demand and plan accordingly.

Customer data analysis is crucial. It reveals preferences and behaviours, helping tailor products and services. This can lead to increased customer loyalty and higher revenue.

Evaluating Portfolio Companies' Performance

Robust data analytics allows private equity firms to closely monitor their investments. They track key performance indicators (KPIs) in real-time, spotting issues early.

Firms use dashboards to visualise complex data sets. This makes it easier to compare performance across the portfolio. They can quickly identify which companies are thriving and which need support.

Data-driven approaches also help in valuing companies more accurately. By analysing market trends and company financials, firms can make better-informed decisions about when to exit investments.

Analytics Implementation in PE Firms

Private equity firms are embracing data analytics to gain a competitive edge. They're building data-driven cultures, investing in powerful tools, and upskilling their teams.

Building an Analytics-Driven Culture

PE firms are reshaping their cultures to put data at the forefront. They're hiring data scientists and analysts to work alongside investment professionals. These firms are also creating data-focused roles like Chief Data Officers.

Many PE firms are setting up dedicated analytics teams. These teams work across the organisation to support decision-making. They help with deal sourcing, due diligence, and portfolio management.

Data governance is becoming a priority. PE firms are establishing clear policies for data collection, storage, and use. They're also implementing data quality measures to ensure reliable insights.

Investing in Business Intelligence Tools

PE firms are investing heavily in business intelligence tools to process vast amounts of data. These tools help them analyse financial performance, market trends, and operational metrics.

Popular BI tools in PE include:

- Tableau

- Power BI

- Qlik

These platforms offer powerful visualisation capabilities. They allow PE firms to create interactive dashboards and reports. This makes complex data more accessible to decision-makers.

PE firms are also adopting advanced analytics tools. These include machine learning platforms and predictive modelling software. Such tools help identify investment opportunities and assess risks.

Training the Management Team in Data Literacy

PE firms recognise the importance of data literacy across all levels. They're investing in training programmes to upskill their management teams.

These programmes cover:

- Basic statistical concepts

- Data interpretation

- Use of BI tools

- Understanding of AI and machine learning

Many firms are partnering with universities and online learning platforms. They're offering customised courses tailored to the PE industry.

PE firms are also encouraging a 'test and learn' approach. They're creating safe environments for managers to experiment with data-driven decision-making. This hands-on experience helps build confidence in using analytics.

Analytics for Portfolio Management

Data analytics empowers private equity firms to optimise portfolio performance through enhanced monitoring, operational improvements, and risk management. These tools provide valuable insights for decision-making and value creation across investments.

Monitoring and Reporting EBITDA Improvements

Data-driven approaches enable private equity firms to track and boost EBITDA across their portfolio. Advanced analytics tools collect and analyse financial data from multiple sources, providing real-time visibility into company performance.

Key performance indicators (KPIs) are monitored through customised dashboards, allowing quick identification of areas for improvement. These may include:

• Revenue growth

• Cost reduction

• Working capital efficiency

• Profit margins

By leveraging predictive analytics, firms can forecast future EBITDA trends and take proactive measures to address potential issues. This data-centric approach facilitates more informed decision-making and targeted interventions to drive value creation.

Supply Chain and Operations Analytics

Private equity firms utilise analytics to optimise supply chain and operations across portfolio companies. Advanced data analysis helps identify inefficiencies and opportunities for improvement.

Key areas of focus include:

• Inventory management

• Demand forecasting

• Supplier performance

• Production efficiency

By analysing historical data and market trends, firms can optimise inventory levels, reduce carrying costs, and improve cash flow. Predictive analytics aids in anticipating demand fluctuations, enabling better production planning and resource allocation.

Process mining techniques help identify bottlenecks and streamline operations, leading to cost savings and improved productivity. These insights drive operational excellence and enhance overall portfolio value.

Insurance and Risk Assessment

Data analytics plays a crucial role in managing insurance and assessing risk across private equity portfolios. Advanced algorithms analyse vast amounts of data to identify potential risks and optimise insurance coverage.

Key benefits include:

• More accurate risk quantification

• Tailored insurance policies

• Reduced premiums

• Improved claims management

By leveraging machine learning, firms can predict the likelihood of various risk events and their potential impact on portfolio companies. This enables more informed decision-making regarding risk mitigation strategies and insurance coverage.

Analytics also aids in claims processing, identifying patterns that may indicate fraud or areas for process improvement. This data-driven approach helps minimise losses and protect portfolio value.

Industry-Specific Analytics Applications

Private equity firms use data analytics to gain insights in various sectors. These tools help identify investment opportunities and drive value creation.

Healthcare Sector Analytics

In healthcare, private equity firms use analytics to spot trends and find promising investments. They look at patient data, treatment outcomes, and healthcare costs. This helps them pick companies with growth potential.

Analytics tools examine hospital efficiency and patient satisfaction scores. They also track new medical technologies and their adoption rates. This data guides investment choices in medical device firms and healthcare tech startups.

Private equity teams use these insights to improve operations in healthcare companies they own. They might suggest ways to cut waiting times or boost patient care quality. This can lead to better financial results for their portfolio companies.

Technology and Software Investments

For tech investments, private equity firms rely on data to assess market potential. They analyse user growth rates, customer retention, and revenue patterns of software companies.

Analytics tools track software usage metrics and customer feedback. This helps identify products with loyal user bases and growth potential. Firms also use data to spot emerging tech trends and promising startups.

In software investments, analytics help measure key performance indicators like:

- Monthly recurring revenue

- Customer acquisition costs

- User engagement rates

These metrics guide decisions on which tech companies to buy and how to improve them after purchase.

Analytics in Real Estate Investments

In real estate, private equity firms use data to find profitable properties and markets. They analyse factors like population growth, job market trends, and local economic indicators.

Analytics tools help assess property values and rental income potential. They look at data on:

- Occupancy rates

- Rental price trends

- Property maintenance costs

This information guides decisions on which properties to buy, sell, or develop.

Firms also use analytics to improve property management in their portfolios. They might use data to set optimal rental prices or plan renovations that boost property values.

Integrating Sustainability and Data Analytics

Private equity firms are increasingly using advanced analytics to assess sustainability metrics and drive long-term value creation. These tools enable more accurate impact investing decisions and help firms align their portfolios with environmental, social, and governance (ESG) goals.

Sustainability Metrics for Long-Term Value

Private equity firms now recognise the importance of sustainability data in strategic planning. They use advanced analytics to track key ESG metrics across their portfolio companies. This includes carbon emissions, water usage, and labour practices.

By analysing these metrics, firms can identify risks and opportunities. For example, they might spot energy inefficiencies or potential supply chain disruptions. This data-driven approach helps firms make better investment decisions and improve portfolio performance.

Some firms are creating custom sustainability scorecards. These tools combine financial and ESG data to provide a holistic view of company performance. This approach helps align sustainability goals with financial returns.

Impact Investing and Advanced Data Techniques

Impact investing relies heavily on data analytics to measure and report social and environmental outcomes. Private equity firms use AI-powered software to create business value from sustainability initiatives.

Advanced techniques like machine learning can predict the future impact of investments. For instance, models might forecast how a company's carbon emissions will change over time. This helps firms set realistic sustainability targets and track progress.

Firms also use data visualisation tools to communicate impact to stakeholders. Interactive dashboards can show the real-time progress of sustainability initiatives across a portfolio. This transparency helps build trust with investors and the public.

Data Science and Innovation in PE

Data science drives innovation and competitive advantage in private equity. It enables firms to make smarter investment decisions and unlock hidden value in portfolio companies.

Data Science as a Competitive Edge

Private equity firms use data science to gain an edge. They analyse vast amounts of data to spot trends and opportunities others miss. This helps them:

• Find promising companies before competitors

• Value businesses more accurately

• Identify areas for operational improvement post-acquisition

Advanced analytics allow PE firms to crunch numbers faster and uncover insights from diverse data sources. Machine learning models can predict company performance and market trends. This data-driven approach leads to better investment decisions and higher returns.

Harnessing Venture Capital Data Insights

Venture capital firms leverage data science to evaluate startups and track market trends. They use it to:

• Assess founder teams and their likelihood of success

• Analyse product-market fit and growth potential

• Monitor competitor funding and market dynamics

VC firms build databases of startup metrics, funding rounds, and exit valuations. They apply algorithms to this data to spot promising investment targets early. Some firms even use natural language processing to analyse startup pitches and founder interviews.

Data analytics is transforming how VCs source deals and support portfolio companies. It helps them make more informed bets in a high-risk, high-reward environment.

The Future of Private Equity and Analytics

The landscape of private equity is rapidly evolving with data analytics at its core. Advanced technologies and sophisticated analysis methods are reshaping investment strategies and decision-making processes.

Predictive Analytics for Market Trends

Private equity firms are increasingly using data and analytics to drive value. They analyse vast amounts of market data to predict trends and identify potential investment opportunities. This approach helps firms spot emerging sectors and companies poised for growth.

Predictive models now incorporate diverse data sources, including:

- Social media sentiment

- Satellite imagery

- Consumer spending patterns

- Macroeconomic indicators

These models enable PE firms to make more informed decisions about target acquisitions and exit timings. By leveraging predictive analytics, firms can better anticipate market shifts and position their portfolios accordingly.

The Growth of AI and Machine Learning

Artificial intelligence and machine learning are transforming due diligence and portfolio management in private equity. These technologies can process enormous datasets at unprecedented speeds, uncovering insights that humans might miss.

AI-powered tools are being used for:

- Automating financial modelling

- Assessing risk factors

- Optimising operational efficiencies in portfolio companies

Machine learning algorithms can adapt and improve over time, leading to more accurate predictions and better-informed investment decisions. As these technologies advance, PE firms are ramping up their technical sophistication to stay competitive.

Emerging Trends in PE Investment Strategies

Data-driven strategies are reshaping how private equity firms approach investments. There's a growing focus on operational excellence and value creation beyond financial engineering.

Key trends include:

- ESG integration: Using data analytics to assess environmental, social, and governance factors.

- Digital transformation: Investing in companies with strong digital capabilities or potential.

- Sector specialisation: Leveraging deep industry knowledge and data insights for targeted investments.

PE firms are also exploring new investment structures and alternative data sources to gain a competitive edge. The future of private equity lies in harnessing the power of data, with those embracing these changes likely to emerge as industry leaders.

Frequently Asked Questions

Government data analytics offers valuable insights for private equity firms. It enhances investment decisions, improves project delivery, and guides strategy. Key considerations include best practices, salary ranges, and the impact of AI.

What are the best practices for utilising government data analytics in private equity investments?

Private equity firms should focus on data-driven value creation. This involves using analytics tools to gain deeper insights into portfolio company performance.

Firms must invest in technology and develop data analysis strategies. These should align with overall business objectives to maximise the benefits of government data.

How can data analytics enhance the project delivery process within government departments?

Data analytics can streamline project delivery in government departments. It helps identify bottlenecks, optimise resource allocation, and predict potential issues.

By analysing historical data, departments can improve decision-making and increase efficiency. This leads to better outcomes and cost savings in project delivery.

What are the current priorities for government data management that private equity firms should be aware of?

Government priorities include improving data quality and accessibility. Private equity firms should monitor these efforts as they impact investment opportunities.

Data security and privacy are also key concerns. Firms must stay informed about regulations and compliance requirements when using government data.

What is the typical salary range for a Data Scientist working in the private equity sector?

Data Scientists in private equity typically earn competitive salaries. The range varies based on experience, location, and firm size.

Junior roles may start around £50,000 to £70,000 per year. Senior positions can command salaries of £100,000 or more, especially in major financial centres.

How does the implementation of AI and data analytics in government agencies impact private equity decisions?

AI and data analytics in government agencies provide more accurate and timely information. This helps private equity firms make better-informed investment decisions.

Firms can leverage these tools to identify trends, assess risks, and spot opportunities in government-related sectors. This can lead to more targeted and successful investments.

What are the key benefits and limitations of government data analytics for private equity reviews?

Benefits include improved due diligence and more efficient analysis of businesses. Government data can reveal insights about market conditions, regulatory changes, and economic trends.

Limitations may include data quality issues or gaps in available information. Private equity firms must also be cautious about data interpretation and potential biases in government datasets.