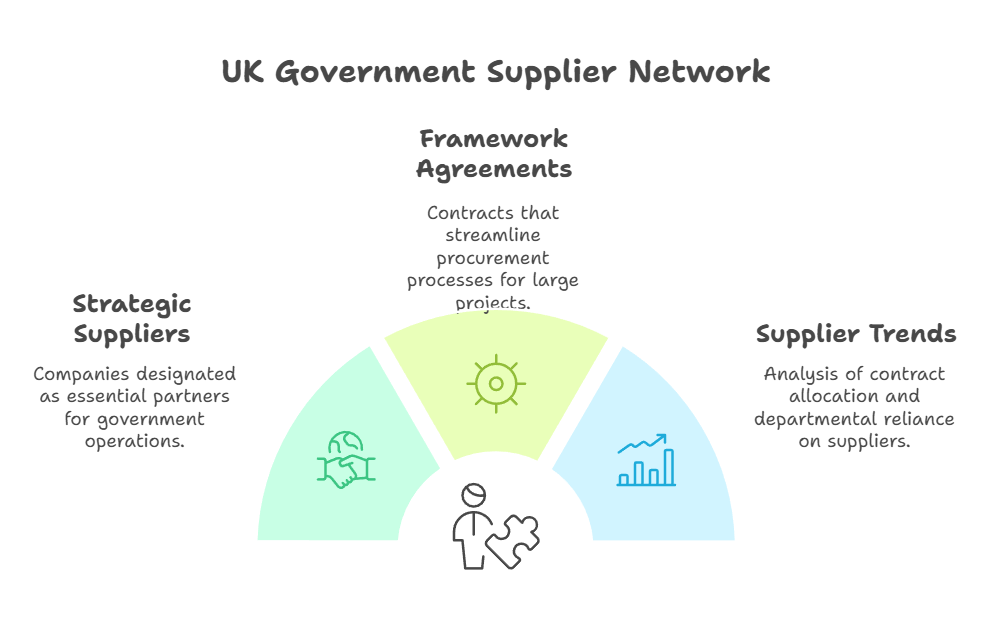

Government departments in the UK rely on a network of suppliers to provide essential goods and services. These suppliers play a crucial role in helping the government function effectively and deliver services to the public. The UK government has designated 39 companies as 'Strategic Suppliers' due to their significant business relationships with ministerial departments.

These strategic suppliers work across various sectors, from IT and infrastructure to defence and healthcare. They win contracts through competitive bidding processes and framework agreements. The use of framework agreements for large contracts has grown substantially in recent years, increasing from 20% of contracts by value in 2018-19 to 68% in 2021-22.

Understanding supplier trends is vital for both government officials and businesses looking to work with the public sector. It sheds light on which companies are winning contracts, how much they're earning, and which departments are most reliant on external suppliers. This information can help improve procurement strategies and ensure value for money in public spending.

Key Takeaways

- The UK government has 39 designated 'Strategic Suppliers' that provide essential goods and services

- Framework agreements are increasingly used for awarding large government contracts

- Analysing supplier trends can improve procurement strategies and ensure better value for public money

Overview of Government Department Suppliers

The UK government relies on a network of suppliers to provide goods and services. Some companies play a crucial role due to the scale and importance of their contracts.

The Role of Strategic Suppliers

Strategic Suppliers are key partners for UK government departments. These firms have substantial contracts and deliver critical services. As of November 2024, there were 39 Strategic Suppliers. They work with many public sector organisations.

Strategic Suppliers get special attention from the Cabinet Office. This is because of their impact on public services. They often have contracts across multiple departments. This can lead to complex relationships with the government.

The government keeps a close eye on these suppliers' performance. It also monitors their financial health. This helps ensure stable public service delivery.

Impact of Public Procurement on Suppliers

Public procurement has a big effect on many UK businesses. Government contracts can make up a large part of some companies' revenue. This is especially true for Strategic Suppliers.

The public sector's buying power shapes markets. It can influence how suppliers operate and grow. Awarded contracts can provide steady income for businesses. But they also come with strict rules and oversight.

Suppliers must follow specific guidelines when working with the government. This includes transparency requirements. Some firms must share financial information with the Crown Commercial Service.

Public procurement can drive innovation. It can also help smaller businesses grow. The government often tries to spread contracts across different suppliers. This aims to create a diverse and competitive market.

Key Sectors and Trends in Government Supply

The UK government relies on various sectors to provide essential services and products. These industries play crucial roles in supporting public services and infrastructure development.

Healthcare Services and Equipment

The National Health Service (NHS) is a major buyer of healthcare supplies and services. Key trends include:

- Increased demand for medical equipment and personal protective gear

- Growing focus on digital health solutions and telemedicine

- Rising importance of data analytics in healthcare management

NHS suppliers range from pharmaceutical companies to medical device manufacturers. The sector faces challenges in balancing cost-effectiveness with quality care delivery.

Defence and Security

The Ministry of Defence (MoD) is a significant spender on military equipment and services. Current trends include:

- Investment in cybersecurity and intelligence technologies

- Modernisation of naval and air force capabilities

- Focus on autonomous systems and artificial intelligence

Major defence contractors provide everything from aircraft to IT systems. The sector is adapting to new threats and technological advancements.

Education Materials and Services

The Department for Education procures a wide range of educational resources. Key areas include:

- Digital learning platforms and educational software

- Textbooks and curriculum materials

- Teacher training and professional development services

Suppliers in this sector are increasingly focused on personalised learning solutions and adaptive technologies to support diverse student needs.

Construction and Infrastructure

Government construction projects span transport, housing, and public buildings. Notable trends are:

- Emphasis on sustainable and energy-efficient building practices

- Integration of smart technologies in infrastructure projects

- Focus on urban regeneration and regional development

Construction firms and engineering consultancies play vital roles in shaping the UK's built environment.

Technology and Digital Transformation

The government's digital transformation efforts drive demand for IT services. Key trends include:

- Cloud migration of government systems and data

- Implementation of artificial intelligence and machine learning

- Enhancement of cybersecurity measures

Tech giants and specialised IT firms compete for contracts to modernise public sector technology infrastructure.

Telecommunications and Cloud Computing

Reliable communication networks are essential for government operations. Current focus areas are:

- 5G network rollout and expansion

- Cloud-based services for data storage and processing

- Secure communication systems for sensitive government departments

Major telecom providers and cloud computing companies are key players in this sector, supporting the government's connectivity needs.

Current State of Government Contracts

The UK government's contracting landscape is evolving rapidly. New trends in framework agreements, data analytics, and supplier dynamics are reshaping public procurement practices.

Framework Agreements and Tendering

Framework agreements have become a cornerstone of UK government procurement. These agreements streamline the buying process and offer better value for money. The GSA OASIS+ is an example of a Best in Class vehicle that speeds up acquisitions.

Public bodies are using these frameworks more often. They help reduce paperwork and save time. But some worry this might limit competition.

Open tendering is still important. Yet, the National Audit Office found that 20% of large contracts had only one bidder. This raises questions about market health.

Contracts Analytics and Intelligence

Data-driven insights are now crucial in government contracting. Departments use analytics to spot trends and make smarter choices.

Tools like Tussell's Strategic Suppliers Report offer deep dives into supplier performance. These reports show who's winning contracts and why.

Contract intelligence helps identify:

- Best value suppliers

- Market concentration risks

- Opportunities for innovation

This data helps shape policy and guides future procurement strategies.

Key Players and Their Market Shares

The UK government relies on a group of strategic suppliers for major contracts. As of 2024, there are 39 such suppliers.

These firms span various sectors:

- IT and digital services

- Construction

- Defence

- Professional services

Market shares are not evenly distributed. Some suppliers have a larger slice of government spending than others.

Recent years have seen shifts in spending patterns. New players are entering the market, challenging established providers.

The government aims to diversify its supplier base. This could lead to changes in market shares over time.

Public Sector Procurement Processes

The UK government has implemented several key processes to improve efficiency and value in public sector procurement. These include creating opportunities for private providers, appointing Crown Representatives, and developing best practices for bidding. Recent changes aim to transform and modernise procurement systems.

Opportunities for Outsourcing and Private Providers

The public sector offers many chances for private companies to provide services. Transforming public procurement aims to make it easier for suppliers to work with the government. New legislation will simplify processes and help suppliers understand public sector needs better.

Framework agreements allow suppliers to join pre-approved lists. This speeds up the contracting process for specific projects. The use of frameworks for large contracts grew from 20% to 68% between 2018 and 2022.

Outsourcing can lead to cost savings and improved service quality. However, contracts must be carefully managed to ensure value for money and maintain service standards.

Crown Representatives and Their Role

Crown Representatives act as a bridge between the government and its suppliers. They work with key providers to improve performance, reduce costs, and drive innovation.

These representatives help:

- Negotiate better deals

- Resolve disputes

- Share best practices across departments

- Identify opportunities for collaboration

Their role is crucial in managing relationships with strategic suppliers. This ensures that large contracts deliver value and meet public sector needs effectively.

Adhering to Best Practice in Bidding

Following best practices in bidding is essential for suppliers. This improves their chances of winning contracts and ensures fair competition.

Key best practices include:

- Understanding the procurement process fully

- Responding clearly to all tender requirements

- Demonstrating value for money

- Highlighting relevant experience and capabilities

The Public Procurement Review Service allows suppliers to raise concerns about procurement practices. This helps maintain fairness and transparency in the bidding process.

Developments in Public Sector Procurement

Recent developments aim to make procurement more efficient and innovative. The UK government is focusing on:

- Simplifying procurement processes

- Encouraging small and medium-sized enterprises (SMEs) to bid

- Promoting sustainability in contracts

- Leveraging technology for better procurement systems

New legislation will introduce more flexible procedures. This will allow for negotiations in complex procurements and make it easier to take account of wider social value.

The government is also working to improve payment practices. Suppliers should be paid within 30 days to support their cash flow, especially for smaller businesses.

Public Sector Revenue Generation and Growth Strategies

Successful suppliers to government departments employ targeted tactics to boost income and expand their market presence. These strategies focus on optimising contract performance, building a robust project pipeline, and engaging strategically with public sector buyers.

Improving Direct Revenue Through Contracts

To increase public sector revenue, suppliers must excel in contract delivery. This involves meeting or exceeding key performance indicators (KPIs) and delivering value for money. Suppliers should:

• Invest in staff training to enhance service quality

• Implement efficient processes to reduce costs

• Offer innovative solutions to address client needs

Suppliers can also seek contract extensions or expand the scope of existing agreements. By demonstrating reliability and expertise, they position themselves for additional work within current client departments.

Building a Sustainable Pipeline

A strong pipeline of future opportunities is crucial for growth. Suppliers should:

- Monitor contract notices and prior information notices

- Attend supplier engagement events

- Network with procurement professionals

Developing relationships with key decision-makers helps suppliers understand upcoming needs. This insight allows for better preparation and tailoring of proposals to meet specific requirements.

Strategic Market Engagement

Effective market engagement is vital for long-term success. Suppliers should:

• Conduct thorough market research

• Develop a clear value proposition

• Tailor messaging to different public sector segments

By understanding the unique challenges of each department, suppliers can position themselves as trusted partners. This approach helps in winning new contracts and becoming strategic suppliers to government.

Suppliers should also consider forming partnerships or consortia to bid for larger contracts. This strategy can open up new revenue streams and expand market reach.

Sector-Specific Supplier Dynamics

Government departments engage with suppliers across various sectors, each with unique trends and challenges. The following subsections explore key areas where supplier relationships significantly impact public services and operations.

Facilities Management in the Public Sector

Facilities management plays a crucial role in maintaining government buildings and infrastructure. Large suppliers often dominate this sector, providing services like cleaning, maintenance, and security.

Public sector organisations increasingly seek integrated facility management solutions. This approach aims to improve efficiency and reduce costs.

Sustainability is becoming a key focus. Suppliers are expected to implement eco-friendly practices and help government buildings meet energy efficiency targets.

Small and medium-sized enterprises (SMEs) are gaining ground in specialised areas. They often offer niche services or cater to specific regional needs.

Engineering and Technical Services Engagement

Engineering firms provide vital expertise for infrastructure projects and technical consultancy. The government relies on these suppliers for large-scale initiatives like transport upgrades and energy systems.

Digitalisation is reshaping this sector. Suppliers are increasingly offering services that incorporate advanced technologies such as AI and IoT.

There's a growing emphasis on innovation. The public sector is seeking partners who can bring fresh ideas to solve complex engineering challenges.

Skills shortages remain a concern. Suppliers are working closely with the government to develop talent pipelines and upskill the workforce.

Policing, Security, and Public Safety Supply Chain

The policing and security sector has unique supplier dynamics due to its sensitive nature. Strict vetting processes are in place for suppliers handling confidential information.

Technology is transforming this sector. Suppliers are providing advanced surveillance systems, data analytics tools, and cybersecurity solutions.

There's an increased focus on community-oriented policing. This has led to demand for suppliers who can provide innovative engagement tools and software.

Interoperability is a key concern. Suppliers are working to ensure their systems can integrate seamlessly with existing police and security infrastructure.

Engagement With Local Authorities and Opportunities

Local governments play a crucial role in supplier selection and procurement. They often use collaborative approaches to get better deals and save money. These strategies help improve public services.

The Role of Local Governments in Supplier Selection

Local authorities have a big impact on which suppliers get public sector contracts. They spent £2.8 billion with 39 'strategic suppliers' in the 2022-2023 financial year. These are companies the Cabinet Office works closely with.

The rules for picking suppliers are changing. Instead of just looking at cost, councils can now focus on overall value. This helps them choose suppliers that offer the best mix of quality and price.

Local government spending has gone up. In 2021, it was over £70 billion. This means there are lots of chances for suppliers to work with councils.

Collaborative Procurement and Economy of Scale Benefits

When local authorities work together to buy goods and services, they can save money. This is called collaborative procurement. It helps them get better deals by buying in bulk.

Framework procurement routes are popular. These are agreements that let councils buy from a list of approved suppliers. They make it easier and quicker to get what's needed.

Working together also helps councils share knowledge. They can learn from each other about the best ways to buy things. This can lead to better public services.

Some regions are getting better at buying from local suppliers. The East Midlands increased its local spending by nearly 45% from 2017 to 2020. This helps boost local economies.

Frequently Asked Questions

UK government procurement involves complex processes and regulations. The following questions address key aspects of supplier relationships, contract awards, and recent legislative changes.

What constitutes a strategic supplier to the UK government?

Strategic suppliers are companies that provide critical goods or services to multiple government departments. They often have large-value contracts and play a vital role in public service delivery. The government closely monitors these suppliers' financial health and performance.

How are contracts awarded in UK public sector procurement?

Public sector contracts are typically awarded through competitive tendering processes. Contracting authorities must follow strict rules to ensure fairness and value for money. These rules apply to central government, local authorities, and NHS bodies.

What changes does the Procurement Regulations 2024 introduce?

The Procurement Regulations 2024 aim to simplify and modernise UK procurement processes. They focus on increasing transparency, supporting small businesses, and promoting innovation in public sector purchasing.

What is the scope of Section 11 within the Procurement Act?

Section 11 of the Procurement Act outlines requirements for supplier assessment. It covers factors such as financial stability, technical capability, and past performance. The section aims to ensure suppliers can reliably deliver contracted goods and services.

How does the public procurement bill 2024 affect procurement processes?

The 2024 public procurement bill introduces new procedures for contract awards. It emphasises streamlining procurement and creating more opportunities for small businesses and social enterprises.

What are the implications of outsourcing by the UK government companies?

Outsourcing allows the government to access specialised skills and potentially reduce costs. However, it also raises concerns about accountability and service quality. The government must carefully manage outsourced contracts to ensure public value and maintain service standards.