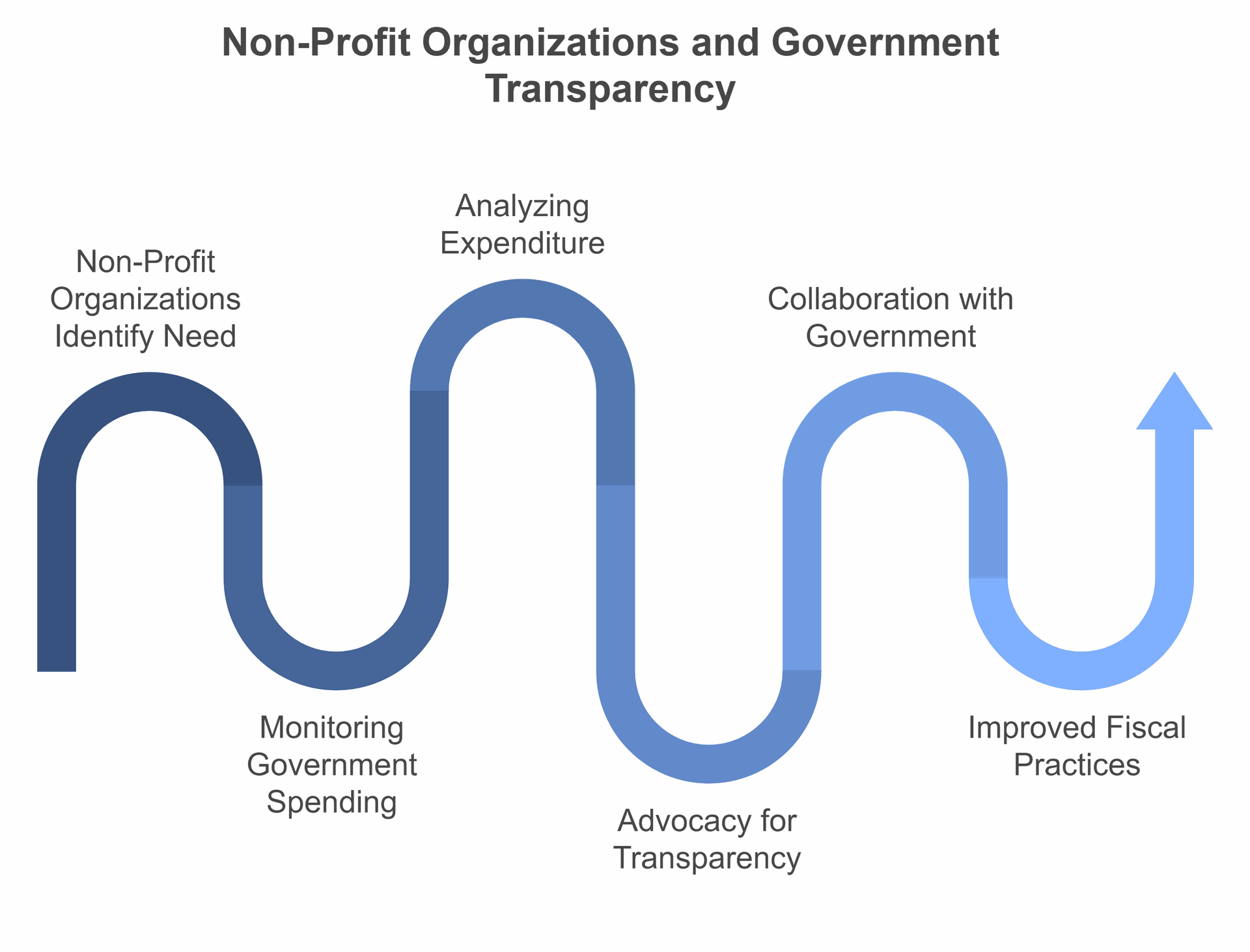

Non-profit organisations play a crucial role in monitoring government spending transparency. These groups act as watchdogs, scrutinising how public funds are used and ensuring accountability. They often employ various methods to track and analyse government expenditure, from reviewing official documents to conducting independent research.

Non-profits use their findings to advocate for better fiscal practices and push for greater transparency in government operations. By doing so, they help bridge the gap between citizens and their elected officials, promoting a more open and responsible governance system. This work is essential for maintaining public trust and ensuring that taxpayer money is used effectively and ethically.

Many non-profits also collaborate with government agencies and other organisations to develop better frameworks for financial reporting and transparency. They may offer training, share best practices, and work towards establishing industry standards that promote clearer, more accessible financial information for the public.

Key Takeaways

- Non-profits act as watchdogs to monitor government spending and promote transparency

- These organisations use various methods to analyse and report on public expenditure

- Collaboration between non-profits and government agencies can improve fiscal practices

The Role of Non-Profit Organisations in Governance

Non-profit organisations play a vital part in monitoring and improving governance practices. They act as watchdogs, advocates, and partners in promoting transparency and accountability.

Stakeholders in Non-Profit Governance

Effective governance in non-profits involves various stakeholders. The board of directors is a key player, responsible for setting the organisation's direction and ensuring its mission is fulfilled.

Staff members carry out day-to-day operations and implement policies. Volunteers contribute their time and skills to support the organisation's work.

Donors and funders provide financial support and often expect transparency in how their contributions are used. Beneficiaries, the people or causes the non-profit serves, are central stakeholders.

The wider community and government bodies also have a stake in non-profit governance, as these organisations often provide essential services and receive public funds or tax benefits.

Accountability and Ethical Practices

Non-profits must maintain high standards of accountability and ethical behaviour to retain public trust. This includes financial transparency, with regular audits and clear reporting of how funds are used.

Ethical decision-making should guide all aspects of operations, from fundraising to programme delivery. Many non-profits adopt codes of conduct to ensure ethical practices.

Web transparency is increasingly important, with organisations sharing key information online. This can include financial reports, board meeting minutes, and impact assessments.

Non-profits often implement conflict of interest policies to maintain integrity in decision-making. They may also seek external accreditation or certifications to demonstrate their commitment to good governance.

Monitoring Government Spending

Non-profits play a crucial role in tracking how governments manage public funds. They use various methods to ensure financial accountability and openness in government operations.

Budgeting and Financial Reporting

Non-profits carefully review government budget documents to understand planned expenditures. They examine financial reports to compare actual spending with budgeted amounts.

These organisations often create easy-to-read summaries of complex budget information. This helps citizens grasp how public money is being used.

Non-profits may also track spending patterns over time. They look for unusual changes or discrepancies that could signal misuse of funds.

Some groups use data analysis tools to spot trends in government spending. This can reveal areas where funds may not be used efficiently.

Financial Transparency and Public Administration

Non-profits advocate for greater transparency in government financial practices. They push for the release of detailed spending data to the public.

These groups often train citizens on how to access and interpret government financial information. This empowers communities to hold their leaders accountable.

Non-profits may collaborate with government agencies to improve financial reporting systems. They might suggest ways to make data more accessible and understandable.

Some organisations create online platforms that present government spending data in user-friendly formats. This makes it easier for the public to track how their tax money is used.

Internal Controls and Performance Evaluation

Non-profit organisations use internal controls and performance evaluations to monitor their financial health and ensure accountability. These practices help maintain transparency and improve operational efficiency.

Assessing Financial Health

Non-profits assess their financial health through various methods. They track key performance indicators (KPIs) such as revenue growth, expense ratios, and programme efficiency. Regular financial reports provide insights into cash flow, budget adherence, and overall fiscal stability.

Many organisations use financial dashboards to visualise data. These tools offer real-time updates on:

- Donation trends

- Grant utilisation

- Operational costs

- Programme expenses

Benchmarking against similar non-profits helps gauge performance. This comparison identifies areas for improvement and highlights successful strategies.

Best Practices in Financial Audits

Financial audits are crucial for maintaining trust and transparency in non-profit operations. Regular audits help detect errors, prevent fraud, and ensure compliance with regulations.

Best practices for financial audits include:

- Engaging independent auditors

- Conducting annual audits

- Implementing a risk-based approach

- Ensuring board oversight

Auditors examine financial statements, internal controls, and compliance with laws. They provide recommendations for improving financial processes and reducing risks.

Non-profits should maintain detailed records and documentation. This practice supports audit efficiency and accuracy. Clear communication between staff, board members, and auditors is essential for a smooth audit process.

Information Disclosure and Transparency

Nonprofit organisations play a crucial role in monitoring government spending transparency. They use various methods to gather and share information about public finances and policy implementation.

Public and Voluntary Disclosure

Government agencies often disclose information about their spending and policies. This can be due to legal requirements or voluntary initiatives. Public disclosure helps citizens understand how their tax money is used.

Some governments create online platforms to share financial data. These sites allow easy access to budget reports and spending records.

Nonprofits may also encourage voluntary disclosure. They work with government bodies to increase openness. This can lead to more detailed reporting on public projects and spending.

Credibility and Social Credibility

Transparent nonprofits are seen as more trustworthy. They build credibility by sharing clear, accurate information about government spending.

Social credibility comes from public trust. When nonprofits provide reliable data, people are more likely to believe their findings.

These organisations often use social media and websites to share their research. This helps reach a wider audience and increases social credibility.

Nonprofits may also partner with academic institutions. These collaborations add weight to their reports on government transparency.

Frameworks and Policies for Ethical Governance

Non-profit organisations need strong ethical frameworks to ensure proper governance. These frameworks help maintain transparency and accountability in their operations.

Conflict of Interest Policy

A conflict of interest policy is crucial for non-profits. It helps prevent personal interests from interfering with the organisation's mission.

Key elements of a strong policy include:

- Clear definition of what constitutes a conflict

- Disclosure requirements for board members and staff

- Procedures for handling potential conflicts

- Regular review and updates of the policy

Non-profits should require annual disclosure statements from board members and key staff. This helps identify potential conflicts before they become issues.

Organisations can also create a conflicts committee. This group reviews disclosures and recommends actions when conflicts arise.

Establishing an Ethical Code

An ethical code guides behaviour and decision-making within a non-profit. It sets standards for conduct and integrity.

Important components of an ethical code include:

- Core values of the organisation

- Expectations for professional conduct

- Guidelines for handling sensitive information

- Reporting procedures for ethical concerns

Non-profits should involve staff and board members in creating the code. This helps ensure buy-in and understanding.

Regular training on the ethical code is essential. It keeps ethical practices at the forefront of daily operations.

Effective governance relies on these frameworks. They help non-profits maintain public trust and fulfil their missions responsibly.

Collaboration and Resource Allocation

Non-profits play a vital role in monitoring government spending transparency. They work with various partners and align their efforts with global goals to maximise impact.

Working with Third Sector

Non-profits often team up with other third sector organisations to track government spending. These partnerships help pool resources and expertise. For example, they might share budget information and analysis tools.

Some key benefits of collaboration include:

- Increased reach and influence

- Shared costs for research and advocacy

- Diverse perspectives on spending issues

Non-profits may also work with academic institutions to gain access to specialised knowledge. This can help them better understand complex budget documents.

Aligning with Sustainable Development Goals

Many non-profits align their work with the UN's Sustainable Development Goals (SDGs). This helps them focus their efforts on key global priorities. When monitoring government spending, they often look at how funds are used to support SDGs.

Non-profits might track spending on:

- Education (SDG 4)

- Healthcare (SDG 3)

- Clean water and sanitation (SDG 6)

By linking their work to SDGs, non-profits can show how government spending impacts broader development goals. This can help make their advocacy more effective and relevant to policymakers.

Non-Profit Management and Strategy

Non-profit organisations face unique challenges in managing resources and achieving their missions. Effective strategies for handling contributions, allocating funds, and compensating leadership are crucial for success.

Managing Contributions and Funding

Non-profits rely heavily on donations and grants to fund their operations. Proper management of these resources is essential. Organisations must develop clear policies for accepting and tracking contributions.

Transparency in financial reporting builds trust with donors. Non-profits should regularly publish detailed accounts of how funds are used. This openness can lead to increased support from the public and funders.

Diversifying funding sources helps ensure stability. Relying on a mix of individual donors, corporate sponsors, and government grants reduces risk. Non-profits should also consider earned income strategies where appropriate.

Executive Compensation and Resource Planning

Setting fair compensation for non-profit executives requires balancing multiple factors. Boards must consider the organisation's budget, mission, and market rates for similar roles.

Excessive executive pay can damage public trust. However, underpaying can make it difficult to attract top talent. Strategic resource planning helps ensure funds are allocated efficiently across all areas of the organisation.

Regular performance reviews for executives help justify compensation decisions. Tying pay to measurable outcomes can align leadership incentives with the non-profit's goals.

The Impact of Legislative Environment

The legal landscape shapes how non-profits monitor government spending transparency. Tax laws and interactions with officials play key roles in this process.

Understanding the Tax Regime

Non-profits must navigate complex tax rules when tracking public funds. The tax regime affects their ability to access and analyse government financial data. In the UK, charities enjoy certain tax breaks but face strict reporting requirements. This can help and hinder their watchdog efforts.

Freedom of Information laws give non-profits tools to request spending data. But tax rules may limit how they can use or share this info. Non-profits need to balance transparency goals with tax compliance.

Some tax policies encourage government openness. Others may create barriers. Non-profits must stay up-to-date on changes to tax laws that impact their work.

Engagement with Public Authorities

Non-profits often work closely with government bodies to monitor spending. This engagement can take many forms:

- Formal partnerships

- Advisory roles

- Watchdog activities

Public accountability initiatives rely on strong non-profit-government ties. Non-profits may help design transparency policies or train officials on best practices.

But these relationships can be tricky. Non-profits must maintain independence while cooperating. They need clear guidelines for interacting with authorities.

Some governments are more open to non-profit input than others. The level of engagement often depends on local political culture and laws.

Future Directions and Research Agenda

Non-profit organisations play a crucial role in monitoring government spending transparency. Ongoing research aims to improve understanding and effectiveness in this area.

Systematic Literature Review

A systematic literature review can provide valuable insights into current knowledge gaps. This approach involves analysing existing studies on government transparency and non-profit monitoring efforts.

Researchers should focus on:

- Identifying key themes and trends

- Evaluating methodologies used in previous studies

- Highlighting areas that require further investigation

Such a review can help pinpoint effective strategies for non-profits to monitor government spending transparency. It may also reveal challenges faced by organisations in this process.

Setting a Research Agenda

Based on the findings from a systematic review, experts can develop a focused research agenda. This agenda should prioritise areas that will have the most significant impact on improving transparency monitoring.

Key areas to explore include:

- Developing standardised metrics for assessing government spending transparency

- Investigating the role of technology in enhancing monitoring capabilities

- Examining the impact of NPO transparency on their ability to monitor government spending

The research agenda should also consider how non-profits can better collaborate with government agencies and other stakeholders to promote transparency in social services spending.

Frequently Asked Questions

Non-profits play a crucial role in monitoring government spending transparency. They face several challenges and responsibilities in this process. Let's explore some common questions about how charities can effectively oversee and influence governmental financial transparency.

How can charities effectively carry out due diligence on governmental bodies?

Charities can review public records and financial reports. They may also attend government meetings and ask for detailed spending breakdowns. Building relationships with government officials can help charities gain access to needed information.

Why is it critical for non-profits to ensure government spending transparency?

Transparency helps prevent misuse of funds and corruption. It allows non-profits to verify that donations are used as intended. Clear spending records also build public trust in both the government and charitable organisations.

What steps should charities take to verify the transparency of donations spent by the government?

Charities can request itemised spending reports. They should cross-check these reports with public records. Regular audits and site visits can help verify that funds are used properly.

What proportion of charitable donations is typically allocated to administrative government expenses?

This varies widely depending on the project and government body. Charities should ask for a breakdown of administrative costs. They can then compare this to industry standards and their own expectations.

How can non-profits ascertain the level of transparency in government expenditure?

Non-profits can review government transparency codes. They should check if spending data is easily accessible and up-to-date. Comparing practices across different government bodies can also be helpful.

In what ways can non-profit organisations influence improved transparency in government spending?

Non-profits can advocate for stricter transparency laws. They may partner with government bodies to develop better reporting systems. Public awareness campaigns can also pressure governments to be more open about their spending.