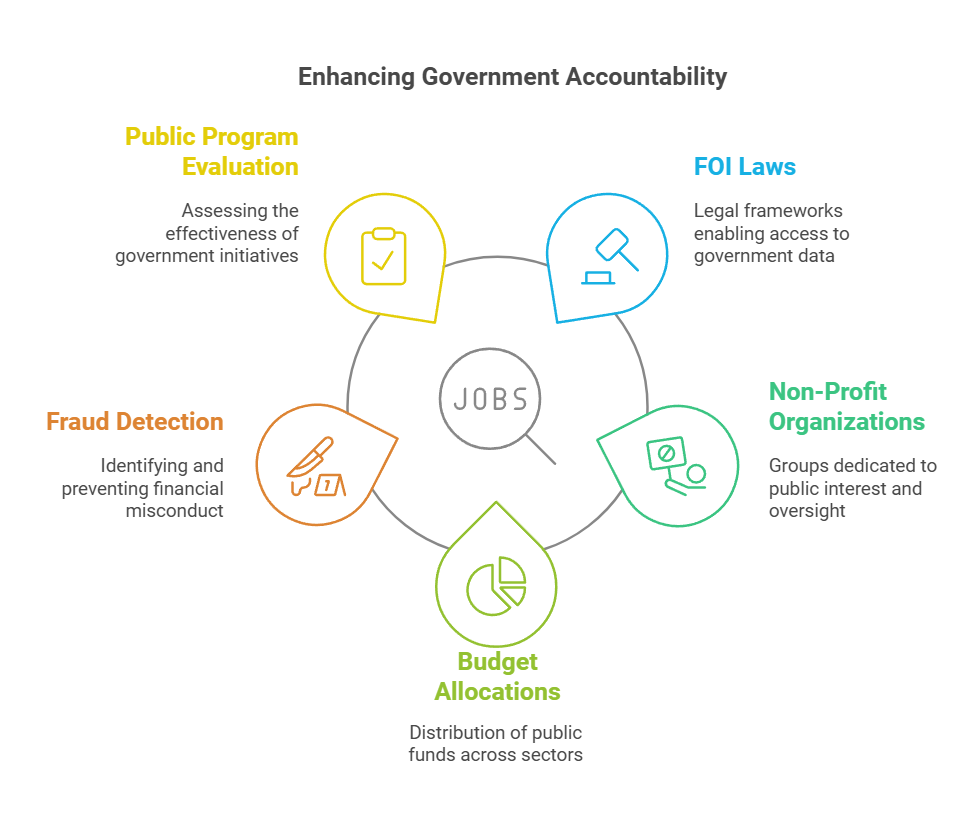

Non-profit organisations play a vital role in keeping governments accountable for their spending. By using Freedom of Information (FOI) laws, these groups can access data about how public funds are used. This information helps them track expenditure and ensure it aligns with the public interest.

Non-profits use FOI data to monitor government spending by analysing budget allocations, detecting potential fraud, and evaluating the effectiveness of public programmes. They compare official records with on-the-ground realities to spot discrepancies. This watchdog function is crucial for maintaining transparency in governance.

The impact of this work extends beyond mere oversight. When non-profits uncover misuse of funds or inefficiencies, they can push for policy changes and improvements in public services. Their efforts often lead to better resource allocation and enhanced service delivery for communities.

Key Takeaways

- Non-profits leverage FOI laws to access and scrutinise government spending data

- This oversight helps detect fraud, improve public services, and promote accountability

- Collaboration between non-profits and governments can lead to more transparent governance

Understanding Freedom of Information

Freedom of information laws give people the right to access government data. These laws help keep governments accountable and transparent. They allow citizens and organisations to monitor how public funds are spent.

Freedom of Information Act (FOIA)

The Freedom of Information Act is a key law that promotes government openness. It gives people the right to request information from public authorities. This includes government departments, local councils, and other public bodies.

Under FOIA, anyone can ask for recorded information held by public authorities. The authority must respond within 20 working days. They must provide the information unless an exemption applies.

FOIA helps non-profits monitor government spending by allowing them to request:

- Contracts and tenders

- Budget reports

- Expense claims

- Meeting minutes

This data can reveal how public money is used and highlight areas of concern.

Right to Information Law

Right to Information (RTI) laws exist in many countries. They are similar to FOIA but may have different names. These laws give citizens the legal right to access government information.

RTI laws aim to promote transparency and reduce corruption. They allow people to ask questions about government decisions and actions.

Non-profits use RTI laws to:

- Track public spending

- Monitor policy implementation

- Investigate potential misuse of funds

By using RTI, organisations can hold governments accountable and push for better use of public resources.

Open Government Data

Open Government Data (OGD) refers to information that governments publish proactively. This data is freely available for anyone to use and share.

Many countries now have open data portals. These websites provide access to datasets on various topics, including:

- Government budgets

- Public contracts

- Infrastructure projects

- Healthcare spending

Non-profits can use this data to analyse trends in government spending. They can create visualisations and reports to inform the public.

OGD helps save time and resources. Organisations don't need to make individual requests for commonly sought information.

Non-Profits and Freedom of Information

Non-profit organisations play a crucial role in using Freedom of Information (FOI) data to monitor government spending and activities. They leverage FOI requests to access public records and promote transparency.

Role of Non-Profit Organisations

Non-profits act as watchdogs, scrutinising government actions through FOI requests. They gather data on public spending, policy implementation, and decision-making processes. This information helps them:

• Hold public authorities accountable

• Identify areas for improvement in public management

• Advocate for policy changes

Non-profits often specialise in specific areas like environmental protection or social justice. They use FOI data to support their causes and inform the public.

Non-Profit Operations and Data

Non-profits rely on FOI data to shape their strategies and activities. They:

- Analyse government records to identify trends

- Use findings to create reports and campaigns

- Share information with the public and media

FOI requests can be time-consuming and complex. Many non-profits have dedicated staff or volunteers who handle these requests. They must navigate FOI regulations and sometimes face challenges in obtaining information.

Non-profits also use FOI data to improve their own operations. They learn from government practices and adapt their programmes accordingly.

Monitoring Government Expenditure

Non-profit organisations play a crucial role in ensuring government funds are used effectively. They examine financial records and track spending to promote transparency and accountability in public services.

Analysing Government Funding

Non-profits use Freedom of Information requests to access detailed budget data. They scrutinise this information to understand how funds are allocated across different sectors.

Key areas of focus include:

- Revenue sources

- Spending priorities

- Allocation to various departments

By comparing budgets to actual expenditure, non-profits can identify discrepancies. This analysis helps reveal potential misuse of funds or areas where spending doesn't align with stated priorities.

Non-profits also examine trends over time. They look at changes in funding levels for different programmes and services. This long-term view helps assess the government's commitment to specific policy areas.

Tracking Programme Spending

Non-profits monitor how government funds translate into real-world impact. They track the execution of budgets to ensure money reaches intended beneficiaries.

Methods used include:

- Reviewing financial reports

- Conducting community surveys

- Observing service delivery on the ground

These organisations pay close attention to procurement processes. They check if contracts are awarded fairly and if goods and services are delivered as promised.

Non-profits also assess the effectiveness of government programmes. They measure outcomes against stated goals and compare results to the resources invested. This evaluation helps identify successful initiatives and areas needing improvement.

Enhancing Public Sector Accountability

Public sector accountability plays a crucial role in monitoring government spending and fostering trust. It relies on transparency, compliance, and robust governance models to ensure effective oversight.

Promoting Transparency and Compliance

Transparency in government activities is key to accountability. It allows citizens and organisations to scrutinise public spending and decision-making processes.

Public sector agencies must follow strict reporting guidelines. These include regular financial disclosures and performance reports.

Freedom of Information (FOI) laws are vital tools. They give the public access to government records and data.

Compliance measures help prevent corruption. These may include:

- Regular audits

- Whistleblower protection policies

- Conflict of interest declarations

Technology plays a growing role in transparency. Open data portals and digital platforms make information more accessible to the public.

Governance Models and Indicators

Effective governance models are essential for accountability. They provide frameworks for decision-making and oversight in public organisations.

Common governance models include:

- Hierarchical structures with clear reporting lines

- Collaborative models involving multiple stakeholders

- Independent oversight committees

Governance indicators help measure the effectiveness of public sector accountability. These may track:

- Budget transparency

- Public participation in policy-making

- Anti-corruption efforts

Regular assessment of these indicators can identify areas for improvement. It also helps track progress in enhancing accountability over time.

International organisations often provide benchmarks for good governance. These standards help countries compare and improve their public sector practices.

Impacts on Service Delivery and Development

Freedom of Information (FOI) data helps non-profits monitor government spending and improve public services. This leads to better service delivery and supports economic growth.

Effect on Public Services

FOI data allows non-profits to track how the government uses public funds for services. This improves accountability and service delivery in key areas like health and education.

Non-profits use this information to:

- Identify gaps in service provision

- Spot inefficiencies in spending

- Suggest improvements to public programmes

By analysing FOI data, non-profits can push for better resource allocation. This often leads to more effective public services that reach more people in need.

In some cases, non-profits use FOI data to provide services directly. They fill gaps left by government cuts or inefficiencies.

Public and Economic Development

FOI data helps non-profits support broader economic development goals. They use this information to:

- Advocate for fair distribution of resources

- Promote transparency in government projects

- Encourage public participation in development plans

Non-profits can track government funding for development programmes. This oversight ensures money is spent effectively on projects that boost economic growth.

By pushing for openness, non-profits help create a more stable environment for investment. This can lead to job creation and improved living standards in communities.

FOI data also allows non-profits to monitor the impact of development projects. They can assess whether initiatives are meeting their goals and benefiting the public.

Partnerships for Open Governance

Governments and non-profits work together to increase transparency and accountability. These partnerships make data more accessible and help the public understand how money is spent.

Collaborative Governance

Open Government Partnership (OGP) brings governments and civil society groups together. They aim to make governments more open and responsible. OGP members create plans to boost transparency.

Many cities share spending data with non-profits. For example, Amsterdam worked with an NGO to show its spending clearly online. This helps citizens see where money goes.

E-government tools make sharing easier. Online platforms let agencies post budget info quickly. Non-profits can then analyse this data to spot trends or issues.

Supporting Civil Society Involvement

Governments back civil society groups to take part in open governance. They give grants for projects that use public data creatively.

Training programmes teach non-profits how to use Freedom of Information (FOI) requests. This helps them get key info on spending.

Some partnerships focus on specific areas like health or education. Non-profits and officials work side by side to track funds in these sectors.

Regular meetings between government and civil groups build trust. This leads to better sharing of spending data over time.

Non-Profit Influence in Policy Implementation

Non-profit organisations play a crucial role in shaping and implementing public policies. They bring unique perspectives and resources to the table, often leading to more effective and community-focused outcomes. Their involvement can enhance government transparency and serve the public interest.

Engagement in Policy Development

Non-profits actively participate in policy development through various means. They provide valuable input during consultation processes, offering insights based on their direct work with communities. These organisations often conduct research and present evidence to policymakers, highlighting issues that may be overlooked.

Non-profits also mobilise public support for specific policies. They organise campaigns, petitions, and awareness programmes to influence decision-makers. By leveraging their networks, they can amplify voices that might otherwise go unheard.

Many non-profits form coalitions to increase their impact. These alliances allow them to pool resources and expertise, presenting a united front on key issues. Such collaborations can be particularly effective in complex policy areas.

Handling Unintended Consequences

Non-profits often step in to address unintended consequences of policies. They act as a safety net, filling gaps in service provision that may arise from policy implementation. This role is crucial in ensuring that vulnerable populations are not left behind.

These organisations monitor policy outcomes and provide feedback to government agencies. They collect data, conduct surveys, and share real-world experiences to highlight areas needing improvement. This feedback loop is essential for refining policies and improving their effectiveness.

Non-profits also develop innovative solutions to address unforeseen challenges. They often have the flexibility to pilot new approaches and adapt quickly to changing circumstances. This agility can be invaluable in responding to emerging issues.

Fostering International Non-Profit Cooperation

Non-profit organisations worldwide collaborate to monitor government spending using FOI data. This cooperation enhances transparency and accountability across borders.

International Non-Profits and Development

International development nonprofits play a crucial role in fostering global cooperation. These organisations often work together to share resources and expertise.

Many non-profits focus on improving governance indicators in developing countries. They use FOI data to track government spending and ensure funds are used effectively.

By sharing information, non-profits can identify trends and patterns in government spending across different nations. This helps them spot potential issues and advocate for better policies.

International cooperation also allows non-profits to pool their resources for larger projects. This can lead to more significant impacts in areas like poverty reduction and healthcare improvement.

The Role of USAID

The United States Agency for International Development (USAID) is a key player in fostering international non-profit cooperation. It provides funding and support to many development organisations worldwide.

USAID encourages non-profits to use open government data in their work. This promotes transparency and helps organisations make data-driven decisions.

The agency also facilitates partnerships between US-based and international non-profits. These collaborations often focus on using FOI data to improve government accountability.

USAID-funded projects frequently involve multiple non-profits working together. This approach helps spread knowledge and best practices across different organisations and countries.

Boosting Non-Profit Resources and Capabilities

Non-profits can strengthen their ability to use FOI data by expanding resources and developing leadership skills. These efforts help organisations build capacity to monitor government spending more effectively.

Expanding Organisational Resources

Non-profits need proper tools and funding to make the most of FOI data. Many groups work with each team to understand their specific needs and provide options for programme delivery.

Key areas to focus on include:

• Technology: Up-to-date software for data analysis

• Training: Workshops on FOI requests and data interpretation

• Funding: Grants for data-related projects

Non-profits can also leverage volunteer talent to expand their capacity. Skilled volunteers can help with data analysis, IT support, and research tasks.

Leadership and Team Building

Strong leadership is crucial for non-profits to use FOI data effectively. Leaders must foster a data-driven culture and guide teams in using information to drive change.

Nonprofit leaders can:

• Set clear goals for using FOI data

• Encourage staff training in data skills

• Build partnerships with other organisations

Collaborative governance can help non-profits share resources and expertise. This approach allows smaller groups to access skills and tools they might not have on their own.

Team-building activities focused on data use can boost staff confidence and skills. Regular meetings to discuss FOI findings help keep everyone informed and engaged in the monitoring process.

Local and Global Anti-Corruption Efforts

Anti-corruption initiatives span local and global levels. These efforts rely on legal frameworks, data transparency, and public oversight to monitor government spending and curb corrupt practices.

Anti-Corruption Frameworks

Freedom of information (FOI) laws play a crucial role in combating corruption. These laws enable access to government data, which non-profits use to scrutinise spending.

Open government data initiatives complement FOI laws. They proactively release information, making it easier for watchdogs to spot irregularities.

Some countries have seen success with these approaches. For example, local governance programmes have improved trust in government by increasing transparency and accountability.

However, the effectiveness of these tools varies. Factors like media freedom and internet access can impact their success in reducing corruption.

The Role of Journalism and Public Oversight

Journalists and civil society organisations are key players in anti-corruption efforts. They use FOI data to investigate government activities and expose wrongdoing.

Media outlets analyse and report on government spending data. This helps inform the public and hold officials accountable.

Public oversight is crucial. Citizen engagement with open data can lead to grassroots anti-corruption movements.

Cross-country studies show that the impact of open data on corruption depends on press freedom. A free media is essential for turning data into actionable information.

Local journalists often focus on municipal spending, while global networks tackle large-scale corruption across borders.

Frequently Asked Questions

Non-profit organisations often use Freedom of Information requests to monitor government spending. These requests can reveal important details about public expenditure and financial activities.

What details can be requested by non-profit organisations under the Freedom of Information Act to oversee government expenditure?

Non-profits can ask for various financial records, including budget reports, expense accounts, and contract details. They may also request information on specific projects, grant allocations, and procurement processes.

These requests help shed light on how public funds are used and distributed across different sectors and programmes.

What are the statutory exemptions that may limit non-profits from accessing information on government spending under the FOI Act?

The FOI Act includes several exemptions that may restrict access to certain information. These can include data related to national security, ongoing investigations, or commercially sensitive details.

Public authorities can also refuse requests if responding would cost more than the set limit. This limit is currently £600 for central government and £450 for other public authorities.

Within what period must healthcare institutions reply to FOI queries relating to governmental financial activities?

Healthcare institutions, like other public authorities, must respond to FOI requests within 20 working days. This timeframe begins from the day after they receive the request.

In some cases, they may need more time to consider public interest factors. If so, they must inform the requester and provide a response as soon as possible.

How does the Freedom of Information Act 2000 define the scope for non-profits investigating public spending?

The Act gives non-profits the right to access recorded information held by public authorities. This includes financial data, meeting minutes, and policy documents related to government spending.

Non-profits can use this information to analyse spending patterns, identify potential issues, and hold public bodies accountable for their financial decisions.

Are private companies contracted by the government subject to FOI requests concerning public fund usage?

Private companies are not directly subject to FOI requests. However, information about their contracts and dealings with public authorities may be obtainable through FOI requests to the relevant government body.

The level of detail available may depend on confidentiality clauses and commercial sensitivity considerations.

What is the significance of a publication scheme under the FOI Act for non-profits tracking government financial transactions?

A publication scheme outlines the types of information that a public authority routinely makes available. For non-profits, these schemes can be valuable sources of financial data.

They often include budget reports, spending records, and procurement information. By reviewing these schemes, non-profits can access key financial details without needing to submit formal FOI requests.