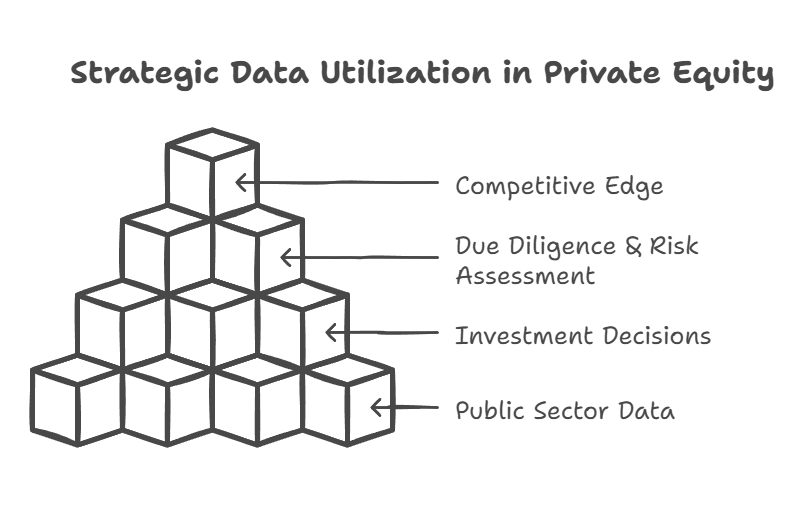

Private equity firms are always looking for ways to gain an edge in their investment strategies. One powerful tool they're increasingly using is public sector data. This information can provide valuable insights into market trends, economic conditions, and potential investment opportunities.

By leveraging public sector data, private equity firms can make more informed decisions about where to invest and how to create value in their portfolio companies. This data can include everything from government economic reports to local planning applications. It helps firms identify promising sectors, assess risks, and spot emerging trends before they become widely known.

Public sector data is particularly useful during the due diligence process. Firms can use it to verify claims made by potential acquisition targets and to uncover hidden risks or opportunities. This data-driven approach allows private equity firms to be more strategic in their investments and to better manage risk across their portfolios.

Key Takeaways

- Private equity firms use public sector data to inform investment decisions and create value

- Public data aids in due diligence, risk assessment, and identifying market trends

- Data-driven strategies help private equity firms gain a competitive edge in today's market

The Role of Private Equity Firms

Private equity firms play a key part in the financial world. They invest in companies, work to boost their value, and aim to profit from selling them later. These firms use many tools to achieve their goals.

Understanding Private Equity

Private equity firms raise large sums of money from investors like pension funds and wealthy people. They use this cash to buy companies that they think have growth potential.

These firms often focus on businesses that are struggling or need a shake-up. They might buy the whole company or just a big part of it.

Private equity firms usually plan to own a company for 3-7 years. During this time, they try to make the business more valuable. They might change how the company works, bring in new managers, or help it grow faster.

Value Creation for Portfolio Companies

Private equity firms aim to boost the value of the companies they own. They do this in several ways:

- Cutting costs

- Improving operations

- Helping the company grow

- Making smart use of debt

These firms often have experts who know a lot about different industries. They use this know-how to help their portfolio companies do better.

They might also help companies buy other businesses. This can make the company bigger and more valuable. Private equity firms often use their networks to find good deals for their companies.

Private Equity Firms as Stakeholders

When a private equity firm buys a company, it becomes a key stakeholder. It has a big say in how the company is run. The firm usually puts its own people on the company's board.

These firms can be more hands-on than public market investors. They often work closely with the company's managers to make changes.

Private equity firms also talk to other stakeholders. They might work with banks to get loans for the company. They also keep their own investors updated on how things are going.

Due Diligence and Data Utilisation

Private equity firms use data and analytics to inform their investment decisions. These tools help them assess risks, identify opportunities, and make better choices during the due diligence process.

The Due Diligence Process

Data and analytics play a crucial role in the due diligence process for private equity firms. They use these tools to:

- Verify target company claims

- Refine valuation models

- Spot commercial opportunities and risks

By analysing large datasets, firms can gain deeper insights into potential investments. This approach allows them to make more informed decisions and reduce risks.

Private equity firms often use data to assess:

• Financial performance

• Market trends

• Customer behaviour

• Operational efficiency

These insights help firms identify areas for improvement and growth in potential acquisitions.

Transparency and Data Analytics

Data analytics enhances transparency in private equity deals. Firms can:

- Track key performance indicators

- Monitor portfolio company progress

- Identify potential issues early

This increased transparency benefits both investors and portfolio companies. It allows for better communication and more effective decision-making.

Private equity leaders use data to quantify the value of their assets and potential targets. This approach helps them:

• Set realistic goals

• Measure progress accurately

• Adjust strategies as needed

By using data-driven insights, firms can create more value for their investors and portfolio companies.

Screening and Acquisition Strategies

Private equity firms use data to improve their screening and acquisition strategies. They analyse:

- Market trends

- Company financials

- Industry benchmarks

This data-driven approach helps firms identify promising investment opportunities more efficiently. It also allows them to spot potential risks early in the process.

Data-driven strategies give firms an edge in today's competitive market. They use advanced analytics to:

• Evaluate potential targets quickly

• Compare opportunities more effectively

• Make faster, more informed decisions

By leveraging data and analytics, private equity firms can improve their acquisition success rates and create more value for their investors.

Strategic Use of Public Sector Data

Private equity firms are finding innovative ways to leverage public sector data. They use this information to gain market insights, spot opportunities, and create value. Let's explore how they do this.

Data Sourcing and Collection

Private equity firms gather public sector data from various sources. They tap into open government data portals, which provide a wealth of information. These portals offer data on demographics, economic indicators, and industry trends.

Firms also use web scraping tools to collect data from government websites. This method helps them gather real-time information on regulatory changes and policy updates.

Some firms partner with data providers specialising in public sector information. These partnerships give them access to cleaned and organised datasets, saving time and resources.

Leveraging Alternative Data

Alternative data from public sources offers unique insights. Private equity firms use satellite imagery to assess property values and infrastructure projects. This helps them make informed investment decisions in real estate and construction sectors.

Social media data from government accounts provides sentiment analysis. Firms track public opinion on policies and initiatives, which can impact market trends.

Public transport data helps analyse footfall in retail areas. This information is valuable for firms investing in retail and hospitality sectors.

Data Systems and Advanced Analytics

Private equity firms invest in robust data systems to handle large volumes of public sector data. They use cloud-based storage solutions for scalability and easy access.

Advanced analytics tools help firms extract meaningful insights. Machine learning algorithms identify patterns and trends in complex datasets.

Predictive models use historical public data to forecast market movements. This aids in timing investment decisions and exits.

Visualisation tools create dashboards for easy interpretation of data. These help firms present findings to stakeholders and inform decision-making.

Sustainability and Social Responsibility

Public sector data on environmental factors is crucial for sustainable investing. Private equity firms use this data to assess the environmental impact of potential investments.

They analyse government reports on carbon emissions and climate change. This helps them identify companies with strong sustainability practices.

Social responsibility metrics from public sources inform investment strategies. Firms look at data on diversity, labour practices, and community engagement.

By using this data, private equity firms align their investments with environmental, social, and governance (ESG) criteria. This approach appeals to socially conscious investors and helps manage long-term risks.

Operational Excellence and Performance Monitoring

Private equity firms use data-driven approaches to boost portfolio company performance. They focus on key metrics and implement strategies to improve operations and financial results.

Implementing Operational Data Analytics

Private equity firms leverage data analytics to enhance decision-making and drive value creation. They use advanced tools to analyse operational data from portfolio companies. This helps identify areas for improvement and growth opportunities.

Data analytics can reveal inefficiencies in supply chains, production processes, and resource allocation. By using data analytics in their investment process, firms can achieve higher returns compared to those that don't.

Key benefits of operational data analytics:

- Improved forecasting accuracy

- Optimised pricing strategies

- Enhanced inventory management

- Streamlined production processes

EBITDA Improvement Strategies

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) is a crucial metric for private equity firms. They employ various strategies to boost EBITDA in portfolio companies.

Common EBITDA improvement tactics:

- Cost reduction initiatives

- Revenue enhancement programmes

- Working capital optimisation

- Operational efficiency improvements

Firms often bring in experienced industry experts to work with management teams. These specialists help identify and implement strategies to reduce costs and improve efficiency.

Portfolio Company Monitoring

Continuous monitoring plays a pivotal role in private equity value creation. Firms track operational and financial performance of their portfolio companies in real-time.

They implement robust monitoring mechanisms such as:

- Real-time reporting dashboards

- Key Performance Indicator (KPI) tracking

- Regular management meetings

- Quarterly business reviews

This allows investors to quickly identify issues and opportunities. They can then make informed decisions to support growth and address challenges promptly.

Customer Satisfaction Metrics

Private equity firms recognise the importance of customer satisfaction in driving long-term value. They monitor various metrics to gauge customer sentiment and loyalty.

Key customer satisfaction metrics include:

- Net Promoter Score (NPS)

- Customer Retention Rate

- Customer Lifetime Value

- Customer Effort Score

By tracking these metrics, firms can identify areas for improvement in product quality, customer service, and overall customer experience. This helps portfolio companies build stronger customer relationships and drive sustainable growth.

Technology Integration and Big Data

Private equity firms are leveraging advanced technologies and big data to gain competitive advantages. These tools help them make smarter investment decisions and manage their portfolios more effectively.

Investing in Technology Infrastructure

PE firms are investing heavily in technology infrastructure to support data-driven approaches. This includes robust data storage systems, high-speed networks, and powerful computing resources.

Many firms are moving to cloud-based platforms for scalability and flexibility. These systems allow them to handle massive amounts of data from various sources.

Cybersecurity is a top priority. PE firms implement advanced security measures to protect sensitive financial and operational data.

Some firms are building in-house data science teams. Others partner with specialised tech companies to access cutting-edge tools and expertise.

Big Data and Machine Learning

Big data analytics and machine learning are transforming how PE firms operate. These technologies help identify promising investment opportunities and assess risks.

Machine learning algorithms can analyse vast amounts of structured and unstructured data. They can spot patterns and trends that humans might miss.

PE firms use these tools to:

- Evaluate potential acquisitions

- Predict market trends

- Optimise portfolio company operations

- Assess the impact of economic factors on investments

Natural language processing helps analyse news, social media, and other text-based sources. This provides valuable insights into market sentiment and emerging trends.

Dashboard Solutions for Real-Time Analytics

PE firms are adopting sophisticated dashboard solutions for real-time analytics. These tools provide a clear, visual representation of key performance indicators.

Dashboards consolidate data from multiple sources into a single view. This allows decision-makers to quickly assess the health of their portfolio companies.

Key features of modern PE dashboards include:

- Interactive visualisations

- Customisable metrics and KPIs

- Alerts for critical events or thresholds

- Integration with financial modelling tools

Real-time analytics enable PE firms to respond quickly to market changes. They can make timely decisions based on the most current data available.

Mobile-friendly dashboards allow executives to access critical information on-the-go. This ensures they stay informed even when away from the office.

Financial Considerations and Valuations

Private equity firms carefully analyse financial data to make informed investment decisions. They focus on valuations, interest rates, and creating competitive advantages to maximise returns.

Understanding Valuations and Market Trends

Private equity firms use various methods to value potential investments. The market approach compares similar public companies to assess a private asset's worth. Firms also examine recent transactions in the sector to gauge market trends.

PE experts analyse financial statements, growth projections, and industry dynamics. They consider factors like:

- Revenue growth rates

- Profit margins

- Debt levels

- Market share

These elements help determine a company's intrinsic value and growth potential.

Firms also monitor secondary market sales of private equity fund stakes to gain insights into current valuations. This data helps them identify opportunities and adjust their strategies.

Interest Rates and Their Impact on PE Investments

Interest rates significantly influence private equity investments. Low rates typically boost PE activity by:

- Reducing borrowing costs for leveraged buyouts

- Increasing the present value of future cash flows

- Encouraging investors to seek higher returns in alternative assets

Conversely, high interest rates can:

- Increase the cost of debt financing

- Lower company valuations

- Make it harder to achieve target returns

PE firms must adjust their strategies as rates fluctuate. They may focus more on operational improvements or seek longer-term investments during high-rate periods.

Creating a Competitive Advantage

Private equity firms increasingly use data and analytics to drive value creation. They leverage these tools to:

- Identify promising investment targets

- Improve operational efficiency in portfolio companies

- Uncover new growth opportunities

Advanced analytics help firms make data-driven decisions throughout the investment lifecycle. They can:

- Assess market trends more accurately

- Optimise pricing strategies

- Streamline supply chains

By harnessing data, PE firms gain a competitive edge in deal sourcing and value creation. This approach is crucial in today's market, where traditional value drivers may be less effective.

Exit Strategies and Value Realisation

Private equity firms use exit strategies to realise value from their investments. These strategies involve careful planning and execution to maximise returns. Firms measure success through various metrics and data-driven approaches.

Developing an Exit Strategy

Exit strategies are key to private equity value creation. Firms typically plan exits from the start of an investment. Common strategies include:

- Initial Public Offerings (IPOs)

- Strategic sales to other companies

- Secondary buyouts to other PE firms

- Management buyouts

Firms analyse market conditions, company performance, and economic factors to choose the best exit timing. They also consider tax implications and fund preferences.

Data plays a crucial role in exit planning. PE firms use AI and analytics to:

- Identify potential buyers

- Optimise company operations

- Enhance financial performance

- Create compelling equity stories

Value Realisation and Success Measurement

PE firms measure value realisation through various metrics. Key indicators include:

- Return on Investment (ROI)

- Internal Rate of Return (IRR)

- Multiple of Invested Capital (MOIC)

Firms track these metrics throughout the investment lifecycle. They use data-backed approaches to refine their strategies and improve outcomes.

Success often depends on operational improvements. PE firms focus on:

- Revenue growth

- Cost reduction

- Margin expansion

They use AI and data analytics to identify areas for improvement. This helps create more valuable companies at exit.

Frequently Asked Questions

Private equity firms utilise public sector data in various ways to inform their investment strategies and decision-making processes. These firms also interact with public markets and regulatory frameworks as they pursue returns and manage their portfolios.

What strategies do private equity firms employ to leverage public sector data for investment decisions?

Private equity firms use data analytics to support their investment decisions. They analyse public sector data to identify market trends and potential opportunities. This data helps them assess risks and forecast potential returns.

Firms may use machine learning algorithms to process large amounts of public data quickly. This allows them to spot patterns and insights that might not be obvious through traditional analysis methods.

In what ways can private sector involvement enhance the effectiveness of public investments?

Private equity firms can bring efficiency and innovation to public sector projects. They often have expertise in optimising operations and improving financial performance.

These firms may introduce new technologies or management practices to public sector entities. This can lead to cost savings and improved service delivery for citizens.

What regulatory frameworks govern the use of public sector data by private equity entities in the UK?

The UK has strict data protection laws that apply to both public and private sectors. The General Data Protection Regulation (GDPR) and the Data Protection Act 2018 are key pieces of legislation.

Private equity firms must comply with these regulations when handling public sector data. They need to ensure data is used ethically and securely, with proper consent where required.

How do private equity firms assess the potential of companies for investment using public data?

Private equity firms use data and analytics to evaluate potential investments. They analyse financial statements, market reports, and industry trends from public sources.

These firms may also look at customer reviews, social media sentiment, and other public data to gauge a company's reputation and market position. This helps them assess growth potential and risks.

Why is private equity typically more successful than public markets in generating returns?

Private equity firms often have more control over their investments than public market investors. They can make significant changes to a company's operations and strategy.

These firms typically have a longer investment horizon, allowing them to implement substantial improvements. They also have access to specialised expertise and resources to drive value creation.

What are the implications of private equity firms transitioning to public companies?

When private equity firms go public, they face increased scrutiny and regulatory requirements. They must disclose more information about their operations and performance.

Public status can provide these firms with access to more capital through public markets. However, it may also introduce pressure for short-term results, which can conflict with the long-term strategies typically employed in private equity.