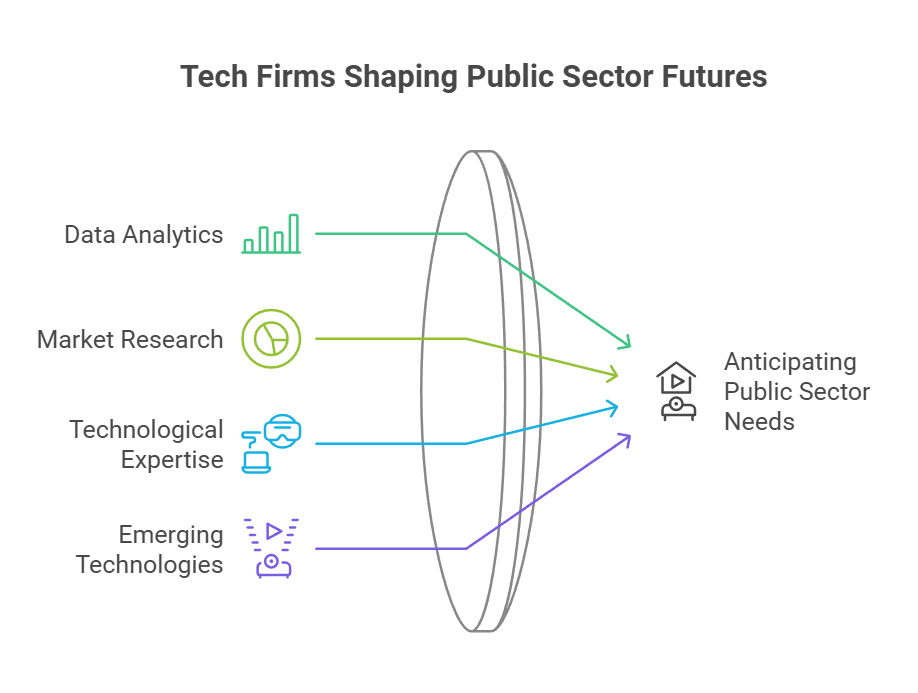

Tech firms play a crucial role in analysing public sector supplier needs. They use advanced data analytics and market research to understand the complex requirements of government agencies and public institutions. These companies leverage their technological expertise to identify procurement trends, assess supplier capabilities, and forecast future needs across various sectors like healthcare, education, and defence.

The UK public sector IT market has grown significantly in recent years, with spending increasing by 41% between FY19/20 and FY23/24. This growth creates opportunities for tech firms to develop tailored solutions that address specific challenges faced by public sector organisations. By analysing procurement data, contract awards, and market reports, these companies gain valuable insights into the evolving needs of government buyers.

Tech firms also monitor emerging technologies and their potential applications in the public sector. For example, the Internet of Things (IoT) is a gradually developing market in the public sector, with an average annual size of £24.5 million between 2018 and 2021. By tracking such trends, tech companies can position themselves to meet future supplier needs and drive innovation in public services.

Key Takeaways

- Tech firms use data analytics to understand public sector procurement trends and supplier capabilities

- The UK public sector IT market has experienced substantial growth, creating opportunities for tailored solutions

- Monitoring emerging technologies helps tech companies anticipate future supplier needs in the public sector

Understanding Public Sector Procurement

Public sector procurement involves complex processes and principles aimed at efficient spending of taxpayer money. It requires balancing various needs while following strict regulations.

The Public Sector Landscape

The UK public sector encompasses a wide range of organisations. These include central government departments, regional authorities, schools, and hospitals. Each has unique procurement needs.

Central government often focuses on large-scale contracts. Regional bodies may prioritise local suppliers. Education and healthcare have specialised requirements.

Public sector organisations must balance cost-effectiveness with quality. They also need to consider social value and environmental impact. This makes their buying decisions more complex than private businesses.

Key Procurement Principles

Public procurement follows core principles:

• Fairness •

• Sustainability

Transparency ensures open competition. Fairness gives all suppliers an equal chance. Value for money looks beyond just the lowest price.

Sustainability considers long-term impacts. This includes environmental and social factors. Public buyers must show how they apply these principles.

UK regulations stem from both national and EU laws. Brexit may bring changes, but core values remain. Public bodies must comply with strict rules on tendering and awarding contracts.

Engagement with Suppliers

Supplier relations are crucial in public procurement. Good engagement helps buyers understand market capabilities. It also allows suppliers to grasp public sector needs.

Many public bodies host supplier days or market engagement events. These offer chances for dialogue before formal tenders. Online portals now play a key role in sharing opportunities.

Feedback is vital. Suppliers need clear reasons if they lose bids. This helps them improve for future tenders. Public buyers benefit from supplier innovation and expertise.

Building trust takes time. Both sides must work to create productive partnerships. This can lead to better outcomes and more efficient use of public funds.

The Role of Technology Firms in the Public Sector

Technology firms play a crucial part in modernising government services and operations. They bring innovative solutions to improve efficiency, security, and citizen engagement in the public sector.

Providing IT Services

Technology companies offer a wide range of IT services to public sector organisations. These services include network management, cloud computing, and data analytics.

UK public sector IT spending has grown by 41% between FY19/20 and FY23/24. This increase shows the growing reliance on tech firms for essential services.

IT suppliers help government agencies:

- Streamline operations

- Reduce costs

- Improve service delivery

Many firms specialise in public sector needs, offering tailored solutions for specific government departments or local authorities.

Digital Transformation Initiatives

Tech companies are key drivers of digital transformation in the public sector. They help government bodies move from outdated systems to modern, user-friendly digital platforms.

Digital transformation projects often focus on:

- Developing online portals for citizen services

- Creating mobile apps for easy access to information

- Implementing data-driven decision-making tools

These initiatives aim to make public services more accessible and responsive to citizens' needs. They also help government agencies work more efficiently and reduce paper-based processes.

Cyber Security Solutions

With the rise of digital services, cyber security has become a top priority for the public sector. Technology firms provide crucial protection against cyber threats and data breaches.

Cyber security services typically include:

- Network security monitoring

- Threat detection and response

- Data encryption and protection

- Staff training on security best practices

Government agencies value tech companies for their role in meeting strict security regulations and building resilience against cyber attacks.

Tech firms also help develop national cyber security strategies and protect critical infrastructure from online threats.

Identifying Supplier Needs in Specific Sectors

Tech firms use various methods to analyse supplier needs in different public sectors. Each sector has unique requirements that shape how companies approach procurement and supplier relationships.

Health Sector Analysis

The NHS and other healthcare providers have complex supplier needs. Tech firms focus on identifying suppliers capable of delivering innovative medical equipment and digital health solutions.

Key areas of analysis include:

- Electronic health record systems

- Telemedicine platforms

- Medical imaging technologies

- Data analytics for patient care

Tech companies often use surveys and direct communication with healthcare professionals to understand evolving needs. They also review public health policies and emerging medical trends to anticipate future requirements.

Defence and Security

In the defence sector, tech firms analyse supplier needs with a focus on advanced technologies and cybersecurity. They look for suppliers who can provide:

- Secure communication systems

- Drone and robotics technologies

- AI-powered threat detection

- Encrypted data storage solutions

Confidentiality is crucial in this sector. Tech firms often work closely with defence agencies to understand classified requirements. They may use specialised procurement platforms designed for high-security environments.

Education Technology Needs

The education sector's supplier needs centre around digital learning tools and administrative systems. Tech firms analyse requirements for:

- Learning management systems

- Online assessment platforms

- Virtual reality educational content

- Student information systems

Companies gather feedback from educators and administrators to understand classroom challenges. They also study educational policies and curriculum changes to align their supplier selection with sector trends.

Infrastructure Projects

For infrastructure projects, tech firms analyse supplier needs related to smart city technologies and sustainable solutions. Key areas include:

- IoT sensors for traffic management

- Energy-efficient building systems

- Water management technologies

- 5G network infrastructure

Tech companies often collaborate with urban planners and local authorities to understand specific city needs. They use data analytics to predict future infrastructure requirements and identify suppliers who can meet long-term goals.

Major Players and Market Dynamics

The UK public sector IT market is dominated by a mix of large tech firms and smaller enterprises. Market dynamics are shaped by government spending patterns and the evolving needs of public organisations.

Top 20 Suppliers in the UK Public Sector

The top 20 suppliers in the UK public sector IT market include major tech giants and specialised service providers. Microsoft, IBM, and Oracle are among the leading software vendors. IT services are primarily delivered by firms like Atos, Capita, and CGI.

Accenture and Sopra Steria have strong positions in consulting and digital transformation. Defence and security-focused suppliers such as BAE Systems and Leidos play crucial roles in specialised sectors.

Fujitsu and DXC Technology provide a range of IT infrastructure and support services. Serco and Civica offer solutions tailored to specific public sector needs.

SMEs and Large Corporations

The UK government has made efforts to increase SME participation in public sector contracts. Large corporations still dominate, but SMEs are gaining ground.

SMEs bring innovation and agility to public sector IT projects. They often specialise in emerging technologies like IoT and AI.

Large corporations leverage their scale and resources to deliver complex, large-scale projects. They often partner with SMEs to combine strengths and meet diverse requirements.

The government's commitment to awarding 33% of contracts to SMEs has created new opportunities for smaller firms.

Public Sector Revenue and Spending Analysis

Public sector IT spending has grown significantly, with a 41% increase between FY19/20 and FY23/24. The NHS has seen a particularly sharp rise, with IT supplier spending up 79% in the same period.

Key areas of investment include:

- Digital transformation initiatives

- Cybersecurity enhancements

- Cloud computing adoption

- Data analytics and AI projects

The COVID-19 pandemic accelerated digital transformation efforts, leading to increased IT spending across all public sector domains.

Market challenges include budget constraints, legacy system integration, and the need for specialised skills in emerging technologies.

Key Frameworks and Initiatives

The public sector relies on several key frameworks and initiatives to analyse supplier needs and improve procurement processes. These approaches aim to streamline technology adoption, promote social value, and foster strategic relationships with suppliers.

G-Cloud and Digital Marketplace

The G-Cloud framework and Digital Marketplace play crucial roles in public sector IT procurement. G-Cloud provides a pre-approved list of cloud services and suppliers, making it easier for government bodies to purchase cloud solutions.

The Digital Marketplace serves as an online platform where public sector organisations can find and buy digital services. It simplifies the procurement process and encourages competition among suppliers.

Both G-Cloud and the Digital Marketplace help tech firms understand public sector needs by:

- Providing clear categorisation of services

- Offering transparent pricing information

- Facilitating direct communication between buyers and suppliers

Social Value in Procurement

Social value has become a key consideration in public sector procurement. The UK government now requires suppliers to demonstrate how they will deliver social value through their contracts.

Key aspects of social value in procurement include:

- Environmental sustainability

- Economic recovery and growth

- Tackling economic inequality

- Equal opportunity and diversity

Tech firms must analyse how their offerings can contribute to these social value objectives. This may involve adapting their products or services to better align with public sector priorities.

Strategic Supplier Relationships

The public sector is increasingly focusing on building strategic relationships with key suppliers. This approach involves:

- Long-term partnerships rather than transactional relationships

- Regular communication and feedback loops

- Joint problem-solving and innovation

The Cabinet Office plays a crucial role in managing these relationships through its Crown Representatives programme. Crown Representatives work with strategic suppliers to:

- Improve performance

- Achieve better value for money

- Drive innovation in public services

Tech firms can benefit from this approach by gaining deeper insights into public sector needs and challenges.

Analysing Trends and Reports

Tech firms use various methods to understand public sector supplier needs. They look at market trends, study detailed reports, and talk to key people in the industry.

Public Sector IT Trends

The UK public sector IT market is growing fast. From 2019 to 2024, spending went up by 41%. The NHS alone increased its IT spending by 79% in this time.

Tech firms watch these trends closely. They look at which areas are getting more money. This helps them spot new chances to work with the government.

Some key trends include:

- More cloud computing use

- Better cyber security

- Digital services for citizens

Firms also track which government departments spend the most on IT. This helps them focus their efforts.

Reports and Forecasts

Companies rely on detailed market reports. These give a clear picture of the UK public sector software and IT services (SITS) market.

These reports show:

- How big the market is now

- How it might grow in the future

- Which areas are likely to see more spending

Tech firms use this data to plan their strategies. They might decide to focus on fast-growing areas or invest in new skills.

Some reports also compare different suppliers. This helps firms see where they stand against rivals.

Insights Through Interviews

Tech firms often talk directly to people in the public sector. This gives them first-hand knowledge of what's needed.

They might speak to:

- IT managers in government departments

- Chief technology officers in local councils

- Procurement specialists in the NHS

These talks help firms understand the real challenges faced by public sector IT teams. They learn about budget issues, security worries, and plans for the future.

Firms use these insights to shape their products and services. They can make sure they're offering exactly what the public sector needs.

Navigating Regulations and Compliance

Tech firms must carefully navigate complex regulations when analysing public sector supplier needs. Government bodies play a crucial role in shaping these rules, while compliance with procurement regulations is essential for success.

Role of Government Bodies

Government bodies set the framework for public procurement in the UK. The Cabinet Office oversees policy and best practices. It issues guidelines that tech firms must follow when working with public sector clients.

Other key players include:

- Crown Commercial Service

- Government Digital Service

- Department for Business and Trade

These entities create and enforce rules on:

- Data protection

- Cybersecurity

- Accessibility standards

- Fair competition

Tech firms must stay up-to-date with changing policies. This helps them tailor their solutions to meet public sector requirements.

Compliance with Procurement Regulations

Compliance is critical for tech firms bidding on public contracts. The UK public sector follows strict procurement regulations to ensure fairness and value for money.

Key compliance areas include:

- Transparency in pricing

- Equal treatment of suppliers

- Environmental sustainability

- Social value considerations

Tech firms must demonstrate their ability to meet these requirements. This often involves:

- Detailed documentation

- Security clearances

- Financial stability proofs

- Adherence to specific technical standards

Firms that prioritise compliance gain a competitive edge. They build trust with public sector clients and increase their chances of winning contracts.

Future Outlook and Predictions

Tech firms are set to transform their approach to public sector supplier needs. Emerging technologies, long-term planning, and innovation will drive significant changes in how companies analyse and meet government requirements.

Emerging Technologies Impact

Autonomous AI agents are poised to revolutionise public sector operations. These advanced systems will enable proactive governance, streamlining processes and enhancing service delivery.

Tech firms will need to adapt their offerings to support this shift. They'll focus on developing AI-powered solutions that can integrate seamlessly with government systems.

Blockchain technology is likely to gain traction for secure data management. Companies will invest in blockchain expertise to meet growing demand for transparent, tamper-proof record-keeping in the public sector.

Long-Term Strategic Planning

Tech firms will adopt a more forward-thinking approach to public sector needs. They'll invest in research and development to anticipate future government requirements.

This shift will involve:

- Closer collaboration with policymakers

- Increased focus on sustainability and social impact

- Development of scalable, future-proof solutions

Companies will also need to navigate the changing global tech landscape. The rise of distinct tech markets will impact supply chains and product development strategies.

The Role of Innovation

Innovation will be crucial for tech firms serving the public sector. Companies will need to balance cutting-edge solutions with reliability and security.

Key areas of focus will include:

- Cybersecurity enhancements

- Cloud-based services optimised for government use

- Data analytics tools for evidence-based policymaking

To drive innovation, tech firms will invest in digital skills within their workforce. They'll also seek partnerships with academic institutions and startups to access fresh ideas and talent.

The UK government's Regulatory Innovation Office will likely influence tech firms' innovation strategies. Companies will need to align their R&D efforts with regulatory frameworks to ensure swift adoption of new technologies in the public sector.

Conclusion

Tech firms play a vital role in meeting public sector supplier needs. They use data analytics and market research to understand government requirements.

UK public sector IT spending has grown significantly, rising 41% from 2019 to 2024. This trend is likely to continue as digital transformation accelerates.

Strategic suppliers like Capita and BT remain important partners. However, smaller innovative firms are also gaining ground in niche areas.

Future predictions point to increased adoption of emerging technologies. Internet of Things (IoT) solutions for "smart cities" are one area of gradual growth.

Tech firms must stay agile to meet evolving public sector needs. This includes:

• Understanding complex procurement processes

• Offering flexible, scalable solutions

• Demonstrating value for money

• Prioritising data security and privacy

As the public sector further embraces digital, tech firms that can align with government priorities will be well-positioned for success.

Frequently Asked Questions

Tech firms employ various methods to analyse public sector supplier needs. These approaches involve data analytics, market research, and digital tools to understand procurement demands and streamline processes.

What methods do technology companies employ to evaluate the requirements of suppliers in the public sector?

Tech companies use data mining and predictive analytics to assess supplier requirements. They analyse past procurement data and market trends. Some firms conduct surveys and interviews with public sector officials to gain insights.

In what ways has technological advancement impacted procurement processes within government agencies?

Digital transformation has streamlined procurement in government agencies. E-procurement platforms have replaced paper-based systems. Artificial intelligence helps in supplier selection and contract management.

How do government bodies utilise digital tools for supplier engagement and selection?

Government bodies use e-tendering portals for supplier engagement. They employ vendor management systems to track supplier performance. Some agencies use AI-powered chatbots for supplier queries and support.

What are the predominant strategies tech firms use to understand and meet government procurement demands?

Tech firms often participate in public sector technology surveys to understand needs. They collaborate with government agencies on pilot projects. Many firms invest in developing specialised solutions for public sector procurement.

How do advancements in technology mould the landscape of public sector supply chain management?

IoT technology is reshaping supply chain management in the public sector. Blockchain improves transparency in procurement processes. Advanced analytics help in demand forecasting and inventory optimisation.

Can you describe the analytics processes technology companies apply to forecast public sector procurement needs?

Tech companies use machine learning algorithms to analyse historical procurement data. They employ sentiment analysis on public sector communications. Some firms use big data analytics to identify emerging trends in government spending patterns.