UK government tenders offer valuable insights for businesses looking to enter or expand in the public sector market. These tenders provide a wealth of information about upcoming projects, spending patterns, and procurement priorities across various government departments and agencies. By analysing tender data, companies can gain a competitive edge and make informed decisions about which opportunities to pursue.

Market analysis platforms have made it easier than ever to access and interpret this data. These tools allow businesses to track trends, identify potential clients, and spot emerging sectors within the public sector. This information can be crucial for developing targeted marketing strategies and tailoring products or services to meet specific government needs.

To make the most of these insights, businesses should regularly review tender notices and contract awards. This practice helps in understanding the government's current focus areas and future plans. It also aids in identifying key competitors and potential partners for joint ventures or subcontracting opportunities.

Key Takeaways

- Government tender data provides crucial market insights for businesses targeting the public sector

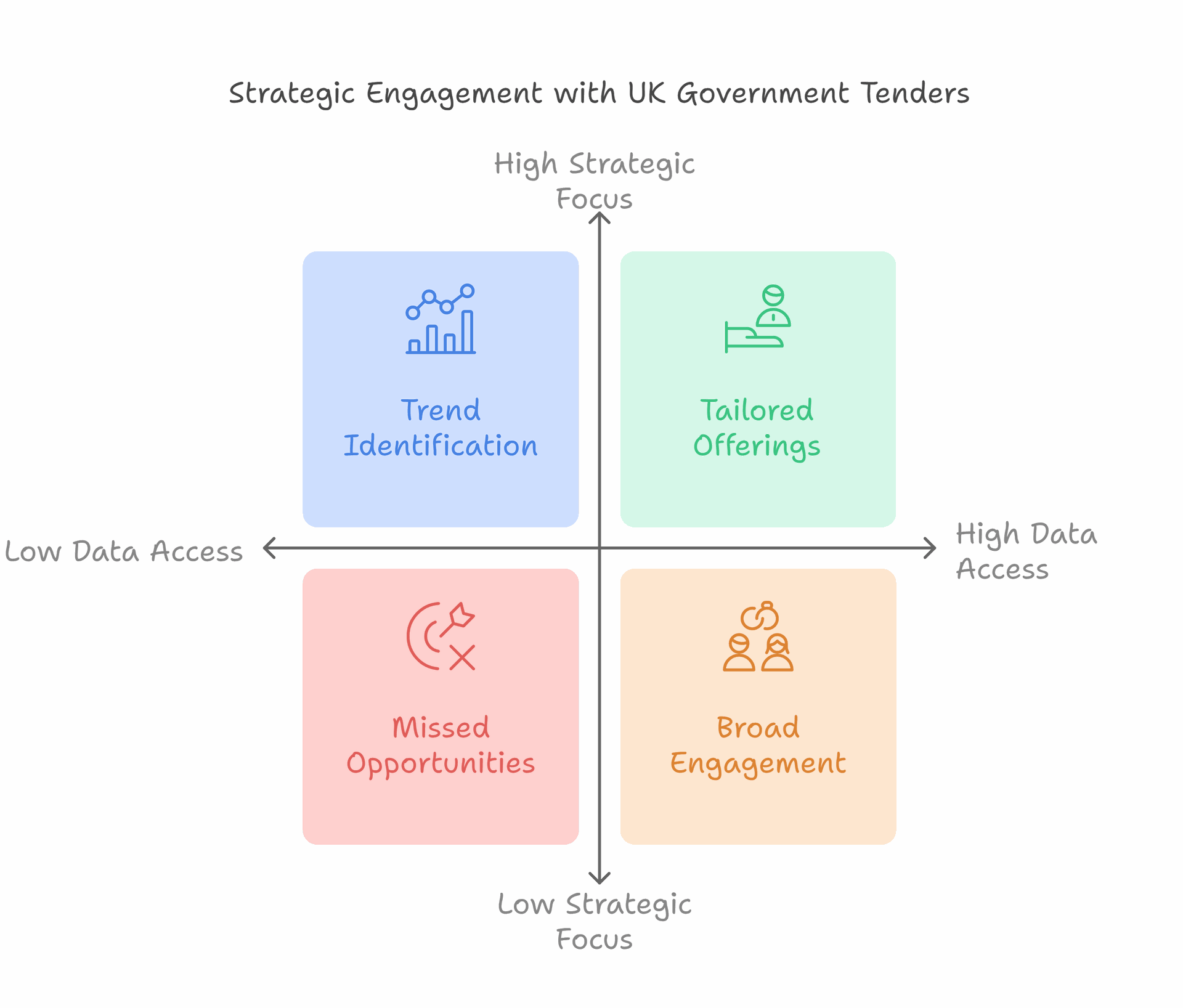

- Regular analysis of tender notices helps companies spot trends and tailor their offerings

- Specialised platforms simplify the process of finding and analysing public sector opportunities

Overview of UK Government Tendering

The UK government tendering process is a key part of public procurement. It helps the government buy goods and services from private firms.

Contracts Finder is the main website for finding UK government tenders. It lists contracts worth over £10,000.

For bigger deals, the Find a Tender service is used. This is for contracts above £139,688 including VAT.

The government uses different ways to award contracts:

- Open tenders

- Restricted tenders

- Competitive dialogue

- Frameworks

Frameworks are popular. They let the government make deals with a group of suppliers for a set time.

UK government tenders cover many areas:

- Construction

- IT services

- Healthcare

- Defence

- Education

Each year, the UK public sector puts out about 70,000 new tenders. This shows how big the market is.

Firms can use these tenders to grow their business. 10% of tender notices are frameworks or DPS. These offer long-term chances for new business.

The Importance of Market Analysis in Public Procurement

Market analysis plays a crucial role in UK public procurement. It helps buyers understand the supplier landscape and make informed decisions. Good market analysis leads to better value and outcomes from government contracts.

Understanding Market Share and Competitor Landscape

Market analysis is key to grasping the public sector supplier base. It reveals which companies hold the largest market shares and how the competitive landscape looks.

Buyers can identify:

• Major players

• Small and medium enterprises

• New market entrants

This knowledge helps shape procurement strategies. For example, buyers may split large contracts to encourage SME participation. Or they may consolidate spending with top suppliers for better deals.

Regular analysis tracks changes in the market over time. It shows if competition is increasing or decreasing. This informs decisions on contract length and structure.

Utilising Market Intelligence for Strategic Decisions

Market intelligence guides critical procurement choices.

It provides data on:

• Pricing trends

• Innovation in products/services

• Supply chain risks

Armed with this info, buyers can time purchases to get the best value. They can also spot opportunities to adopt new technologies or approaches.

Market research helps buyers understand supplier capabilities. This ensures tender requirements match what the market can deliver. It also highlights gaps where government may need to stimulate innovation.

Good market intelligence supports make-or-buy decisions too. It shows when outsourcing makes sense versus in-house provision.

Key Sectors within UK Government Tenders

UK government tenders span various sectors, with construction and defence being particularly prominent. These areas offer significant opportunities for businesses seeking to work with public entities.

Construction and Infrastructure

The construction sector is a major focus of UK government tenders. It covers a wide range of projects, from building new schools and hospitals to improving transport networks.

Many tenders in this sector involve large-scale infrastructure projects. These can include road and rail improvements, as well as the development of new energy facilities.

Local councils often put out tenders for smaller construction projects. These might involve renovating public buildings or creating new community spaces.

The government also seeks contractors for maintenance work on existing structures. This can provide steady, long-term contracts for suitable firms.

Defence and Security

Defence and security tenders are crucial for maintaining the UK's national interests. The Ministry of Defence regularly issues tenders for various goods and services.

These tenders often involve cutting-edge technology. Companies might be asked to develop new weapons systems or improve cybersecurity measures.

Many defence contracts are long-term, offering stable income for successful bidders. They can cover everything from uniforms and equipment to complex military hardware.

Security tenders aren't limited to military needs. Government departments also seek services for protecting public buildings and data systems.

Firms working in this sector must meet strict security clearance requirements. This can make the bidding process more complex but also less competitive.

Leveraging Data for Growth

Data from government tenders offers valuable insights for businesses looking to expand. Companies can use this information to spot trends and find new opportunities in the public sector.

Analysing Public Sector Revenue Opportunities

Tender analytics tools help firms tap into public sector revenue streams. These platforms gather data on all UK government contracts in one place. This makes it easy to find and track new chances to bid.

With historic awards data, companies can see which areas are growing. They can then focus their efforts on the most promising sectors. Real-time tracking also lets businesses jump on new openings fast.

Some tools offer predictive analysis. This helps firms plan their growth strategies based on future trends. By looking at past awards, they can guess which types of contracts might come up next.

Tussell as a Source for Tender Insights

Tussell is a key player in UK public sector market intelligence. Their database covers a wide range of government spending data.

Tussell's reports show which firms are winning contracts and how much they're worth. This helps companies size up their rivals and spot gaps in the market.

The platform also tracks upcoming contract renewals. This gives businesses time to prepare strong bids for soon-to-expire deals.

Tussell's insights can guide firms on where to focus their growth plans. By seeing which areas of government are spending more, companies can tailor their services to meet these needs.

Developing Effective Tender Responses

Creating strong tender responses is crucial for winning public sector contracts. It requires careful planning, attention to detail, and a deep understanding of the buyer's needs.

Crafting a Winning Tender Application

To craft a winning tender application, start by thoroughly analysing the tender requirements. Focus on addressing each point clearly and concisely. Use simple language and avoid jargon.

Highlight your company's unique selling points and how they align with the buyer's needs. Include relevant case studies and testimonials to showcase your experience.

Tailor your response to the specific contract. Don't use a one-size-fits-all approach. Instead, demonstrate your understanding of the buyer's challenges and how you can solve them.

Provide easily accessible market research insights to support your claims. Use data and statistics to back up your statements and show your expertise.

Common Pitfalls to Avoid in Tender Submissions

One common mistake is failing to answer all questions fully. Read the tender document carefully and address each point thoroughly.

Don't overlook the importance of presentation. Poor formatting or spelling errors can undermine an otherwise strong bid.

Avoid using generic content. Buyers can spot copy-pasted responses easily. Instead, customise your answers to the specific tender.

Don't miss deadlines. Late submissions are often rejected outright. Plan your time carefully and allow for unexpected delays.

Refrain from making unsubstantiated claims. Always provide evidence to support your statements.

Lastly, don't forget to proofread. A fresh pair of eyes can catch errors you might have missed.

Future Trends in UK Public Sector Procurement

The UK public sector procurement landscape is evolving rapidly. New technologies and policy changes are reshaping how government entities acquire goods and services.

Innovation and Technological Advancements

Public sector IT spending has grown significantly, with a 41% increase from 2019 to 2024. This trend is likely to continue as government bodies embrace digital transformation.

Artificial intelligence and machine learning are poised to play a larger role in procurement processes. These technologies can help automate routine tasks and improve decision-making.

Blockchain technology may enhance transparency and security in tender processes. It could create tamper-proof records of bids and contracts.

The Internet of Things (IoT) is expected to impact procurement in areas like asset tracking and predictive maintenance. This could lead to more efficient use of public resources.

Policy Changes and Their Implications

The UK government's innovation ambition aims to transform public procurement. It encourages public sector leaders to promote innovation in their organisations.

New policies may focus on sustainable procurement practices. This could mean stricter environmental criteria for suppliers and increased emphasis on circular economy principles.

Changes to procurement thresholds came into effect in January 2024. These updates may affect which contracts are subject to full tender processes.

There's a growing push for increased SME participation in public sector tenders. Future policies might include measures to simplify bidding processes for smaller businesses.

Frequently Asked Questions

UK government tenders offer valuable market insights. Companies can use this data to spot trends, identify key suppliers, and plan their bidding strategies.

What are the prevailing trends in the UK government's spending on procurement?

The UK government has been increasing its focus on digital transformation and sustainability. Many recent tenders involve IT modernisation projects and green initiatives.

Spending on healthcare and social care services has also risen, partly due to the ongoing impacts of the COVID-19 pandemic.

How can one identify strategic suppliers in the UK government contracts?

Tender analytics dashboards can help identify key suppliers. These tools often show which companies win the most contracts in specific sectors.

Looking at high-value, long-term contracts can also reveal strategic suppliers. The government often forms close partnerships with these firms.

Where can one find published information on awarded UK government contracts?

The Find a Tender service publishes information on UK government contracts over £10,000. This platform replaced the EU's TED system after Brexit.

Contracts Finder is another useful resource. It lists smaller contracts and provides details on awarded tenders.

What steps should companies take to participate in UK government tendering processes?

Companies should first register on relevant procurement portals. They need to ensure they meet all qualification criteria for their chosen tenders.

Conducting thorough competitor analysis is crucial. This helps firms understand the competitive landscape and refine their bids.

Which sectors do the UK government's market analysis tenders primarily focus on?

The government often seeks market analysis for healthcare, defence, and technology sectors. These areas see rapid changes and require constant monitoring.

Environmental services and renewable energy are also becoming key focus areas for market analysis tenders.

How does the NHS utilise market analysis in its procurement strategy?

The NHS uses market analysis to identify cost-saving opportunities and innovative solutions. It helps them understand new medical technologies and their potential impacts.

Market analysis also aids the NHS in forecasting future healthcare needs and planning long-term procurement strategies.