Venture capital firms are increasingly eyeing the public sector as a key area for growth and innovation. This trend is driven by the unique opportunities presented by government initiatives and the need for technological advancements in public services. The public sector's vast resources and influence make it an attractive target for venture capitalists looking to expand their portfolios.

Government venture capital programmes are becoming a vital tool for fostering innovation and economic growth. These initiatives often involve partnerships between public entities and private investors, creating a symbiotic relationship that benefits both sectors. By leveraging the expertise of venture capital firms, governments can access cutting-edge technologies and solutions to address complex societal challenges.

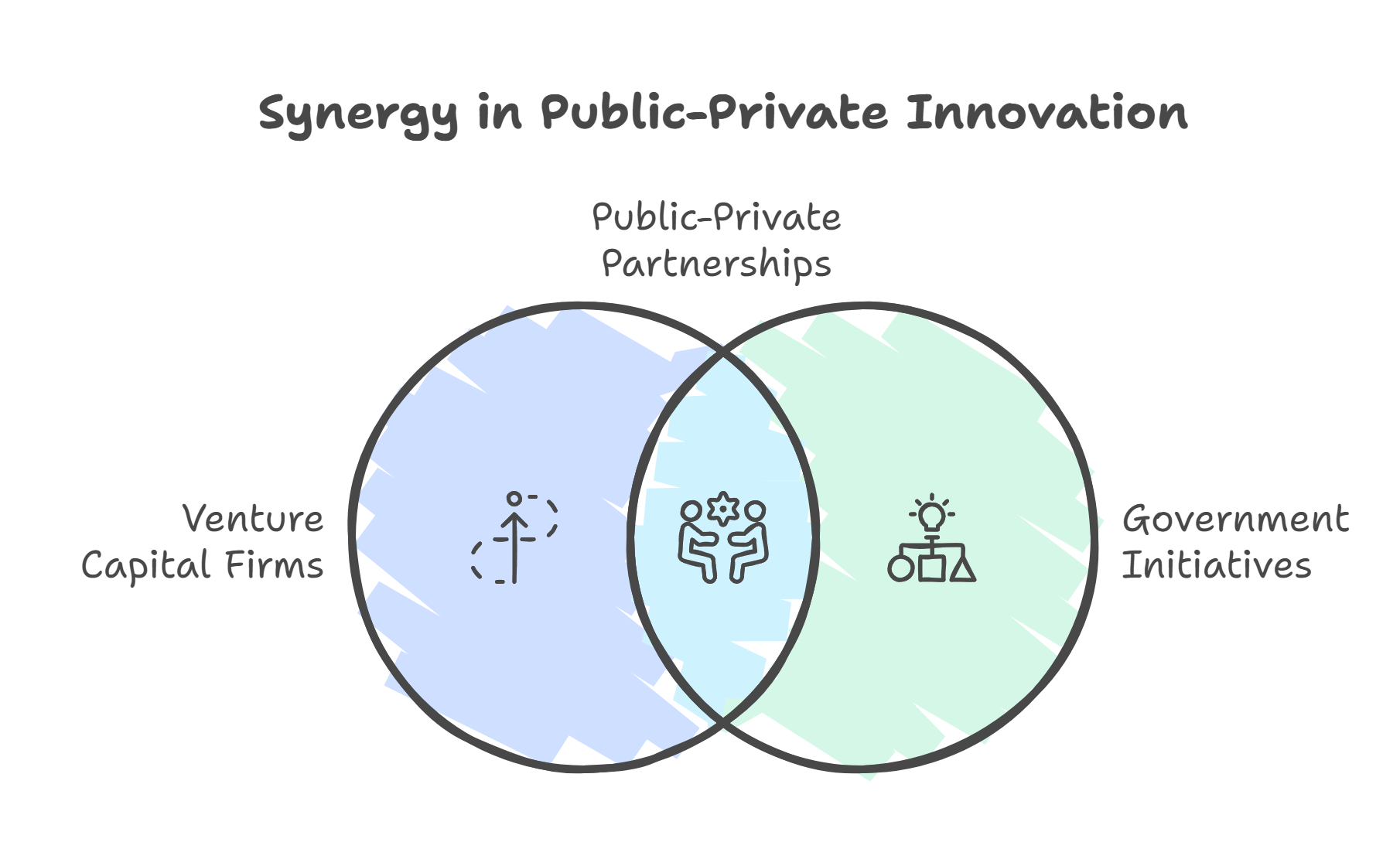

The intersection of public sector needs and venture capital investment is creating a fertile ground for startups and established companies alike. This collaboration is particularly evident in areas such as corporate venture capital, where private companies are leading technological advances that governments can adopt. As this trend continues to evolve, it promises to reshape the landscape of public-private partnerships and drive innovation across various industries.

Key Takeaways

- Venture capital firms are exploring growth opportunities in the public sector

- Government-backed venture programmes foster innovation and economic development

- Public-private partnerships are reshaping technological advancements in public services

Overview of Public Sector Involvement in Venture Capital

The public sector plays a vital role in venture capital, supporting innovation and economic growth. Governments have evolved from regulatory bodies to active participants in funding high-potential startups.

Defining Public Sector Venture Capital

Public sector venture capital (PVC) refers to government-backed investment programmes aimed at funding early-stage companies. These initiatives provide capital to startups that may struggle to secure private funding.

PVC programmes often focus on strategic sectors like technology, healthcare, and clean energy. They aim to fill funding gaps and stimulate economic development.

Government venture capital funds can take various forms. These include direct investment funds, tax incentives for private investors, and public-private partnerships.

Historical Evolution and Current Trends

The public sector's involvement in venture capital has grown significantly over time. Initially, governments primarily set regulations for private venture capital markets.

In the 1990s, many countries introduced tax incentives to boost private investment in startups. The UK, for example, launched the Enterprise Investment Scheme and Venture Capital Trusts to encourage seed and early-stage financing.

Recent years have seen a shift towards more direct government involvement. Many countries now operate their own venture capital funds or co-invest with private partners.

This trend reflects a growing recognition of the strategic importance of fostering innovation through targeted investment. Public venture capital now plays a crucial role in supporting high-growth potential firms and driving economic development.

Mechanisms of Public Sector Support for Venture Capital

The public sector employs various strategies to bolster venture capital growth. These approaches aim to foster innovation, support start-ups, and encourage private investment in high-potential firms.

Funding Initiatives for Start-Ups

Government-backed venture capital programmes provide crucial financial support to early-stage companies. These initiatives often target sectors deemed vital for economic growth or national interests. The UK government, for example, has established funds to support innovative start-ups in technology and green energy.

Public sector funding can take several forms:

- Direct investments in start-ups

- Co-investment schemes with private investors

- Loans with favourable terms

These programmes help bridge the funding gap many entrepreneurial firms face in their initial stages. By providing capital, the public sector acts as a catalyst for private investment, helping start-ups reach critical milestones.

Innovation Grants and Awards

Innovation grants and awards serve as powerful tools to stimulate research and development in the private sector. These mechanisms offer non-dilutive funding, allowing companies to pursue groundbreaking ideas without giving up equity.

Key features of innovation grants include:

- Competitive application processes

- Focus on specific technological or societal challenges

- Milestone-based funding releases

Public venture capitalists often use these grants to guide entrepreneurial firms towards areas of national priority. This approach helps align private sector innovation with public policy goals, fostering a mutually beneficial ecosystem.

Tax Incentives for Investors

Tax incentives play a vital role in attracting private capital to venture investments. By offering tax relief, governments can significantly enhance the risk-reward profile for investors in start-ups and high-growth companies.

Common tax incentives include:

- Capital gains tax relief on venture investments

- Tax credits for angel investors

- Deductions for losses on investments in qualifying companies

These measures aim to increase the pool of available capital for entrepreneurial firms. By reducing the financial risk for investors, tax incentives can help channel more private equity into innovative sectors, complementing direct public funding efforts.

The Role of Corporate and Governmental Venture Capital

Corporate and governmental venture capital play crucial roles in funding innovative startups. These entities bring unique resources and goals to the venture capital landscape, shaping investment strategies and outcomes.

Comparative Analysis of Corporate vs Governmental VC

Corporate venture capital (CVC) focuses on strategic investments aligned with company goals. These firms often seek innovations that complement their existing products or services. CVCs typically have shorter investment horizons and may aim for eventual acquisition of promising startups.

In contrast, government venture capital schemes (GVCs) target broader economic objectives. They aim to foster innovation, create jobs, and support strategic sectors. GVCs often have longer investment horizons and may accept lower financial returns if social benefits are significant.

CVCs bring industry expertise and potential customer relationships. GVCs offer stability and can attract private co-investors. Both types face challenges in balancing financial returns with strategic or policy goals.

Case Studies of Successful Public Sector VC Investments

The UK's Enterprise Capital Funds programme has shown promising results. It combines public and private funding to support high-growth potential firms. This approach has led to positive impacts on employment and sales turnover in beneficiary companies.

In the US, the Small Business Innovation Research (SBIR) programme has been successful in funding early-stage tech firms. Many SBIR-funded companies have gone on to achieve significant commercial success and technological breakthroughs.

These cases highlight the potential of well-designed public sector VC initiatives. They show how government funding can effectively complement private capital markets and drive innovation-led growth.

Entrepreneurial Ecosystem and Public Sector Growth

The public sector plays a crucial role in fostering entrepreneurship and innovation. It shapes policies and provides resources that can spur technological advancements and organisational changes within both public and private entities.

Impact on Entrepreneurship and Innovation

Public sector growth has a significant effect on entrepreneurial ecosystems. Government agencies often act as catalysts for innovation by funding research and development initiatives. This support can lead to the creation of new technologies and business models.

Public-private partnerships are another key aspect. These collaborations allow for the sharing of resources and expertise between sectors. This can result in more efficient problem-solving and the development of innovative solutions to societal challenges.

The public sector also influences entrepreneurial finance. Government-backed venture capital funds and grants provide crucial early-stage funding for startups. This financial support can be especially important in high-risk, high-reward sectors like biotechnology or clean energy.

Facilitating Organisational Innovation and Technology Advancement

Public sector growth often drives organisational innovation within government agencies. As these entities adopt new management practices and technologies, they become more efficient and responsive to public needs.

This innovation can spread to the private sector through:

- Knowledge transfer programmes

- Public procurement policies that favour innovative solutions

- Regulatory frameworks that encourage experimentation

Technology advancement in the public sector can have far-reaching effects. For example, the development of e-government services can spur the growth of civic technology startups. These companies create products and services that improve citizen engagement and government transparency.

Public sector investment in digital infrastructure, such as high-speed internet networks, can also create new opportunities for tech entrepreneurs. This improved connectivity enables the development of new digital products and services across various industries.

Challenges and Opportunities

Public sector venture capital faces unique hurdles but also promising avenues for growth. The landscape is shaped by complex regulations and market forces, while offering potential for collaboration and innovation.

Regulatory Hurdles and Market Dynamics

Public sector venture capital firms must navigate a complex web of regulations. Government oversight can slow decision-making processes and limit investment flexibility. These firms often face scrutiny over valuations and return expectations.

Market dynamics pose additional challenges. Public sector firms may struggle to compete with private investors for top-tier deals. They might also face pressure to focus on social impact rather than pure financial returns.

Despite these hurdles, public sector venture capital plays a vital role. It can fill funding gaps in areas deemed too risky by private investors. This includes early-stage technologies and sectors crucial for public welfare.

Opportunities for Synergistic Growth

Public sector venture capital offers unique opportunities for synergistic growth. These firms can leverage government resources and networks to support portfolio companies. This creates a powerful ecosystem for innovation and knowledge spillovers.

Collaboration between public and private investors is a key growth area. Joint investments can combine public sector stability with private sector agility. This model can unlock new funding sources and expertise.

Public sector firms are well-positioned to drive innovation in strategic sectors. They can focus on long-term societal benefits alongside financial returns. This approach can attract mission-driven entrepreneurs and foster groundbreaking technologies.

Quantitative Impact and Performance Metrics

Public venture capital programmes aim to boost economic growth and innovation. Measuring their effectiveness requires looking at key performance indicators and intellectual property outcomes.

Assessing Firm Performance and Productivity

Publicly backed VC funds invest capital from government sources to support growing companies. To gauge their impact, analysts track metrics like revenue growth, job creation, and productivity gains in funded firms.

Productivity is often measured by output per employee or total factor productivity. Firms receiving public VC may see productivity rise through better technology or management practices.

Another key metric is the rate of successful exits, either through IPOs or acquisitions. A higher exit rate suggests the programme is picking promising ventures.

Significance of Patents and Intellectual Property

Patents serve as a crucial indicator of innovation output for VC-backed firms. The number of patents filed and granted can signal a company's technological progress.

Patent quality matters too. Metrics like citation counts and renewal rates help assess the value of a firm's intellectual property. High-quality patents may lead to licensing revenue or strategic advantages.

Beyond patents, other forms of IP like trademarks and copyrights can be valuable. These protect brands and creative works, potentially boosting a company's market position and valuation.

Future Outlook and Predictive Trends

The public sector venture capital landscape is poised for significant changes. Emerging technologies and long-term projections will shape the future of this dynamic field.

The Role of Emerging Technologies

Generative AI is set to play a crucial role in public sector VC growth. This technology could streamline processes and improve decision-making for government agencies.

Innovation in blockchain and cloud computing may also drive public sector investments. These technologies offer enhanced security and efficiency for government operations.

Data analytics tools are likely to gain traction. They can help public entities make more informed choices about resource allocation and policy development.

Long-Term Projections for Public Sector VC

Public sector VC is expected to see steady growth over the next five years. Governments may increase funding for startups that address pressing social and environmental issues.

Healthcare and financial services are projected to remain top investment areas. These sectors offer opportunities for innovation and improved public services.

Mergers and acquisitions in the public sector VC space may increase. This could lead to the formation of larger, more specialised funds focused on government-related investments.

Climate tech and sustainable energy solutions are likely to attract significant public sector VC interest. These areas align with growing government priorities for environmental sustainability.

Frequently Asked Questions

Venture capital in the public sector is experiencing significant shifts. The landscape is evolving rapidly, with new trends emerging and industries gaining prominence. Funding patterns are changing, and the impact on company growth is substantial.

What trends are shaping the venture capital landscape in the public sector for 2024?

Government grants are playing a larger role in innovation for newly public firms. These grants are influencing both research and development inputs and patent outputs.

Public sector platforms are gaining traction. They're creating structures that boost the value of broader systems, similar to corporate venture funds like Slack Fund.

Which industries are attracting the most venture capital in the current economic climate?

Technology-driven sectors continue to lead. Artificial intelligence, clean energy, and healthcare tech are drawing significant investment.

Cybersecurity firms are also seeing increased interest, given the growing importance of data protection in the public sector.

How is venture capital funding distributed among industries in 2024?

Funding is concentrating in sectors with high growth potential. Healthcare and biotech are receiving substantial investments due to ongoing public health concerns.

Climate tech is another area seeing a surge in funding, as governments prioritise sustainability initiatives.

In what ways do venture capital firms contribute to the growth of companies within the public sector?

Venture capital firms provide more than just funding. They offer expertise, networking opportunities, and strategic guidance to help public sector companies scale.

They also drive innovation by encouraging risk-taking and supporting cutting-edge technologies that can improve public services.

Can trends from public markets offer predictive insights for venture capital investments?

Public market activity can indeed provide valuable insights. A backlog of venture-backed companies seeking liquidity may lead to increased public market activity in 2024.

This trend could influence venture capital strategies, potentially shifting focus towards companies with clear paths to public offerings.

What projections can be made for global venture capital funding patterns in the upcoming year?

Global venture capital funding is expected to stabilise after recent fluctuations. Emerging markets may see increased activity as investors seek new opportunities.

Seed-stage funding could see a resurgence as investors look to capitalise on early-stage innovations in the public sector.