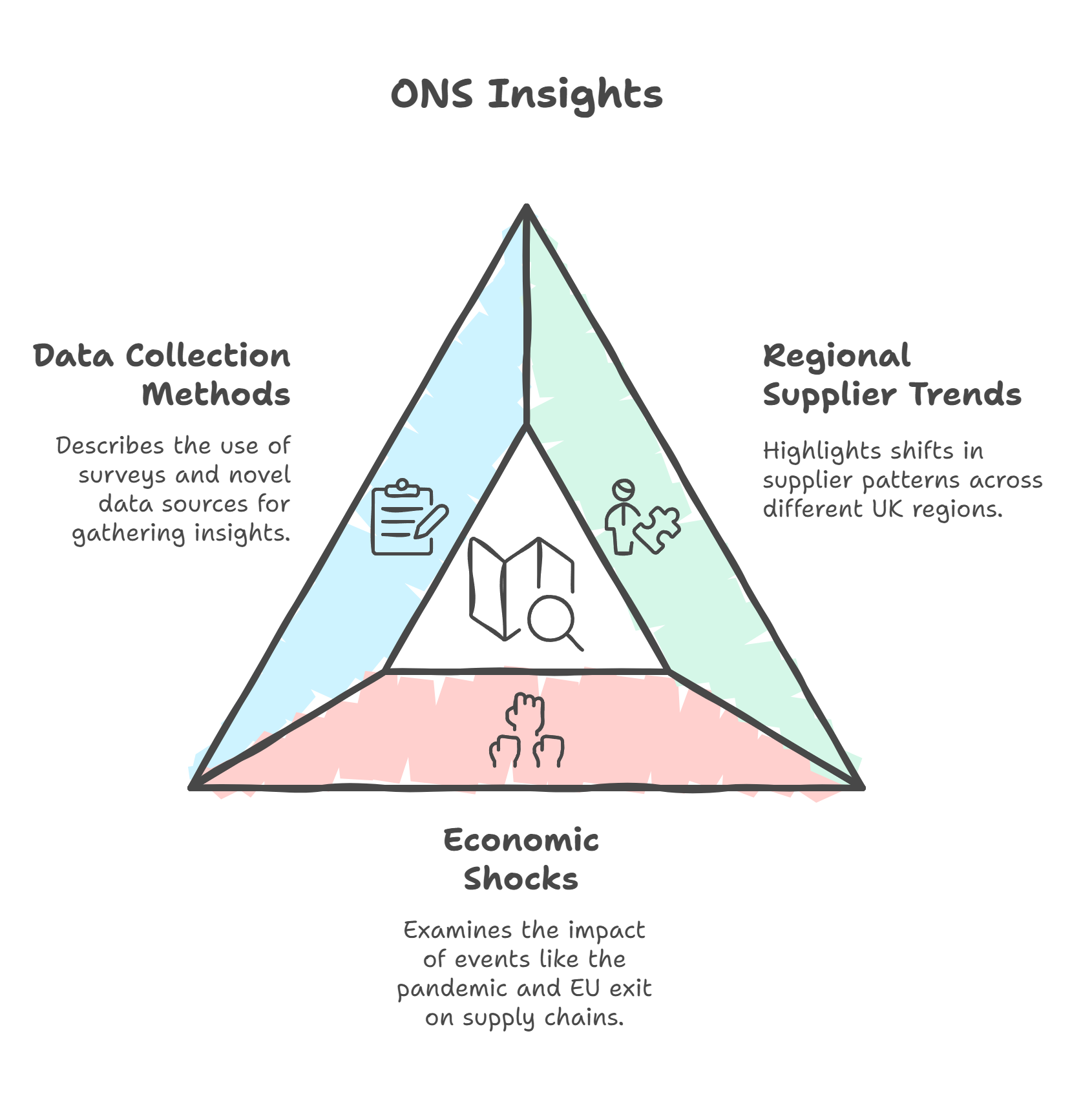

The Office for National Statistics (ONS) provides valuable insights into regional supplier trends across the UK. Their data collection efforts span various sectors, offering a comprehensive view of business activities and economic patterns. Recent ONS analyses reveal notable impacts on trade trends, influenced by events such as the coronavirus pandemic and EU exit.

These findings shed light on labour and product shortages, reflecting shocks to businesses' supply capacity and their ability to adapt to changing demand for goods and services. The ONS utilises a range of methods, including response surveys and novel data sources, to gather this information. Their Business Insights and Conditions Survey provides regular updates on economic trends, employment, and trade.

Key Takeaways

- ONS data reveals significant shifts in regional supplier trends across the UK

- Economic shocks have impacted business supply capacity and demand responsiveness

- Regular surveys and novel data sources inform ONS analyses of business conditions

The Office for National Statistics Overview

The Office for National Statistics (ONS) plays a crucial role in gathering and analysing data about the UK economy and society. Its work shapes policy decisions and provides valuable insights for businesses and researchers.

Role and Responsibilities

The ONS is the UK's largest independent producer of official statistics. It collects, analyses, and publishes data on a wide range of economic, social, and demographic topics.

Key responsibilities include:

- Conducting the national census every 10 years

- Producing monthly reports on inflation and employment

- Calculating the UK's Gross Domestic Product (GDP)

- Maintaining the Integrated Data Service for researchers and policymakers

The ONS employs statisticians, economists, and data scientists to ensure the accuracy and reliability of its outputs. It operates independently from government influence to maintain public trust in its findings.

Impact of ONS Data on Socio-Economic Understanding

ONS data provides a foundation for evidence-based decision-making across the public and private sectors. Its statistics inform policy at all levels of government and help businesses plan for the future.

Recent examples of ONS impact include:

- Insights into household spending during the cost-of-living crisis

- Tracking the effects of COVID-19 on businesses and the economy

- Providing regional economic data to support levelling-up initiatives

The ONS also collaborates with international organisations, ensuring UK statistics are comparable with global datasets. This enhances the country's ability to benchmark its performance and identify areas for improvement.

Exploring Regional Supplier Trends

Regional supplier trends show notable shifts across key UK industries. Recent data reveals evolving patterns in manufacturing, aerospace, automotive, engineering, and financial services sectors. Labour markets and supply chains have also seen significant adjustments.

Patterns in Manufacturing

UK manufacturing has seen a move towards regional suppliers. By 2026, 65% of companies are expected to source most key items regionally, up from 38% currently. This shift aims to reduce supply chain risks and boost local economies.

The trend is particularly strong in the Midlands and North of England. These areas have seen increased investment in advanced manufacturing facilities.

Small and medium-sized enterprises (SMEs) are playing a larger role. Many are specialising in niche products to meet specific regional demands.

Shifts in Aerospace and Automotive Industries

The aerospace sector has seen a growing focus on regional supply chains. This is partly due to Brexit-related changes and efforts to reduce carbon footprints.

Key clusters have formed around major manufacturers. Bristol, Derby, and Glasgow have become hubs for aerospace suppliers.

In the automotive industry, there's a push towards electric vehicle production. This has led to new regional supplier networks forming, particularly in the West Midlands and North East.

Engineering Sector Dynamics

The engineering sector has seen a rise in collaborative regional networks. These networks often involve universities, SMEs, and larger firms working together on innovation projects.

Digital engineering has grown rapidly. This has allowed smaller regional firms to compete more effectively with larger national players.

There's been an increase in specialised engineering services. Many regions now boast expertise in areas like renewable energy or advanced materials.

Developments in Financial Services

Regional financial services have seen growth outside London. Cities like Manchester, Edinburgh, and Leeds have become important fintech hubs.

There's been an increase in specialist financial services firms. These often cater to specific regional industries or SME needs.

Digital banking has allowed regional providers to expand their reach. This has increased competition with traditional national banks.

Labour Market Adjustments

Regional labour markets have adapted to changing industry needs. There's been a rise in demand for digital skills across all sectors.

Some regions have seen skills shortages in specific areas. This has led to increased investment in local training and apprenticeship programmes.

Remote working has changed regional employment patterns. Some areas have seen an influx of skilled workers moving from larger cities.

Supply Chain Disruption

Recent years have seen significant supply chain disruptions. This has led many firms to seek regional suppliers for greater resilience.

Just-in-time models are being reconsidered. Many companies are now holding larger inventories of critical components.

There's been increased investment in supply chain technology. This aims to improve visibility and reduce risks of disruption.

Assessing the Economic Impact of Coronavirus

The coronavirus pandemic triggered major shifts in the UK economy. Business closures, job losses, and changed consumer habits reshaped local economies and workplaces across the nation.

Effects on the Workforce

Covid-19 led to widespread job losses and furloughs in many sectors. Hospitality, retail, and tourism were hit especially hard. Millions of workers found themselves suddenly unemployed or with reduced hours.

Remote work became the norm for many office-based roles. This shift changed commuting patterns and impacted city centres. Some industries saw increased demand and hiring, like healthcare and delivery services.

The pandemic worsened existing inequalities. Low-wage workers and those in precarious jobs faced greater financial strain. Young people and ethnic minorities saw higher rates of job loss.

Business Financial Resilience and Furlough

Many businesses struggled with cash flow issues during lockdowns. The government's furlough scheme helped prevent mass layoffs. It covered up to 80% of wages for workers unable to do their jobs.

Small businesses were often less resilient to extended closures. Some sectors like pubs and gyms faced long periods of mandated closure. Others adapted with online sales or takeaway services.

Government loans and grants provided a lifeline for many firms. But some still faced bankruptcy, especially in hard-hit sectors. The pandemic accelerated existing trends like the decline of high street retail.

Adjustments in High Streets and Local Economies

Town and city centres saw major changes as footfall plummeted. Many shops and restaurants closed permanently. Office workers staying home impacted cafes and other businesses that served them.

Some local high streets fared better as people shopped closer to home. But overall, vacant storefronts increased in many areas. The shift to online shopping accelerated dramatically.

Communities adapted in creative ways. Pop-up cycle lanes and outdoor dining areas appeared. Some areas saw increased interest in local shops and services. But the long-term impacts on high streets remain uncertain as work and shopping habits continue to evolve.

Data Accessibility and Usage

The Office for National Statistics (ONS) offers various ways to access and use regional supplier data. These include direct downloads, searching on data.gov.uk, and previewing data in HTML format. Each method caters to different user needs and skill levels.

ONS Data Downloads

The ONS website provides a straightforward way to download datasets. Users can access regional trends data covering demographic, social, industrial, and economic statistics for UK regions.

To download data:

- Navigate to the desired dataset page

- Look for the 'Download' button

- Choose the preferred file format (e.g. CSV, Excel)

Some datasets may require creating a free ONS account. This allows for personalised data access and email notifications about updates.

Data.gov.uk and Search Data

Data.gov.uk serves as a central hub for UK government data. It offers a powerful search function to find regional supplier information.

Key features:

- Advanced filters to narrow down results

- Metadata descriptions for each dataset

- Links to original data sources

Users can search by keywords, region, or data type. This platform is particularly useful for finding cross-departmental data or niche regional statistics.

HTML and Data Preview

Many ONS datasets offer HTML previews. This feature allows users to quickly assess data without downloading large files.

Benefits of HTML previews:

- Instant viewing in web browsers

- Basic sorting and filtering options

- Easy copying of small data sections

For larger datasets, the preview may show a sample of records. This helps users determine if the full dataset meets their needs before downloading.

The ONS also provides interactive tools for exploring local data. These visual interfaces make complex regional data more accessible to non-technical users.

Societal Indicators from ONS Data

The Office for National Statistics (ONS) provides real-time indicators that offer insights into various aspects of UK society. These indicators cover education, employment, housing, well-being, and crime rates.

Education and Employment Trends

Education and employment trends in the UK have seen notable shifts. The ONS data shows changes in university enrolment rates and vocational training uptake.

Employment figures fluctuate across different sectors. The service industry has experienced growth, while manufacturing jobs have declined slightly.

Remote work has become more common. Many companies now offer flexible working arrangements, influencing job satisfaction and productivity.

Skill shortages persist in certain fields. There's high demand for workers in healthcare, technology, and green energy sectors.

Housing Market Fluctuations

The UK housing market has faced challenges. House prices have risen in some regions, making home ownership difficult for first-time buyers.

Rental costs have increased in urban areas. This has led to a rise in shared living arrangements, especially among young professionals.

The government has introduced schemes to boost affordable housing. These include Help to Buy and shared ownership programmes.

New housing developments focus on sustainability. Many incorporate energy-efficient features and green spaces.

National Well-Being and Crime Rates

National well-being indicators show mixed results. Mental health awareness has improved, but stress levels remain high in certain demographics.

Physical health trends are positive. More people are engaging in regular exercise and adopting healthier diets.

Crime rates vary across regions. Urban areas generally report higher crime rates compared to rural communities.

Cybercrime has become a growing concern. The ONS data indicates a rise in online fraud and identity theft cases.

Community policing initiatives have shown promise. These programmes aim to reduce petty crime and improve public safety.

Business and Consumer Surveys Analysis

The ONS conducts two key surveys to gather data on business and consumer trends. These surveys provide valuable insights into economic conditions and market sentiment across the UK.

Business Insights and Conditions Survey (BICS)

The Business Insights and Conditions Survey (BICS) collects data from private sector firms in the UK. It covers a wide range of industries, excluding the public sector and some specific business types.

BICS asks companies about their current operations, workforce, and financial situation. This helps track economic trends and business confidence.

The survey results offer a snapshot of UK business health. They show how firms are coping with challenges and adapting to market changes.

BICS data is crucial for understanding economic growth patterns. It highlights sectors that are thriving or struggling, giving a nuanced view of the UK economy.

Opinions and Lifestyle Survey

The Opinions and Lifestyle Survey focuses on consumer attitudes and behaviours. It gathers data on various aspects of daily life in the UK.

This survey covers topics like household spending, social trends, and public opinions. The results help policymakers understand how people are feeling about the economy.

Consumer confidence is a key indicator tracked by this survey. It shows whether people are likely to spend or save, which impacts economic growth.

The survey also reveals regional differences in consumer behaviour. This information is valuable for businesses planning marketing strategies or expansion.

By combining BICS and Opinions and Lifestyle Survey data, analysts can form a comprehensive picture of the UK's economic landscape.

Advancements in Technology and AI

New technology and AI are changing how businesses work with suppliers. These tools make data analysis faster and help companies grow.

Incorporation of AI in Data Analysis

AI is making data analysis better and quicker. 72% of UK adults can now explain AI, showing its growing importance. Companies use AI to look at supplier data and spot trends.

This helps them make smarter choices about who to work with. AI can find patterns humans might miss, leading to better supply chain decisions.

It also speeds up tasks like checking invoices and tracking shipments. This saves time and cuts down on mistakes.

Impact on Economic Growth and Development

New tech and AI boost the economy in many ways. They help businesses work more efficiently, which can lead to more growth.

AI is crucial for meeting key business goals. It makes data analysis more efficient and automates routine tasks. This lets companies focus on innovation and expansion.

AI can also help create new products and services. This opens up new markets and creates jobs, further driving economic growth.

Technology's Role in Modernising the Labour Market

Technology is changing the types of jobs available and the skills workers need. Many routine tasks are now done by machines, freeing up people for more complex work.

This shift means workers need to learn new skills. Data analysis and AI knowledge are becoming more valuable in many industries.

At the same time, new tech jobs are emerging. Roles like AI specialists and data scientists are in high demand. This creates new opportunities for workers willing to adapt and learn.

Historical Context and Data Evolution

The Office for National Statistics (ONS) has made significant strides in data collection and analysis since March 2013. This evolution has improved our understanding of regional economic trends and supplier dynamics across the UK.

From March 2013 to Present

In March 2013, the ONS began expanding its regional economic datasets. This move aimed to provide deeper insights into local economic performance and supplier trends. The agency developed new tools to analyse micro-level and administrative data for producing quarterly regional output figures.

The ONS created an Employment Prospects Data Visualisation Tool to help government analysts and policymakers. This interactive platform explores variables related to employment prospects in local authority areas.

A key focus has been improving the quality of regional economic indicators. The ONS has worked to extend economic statistics coverage to the regional level and enhance existing data quality. This effort has two main parts:

- Exploring micro-level and administrative data use

- Producing model-free quarterly regional output data

These changes have allowed for more accurate tracking of economic growth and supplier trends across different UK regions. The enhanced datasets provide valuable insights for businesses and policymakers alike.

Frequently Asked Questions

Recent Office for National Statistics (ONS) data reveals notable shifts in regional supplier dynamics across the UK. These changes reflect evolving business practices and economic conditions in different areas.

What emerging patterns are evident in the latest regional supplier data from the ONS?

The latest ONS data shows a trend towards regional suppliers. By 2026, 65% of companies are expected to buy most key items from regional suppliers, up from 38% currently.

This shift suggests businesses are prioritising local supply chains to improve resilience and reduce disruption risks.

How has the regional distribution of suppliers shifted according to the ONS statistics?

ONS statistics indicate a growing preference for regional suppliers across various UK regions. This trend is particularly pronounced in manufacturing sectors.

Businesses are increasingly favouring suppliers within closer proximity to reduce transport costs and improve supply chain efficiency.

What can recent ONS BICS reports reveal about supplier dynamics in various UK regions?

Recent Business Insights and Conditions Survey (BICS) reports from the ONS highlight regional variations in supplier relationships. Some areas show stronger local supplier networks than others.

These reports also reveal differences in how businesses in various regions are adapting to supply chain challenges.

In what ways have supplier trends and business insights reflected in the ONS data changed over the past year?

ONS data over the past year shows an increasing focus on regional suppliers. This trend has been driven by ongoing supply chain disruptions and economic uncertainties.

Businesses are adapting their strategies to prioritise reliability and resilience in their supply chains.

What are the key factors influencing regional supplier trends as identified by ONS research?

ONS research identifies several key factors influencing regional supplier trends. These include the need for greater supply chain resilience, reduced transport costs, and improved response times to market demands.

Environmental considerations and Brexit-related changes have also played a role in shaping these trends.

How do supplier trends differ across industries within the ONS's regional data?

ONS regional data shows varying supplier trends across different industries. Manufacturing sectors tend to show a stronger shift towards regional suppliers compared to service-based industries.

Some sectors, such as food and beverage, demonstrate a particularly strong preference for local suppliers due to freshness and quality concerns.