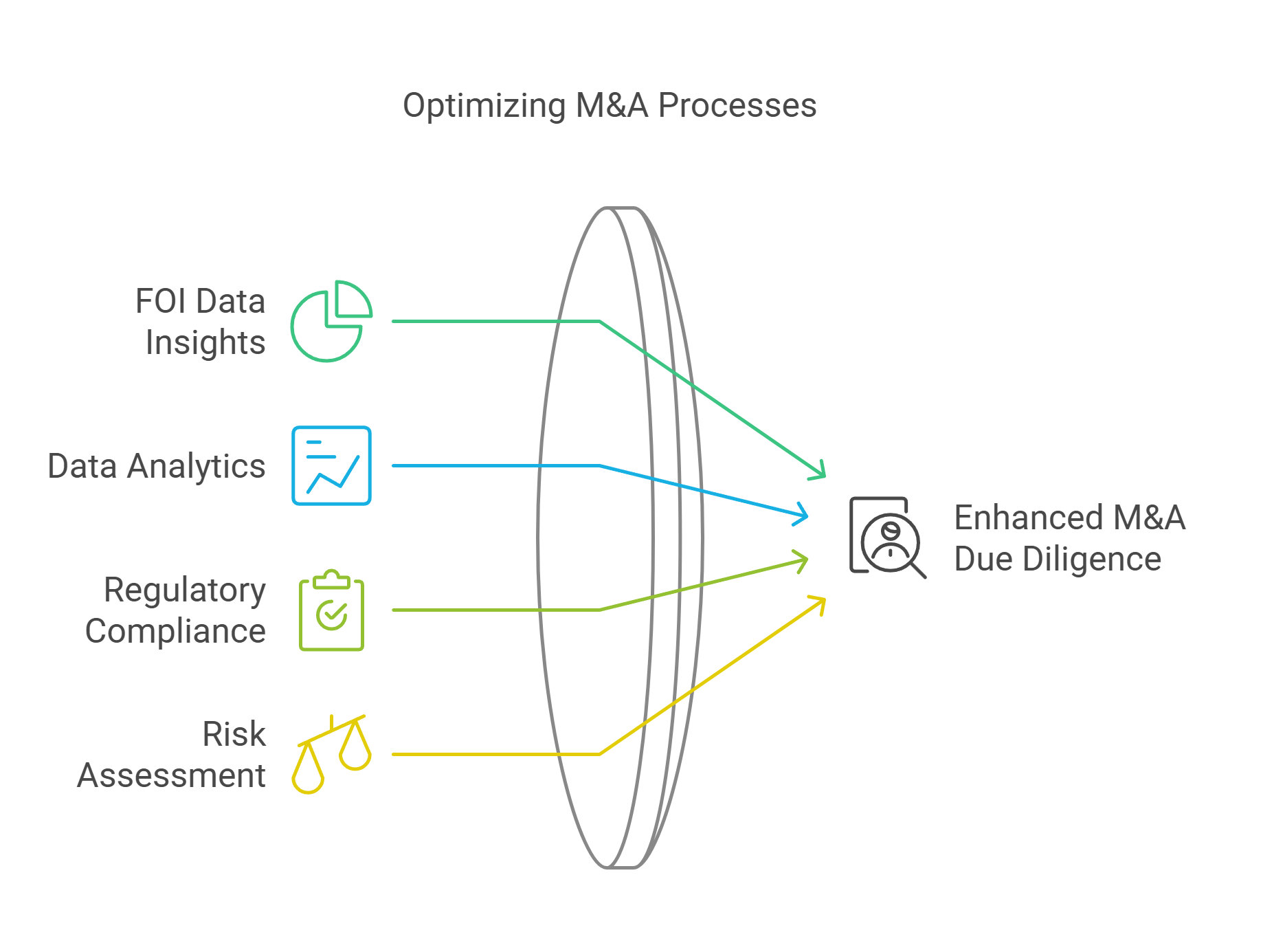

Mergers and acquisitions are complex processes that require thorough due diligence. In recent years, companies have begun leveraging data analytics in M&A due diligence to gain deeper insights and make more informed decisions. One valuable source of information is Freedom of Information (FOI) data, which can provide crucial insights into potential risks and opportunities.

By utilising FOI data in due diligence, companies can uncover hidden liabilities, assess regulatory compliance, and gain a more comprehensive understanding of the target organisation's operations. This approach allows for a more thorough evaluation of potential risks and can help identify areas that require further investigation. FOI data can also shed light on the target company's relationships with government entities and its standing in the public sector.

Data sharing during mergers and acquisitions requires careful consideration of legal and ethical obligations. Companies must ensure they comply with data protection regulations and conduct proper due diligence when transferring data to new controllers. By incorporating FOI data into this process, organisations can better navigate the complexities of data sharing and minimise potential legal risks.

Key Takeaways

- FOI data provides valuable insights for comprehensive due diligence in mergers

- Leveraging data analytics enhances risk assessment and decision-making in M&A

- Proper data handling during mergers is crucial for legal compliance and risk mitigation

Understanding the Scope of Due Diligence in Mergers

Due diligence is a critical step in mergers and acquisitions. It involves a thorough review of the target company's finances, operations, and legal standing. This process helps identify risks and opportunities that could impact the deal's success.

Components of Due Diligence

Due diligence covers several key areas. Financial due diligence looks at the target's financial statements, cash flow, and projections. Legal due diligence examines contracts, intellectual property, and potential lawsuits. Operational due diligence assesses the company's business processes and efficiency.

Compliance checks are crucial to ensure the target follows industry regulations. Technology due diligence evaluates IT systems and cybersecurity measures. Human resources due diligence reviews employment contracts and workplace policies.

Cultural due diligence is often overlooked but vital for smooth integration. It examines the company's values, management style, and employee attitudes.

The Due Diligence Process

The due diligence process typically starts with planning and setting objectives. A team of experts is assembled to cover all necessary areas.

Data collection is the next step. This involves gathering documents, financial records, and other relevant information from the target company.

Analysis follows, where experts review the collected data. They look for red flags, assess risks, and identify potential synergies.

Valuation is a key part of the process. It helps determine if the asking price is fair based on the company's assets, liabilities, and future potential.

The final step is reporting. The due diligence team presents their findings to decision-makers, who use this information to negotiate terms or decide whether to proceed with the merger.

Strategic Importance of FOI Data in Mergers

FOI data plays a crucial role in merger strategies. It provides valuable insights into market potential and growth opportunities, helping companies make informed decisions.

Assessing Market Potential

FOI data is vital for evaluating market potential in mergers. It offers a clear picture of the target company's position in the market.

By analysing FOI data, firms can:

• Gauge customer demand • Assess competitor strength • Identify market trends

This information helps companies decide if a merger aligns with their goals. It also reveals potential risks and challenges in the target market.

FOI data can uncover hidden market opportunities. For instance, it might show untapped customer segments or emerging product niches. This knowledge is crucial for planning post-merger strategies.

Identifying Growth Opportunities

FOI data is key in spotting growth prospects during mergers. It helps companies find new ways to expand and diversify.

Growth opportunities revealed by FOI data include:

- New geographic markets

- Innovative product lines

- Potential partnerships

Companies can use this data to plan their expansion strategies. It helps them decide where to invest resources for maximum growth.

FOI data also aids in identifying synergies between merging companies. This can lead to cost savings and increased efficiency. By pinpointing these areas, firms can create a stronger, more competitive entity post-merger.

Financial Due Diligence and FOI Data

FOI data can provide valuable insights for financial due diligence in mergers. It offers access to key financial information and helps identify potential risks or liabilities.

Analysing Financial Statements

FOI data allows for thorough examination of balance sheets and income statements. This information helps assess a company's financial health and performance.

Analysts can review revenue trends, profit margins, and cash flow patterns. They might spot unusual transactions or accounting practices that warrant further investigation.

FOI data may reveal details about a firm's assets, including property holdings or intellectual property rights. This aids in valuing the company accurately.

Comparing financial data with industry benchmarks helps gauge the target company's position relative to competitors. It can highlight strengths or weaknesses in financial performance.

Identifying Financial Liabilities

FOI requests can uncover hidden financial liabilities that might not be apparent in standard financial reports. This is crucial for assessing potential risks in a merger.

Analysts can discover outstanding legal claims, regulatory fines, or pension obligations. These liabilities could significantly impact the merger's financial viability.

FOI data might reveal long-term contracts or lease agreements that create ongoing financial commitments. Understanding these obligations is essential for accurate financial planning.

Information about government grants or subsidies can be obtained. This helps assess the sustainability of the target company's financial position.

FOI requests can also provide insights into the quality of customer relationships and any associated financial risks.

Legal Aspects and Regulatory Compliance

Legal due diligence plays a crucial role in mergers and acquisitions. It ensures compliance with laws and regulations while protecting intellectual property and personal data.

Reviewing Intellectual Property Assets

When conducting due diligence, it's vital to examine intellectual property (IP) assets. This includes patents, trademarks, copyrights, and trade secrets. Buyers should verify ownership and validity of IP rights.

A thorough review helps:

- Identify potential infringement risks

- Assess the value of IP assets

- Uncover any licensing agreements or disputes

IP due diligence may involve:

- Searching patent databases

- Reviewing trademark registrations

- Checking copyright records

It's wise to engage IP specialists to spot issues that could impact the deal's value or future operations.

Ensuring GDPR and Consent Compliance

Data sharing in mergers requires careful handling of personal information. GDPR compliance is essential to avoid hefty fines and reputational damage.

Key steps include:

- Auditing data processing activities

- Verifying consent mechanisms

- Reviewing data protection policies

Buyers must check if the target company has:

- Proper data subject consent records

- Robust data protection measures

- Processes for handling data subject rights

It's crucial to assess any past data breaches or regulatory issues. This helps gauge potential liabilities and compliance gaps.

Engaging data protection experts can ensure a smooth transition of data assets while maintaining regulatory compliance.

Utilising FOI Data for Operational and Cultural Insight

FOI data offers valuable insights for operational due diligence and cultural fit assessment in mergers. This information can reveal key aspects of an organisation's practices and values.

Operational Due Diligence Insights

FOI requests can uncover crucial details about a company's operations. These may include governance structures and accountability measures.

Firms can analyse FOI data to assess:

- Quality control processes

- Compliance with regulations

- Operational efficiency metrics

- Risk management practices

This information helps identify potential issues or strengths in the target company's operations. It allows for a more thorough evaluation of operational compatibility between merging entities.

Cultural Fit and Integration Planning

FOI data can provide insights into an organisation's culture and values. This is vital for assessing cultural fit during mergers.

Key areas to examine include:

- Employee policies and benefits

- Leadership communication styles

- Corporate social responsibility initiatives

- Decision-making processes

By analysing this data, firms can develop more effective integration strategies. It helps identify potential cultural clashes and areas where alignment is needed.

FOI insights can guide the creation of tailored onboarding programmes and communication plans. This supports a smoother transition and improves the chances of a successful merger.

Risk Management and Liability Identification

Identifying potential risks and liabilities is crucial when using FOI data for due diligence in mergers. This process helps companies make informed decisions and avoid costly surprises.

Analysing Litigation and Antitrust Issues

E-discovery tools can help identify litigation risks by scanning FOI data for legal disputes involving the target company. These tools can flag court cases, settlements, and regulatory actions.

Companies should look for patterns in past litigation that could indicate ongoing issues. This might include:

• Product liability claims

• Employment lawsuits

• Intellectual property disputes

Antitrust concerns are another key area to examine. Merger partners should review:

• Market share data

• Pricing practices

• Competitor relationships

If antitrust issues are found, companies may need to divest certain assets or alter deal terms to gain regulatory approval.

Assessing Insolvency Risks

FOI data can reveal signs of financial distress that may lead to insolvency. Key indicators to watch for include:

• Late payments to suppliers or creditors

• Declining revenue or profit margins

• Significant debt obligations

Data analytics tools can help analyse financial trends and predict future cash flow issues. This allows companies to assess the likelihood of insolvency and plan accordingly.

Merger partners should also review:

• Credit ratings and reports

• Asset valuations

• Pension fund liabilities

By thoroughly assessing insolvency risks, companies can better protect themselves from taking on unexpected financial burdens through a merger.

Advanced Techniques in Due Diligence

Modern due diligence leverages technology to enhance accuracy and completeness. Data management and scalability are crucial for effective analysis in mergers and acquisitions.

Data Management and Accuracy

AI-powered due diligence tools streamline data collection and analysis. These systems can process vast amounts of information quickly, reducing human error.

Machine learning algorithms identify patterns and anomalies in financial records. This helps uncover potential risks that manual reviews might miss.

Natural language processing enables the analysis of unstructured data like contracts and emails. It extracts key information and flags potential issues for further review.

Data visualisation tools present complex information in easily digestible formats. This aids decision-makers in understanding key trends and risks.

Scalability and Market Expansion Considerations

Advanced analytics enable firms to assess market expansion opportunities more effectively. These tools analyse market trends, consumer behaviour, and competitive landscapes at scale.

Predictive modelling helps forecast potential outcomes of mergers across different markets. This supports strategic decision-making and risk assessment.

Cloud-based platforms allow for seamless collaboration between teams across different locations. This is crucial for large-scale, cross-border mergers.

Automated compliance checks ensure adherence to regulatory requirements in multiple jurisdictions. This is essential when expanding into new markets through mergers.

Post-Merger Integration and Continuity Planning

Post-merger integration requires careful planning and execution. It involves blending two organisations' operations, cultures, and systems to create a unified entity. Effective integration is key to realising the full value of a merger.

Navigating the Post-Merger Landscape

Post-merger integration (PMI) is a complex process that demands a clear strategy. Companies must identify key areas for integration, such as IT systems, human resources, and financial processes.

Best practices include setting realistic timelines and goals. It's crucial to maintain open communication with all stakeholders throughout the process.

Integration teams should focus on quick wins to build momentum. This might involve consolidating office spaces or streamlining supplier contracts.

Effective PMI also requires robust change management. Leaders must guide employees through the transition, addressing concerns and fostering a sense of unity.

Cultural Integration and Continuity

Cultural integration is often the most challenging aspect of a merger. It involves blending two distinct corporate cultures into a cohesive whole.

Successful cultural integration starts with understanding both organisations' values and working styles. Leaders should identify common ground and areas of potential conflict.

Creating a new, shared company vision can help unite employees. This vision should incorporate elements from both original cultures.

Regular team-building activities and cross-company projects can foster integration. These efforts help employees build relationships across the merged organisation.

It's important to address cultural differences openly and respectfully. Training programmes can help employees navigate new ways of working and communicating.

Conclusion

FOI data offers valuable insights for due diligence in mergers. It provides a comprehensive view of a target company's operations, finances, and compliance.

Incorporating FOI information into the due diligence checklist enhances the decision-making process. It allows for a more thorough assessment of potential risks and opportunities.

Sales figures and market share data obtained through FOI requests can inform strategy. This information helps in evaluating the target company's growth potential and competitive position.

FOI data supports the development of a robust growth strategy post-merger. It provides insights into market trends, regulatory landscapes, and potential synergies.

Key benefits of leveraging FOI data in due diligence:

- Enhanced transparency

- Improved risk assessment

- Better-informed negotiations

- Stronger post-merger integration planning

By utilising FOI data, organisations can make more confident and informed decisions in mergers and acquisitions. This approach leads to smoother transactions and increased chances of long-term success.

Frequently Asked Questions

Due diligence in mergers and acquisitions involves careful consideration of data protection, information sharing, and regulatory compliance. Key areas include GDPR requirements, cybersecurity assessments, HR practices, and ESG factors.

What steps should be followed to ensure compliance with data protection regulations during M&A due diligence?

To comply with data protection regulations during M&A due diligence, organisations must establish a lawful basis for sharing data. They should identify the purposes for which the data was originally obtained and ensure adherence to data processing principles.

It's crucial to conduct a thorough review of the data being transferred and implement appropriate safeguards. Organisations should also maintain detailed records of data sharing activities and conduct data protection impact assessments where necessary.

How can FOI data be safely and legally shared between public bodies in the context of M&A?

When sharing FOI data between public bodies during M&A, it's essential to follow data sharing codes of practice. This includes establishing clear purposes for sharing and ensuring data minimisation.

Public bodies should implement secure transfer methods and maintain strict access controls. They must also consider any specific legal requirements or exemptions that apply to the FOI data in question.

In what ways does GDPR impact the sharing of employee data with third parties during the due diligence process?

GDPR significantly affects employee data sharing during due diligence. Organisations must obtain explicit consent or rely on legitimate interests to share such data with third parties.

They should provide clear information to employees about the data sharing process and its purposes. Strict data minimisation principles apply, ensuring only necessary employee information is shared.

What are the key considerations for conducting cybersecurity due diligence in mergers and acquisitions?

Cybersecurity due diligence in M&A involves assessing the target company's IT infrastructure, security policies, and incident response plans. It's crucial to evaluate past breaches and the company's compliance with relevant cybersecurity regulations.

Reviewing third-party vendor relationships and their security measures is also essential. The acquiring company should assess potential cybersecurity risks and integration challenges that may arise post-merger.

What are the best practices for HR due diligence in mergers and acquisitions?

HR due diligence best practices include reviewing employment contracts, compensation structures, and benefit programmes. It's important to assess company culture and employee engagement levels.

Evaluating talent retention strategies and identifying key personnel is crucial. HR teams should also review labour relations, including any ongoing disputes or union agreements.

How does ESG due diligence fit within the framework of a typical M&A due diligence process?

ESG due diligence examines environmental, social, and governance factors that may impact the target company's value and risk profile. It involves assessing sustainability practices, labour standards, and corporate governance structures.

This process should be integrated with financial and operational due diligence. ESG factors can significantly influence regulatory compliance, reputation, and long-term financial performance of the merged entity.