Local authorities in England manage significant budgets to provide essential services. These budgets come from various sources and face ongoing challenges. Understanding how councils spend money helps residents and policymakers make informed decisions.

Local authority net current expenditure on services is budgeted to be £127.1 billion in 2024-25. This figure represents a 7.2% increase from the previous year. It reflects the growing demands on local services and the need for efficient resource allocation.

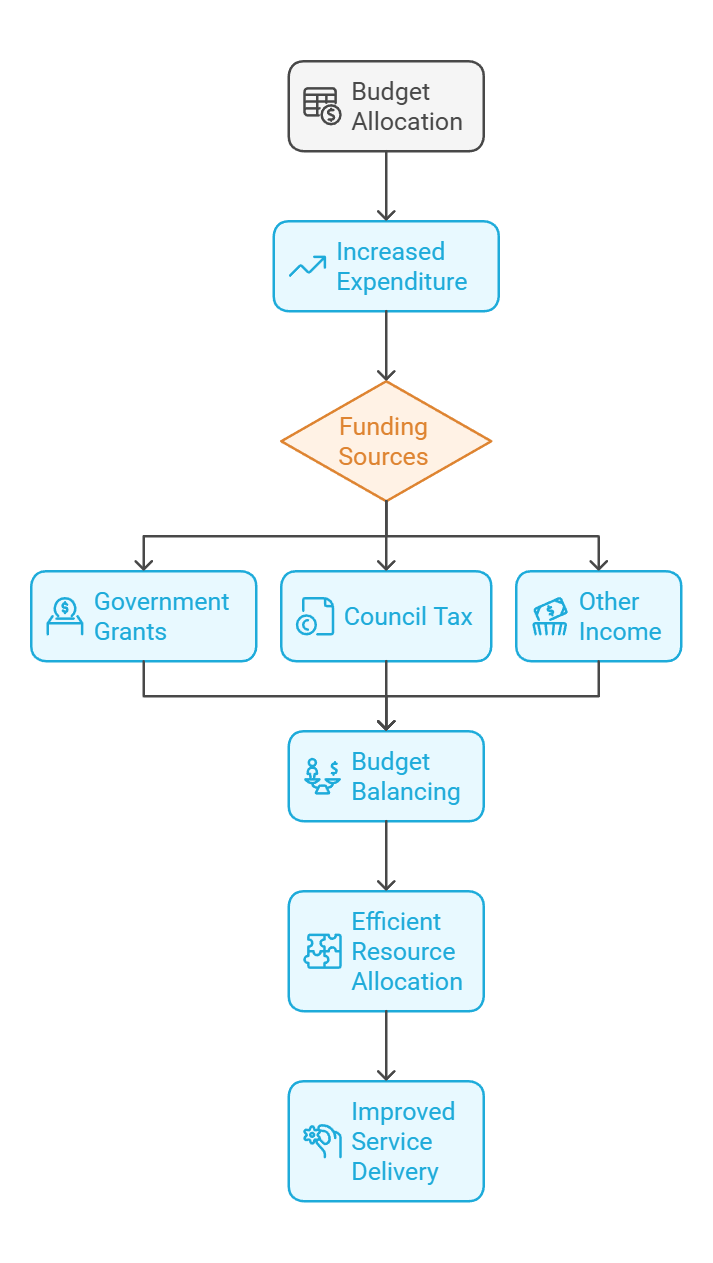

Councils must balance their budgets while meeting community needs. They rely on a mix of government grants, council tax, and other income sources. Exploring these financial details can reveal trends and opportunities for improvement in local governance.

Key Takeaways

- Local authority budgets are complex and face ongoing pressures

- Funding comes from diverse sources, including government grants and local taxes

- Understanding spending patterns can lead to more effective service delivery

Overview of Local Authority Finance

Local authority finance in England is a complex system involving various revenue sources and expenditure types. It encompasses different kinds of local authorities with distinct roles and responsibilities.

Revenue Streams and Spending Power

Local authorities in England rely on multiple revenue streams to fund their services. These include:

• Council tax

• Business rates

• Government grants

• Fees and charges

The Revenue Support Grant from central government is a key funding source, though its importance has decreased in recent years. Local authorities' spending power varies based on their ability to raise funds locally and the level of central government support they receive.

Net current expenditure for English local authorities is budgeted at £127.1 billion for 2024-25. This figure represents a 7.2% increase from the previous year, reflecting growing financial pressures on local services.

Types and Roles of Local Authorities

England has several types of local authorities, each with specific roles:

• County councils

• District councils

• Metropolitan districts

• Unitary authorities

County councils typically handle education, social care, and transport. District councils manage housing, planning, and waste collection. Metropolitan districts and unitary authorities combine these functions.

All local authorities face challenges in maintaining financial sustainability. They must balance increasing service demands with limited resources. Effective financial management is crucial for ensuring the delivery of essential local services.

Key Financial Challenges Facing Local Authorities

Local authorities in the UK face significant financial hurdles that impact their ability to deliver essential services. These challenges stem from various sources, including funding constraints, economic pressures, and the need to balance diverse local needs with fiscal responsibility.

Sustainability of Revenue Sources

Local authorities rely on a mix of funding streams to support their operations. The core spending power of councils, which includes government grants and locally raised taxes, is a crucial factor in their financial health. However, the sustainability of these revenue sources is under strain.

Government grants have seen significant reductions in recent years, putting pressure on local budgets. This has led to increased reliance on council tax and business rates, which can be volatile and subject to economic fluctuations.

The housing revenue account, used to manage council housing finances, also faces challenges. Changes in rent policies and maintenance costs can impact this important revenue stream.

Economic Pressures and Interest Rates

Economic conditions play a vital role in local authority finances. Slow economic growth can reduce income from business rates and affect the overall financial resilience of communities.

Rising interest rates pose a particular challenge. They increase borrowing costs for local authorities, making it more expensive to fund capital projects and manage debt.

Inflation is another key factor. It drives up the cost of providing services and maintaining infrastructure, putting further strain on budgets that are already stretched thin.

Balancing Local Needs with Fiscal Responsibility

Local authorities must strike a delicate balance between meeting community needs and maintaining financial stability. This involves difficult decisions about prioritising services and allocating limited resources.

Councils are tasked with providing a wide range of public services, from social care to waste management. The demand for these services often outpaces available funding, creating tough choices for local leaders.

Financial planning becomes crucial in this context. Authorities must forecast future needs, anticipate economic changes, and develop strategies to ensure long-term sustainability. This may involve exploring new revenue sources, improving efficiency, or collaborating with other organisations to deliver services more cost-effectively.

Funding Sources and Allocations

Local authorities in the UK rely on a mix of central government funding and locally raised revenue to finance their operations and services. The balance between these sources has shifted over time, with increasing emphasis on local financial autonomy.

Central Government Contributions

The local government finance settlement plays a crucial role in determining funding for councils. It outlines the distribution of central government grants, including the Revenue Support Grant.

This grant has decreased significantly in recent years, pushing councils to rely more on local income sources. The settlement also includes specific grants like the Social Care Grant, which helps fund critical services for vulnerable populations.

Central government contributions often come with strings attached, earmarking funds for specific purposes such as education services or public health initiatives.

Localised Funding Mechanisms

Council tax and business rates form the backbone of local revenue generation. These taxes provide a degree of financial independence to local authorities.

Council tax is levied on residential properties, with bands determining the amount paid. Local authorities have some flexibility in setting rates, though increases are often capped by central government.

Business rates, collected from non-domestic properties, are another key source. While initially collected centrally, a portion is now retained locally, incentivising economic growth.

Some areas, particularly combined authorities, have additional powers to raise funds through local levies or precepts.

Impact of Devolution on Financing

Devolution deals have reshaped the funding landscape for many local authorities. Combined authorities, like those in Manchester and the West Midlands, often receive additional powers and resources.

These arrangements can include:

- Greater control over local spending decisions

- Ability to retain a larger share of business rates

- Access to investment funds for infrastructure and economic development

London boroughs benefit from unique arrangements, with the Greater London Authority having significant fiscal powers. This includes control over transport funding and a share of business rates.

Devolution has led to a more complex funding picture, with variations across the country. It aims to tailor funding to local needs but can also lead to disparities between areas with and without devolution deals.

Analysis of Expenditure

Local authorities spend funds on crucial services that impact communities. Key areas include social care, education, and housing. These sectors face unique challenges and funding pressures.

Social Care and Health Services

Local authority spending on social care has risen in recent years. This reflects an ageing population and growing care needs.

Adult social care takes a large slice of budgets. Councils work with the NHS to provide integrated care services. This aims to improve efficiency and outcomes.

Children's social care is another major expense. Funding goes towards safeguarding vulnerable children and supporting families in need.

Mental health services also require significant resources. Local authorities partner with NHS trusts to deliver community-based care.

Education and Children's Services

Education forms a substantial part of council budgets. This covers running costs for schools and support for pupils with special needs.

Looked after children require significant funding. Councils must provide care placements and ongoing support.

Early years education is a growing focus. Many authorities invest in nursery provision and family support services.

Youth services have faced cuts in some areas. However, some councils prioritise programmes to engage young people and prevent antisocial behaviour.

Housing and Homelessness

Housing is a key spending area for local authorities. This includes maintaining council housing stock and planning new affordable homes.

Homelessness services have seen increased demand. Councils fund temporary accommodation and prevention programmes.

Many authorities invest in improving private sector housing. This can involve grants for energy efficiency upgrades or action against rogue landlords.

Social housing remains a significant expense. Councils must balance maintenance costs with rent levels to ensure sustainability.

Data-Driven Insights

Local authorities are using data to make smarter decisions about spending and services. This helps them understand needs, track performance, and be more accountable.

Statistical Analysis of Spending

Councils examine spending patterns to find ways to save money and improve services. They look at things like:

• Council tax levels

• Revenue from different sources

• Costs for various programmes

The Office for National Statistics provides key data like population estimates and GDP deflators. These help put spending in context.

Some councils use advanced analytics to spot trends. This can reveal areas of waste or opportunities to reallocate funds.

Demographic Factors and Funding Needs

Understanding the local population is crucial for budget planning. Councils analyse:

• Age distribution

• Income levels

• Employment rates

• Health statistics

This data shows which services need more funding. For example, an ageing population may require increased social care spending.

Transparency declarations can give early clues about changing needs. They show shifts in spending priorities faster than yearly budget reports.

Performance Metrics and Accountability

Councils track how well services perform using data. Common metrics include:

• Wait times for housing

• Road repair response rates

• Recycling percentages

These numbers help show if money is being spent effectively. They also let residents see how their council compares to others.

Data intelligence tools help link spending to outcomes. This makes it easier to justify budgets and find areas for improvement.

Regular reporting of these metrics increases accountability. It pushes councils to use resources wisely and respond to community needs.

Strategies for Improved Financial Health

Local authorities can boost their financial health through smart planning and targeted actions. These approaches focus on new funding methods, growth-oriented investments, and better service delivery.

Innovative Financing Models

Local councils are exploring fresh ways to fund services and projects. Some are using social impact bonds to pay for social programmes. These bonds link funding to outcomes, reducing financial risk.

Another option is municipal bonds. These allow councils to borrow money directly from investors. This can lead to lower interest rates and more flexible terms.

Public-private partnerships are also gaining traction. They bring in private sector expertise and capital for major projects. This helps spread financial risk and can speed up delivery.

Investing in Growth and Infrastructure

Smart investments can spark economic growth and boost council finances. Many authorities are focusing on key infrastructure projects. These include transport links, digital networks, and renewable energy.

Some councils are creating local investment funds. These target high-growth sectors in their areas. By supporting local businesses, they aim to create jobs and increase tax revenue.

Regeneration projects are another priority. These can transform run-down areas into thriving communities. This often leads to higher property values and more business activity.

Promoting Efficient Service Delivery

Councils are finding ways to do more with less. Many are using digital technology to streamline services. Online portals and apps make it easier for residents to access help and information.

Some authorities are sharing services with neighbours. This can cut costs and improve efficiency. Common areas for sharing include IT systems, legal services, and waste management.

Data analytics is helping councils target resources more effectively. By understanding local needs better, they can focus spending where it's most needed.

Outsourcing non-core services is another option. This can reduce costs and bring in specialist skills. But councils must manage contracts carefully to ensure quality.

Frequently Asked Questions

Local authority spending involves complex budgetary decisions and funding mechanisms. These questions explore key aspects of council finances, from expenditure categories to revenue impacts and service delivery.

What are the primary categories of expenditure in local government budgets?

Local authorities allocate funds across several main areas. Adult social care and children's services typically receive substantial portions of the budget. Housing, education, and environmental services also account for significant spending.

Councils invest in local infrastructure through capital projects. This can include improvements to roads, public buildings, and community facilities.

How does local authority revenue expenditure impact council debt levels?

Revenue spending affects debt when councils borrow to cover shortfalls. If income from council tax, business rates, and government grants falls short, authorities may take on loans.

Increased borrowing can lead to higher debt servicing costs in future budgets. This may reduce funds available for services if not managed carefully.

Which departments within local councils receive the highest financial allocation?

Social care departments often receive the largest share of council budgets. Adult social care in particular faces growing demand due to an ageing population.

Education and children's services also typically see substantial funding. These areas reflect key statutory responsibilities of local authorities.

What influences the annual financial settlement of local authorities?

Government policy plays a major role in determining council funding. The annual settlement sets out how much each authority will receive from central government.

Local economic factors also impact available resources. Changes in business rates collection and council tax revenue affect an authority's financial position.

How do local government financing decisions affect public services?

Budget choices directly impact service provision. When faced with financial pressures, councils may need to reduce non-statutory services or find efficiency savings.

Some authorities have explored new delivery models or partnerships to maintain services with reduced funding. This can include shared services between councils or outsourcing to private providers.

What factors contribute to the fiscal deficit in certain UK councils?

Rising demand for services, particularly in social care, strains council budgets. This increased need often outpaces growth in funding.

Changes to government funding formulas can affect some councils more than others. Areas with higher levels of deprivation may face greater challenges in balancing their budgets.