Public sector funding is a critical aspect of government operations. It involves the allocation and management of resources to support essential services and programs. Keeping a close eye on how these funds are used is crucial for accountability and efficiency.

Monitoring public sector spending helps ensure that taxpayer money is used wisely and for its intended purposes. This process involves tracking expenditures, assessing outcomes, and making adjustments as needed. By doing so, governments can improve their financial management and deliver better value to citizens.

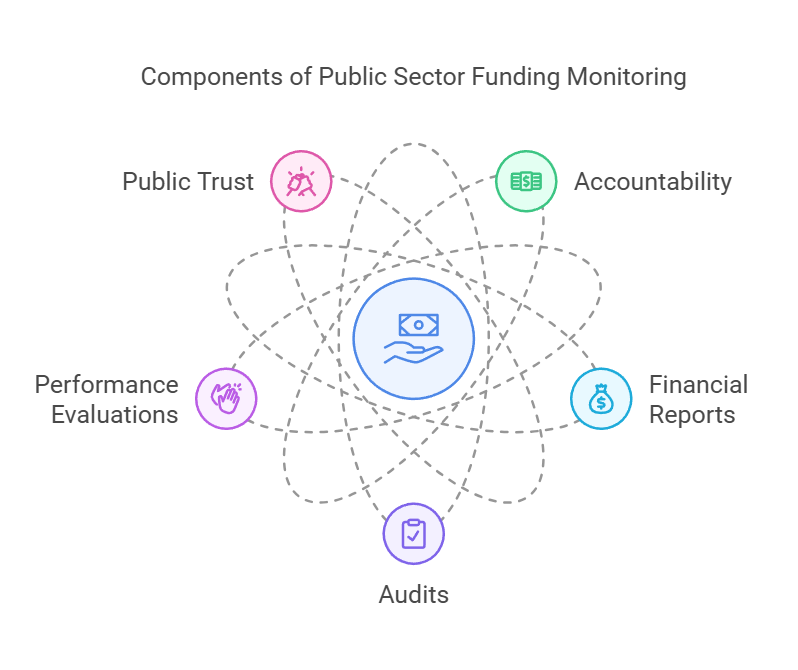

The UK government uses various tools to monitor public sector funding. These include regular financial reports, audits, and performance evaluations. Such measures help identify areas where spending can be optimised and where additional resources might be needed. They also play a vital role in maintaining public trust in government institutions.

Key Takeaways

- Public sector funding monitoring ensures accountability and efficient use of resources

- The UK government uses financial reports, audits, and performance evaluations to track spending

- Effective monitoring helps optimise expenditures and maintain public trust in government institutions

Understanding Public Sector Funding

Public sector funding involves complex processes and mechanisms for allocating and managing government resources. It plays a crucial role in delivering public services and shaping economic policies.

Key Concepts and Definitions

Public sector spending refers to money the government spends on various programmes and services. This includes:

- Operating costs for public institutions

- Infrastructure development

- Social welfare programmes

- Defence and security

The budget is a key tool in public sector funding. It outlines planned expenditure and revenue for a specific period, usually a year. Governments use budgets to allocate resources and set priorities.

Expenditure in the public sector can be categorised as:

- Current expenditure: Day-to-day spending on wages, supplies, and services

- Capital expenditure: Long-term investments in assets like buildings and equipment

Historical Overview of Public Funding

Public funding has evolved significantly over time. In the past, governments focused primarily on basic services like defence and law enforcement.

The 20th century saw a dramatic expansion of public sector roles. This led to increased funding for areas such as:

- Healthcare

- Education

- Social security

Modern public funding faces new challenges. These include ageing populations, climate change, and economic uncertainties.

Governments now use various funding solutions to meet these challenges. These may involve partnerships with private entities or innovative financing methods.

Recent years have seen a growing emphasis on transparency and accountability in public spending. This aims to ensure that taxpayers' money is used effectively and efficiently.

Budget Formation and Approval

The budget process in the UK public sector involves several key steps and stakeholders. HM Treasury plays a central role in shaping fiscal policies and overseeing government spending.

The Budget Process

The budget process starts with planning and reviews. Government departments assess their needs and submit spending proposals. These proposals are scrutinised and negotiated.

HM Treasury then sets spending limits for each department. This helps control overall government expenditure. Departments must prioritise their spending within these limits.

The Chancellor of the Exchequer presents the final budget to Parliament. MPs debate and vote on the budget. Once approved, it becomes law through the Finance Act.

Stakeholders in the Budget Process

Many groups have a stake in the budget process. Key stakeholders include:

- Government ministers

- Civil servants

- Members of Parliament

- The public

- Interest groups

- Local authorities

Local councils play a crucial role. They must set their own budgets based on central government funding and local needs.

Budget holders in each department are responsible for managing allocated funds. They must understand financial regulations and forecast spending accurately.

Role of HM Treasury

HM Treasury is the UK's finance and economic ministry. It leads on:

- Setting the government's fiscal policy

- Controlling public spending

- Delivering infrastructure projects

- Managing the UK's debt

The Treasury conducts Spending Reviews to plan public spending. These reviews set budgets for each department, usually over several years.

Treasury officials work closely with other departments. They ensure spending aligns with government priorities and provides value for money.

Monitoring Mechanisms

Public sector funding requires robust monitoring systems to ensure proper use of resources. These mechanisms aim to track spending, promote accountability, and provide transparency.

Accountability Frameworks

Accountability frameworks are key to monitoring public spending impact. They set clear guidelines for how funds should be used and reported.

These frameworks often include:

• Performance indicators

• Regular audits

• Stakeholder feedback loops

Government agencies use these tools to measure the effectiveness of programmes and policies. This helps them make informed decisions about future funding allocations.

Accountability frameworks also help identify areas where improvements are needed. By tracking outcomes, agencies can adjust their strategies to achieve better results.

Transparency in Public Spending

Transparency is crucial for building public trust in government spending. It involves making financial information easily accessible to the public.

Monitoring public procurement is a key aspect of transparency. This includes:

• Publishing tender details

• Disclosing contract awards

• Sharing spending reports

Many governments now use online portals to share this information. These platforms allow citizens to track how their tax money is being used.

Increased transparency can help reduce corruption and improve efficiency in public spending. It also enables citizens to hold their governments accountable.

Data Collection and Reporting

Effective monitoring relies on accurate and timely data collection. This process involves gathering information from various sources to track spending and outcomes.

Common data collection methods include:

• Financial management systems

• Programme evaluations

• Beneficiary surveys

Performance and financial monitoring are essential components of this process. They help assess whether funds are being used as intended and achieving desired results.

Regular reporting is crucial for keeping stakeholders informed. This may involve quarterly updates, annual reports, or real-time dashboards. Clear and concise reporting helps decision-makers identify trends and make data-driven choices.

Evaluation and Assessment

Evaluating and assessing public sector funding involves careful analysis of expenditure, impact, and performance. These processes help ensure accountability and effectiveness in the use of public resources.

Valuation of Public Expenditure

The Green Book provides guidance on how to appraise policies, programmes, and projects in the UK public sector. It outlines methods for valuing costs and benefits, including:

- Market prices for goods and services

- Social time preference rate for long-term investments

- Opportunity costs of resources used

Valuation techniques help compare different options and make informed decisions. For example, cost-benefit analysis weighs the total expected costs against the total expected benefits of a project.

Impact Evaluation

Impact evaluation assesses the changes that can be attributed to a particular intervention or policy. Key aspects include:

- Identifying causal relationships between interventions and outcomes

- Using experimental or quasi-experimental methods

- Collecting baseline and follow-up data

The UK government encourages civil servants to incorporate evaluation into the policymaking process. This helps develop better policies and improve outcomes.

Performance Monitoring and Review

Performance monitoring tracks progress towards goals and objectives. It involves:

- Setting clear, measurable targets

- Regularly collecting and analysing data

- Comparing actual performance against planned targets

The National Audit Office emphasises the importance of ongoing monitoring and evaluation. This helps identify areas for improvement and ensures value for money in government spending.

Regular reviews allow for adjustments to be made based on performance data. This can lead to more efficient use of public funds and better outcomes for citizens.

Financial Management and Control

Public sector organisations need strong financial management and control systems. These ensure proper use of funds and help prevent fraud. Key areas include managing public money, oversight by the Cabinet Office, and addressing financial risks.

Managing Public Money

The UK government has clear rules for handling public funds. These are outlined in Managing Public Money, a key Treasury document. It covers budgeting, accounting, and reporting practices.

Public bodies must follow these guidelines:

• Use resources efficiently and effectively

• Maintain proper financial records

• Ensure value for money in spending decisions

Regular audits check compliance. The National Audit Office plays a crucial role here. They examine accounts and spending across government departments.

Role of the Cabinet Office

The Cabinet Office oversees financial management across Whitehall. It works to improve efficiency and cut waste. Key responsibilities include:

• Setting cross-government spending controls

• Monitoring major projects and programmes

• Driving civil service reform

The office also runs the Government Internal Audit Agency. This body helps departments strengthen their internal controls.

Fraud Risk and Financial Performance

Public bodies face various financial risks. Fraud is a major concern. To combat this, organisations must:

• Conduct regular risk assessments

• Implement strong internal controls

• Train staff in fraud awareness

Financial management reforms help improve overall performance. These include better forecasting and reporting systems.

Departments now use monthly reviews to track spending. This allows for quicker responses to budget pressures. It also helps identify areas for potential savings.

Public Sector Spending Areas

Public sector spending covers a wide range of areas that impact daily life. The government allocates funds to essential services, infrastructure projects, and procurement activities to meet societal needs and drive economic growth.

Government Spending on Services

The largest portion of public spending goes towards providing services to citizens. Health care is a major focus, with the NHS receiving substantial funding. Education is another key area, covering schools, universities, and skills training.

Social care and welfare programmes also receive significant investment. This includes support for the elderly, disabled, and those facing financial hardship.

Public safety is prioritised through funding for police, fire services, and the justice system. Transport infrastructure, such as roads and railways, gets considerable attention to keep the country moving.

Local councils receive allocations for services like waste collection, parks, and libraries. The government also funds national defence and diplomacy efforts.

Capital Investment and Projects

Capital spending focuses on long-term infrastructure and assets. This includes building new hospitals, schools, and government facilities. Transport projects like HS2 and road improvements receive significant investment.

Energy infrastructure is another priority, with spending on renewable sources and grid upgrades. Digital infrastructure, such as broadband networks, also sees investment to boost connectivity.

Flood defences and environmental projects protect communities and natural resources. Housing programmes aim to increase affordable homes across the country.

Research and development funding supports innovation in science and technology. Cultural projects, like museum renovations, preserve heritage and boost tourism.

Public Procurement and Contracts

The government relies on private sector suppliers for many goods and services. This involves a complex procurement process to ensure value for money and fair competition.

Large contracts are awarded for major infrastructure projects like railway construction or IT system upgrades. Ongoing service contracts cover areas such as facilities management and IT support for government departments.

Defence procurement is a significant area, covering military equipment and support services. The NHS awards contracts for medical supplies, equipment, and some clinical services.

Local councils engage in procurement for waste management, social care providers, and school services. Framework agreements are often used to streamline purchasing across multiple public sector bodies.

Transparency in procurement is crucial. The government publishes contract information and encourages small business participation in bidding processes.

Fiscal Policy and Public Debt

Fiscal policy and public debt are closely linked aspects of government finances. They involve managing public spending, taxation, and borrowing to achieve economic goals and maintain financial stability.

Deficit and Borrowing

When government spending exceeds revenue, it creates a budget deficit. This gap is typically filled through borrowing. The UK government borrows by issuing bonds and gilts to investors.

Short-term borrowing helps smooth out cash flow. Long-term borrowing funds major projects and investments. The amount borrowed adds to the national debt each year.

Deficits can stimulate economic growth during recessions. But large, persistent deficits may lead to unsustainable debt levels. This can increase borrowing costs and reduce fiscal flexibility.

Governments aim to balance deficits with economic growth. The goal is to keep debt at manageable levels relative to GDP.

Management of Public Debt

Effective debt management is crucial for fiscal sustainability. It involves strategies to minimise borrowing costs and risks.

Key aspects include:

- Diversifying debt instruments

- Balancing short-term and long-term debt

- Managing currency and interest rate risks

- Maintaining investor confidence

The UK Debt Management Office oversees these activities. It works to ensure smooth functioning of gilt markets and meet the government's financing needs.

Proper debt management supports broader economic goals. It helps maintain financial stability and protects against market shocks.

Measures of Fiscal Health

Several indicators help assess a country's fiscal position:

- Debt-to-GDP ratio: Shows debt relative to economic output

- Budget balance: Measures yearly deficit or surplus

- Primary balance: Budget balance excluding interest payments

- Fiscal space: Ability to increase spending or lower taxes

These metrics provide insights into fiscal sustainability. They help policymakers and investors evaluate a country's financial health.

Public debt dynamics are influenced by various factors. These include economic growth, interest rates, and inflation. Understanding these relationships is crucial for effective fiscal management.

Regular monitoring of these measures helps identify potential risks. It allows for timely policy adjustments to maintain fiscal stability.

Regulatory Bodies and Legislation

The UK government relies on key regulatory bodies and legislation to monitor public sector funding. These entities and laws play a vital role in ensuring financial accountability and transparency across government departments and agencies.

Office for Budget Responsibility

The Office for Budget Responsibility (OBR) is an independent watchdog for public finances. It was established in 2010 to provide impartial analysis of the UK's public finances.

The OBR produces forecasts for the economy and public finances. These forecasts are used by the government to set fiscal policy and spending limits.

Key responsibilities of the OBR include:

- Producing five-year forecasts twice a year

- Evaluating the government's performance against fiscal targets

- Assessing the long-term sustainability of public finances

The OBR's work helps ensure that budget decisions are based on unbiased economic projections.

Whole of Government Accounts

Whole of Government Accounts (WGA) is a comprehensive financial report that covers the entire UK public sector. It consolidates the audited accounts of over 9,000 public sector organisations.

The WGA provides a complete picture of the government's financial position and performance. It includes:

- Central government departments

- Local authorities

- Public corporations

- The NHS

This consolidated view helps identify financial risks and liabilities across the public sector. It also improves transparency and accountability in public finances.

The Treasury publishes the WGA annually, typically with a two-year lag due to the complexity of the data.

Legislative Environment for Funding

The UK has a robust legislative framework governing public sector funding. Key laws and regulations include:

- The Budget Responsibility and National Audit Act 2011: This established the OBR and set out fiscal rules.

- The Government Resources and Accounts Act 2000: This modernised government accounting practices.

- The Public Bodies Act 2011: This gave ministers powers to reform public bodies.

These laws ensure proper oversight of public spending. They also set standards for financial reporting and auditing in the public sector.

Parliament plays a crucial role in scrutinising public finances through select committees and debates on spending plans.

International Perspective and Comparisons

Public sector funding varies across nations. Different countries employ unique approaches to manage and monitor their public finances. These differences offer valuable insights for improving funding practices.

The UK Public Sector in a Global Context

The UK public sector operates within a global framework of financial management practices. International comparisons of public sector performance help gauge the UK's standing.

The UK government has adopted several international standards for financial reporting. These include the International Public Sector Accounting Standards (IPSAS). Such standards aim to boost transparency and accountability in public finances.

UK public sector entities often benchmark their performance against similar organisations abroad. This practice helps identify areas for improvement and adopt best practices from other countries.

Comparative Analysis of Public Expenditure

Public expenditure patterns differ significantly across nations. Factors such as economic conditions, political priorities, and social needs influence these patterns.

Funding systems for local government vary internationally. Some countries rely heavily on central government funding, while others grant more financial autonomy to local authorities.

The Organisation for Economic Co-operation and Development (OECD) conducts regular reviews of public governance. These reviews assess how well countries manage public funds and deliver services.

Key areas of comparison include:

- Education spending

- Healthcare expenditure

- Infrastructure investment

- Social welfare programmes

Such comparisons help policymakers identify trends and make informed decisions about resource allocation.

Frequently Asked Questions

Public sector funding in the UK involves complex monitoring systems and specific budgeting practices. The government employs various strategies to ensure transparency and effective management of public money across different departments and regions.

How is public sector funding monitored in the United Kingdom?

The UK government uses a multi-layered approach to monitor public sector funding. Lead local authorities submit regular reports on fund usage and project progress.

Central government departments also conduct internal audits and performance reviews. The National Audit Office provides independent scrutiny of public spending and reports to Parliament.

What is the breakdown of the UK government spending for the year 2024?

The exact breakdown for 2024 is not available in the provided search results. Government spending typically covers areas such as healthcare, education, defence, and social protection.

Detailed breakdowns are published annually in the government's Budget and Spending Review documents.

What are the key principles guiding the management of public money in the UK?

Key principles include accountability, transparency, and value for money. Public bodies must use resources efficiently and effectively.

They must also comply with Treasury guidance on managing public funds and follow strict procurement rules.

How does budget management in the public sector operate?

Public sector budget management involves setting spending limits, allocating resources, and monitoring expenditure. Departments receive funding allocations based on agreed priorities and objectives.

Regular financial reporting and performance reviews help ensure budgets are managed effectively throughout the year.

Can you explain the difference between Resource Departmental Expenditure Limits (RDEL) and Capital Departmental Expenditure Limits (CDEL)?

RDEL covers day-to-day operational spending, such as staff salaries and running costs. CDEL is for investment in assets like buildings, equipment, and infrastructure.

These limits help the government control overall spending and ensure a balance between current and future needs.

What strategies are in place to ensure the transparency of public sector funding in Scotland?

Scotland publishes detailed budget documents and financial reports. The Scottish Parliament scrutinises spending plans and outcomes.

Audit Scotland conducts independent audits of public bodies and reports on their financial management and performance.