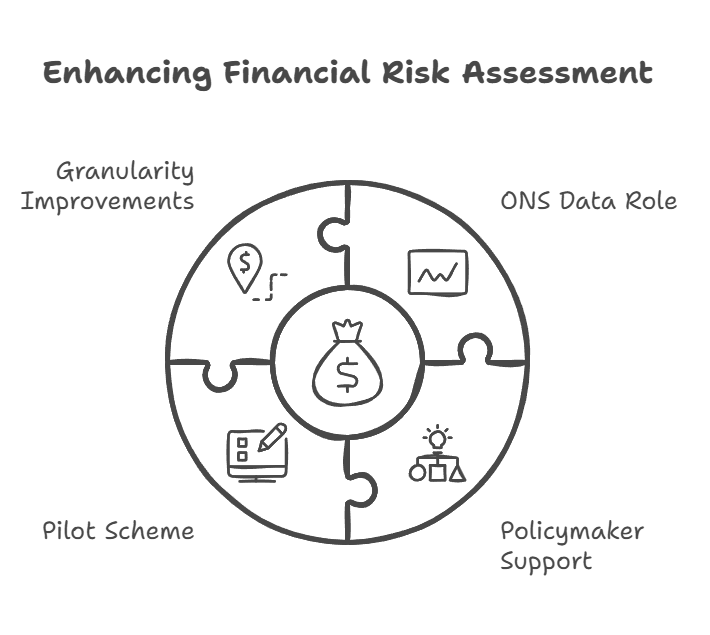

The Office for National Statistics (ONS) plays a crucial role in providing insights for financial risk assessment in the UK. Through its data collection and analysis, the ONS helps policymakers and financial institutions understand the state of the economy and potential risks. The ONS's improved data supports policy makers in monitoring the impact of measures and reforms on the financial sector.

Recent developments in financial risk assessment include the introduction of enhanced methods. From August 2024 to March 2025, a pilot scheme for frictionless financial risk assessments is set to run. This new approach aims to streamline the process and provide more accurate insights into potential financial risks.

The ONS continues to work on improving the granularity of financial statistics. This effort enhances the ability to identify interconnectedness in the UK economy, which is vital for assessing systemic risks and maintaining financial stability.

Key Takeaways

- ONS data aids policymakers in monitoring financial sector reforms

- A pilot scheme for enhanced financial risk assessments begins in 2024

- Improved granularity in financial statistics helps identify economic interconnectedness

Fundamentals of Financial Risk Assessment

Financial risk assessment is key for businesses and institutions. It helps identify and manage potential threats to financial stability. Proper assessment relies on accurate data and rigorous analysis.

Understanding Financial Risks

Financial risks come in many forms. The main types are:

- Credit risk

- Market risk

- Operational risk

- Liquidity risk

Credit risk involves the chance a borrower won't repay a loan. Market risk relates to changes in asset values. Operational risk covers potential losses from failed processes or systems.

Liquidity risk is about having enough cash to meet obligations. Banks and firms must watch this closely.

Systemic risk affects the whole financial system. It can spread quickly and cause widespread problems.

Role of ONS in Financial Risk Analysis

The Office for National Statistics (ONS) plays a vital part in risk assessment. It provides crucial economic data that helps spot trends and issues.

ONS statistics cover areas like:

- GDP growth

- Inflation rates

- Employment figures

- Trade balances

These numbers help analysts gauge economic health. They can point to brewing troubles or positive shifts.

The ONS also works to fill data gaps. Better data means more accurate risk assessments. This can lead to smarter financial choices and policies.

Firms use ONS data to inform their risk models. Regulators rely on it to spot system-wide risks. The ONS thus helps strengthen the UK's financial stability.

Financial Institutions and Regulators

The UK financial sector is overseen by key regulatory bodies that work with financial institutions to maintain stability and protect consumers. These entities play crucial roles in risk assessment and management within the industry.

Key UK Regulators and Their Functions

The Bank of England serves as the central bank and is responsible for monetary policy and financial stability. It houses the Prudential Regulation Authority (PRA), which supervises banks, insurers, and major investment firms.

The Financial Conduct Authority (FCA) regulates financial services firms and markets. Its main goals are to protect consumers, enhance market integrity, and promote competition.

These regulators work together to:

- Set rules and standards for financial institutions

- Monitor compliance and conduct

- Assess and mitigate systemic risks

- Implement reforms to strengthen the financial system

Responsibilities of Financial Institutions

Financial institutions must comply with regulatory requirements and implement robust risk management practices. They are expected to:

- Maintain adequate capital and liquidity levels

- Conduct regular stress tests and risk assessments

- Report accurately to regulators on their financial position

- Implement strong governance and internal control systems

Operational resilience is a key focus. Institutions must assess and address operational risks, including cyber threats and technology failures.

They also play a role in preventing financial crime by implementing anti-money laundering measures and reporting suspicious activities.

Regulatory Frameworks and Policies

Financial regulators use various frameworks and policies to manage risks in the banking sector. These tools help maintain stability and protect consumers whilst promoting economic growth.

Prudential Regulation Authority

The Prudential Regulation Authority (PRA) sets rules for banks and insurers to manage financial risks. It focuses on maintaining safety and soundness of firms.

The PRA expects firms to:

- Assess and identify risks

- Update risk management frameworks

- Include climate risks in board reports

- Integrate risk considerations into business planning

The PRA compares firms to their peers to ensure robust risk governance. It also reviews how banks apply risk assessments to their control frameworks.

Financial Policy Committee Insights

The Financial Policy Committee (FPC) monitors systemic risks to the UK financial system. It uses macroprudential tools to address these risks.

Key FPC actions include:

- Setting capital buffers for banks

- Stress testing the banking system

- Monitoring household debt levels

The FPC works closely with other regulators to spot emerging risks. It provides insights on topics like cyber security and market liquidity.

Macroprudential Policy

Macroprudential policy aims to reduce systemic risks in the financial sector. The Bank of England uses these tools to promote stability.

Common macroprudential measures:

- Countercyclical capital buffers

- Limits on mortgage lending

- Oversight of shadow banking

These policies help prevent the build-up of financial imbalances. They also aim to make the system more resilient to shocks.

The Basel Committee on Banking Supervision provides international standards for macroprudential regulation. UK policymakers adapt these guidelines to fit local conditions.

Financial Markets and Trade

Financial markets and international trade are closely intertwined, with significant impacts on economic stability. Monitoring trade patterns and financial flows is crucial for assessing risks and maintaining market liquidity.

Impact of Trade on Financial Stability

Trade flows can greatly affect financial stability. Changes in exports and imports influence currency values and interest rates. A trade deficit may weaken a country's currency, while a surplus can strengthen it. This impacts foreign exchange markets and investment decisions.

Financial services play a key role in facilitating trade. Banks provide credit and manage currency risks for businesses engaged in international commerce. Trade finance instruments like letters of credit help secure transactions between importers and exporters.

Disruptions to trade, such as tariffs or supply chain issues, can ripple through financial markets. This may lead to volatility in stock prices and bond yields as investors reassess economic outlooks.

Monitoring Liquidity and Flow of Funds

Keeping track of liquidity and fund flows is vital for financial stability. Central banks and regulators closely watch these indicators to spot potential risks.

Money market funds are important players in short-term lending markets. They provide liquidity to businesses and financial institutions. Regulators monitor these funds to ensure they can meet redemption demands.

Investment funds also merit attention. Large outflows from funds can lead to asset fire sales, potentially destabilising markets. The Bank of England's Financial Policy Committee assesses vulnerabilities like liquidity mismatches in these funds.

Cross-border capital flows can quickly shift market conditions. Sudden stops or reversals in these flows may trigger currency crises or credit crunches. Policymakers use tools like capital controls to manage these risks when necessary.

Financial Analysis and Data Management

Financial analysis relies on high-quality data to produce accurate insights. The Office for National Statistics plays a key role in providing reliable financial data for the UK.

Assessing Data Quality for Financial Insights

Data analysis in finance requires careful assessment of data quality. Analysts must verify the accuracy, completeness, and timeliness of financial data before drawing conclusions.

Clean, consistent data allows for more reliable trend analysis and forecasting. Artificial intelligence and machine learning models also depend on quality data inputs to produce meaningful results.

Financial institutions use data governance frameworks to maintain data integrity. This involves documenting data sources, implementing validation checks, and establishing clear data ownership.

Regular audits help identify and correct data quality issues. Analysts should be aware of potential biases or gaps in datasets that could skew results.

Office for National Statistics Role in Data Provision

The Office for National Statistics (ONS) serves as a crucial source of financial data for the UK. It compiles and publishes the UK Financial Accounts, a key component of national economic statistics.

ONS data informs policy decisions and economic research. The agency works to improve data collection methods and close information gaps identified after the 2008 financial crisis.

Recent ONS efforts focus on enhancing coverage of financial derivatives and improving sector classifications. This aims to provide a more accurate picture of the UK's financial landscape.

The ONS also collaborates with other government bodies and international organisations to align data standards. This supports more consistent financial analysis across borders.

Emerging Risks and Future Opportunities

The financial sector faces new challenges and chances for growth. Key areas include fintech advances, cyber threats, and sustainability concerns. These factors shape how firms assess and manage risks.

Fintech Innovation

Fintech is changing how financial services work. New tech brings fresh risks and rewards. Digital banking and mobile payments are growing fast. This growth means banks must update their systems.

AI and machine learning help spot fraud. But they also create new risks. Data privacy is a big worry. Firms need strong rules for using customer info.

Blockchain tech offers safer transactions. It could cut costs and boost trust. Yet, it's still new and not fully tested. Banks must be careful when using it.

Cyber Security Trends

Cyber attacks are a top risk for finance firms. Hackers are getting smarter and attacks more complex. Banks must protect data and systems better.

Cloud computing helps firms work faster. But it can also make them more open to attacks. Strong cloud security is a must.

Ransomware is a growing threat. It can lock up vital data. Firms need good backups and recovery plans.

Staff training is key. Many breaches start with human error. Regular cyber drills can help teams stay sharp.

Sustainability and ESG Factors

Climate change is a big risk for finance. Extreme weather can harm assets and disrupt business. Banks must plan for these risks.

ESG investing is on the rise. Firms need clear ESG policies. They must show how they're helping the planet.

Green finance is growing. It funds eco-friendly projects. But there's a risk of greenwashing. Banks must be honest about their green claims.

New rules are coming. By 31 May 2024, UK firms must follow anti-greenwashing rules. This means being clear about ESG products.

Assessment and Management of Systemic Risks

Systemic risks pose significant threats to financial stability. Effective assessment and management of these risks are crucial for maintaining a resilient financial system.

Systemic Risks in the Financial System

Systemic risks are threats that can disrupt the entire financial system. They often stem from the interconnectedness of financial institutions. When one institution fails, it can trigger a domino effect.

Key vulnerabilities include:

- High levels of debt

- Asset price bubbles

- Liquidity mismatches

- Concentrations of risk

The 2008 global financial crisis highlighted the importance of addressing systemic risks. It showed how problems in one sector can spread rapidly.

Risk identification is an ongoing process. Regulators and financial institutions must stay vigilant. They need to spot emerging threats before they grow too large.

Tools for Systemic Risk Management

Financial authorities use various tools to manage systemic risks. These help maintain stability and prevent crises.

Stress testing is a key technique. It assesses how banks would cope with severe economic shocks. Regulators run these tests to identify weaknesses.

Other important tools include:

- Capital buffers

- Liquidity requirements

- Limits on leverage

- Macro-prudential policies

Systemic risk assessment frameworks help analyse potential threats. They look at factors like:

- Credit growth

- Asset prices

- Risk-taking behaviour

Improved data collection and analysis are vital. They allow for better monitoring of the financial system. This helps spot risks early.

International cooperation is also crucial. Financial markets are global. Risks can easily cross borders. Coordinated action is often needed to address them effectively.

The Intersection of Economics and Financial Stability

Economic conditions and financial stability are closely linked. Changes in one area often have ripple effects on the other, shaping the overall health of a nation's economy.

Impact of Fiscal and Monetary Policy

Fiscal and monetary policies play a crucial role in shaping economic growth and financial stability. The Bank of England uses interest rates as a key tool to manage inflation and economic activity. Higher rates can slow growth but also strengthen financial stability by reducing risk-taking.

Government spending and tax policies also influence the economy. Increased spending may boost GDP and wages in the short term. However, it can lead to higher debt levels, potentially impacting long-term financial stability.

Economic Indicators and Financial Health

Key economic indicators provide vital insights into financial health. GDP growth often correlates with increased business activity and investment. Strong wage growth can boost consumer spending but may also fuel inflation.

The Office for National Statistics (ONS) tracks these indicators and provides data to help assess financial risks. High inflation, for example, can erode purchasing power and lead to economic instability.

Unemployment rates and business confidence surveys are also important. Low unemployment typically supports financial stability, while high confidence can drive investment and growth.

Operational Resilience and Security

Financial firms face growing threats to their operations and data. Strong safeguards and response plans are crucial for weathering disruptions and protecting sensitive information.

Building Resilience in Financial Services

Operational resilience is vital for financial firms. It means being able to prevent, adapt to, and recover from disruptions. Firms must identify their important business services and set impact tolerances. These tolerances define how much disruption they can handle.

Testing is key. Firms should regularly test their ability to stay within impact tolerances. This helps find weak spots before real problems occur.

The UK's Financial Conduct Authority (FCA) requires firms to meet operational resilience rules by 31 March 2025. This gives time to make needed changes.

Non-bank financial institutions also need strong resilience. Their growing role in finance means their stability affects the whole sector.

Preventing and Responding to Data Breaches

Data breaches pose a major risk to financial firms. Strong security measures are essential to protect customer data and maintain trust.

Key steps for preventing breaches:

- Use robust encryption

- Train staff on security best practices

- Keep systems and software up-to-date

- Use multi-factor authentication

If a breach occurs, quick action is crucial. Firms should have a clear response plan ready. This plan should cover:

- Stopping the breach

- Assessing the damage

- Notifying affected parties

- Reporting to regulators

The Digital Operational Resilience Act (DORA) will apply from 2025. It aims to improve ICT security across EU financial firms. This shows the growing focus on digital resilience in the sector.

Frequently Asked Questions

The Office for National Statistics (ONS) plays a crucial role in financial risk assessment through its data collection and analysis. These FAQs explore key aspects of ONS insights and their impact on financial risk strategies.

What methodologies are used in ONS data collection for financial risk analysis?

ONS employs various methods to gather data for financial risk analysis. These include surveys, administrative data, and firm-wide risk assessments. The organisation uses both quantitative and qualitative approaches to ensure comprehensive coverage.

Surveys target businesses and households to collect economic indicators. Administrative data comes from government departments and other official sources.

How has the COVID-19 pandemic affected financial risk assessment strategies?

The pandemic has led to significant changes in financial risk assessment. ONS adapted its data collection methods to capture the rapidly changing economic landscape.

New indicators were introduced to measure the pandemic's impact on businesses and households. These include data on furlough schemes, business closures, and changes in consumer behaviour.

What are the latest developments in the Business Insights and Conditions Survey for risk assessment?

The Business Insights and Conditions Survey (BICS) has become a key tool for assessing financial risks. It provides timely data on business performance, workforce, prices, and trade.

Recent developments include questions on supply chain disruptions, energy prices, and Brexit impacts. The survey's frequency has increased to capture rapid economic changes.

How does ONS data contribute to government policy-making in financial risk management?

ONS data informs government decisions on financial risk management. Policymakers use ONS insights to assess economic trends and potential risks.

The data helps in developing national risk assessments for issues like money laundering and terrorist financing. It also supports the creation of targeted economic support measures.

What statistical tools are applied for financial risk assessment using ONS insights?

ONS uses advanced statistical tools for financial risk assessment. These include time series analysis, regression models, and machine learning algorithms.

Bayesian methods are employed to estimate uncertainty in economic forecasts. Monte Carlo simulations help assess the likelihood of various economic scenarios.

In what ways can ONS data be used to predict economic trends and mitigate financial risks?

ONS data helps predict economic trends through leading indicators and econometric models. These predictions allow businesses and policymakers to prepare for potential risks.

The data can identify emerging sectors and declining industries. This information aids in strategic planning and risk mitigation strategies for both public and private sectors.