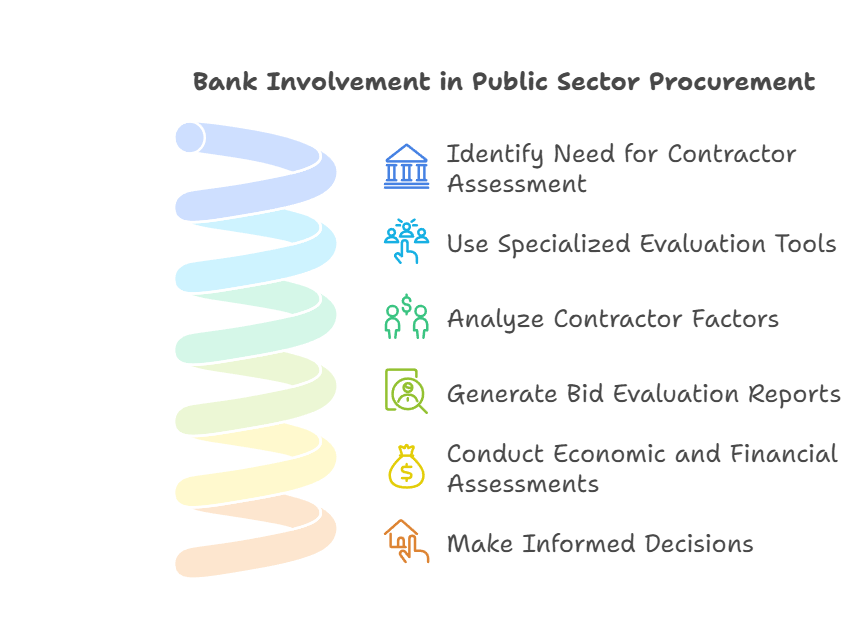

Banks play a crucial role in public sector procurement, often serving as financial partners for government projects. When evaluating contractors for these projects, banks need effective tools to assess potential risks and ensure compliance with regulations. Bid evaluation reports are essential tools that demonstrate the evaluation process has been performed properly and help banks make informed decisions.

Public sector organisations must consider various factors when assessing contractors, including financial stability, technical capability, and past performance. Banks can use specialised evaluation tools to analyse these aspects and determine the most suitable contractors for government projects. These tools often incorporate weighted criteria to ensure a fair and comprehensive assessment of each bidder.

Economic and financial standing assessments are particularly important for banks involved in public sector procurement. These evaluations help identify potential financial risks associated with contractors and protect the interests of both the bank and the public sector organisation.

Key Takeaways

- Banks use specialised evaluation tools to assess contractors for public sector projects

- Bid evaluation reports are crucial for demonstrating a proper assessment process

- Economic and financial standing assessments help identify potential risks in public procurement

Understanding Public Sector Procurement

Public sector procurement in the UK involves specific rules and processes for government bodies to purchase goods and services. It aims to ensure fairness, transparency, and value for money in public spending.

Principles of Public Procurement

Public procurement follows key principles to maintain integrity and efficiency. These include:

- Fair competition

- Value for money

- Transparency

- Non-discrimination

Contracting authorities must adhere to these principles when awarding contracts. They help ensure that taxpayers' money is spent wisely and that all suppliers have an equal chance to win contracts.

Public sector organisations like local authorities, emergency services, and housing associations must follow these principles. This helps build trust with stakeholders and promotes efficient use of public funds.

Public Contracts Regulations 2015

The Public Contracts Regulations 2015 set out the rules for public procurement in England, Wales, and Northern Ireland. They apply to contracts above certain value thresholds.

Key aspects of the regulations include:

- Advertising requirements

- Tender procedures

- Selection criteria

- Award criteria

These rules ensure a level playing field for all suppliers. They also promote transparency in the procurement process.

The regulations cover various public sector bodies, including central government, local authorities, and NHS trusts. They aim to create a fair and open market for public contracts.

Role of Contracting Authorities

Contracting authorities are public bodies responsible for carrying out procurement. They include:

- Central government departments

- Local councils

- NHS trusts

- Universities

These bodies must ensure their procurement practices comply with relevant laws and regulations. They are responsible for:

- Identifying needs

- Planning procurement strategies

- Managing tender processes

- Awarding contracts

- Contract management

Contracting authorities must also consider social value and sustainability in their procurement decisions. This helps ensure that public spending benefits the wider community.

Procurement Partnerships and Framework Agreements

Procurement partnerships and framework agreements are common in public sector procurement. They can help streamline the buying process and achieve better value for money.

Framework agreements are pre-arranged agreements with suppliers. They set out terms and conditions for future contracts. Benefits include:

- Faster procurement processes

- Reduced administrative burden

- Potential cost savings

Procurement partnerships involve multiple public sector bodies working together. This can lead to:

- Shared expertise

- Increased buying power

- Economies of scale

These approaches can be particularly useful for smaller organisations or those with limited procurement resources. They can help achieve national coverage and meet the needs of various stakeholders.

The Contractor Evaluation Process

The contractor evaluation process is crucial for banks in the public sector. It ensures they select the best suppliers for their projects. This process involves setting clear criteria, assessing bids, and using effective tools to measure financial health and risks.

Establishing Evaluation Criteria

Setting the right evaluation criteria is the first step in choosing contractors. Banks need to define what they're looking for in a supplier. This often includes:

• Experience and expertise

• Financial stability

• Quality of service

• Value for money

• Risk management approach

These criteria help banks identify the most economically advantageous tender (MEAT). It's important to note that MEAT isn't always the cheapest option. Banks must balance cost with quality and long-term value.

Tendering and Bid Evaluation

Once criteria are set, banks start the tendering process. This involves:

- Releasing a tender document

- Receiving bids from potential contractors

- Evaluating each bid against the set criteria

During evaluation, banks use a scoring system to rate each bid. This helps make the process fair and transparent. It's crucial to maintain confidentiality during evaluation to ensure fairness.

Tools and Methods for Effective Evaluation

Banks use various tools to evaluate contractors effectively. These might include:

• Weighted scoring matrices

• Financial ratio analysis

• Risk assessment frameworks

• Reference checks

These tools help banks compare bids objectively. They also allow for a thorough assessment of each contractor's strengths and weaknesses.

Some banks use software to streamline the evaluation process. This can help manage large amounts of data and ensure consistency in scoring.

Assessing Financial Viability and Risk

Financial health is a key factor in contractor selection. Banks need to assess the economic and financial standing of potential contractors.

This involves looking at:

• Financial statements

• Credit ratings

• Cash flow projections

• Debt levels

Banks also consider the risk of financial distress. They might use tools like the Altman Z-score to predict bankruptcy risk. It's important to balance financial stability with other criteria to get the best overall value.

Bank-Specific Considerations for Public Sector Contractor Evaluation

Banks face unique challenges when evaluating public sector contractors. They must balance regulatory requirements, financial risks, and long-term partnerships.

Compliance and Confidentiality Requirements

Banks must adhere to strict compliance and confidentiality standards when evaluating public sector contractors. This involves thorough background checks and security clearances for all parties involved.

Confidentiality agreements are crucial to protect sensitive financial information. Banks often use secure data rooms and encrypted communication channels during the evaluation process.

Best practices include implementing a 4-step call-off process:

- Initial screening

- Detailed assessment

- Reference checks

- Final approval

This structured approach helps ensure all regulatory requirements are met whilst maintaining confidentiality.

Banking Tools for Evaluation and Documentation

Banks utilise specialised tools to streamline contractor evaluation. These include:

- Risk assessment matrices

- Financial modelling software

- Compliance tracking systems

- E-signature tools for secure document handling

These tools help banks analyse contractor qualifications, financial stability, and past performance. They also facilitate efficient documentation and record-keeping.

Many banks have adopted digital platforms that centralise the evaluation process. These systems often integrate with existing banking software, allowing for seamless data exchange and analysis.

Managing Financial Transactions and Contract Values

Banks must carefully assess contract values and financial transactions when working with public sector contractors. This involves:

- Analysing proposed budgets

- Evaluating cost-effectiveness

- Assessing potential risks and rewards

Banks often use benchmarking tools to compare contract values against industry standards. They may also employ financial stress testing to gauge a contractor's ability to handle project fluctuations.

It's crucial for banks to establish clear payment terms and schedules. This helps mitigate financial risks and ensures smooth project execution.

Building Sustainable Relationships with Contractors

Developing long-term partnerships with reliable contractors is key for banks in the public sector. This involves:

- Regular performance reviews

- Open communication channels

- Collaborative problem-solving approaches

Banks often establish preferred supplier lists to streamline future collaborations. This helps build trust and efficiency in the contractor-bank relationship.

Sustainability is also a growing concern. Banks increasingly consider a contractor's environmental and social impact as part of their evaluation process.

By fostering sustainable relationships, banks can reduce evaluation costs over time and improve project outcomes.

Tools and Technologies in Contractor Evaluation

Banks use several tools and technologies to evaluate public sector contractors. These tools help banks assess eligibility, costs, and quality while streamlining the evaluation process.

Eligibility Checkers and Cost Matrices

Eligibility checkers are vital tools for banks to screen contractors quickly. These digital tools use pre-set criteria to determine if a contractor meets basic requirements. This saves time by filtering out unsuitable candidates early on.

Cost matrices help banks compare contractor bids easily. These spreadsheets or software tools break down costs into categories. Banks can see how each bid stacks up in terms of labour, materials, and other expenses.

Price and quality are key factors in these tools. Banks use them to find the best value for money, not just the lowest price.

Should Cost Modelling and Sourcing Playbook

Should cost modelling helps banks estimate fair project costs. This tool uses market data and past projects to create a baseline. Banks can then compare contractor bids to this baseline.

The sourcing playbook is a guide for the whole evaluation process. It outlines steps, best practices, and decision-making frameworks. Banks use this to ensure a fair and thorough evaluation.

These tools help the evaluation team stay objective. They provide a standard approach for assessing all bids.

E-signature Tools for Efficient Document Management

E-signature tools speed up the contract process. They allow banks and contractors to sign documents digitally. This cuts down on paperwork and speeds up approvals.

These tools often include features for tracking document status. Banks can see who has signed and who still needs to review documents.

E-signature tools also improve security. They use encryption to protect sensitive information in contracts.

Utilising Evaluation Reports and Software

Evaluation reports are crucial for documenting the selection process. They detail how banks scored each contractor and why they made their final choice.

Software tools help banks create these reports easily. They can pull in data from other evaluation tools to create a complete picture.

These reports are important for transparency. They show that the bank followed a fair process in choosing a contractor.

Some software tools also offer analytics. Banks can use these to spot trends in contractor performance over time.

Contract Award and Performance Monitoring

Public sector banks need robust systems to award contracts and track contractor performance. Key factors include clear selection criteria, ongoing monitoring, and quality assurance practices.

Criteria for Contract Award

Banks must use fair and transparent criteria when awarding public sector contracts. Compliance with regulations is crucial. Important factors include:

- Financial stability of the contractor

- Relevant experience and expertise

- Proposed methodology and approach

- Value for money

- Risk management plans

A scoring matrix can help evaluate bids objectively. Banks should weight criteria based on project priorities. They must document the selection process thoroughly.

Interviews with shortlisted contractors allow for clarification of proposals. Site visits may be necessary for construction projects. References from past clients provide valuable insights into contractor capabilities.

Monitoring Contractor Performance

Once a contract is awarded, ongoing performance monitoring is essential. Banks should:

- Set clear key performance indicators (KPIs)

- Conduct regular progress meetings

- Require detailed reports on milestones and deliverables

- Use site inspections for construction work

- Track financial performance against the agreed budget

Contract managers play a vital role in overseeing contractor activities. They must flag issues promptly and work with contractors to resolve problems.

Digital tools can streamline monitoring processes. These may include project management software, real-time reporting dashboards, and automated alert systems for missed deadlines or budget overruns.

Best Practices in Contractor Delivery

To ensure successful project delivery, banks should:

- Establish clear communication channels

- Define roles and responsibilities upfront

- Implement a change management process

- Encourage innovation and problem-solving

- Foster a collaborative working relationship

Regular review meetings help keep projects on track. Banks should create a culture of continuous improvement, seeking feedback from contractors and end-users.

Risk management is crucial. Contractors must identify potential issues early and develop mitigation strategies. Banks should maintain contingency plans for critical projects.

Ensuring Quality and Compliance in Public Works

Quality assurance is paramount in public sector projects. Banks must:

- Set rigorous quality standards in contract specifications

- Require contractors to follow industry best practices

- Implement quality control checks at key project stages

- Use independent inspectors for complex or high-risk work

- Ensure compliance with health and safety regulations

Performance bonds can protect banks against contractor non-performance. These are especially useful in construction projects.

Banks should maintain detailed records of quality issues and resolutions. This data informs future contractor selections and helps refine quality standards over time.

Training programmes for bank staff and contractors can improve overall project quality and compliance. Regular audits ensure adherence to agreed standards and procedures.

Frequently Asked Questions

Public sector contractor evaluation for banks involves specific criteria and processes. These FAQs cover key aspects of assessment, bid evaluation, and framework agreements in the banking industry.

What criteria are typically used in the assessment of a contractor's economic and financial standing for bank projects?

Banks often look at a contractor's financial stability and insurance coverage. Public Liability Insurance is crucial, as it covers injuries to customers or the public.

Contractors may need to provide financial statements and proof of adequate insurance. Credit ratings and past performance on similar projects are also considered.

How do bid evaluation methods differ when applied to public sector contracts as opposed to private sector deals?

Public sector contracts follow stricter guidelines and transparency requirements. They often use a standardised evaluation process to ensure fairness.

Private sector deals may have more flexibility in their evaluation methods. Public sector evaluations typically involve scoring systems and must comply with regulations like the Public Contracts Regulations 2015.

Can you outline the 'Price per Quality Point' evaluation process in the context of banking sector procurements?

The 'Price per Quality Point' method balances cost and quality in bid evaluations. In banking procurements, bids are scored on quality criteria relevant to financial services.

The total price is divided by the quality score to determine value for money. This approach helps identify bids offering the best combination of quality and cost-effectiveness.

In what circumstances would a contracting authority re-assess a supplier when calling off from a public sector framework?

Re-assessment may occur if significant time has passed since the initial framework evaluation. Changes in a supplier's financial status or performance record could trigger a review.

Contracting authorities might also re-assess if the specific call-off requires additional or different capabilities not fully covered in the original framework assessment.

What key factors should be considered when evaluating bids for public sector banking services?

Evaluators should consider the bidder's financial stability, regulatory compliance, and technological capabilities. Experience in handling public sector accounts is crucial.

Risk management strategies and data security measures are also important factors. The ability to provide tailored services for public entities like pension funds should be assessed.

How does the CCS bronze contract classification impact contractor evaluations in the banking industry?

The CCS bronze classification sets a baseline for contractor capabilities. In banking, this classification may influence the initial screening of potential suppliers.

Contractors with bronze status meet minimum requirements, but banks may seek higher classifications for more complex or sensitive projects. The classification helps streamline the evaluation process for standard banking services.