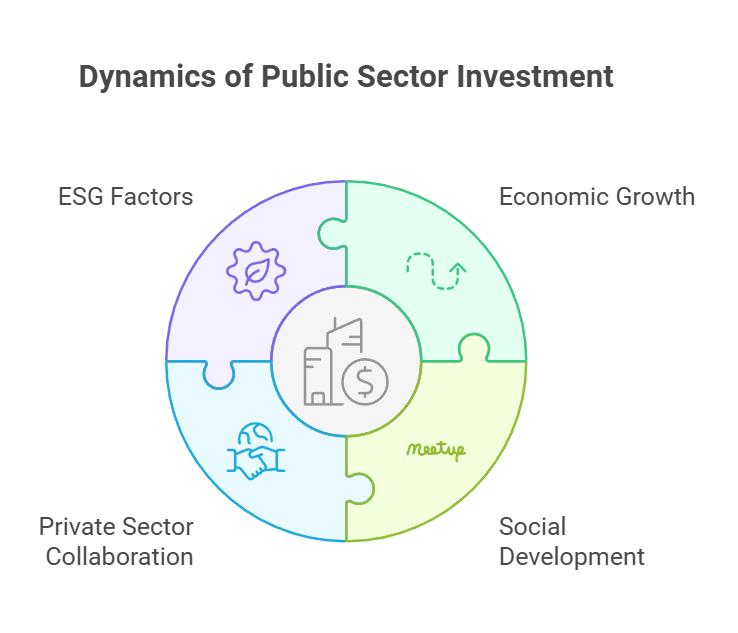

Public sector investment plays a crucial role in driving economic growth and social development. The UK government is actively seeking ways to modernise education through technology and improve public services. This creates exciting opportunities for private investors to partner with the public sector and contribute to meaningful projects.

The public sector spent over £385 billion on procurement in 2022-2023, making up nearly a third of all public spending. This massive expenditure presents a wealth of investment possibilities across various sectors. From education technology to infrastructure and renewable energy, there are numerous areas where private capital can make a significant impact.

Environmental, social, and governance (ESG) factors are becoming increasingly important to private investors. The public sector is well-positioned to align with these priorities, offering projects that deliver both financial returns and positive societal outcomes. By fostering collaboration between public and private entities, the UK aims to create a robust investment climate that benefits all stakeholders.

Key Takeaways

- Public sector investment opportunities span various sectors, including education, infrastructure, and technology

- Collaboration between public and private entities can drive economic growth and social development

- ESG considerations are shaping investment priorities in the public sector

The Role of Public Investment in Economic Development

Public investment plays a crucial part in driving economic progress and national prosperity. It shapes infrastructure, fosters innovation, and creates opportunities for sustainable growth across sectors.

Stimulating Economic Growth

Public investment acts as a powerful engine for economic growth. It boosts GDP and job creation by funding large-scale projects like transport networks, energy systems, and digital infrastructure. These investments reduce business costs and increase productivity.

Government spending on education and healthcare improves human capital. This leads to a more skilled workforce and higher labour productivity. Public research funding sparks innovation in key industries.

During economic downturns, public investment can provide a vital stimulus. It maintains demand and supports employment when private sector spending falls. This helps stabilise the economy and speed up recovery.

Advancing National Wealth Fund Goals

National wealth funds use public investment to grow long-term assets. They invest in domestic projects and global markets to build financial reserves. These funds aim to generate returns that benefit future generations.

Many funds focus on strategic sectors like energy, technology, and infrastructure. They may take stakes in promising companies or fund major development projects. This approach helps diversify the economy and reduce reliance on single industries.

Wealth funds also invest abroad to spread risk and gain exposure to global growth. They often seek stable, long-term returns from a mix of assets. This strategy helps preserve and grow national wealth over time.

Supporting Sustainable Growth Initiatives

Public investment is key to achieving sustainable development goals. It funds clean energy projects, green transport, and eco-friendly urban planning. These initiatives cut carbon emissions and protect natural resources.

Investments in water management and sustainable agriculture boost food security. They help communities adapt to climate change impacts. Public funds also support research into new green technologies.

Social investments promote inclusive growth. They improve access to education, healthcare, and housing. This reduces inequality and creates a more stable economic foundation. By focusing on sustainability, public investment helps build a resilient, future-proof economy.

Public and Private Sector Synergy

The collaboration between public and private sectors creates powerful opportunities for economic growth and development. This partnership combines governmental resources with private sector innovation and capital to drive progress.

Leveraging Private Investment

Private sector investment plays a crucial role in supporting public sector initiatives. Companies are increasingly seeking ways to align their investments with environmental, social, and governance (ESG) frameworks.

Public projects often attract private funding due to their potential for long-term returns and social impact. For example, infrastructure developments like roads, railways, and renewable energy projects can benefit from private capital.

By tapping into private investment, the public sector can accelerate project timelines and reduce the burden on taxpayers. This approach also brings in private sector expertise and efficiency to public endeavours.

Blended Finance Models

Blended finance combines public and private capital to achieve development goals. This model helps mitigate risks for private investors while ensuring public objectives are met.

Key elements of blended finance include:

- Risk-sharing mechanisms

- Concessional funding

- Technical assistance

These structures enable projects that might otherwise struggle to secure funding. For instance, green energy initiatives often use blended finance to attract investors while promoting sustainability.

Blended finance can also address market failures and support projects in emerging markets where traditional financing might be scarce.

Venture Capital and Institutional Investment Partnerships

Venture capital and institutional investors are increasingly partnering with the public sector to drive innovation and economic growth. These partnerships often focus on sectors like technology, healthcare, and clean energy.

Government programmes can provide seed funding or matching investments to attract venture capital to early-stage companies. This approach helps nurture start-ups and emerging industries.

Institutional investors, such as pension funds, are also exploring public-private partnerships. They seek stable, long-term returns from infrastructure and other public projects.

These collaborations can lead to:

- Job creation

- Technological advancements

- Improved public services

By working together, the public sector and institutional investors can achieve both financial returns and societal benefits.

Sector-Specific Investment Opportunities

The UK public sector offers diverse investment prospects across key areas. These opportunities aim to boost economic growth, improve public services, and address societal challenges.

Infrastructure and Transport

The UK government has committed over £100 billion to public sector investment in infrastructure and transport. This includes:

- High-speed rail projects like HS2

- Road network improvements

- Port and airport expansions

- Digital infrastructure upgrades

Private investors can participate through public-private partnerships (PPPs) or by investing in companies involved in these projects. The focus is on enhancing connectivity, reducing travel times, and supporting regional development.

Healthcare and Education

Healthcare and education sectors present significant investment opportunities:

- New hospital construction and modernisation

- Medical research facilities

- School building programmes

- University expansion projects

These investments aim to improve public services and support the UK's knowledge economy. Private capital can fund innovative technologies, such as telemedicine platforms or e-learning solutions.

Housing and Urban Regeneration

The housing and urban regeneration sector offers various investment avenues:

- Affordable housing developments

- Brownfield site redevelopment

- Town centre rejuvenation projects

- Mixed-use urban developments

Investors can engage through real estate investment trusts (REITs) or direct property investments. These projects often align with environmental, social, and governance (ESG) factors, which are increasingly important to private investors.

Defence and Security

Defence and security investment opportunities include:

- Cybersecurity infrastructure

- Advanced military equipment

- Border control technologies

- Emergency response systems

Private investors can participate by investing in defence contractors or technology firms specialising in security solutions. These investments support national security and often drive innovation in dual-use technologies.

Clean Energy and Environmental Sustainability

The clean energy sector offers substantial investment potential:

- Offshore wind farms

- Solar power projects

- Green hydrogen production

- Energy storage solutions

The UK's Green Prosperity Plan aims to attract private capital into clean energy industries. Investors can benefit from government incentives and growing demand for renewable energy solutions. These projects contribute to the UK's net-zero carbon emissions target and support job creation in emerging green industries.

Implementing Strategic Initiatives

The UK government has launched key programmes to boost economic growth and reduce regional inequalities. These initiatives focus on levelling up, industrial innovation, and local development.

The Levelling Up Agenda

The Levelling Up agenda aims to spread opportunity more evenly across the UK. It targets areas like education, health, and infrastructure. The programme includes:

• £4.8 billion for town centre regeneration

• £26 billion for road improvements

• £5 billion for bus services and cycling

Skills development is a key focus. The government is investing in technical education and apprenticeships. This helps local workforces adapt to changing industries.

The New Hospitals Programme is part of this agenda. It will build 40 new hospitals by 2030. This improves healthcare access in underserved regions.

UK's Industrial Strategy and Innovation

The Industrial Strategy supports key sectors and emerging technologies. It aims to boost productivity and create high-value jobs. Focus areas include:

• Artificial intelligence and data

• Clean growth

• Future of mobility

• Ageing society

The strategy invests in research and development. It encourages collaboration between universities and businesses. This helps turn innovative ideas into commercial products.

Local Enterprise Partnerships play a crucial role. They identify regional strengths and direct funding to promising projects.

Local Economic Growth and Devolution

Devolution gives local areas more control over economic decisions. Combined authorities and elected mayors have new powers over:

• Transport

• Skills training

• Business support

The UK Shared Prosperity Fund supports local growth projects. It replaces EU structural funds after Brexit. Local governments can use this money for:

• Small business support

• Employment programmes

• Community development

City deals provide tailored funding packages. They target specific local needs and opportunities. This approach recognises that different regions face unique challenges.

Regulatory Framework and Investment Climate

Public sector investment opportunities are shaped by legal structures, government support, and economic conditions. These factors create a foundation for successful investments and drive economic growth.

Ensuring Rule of Law and Transparency

The UK government has put measures in place to uphold the rule of law and boost transparency in public sector investments. These efforts aim to build trust and attract investors.

Clear legal frameworks protect investor rights and assets. They also set out dispute resolution processes. This gives investors confidence their interests will be safeguarded.

Transparency initiatives include public disclosure of climate-related financial risks by large companies and financial firms. This helps investors make informed decisions about climate impacts.

Regular audits and reports on public projects further enhance transparency. They allow scrutiny of how public funds are used and the outcomes achieved.

Investment Support by Government Bodies

The UK has established dedicated bodies to support and guide public sector investments. These organisations play a crucial role in facilitating projects and attracting capital.

The Office for Investment, for example, works to identify and promote investment opportunities. It acts as a single point of contact for investors, streamlining the process.

Other bodies provide expertise in specific sectors like infrastructure or green energy. They help develop project pipelines and connect investors with suitable opportunities.

These support structures aim to reduce barriers to investment and improve project outcomes. They offer guidance on regulations, funding sources, and best practices.

Planning and Regulation Reforms

Recent reforms have aimed to streamline planning processes and update regulations. These changes seek to speed up project approvals and reduce unnecessary red tape.

Digital planning tools have been introduced to make the system more efficient. They allow for faster processing of applications and better data sharing between agencies.

Regulatory updates focus on balancing investor needs with public interests. New rules in areas like environmental protection aim to provide clear guidelines while promoting sustainable development.

Efforts are also being made to harmonise regulations across different regions. This creates a more consistent investment environment throughout the country.

Economic Stability in Post-Covid-19 Scenario

The UK economy has shown resilience in the face of Covid-19 challenges. Recovery efforts have focused on creating a stable environment for public sector investments.

Fiscal policies have been adjusted to support key sectors and maintain economic stability. This includes targeted spending on infrastructure and green initiatives to drive growth.

Monetary policies have helped manage inflation and maintain low interest rates. This creates favourable conditions for long-term investment projects.

The government has also introduced measures to boost skills and innovation. These efforts aim to enhance productivity and competitiveness in the post-pandemic economy.

Climate-related investment frameworks are being developed to guide future spending. This ensures public investments align with long-term sustainability goals.

Fostering Collaboration and Partnerships

The UK government is actively promoting partnerships to drive investment in infrastructure and boost economic growth. These efforts involve key institutions, stakeholders, and international cooperation.

The Role of the UK Infrastructure Bank

The UK Infrastructure Bank plays a crucial role in fostering public-private partnerships. It provides:

- Financing for large-scale projects

- Advisory services to local authorities

- Support for innovative green technologies

The bank aims to crowd in private investment by taking on some of the risks associated with major infrastructure initiatives. This approach helps to unlock capital and expertise from the private sector.

Engagement with Stakeholders and Developers

Effective collaboration requires strong engagement with various stakeholders. The government works to:

- Hold regular consultations with industry experts

- Create forums for knowledge sharing

- Develop clear guidelines for project proposals

Developers benefit from this engagement through:

- Better understanding of policy priorities

- Access to public sector resources

- Opportunities to shape future infrastructure plans

This collaborative approach helps ensure that projects align with both public needs and private sector capabilities.

Facilitating International Trade and Investment

The Department for Business and Trade leads efforts to attract inward investment and promote UK expertise abroad. Key initiatives include:

- Trade missions to showcase UK infrastructure capabilities

- Support for UK firms bidding on international projects

- Streamlined processes for foreign investors

Despite economic uncertainty, the UK remains an attractive destination for infrastructure investment. The government's commitment to stability and innovation helps maintain investor confidence.

Programmes and Initiatives for Investment

The UK government has launched several key programmes to boost public sector investment. These initiatives aim to drive economic growth, create jobs, and support sustainable development across the nation.

National and Local Growth Plans

National and local growth plans form the backbone of the UK's investment strategy. The government has set out ambitious targets for regional development and economic renewal.

These plans focus on reducing disparities between different parts of the country. They aim to create high-skilled jobs and improve living standards in underperforming areas.

Local authorities play a crucial role in implementing these plans. They work closely with businesses and community groups to identify investment priorities.

Key sectors targeted for growth include technology, green energy, and advanced manufacturing. The plans also emphasise the importance of improving transport links and digital infrastructure.

Infrastructure Projects Delivery

The delivery of large-scale infrastructure projects is vital for the UK's long-term economic success. The government has committed significant funds to upgrade the nation's transport, energy, and digital networks.

Major projects include:

- HS2 high-speed rail network

- Crossrail in London

- Offshore wind farm developments

- 5G network rollout

These projects create thousands of jobs and provide opportunities for UK businesses. They also help to attract private investment into the public sector.

The government has established specialised units to oversee project delivery. These units work to ensure projects are completed on time and within budget.

The British Business Bank and Job Creation

The British Business Bank plays a key role in supporting small and medium-sized enterprises (SMEs). It provides finance and advice to help businesses grow and create jobs.

The bank offers a range of programmes, including:

- Start Up Loans for new entrepreneurs

- Enterprise Finance Guarantee to help SMEs access bank loans

- Regional funds to support businesses in specific areas

These initiatives have helped create thousands of jobs across the UK. They have been particularly important in supporting businesses during economic downturns.

The bank also works to improve access to finance for innovative and high-growth companies. This helps to drive productivity and competitiveness in key sectors.

Carbon Capture and Storage Investment

Investment in carbon capture and storage (CCS) is a crucial part of the UK's strategy to reach net-zero emissions. The government has committed significant funds to develop this technology.

Key CCS projects include:

- The East Coast Cluster in Teesside and Humberside

- HyNet North West in Liverpool Bay

- Acorn Project in Scotland

These projects aim to capture millions of tonnes of CO2 annually. They will help to decarbonise heavy industry and create new jobs in the green economy.

The government is working with private investors to fund these projects. This partnership approach helps to share risks and accelerate technology development.

Evaluating Economic and Social Impacts

Assessing the outcomes of public sector investments involves examining both economic and social factors. These evaluations help determine the effectiveness and value of government spending across various areas.

Measuring Productivity and Growth

Public sector investments can boost productivity and economic growth. Key metrics include:

- GDP growth rates

- Job creation figures

- Industry expansion data

Economists track these indicators to gauge the impact of government spending. For example, infrastructure projects often lead to increased economic activity and job opportunities.

Productivity improvements may stem from better transport links or enhanced digital connectivity. These investments can reduce business costs and improve efficiency across sectors.

Social Benefits and Public Services Improvement

Evaluating social impacts focuses on how investments enhance public welfare. This includes:

- Healthcare outcomes

- Education attainment levels

- Crime reduction rates

Measuring social value in public projects helps quantify non-financial benefits. For instance, improved healthcare facilities may lead to better patient outcomes and reduced waiting times.

Investments in public transport can increase mobility for disadvantaged groups. This might result in better access to jobs and services, improving overall quality of life.

Investment and Skills Enhancement

Public sector investments often aim to boost workforce skills and capabilities. This can involve:

- Funding for vocational training programmes

- Support for apprenticeships

- Investments in higher education facilities

The impact of these initiatives can be measured through:

- Skill level assessments

- Employment rates in targeted sectors

- Wage growth in related industries

Developing a skilled workforce supports long-term economic growth and competitiveness. It can also lead to innovation and productivity gains across various sectors of the economy.

Frequently Asked Questions

Public sector investment opportunities offer various ways for individuals and organisations to engage with government-funded projects. These initiatives span multiple sectors and regions, providing diverse options for potential investors.

What constitutes a public sector investment opportunity?

A public sector investment opportunity involves putting money into projects or ventures backed by the government. These can include infrastructure developments, social programmes, or economic growth initiatives. The Ayrshire Growth Deal is an example, with £251.5 million committed to boost sectors like aerospace and tourism.

How can individuals participate in investment opportunity funds in the UK?

Individuals can take part in UK investment funds through various channels. Some options include buying government bonds, investing in public-private partnerships, or contributing to local authority investment schemes. It's crucial to research and understand the risks and potential returns before committing funds.

What are the characteristics of investment zones, and how do they affect public investment?

Investment zones are designated areas that receive special economic incentives to attract businesses and boost growth. These zones often feature tax breaks, simplified planning processes, and targeted funding. They aim to stimulate local economies and create jobs, which can lead to increased public and private investment in the area.

What role does the National Wealth Fund play in public sector investments?

The National Wealth Fund is a government-backed entity that manages and invests in strategic assets. It focuses on long-term economic growth and stability. The fund can support large-scale public projects, invest in emerging industries, and help diversify the nation's economic portfolio.

Can you outline the four main types of investment opportunities in the public domain?

The four main types of public investment opportunities are:

- Infrastructure projects (e.g., transport, energy, telecommunications)

- Social programmes (e.g., healthcare, education, housing)

- Research and innovation initiatives

- Environmental and sustainability projects

Each type offers different risk profiles and potential returns for investors.

What sectors are currently experiencing significant growth and present viable public investment opportunities?

Several sectors are showing strong growth and investment potential in the public domain. These include:

- Renewable energy and green technologies

- Digital infrastructure and smart cities

- Healthcare and life sciences

- Advanced manufacturing and aerospace

These sectors often benefit from government support and funding, making them attractive for public sector investment.