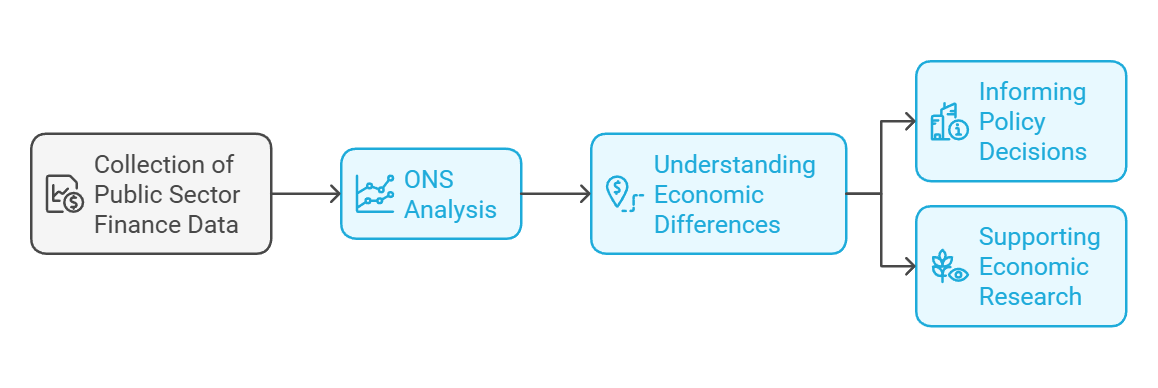

Regional public sector data provides valuable insights into government finances across different areas of the UK. These statistics offer a detailed look at revenue, expenditure and fiscal balances for each country and region. The country and regional public sector finances data reveals how public money is collected and spent across the UK.

This information helps policymakers and researchers understand economic differences between regions. It can show which areas contribute more in taxes and which receive more in public spending. The data also highlights variations in public services and infrastructure investment across the country.

The Office for National Statistics (ONS) produces these figures annually. They use a range of data sources to create a comprehensive picture of regional public finances. The ONS is always working to improve the timeliness and granularity of this data to provide even more useful insights.

Key Takeaways

- Regional finance data reveals public spending and revenue patterns across the UK

- The ONS produces annual statistics on country and regional public sector finances

- This information helps inform policy decisions and economic research

The Importance of Public Sector Data

Public sector data plays a vital role in shaping government policies and improving services. It underpins transparency, accountability, and public trust in democratic institutions.

Principles of Transparency and Governance

Data-driven decision making is crucial for effective governance. Public sector organisations can use data to enhance service delivery and make efficiency savings.

Open data policies promote transparency. They allow citizens to access and analyse government information, fostering accountability.

Data governance frameworks are essential. These ensure data quality, security, and ethical use within public institutions.

Proper data management helps identify trends and patterns. This enables evidence-based policymaking and targeted interventions in areas such as healthcare and education.

Impact on Democracy and Public Trust

Access to public sector data strengthens democratic processes. It empowers citizens to make informed decisions and participate actively in governance.

Open data initiatives build trust between government and citizens. They demonstrate a commitment to openness and accountability.

Data transparency can expose corruption and inefficiencies. This leads to improved public services and more efficient use of taxpayer money.

Citizen engagement increases when data is readily available. People can contribute to policy discussions and hold officials accountable based on factual information.

Public trust grows when government decisions are backed by solid data. This creates a more stable and effective democratic system.

Regional Public Sector Finances Overview

The UK's regional public sector finances provide crucial insights into government spending and revenue across different areas. This data helps inform policy decisions and resource allocation at national and local levels.

Understanding the Public Sector Finance Framework

Public sector finances encompass government revenue, expenditure, and fiscal balances across the UK's countries and regions. The Office for National Statistics (ONS) produces these statistics to ensure consistency with UK-wide public sector finance data.

The framework breaks down revenue sources like taxes and spending categories such as healthcare and education. It also calculates net fiscal balances for each area.

This data allows for comparisons between regions and helps identify areas that may need additional support or investment. It's a valuable tool for policymakers and researchers analysing regional economic disparities.

The Role of HM Treasury and HM Revenue and Customs

HM Treasury plays a key role in overseeing regional public sector finances. It sets overall fiscal policy and allocates budgets to different government departments and devolved administrations.

HM Revenue and Customs (HMRC) is responsible for collecting taxes and other revenues. It works closely with the Treasury to provide accurate revenue figures for each region.

Together, these departments ensure the government has a clear picture of regional financial performance. This information guides decisions on:

- Funding allocations

- Tax policy

- Economic development initiatives

Their work is crucial for maintaining fiscal stability and promoting balanced growth across the UK.

Country and Regional Analysis

The UK government tracks public sector finances across different regions to understand economic patterns. This data reveals important differences in spending and revenue generation between areas like London, Northern Ireland, and the South East.

Identifying Trends in Financial Health Across Regions

Public sector finances vary significantly between UK regions. London and the South East consistently show net fiscal surpluses, while other areas often run deficits.

Northern Ireland typically has higher public spending per person compared to other regions. This reflects unique economic challenges and historical factors.

The Country and Regional Analysis provides detailed breakdowns of identifiable expenditure by function for each area. This helps policymakers target resources effectively.

Recent trends show widening gaps between prosperous and struggling regions. Some areas face persistent economic difficulties despite increased public investment.

Comparison of Expenditure Per Head and Revenue Generation

Expenditure per head differs markedly across the UK. Scotland and Northern Ireland generally see higher levels of public spending per person than England or Wales.

Revenue generation also varies:

- London produces the highest tax receipts per capita

- The South East is another strong revenue generator

- Northern Ireland typically has lower tax revenue per person

These differences stem from factors like:

- Economic activity levels

- Population demographics

- Industrial composition

The country and regional public sector finances data helps illustrate fiscal imbalances between areas that receive more in public spending than they generate in tax revenue, and those that are net contributors to the Treasury.

Details of Revenue and Expenditure

Public sector finances involve complex revenue streams and expenditure patterns across UK regions. These figures shed light on economic activities and government priorities.

Public Sector Revenue Sources

Public sector revenue comes from various taxes and other income. Income tax is a major contributor, with rates varying based on earnings. VAT adds to the coffers through consumption.

Council tax funds local services, while non-domestic rates apply to businesses. North Sea oil and gas revenue fluctuates with market prices and production levels.

Other sources include:

- National Insurance contributions

- Fuel duty

- Inheritance tax

- Capital gains tax

Revenue patterns differ across regions. London and the South East often generate higher income tax receipts due to wage differences.

Insights into Public Sector Expenditure and Investments

Public sector expenditure covers a wide range of services and investments. Health spending is typically the largest category, funding the NHS and related programmes.

Education is another key area, including schools and universities. Local government expenditure varies by region, covering services like waste collection and social care.

Transport infrastructure receives significant investment, especially in urban areas. Defence spending, while centrally managed, impacts different regions through bases and contracts.

Other major expenditure areas include:

- Welfare and pensions

- Public order and safety

- Housing and community amenities

Regional spending often reflects local needs and political priorities. Scotland, Wales, and Northern Ireland have distinct budgeting processes due to devolution.

Fiscal Balance and Economic Performance

The fiscal balance of regions and countries within the UK varies significantly. This impacts economic performance and growth across different areas.

Net Fiscal Deficit vs. Surplus

Most UK regions operate with a net fiscal deficit. This means they receive more in public spending than they generate in revenue.

Only London and the South East consistently show a net fiscal surplus. These regions contribute more to the Treasury than they receive in spending.

The East of England sometimes joins London and the South East in surplus. All other regions run deficits of varying sizes.

Scotland's position is unique. Its deficit has decreased recently, unlike most other regions.

Influence of Public Finances on GDP

A region's fiscal balance can affect its economic growth and gross domestic product. Areas with fiscal surpluses often see stronger economic performance.

London and the South East's surpluses allow for greater investment. This helps boost their GDP and economic growth.

Regions with large deficits may struggle to fund local services and infrastructure. This can limit their economic potential.

However, deficit spending can stimulate growth in the short term. It may boost employment and business activity.

Balancing fiscal targets with economic performance is a key challenge for policymakers. They must consider both regional and national needs.

Employment and Labour Market Insights

The UK labour market shows varied trends across regions, with employment rates and earnings differing significantly. Skills development plays a crucial role in shaping economic outcomes and job prospects.

Employment Rates and Average Earnings Statistics

Employment rates in the UK differ by region. London and the South East typically have higher employment levels compared to other areas. Northern Ireland often has lower rates.

Average earnings also vary. Workers in London earn more on average than those in other regions. The North East and Wales tend to have lower average salaries.

The Department for Work and Pensions tracks these statistics. They use data to shape policies aimed at boosting employment.

Devolved administrations in Scotland, Wales, and Northern Ireland have some control over employment policies. This can lead to different approaches across the UK.

Skills Development and Its Economic Impact

Skills development is key to economic growth. Regions with higher skill levels often see better economic outcomes.

Industries require different skill sets. The tech sector, for example, needs workers with digital skills. Manufacturing needs technical expertise.

• Skills in demand:

- Digital literacy

- Problem-solving

- Adaptability

- Technical skills

Programmes to improve skills can boost productivity. They can also help workers move into higher-paying jobs.

The government and private sector both invest in skills training. This investment aims to close skills gaps and support economic growth.

Regions with successful skills programmes often see improved employment rates. They may also attract more businesses, creating a positive economic cycle.

Education and Public Sector Involvement

Public sector involvement in education shapes regional development through targeted investments and policy initiatives. The impact of these efforts can be seen in educational outcomes and economic growth across different areas.

Analysis of Public Sector Investment in Education

Public sector investment in education varies widely across regions. Local authorities play a crucial role in allocating resources to schools and educational programmes. In some areas, funding focuses on early years education, while others prioritise secondary or vocational training.

Recent data shows that urban centres often receive higher per-pupil funding compared to rural areas. This disparity can affect teacher recruitment and retention, as well as access to advanced learning materials.

Investments in educational technology have increased, with many regions implementing digital learning platforms. These tools aim to bridge gaps in remote and underserved communities.

Outcomes of Educational Funding on Regional Growth

The link between education funding and regional growth is complex but significant. Areas with higher public sector investment in education often see improved skill levels in the workforce.

Research indicates that regions with strong educational outcomes tend to attract more businesses and innovation. This leads to job creation and economic diversification.

Universities and research institutions, supported by public funds, contribute to regional development through knowledge transfer and industry partnerships. These collaborations often result in new technologies and start-up companies.

However, the benefits of educational investment are not always immediate. Long-term studies show that sustained funding over decades produces the most significant regional economic impacts.

Healthcare Sector Analysis

The healthcare sector faces varying challenges across regions. Public health expenditure and healthcare quality differ based on local factors. Access to services also varies widely between urban and rural areas.

Regional Variations in Public Health Expenditure

Public health spending differs greatly between regions in the UK. Urban areas often receive more funding per capita than rural regions. This impacts the services available to residents.

Integrated care systems aim to improve resource allocation. These partnerships between health, social care, and public health sectors coordinate local services. The goal is to reduce inequalities in health expenditure.

Factors affecting regional spending include:

- Population density

- Age demographics

- Local health needs

- Economic conditions

Areas with ageing populations typically require higher health expenditure. Deprived regions may need more funding to address complex health issues.

Assessment of Healthcare Quality and Access

Healthcare quality and access vary across the UK. Urban areas often have better access to specialist services. Rural regions may struggle with longer wait times and limited options.

Data and analytics play a crucial role in assessing healthcare quality. They help identify gaps in service provision and areas for improvement.

Key indicators of healthcare quality include:

- Patient outcomes

- Waiting times

- Staff-to-patient ratios

- Patient satisfaction scores

Access issues persist in some areas. Transport links, digital connectivity, and local service availability all impact access. Telemedicine is helping bridge some gaps, especially in remote regions.

Quality improvement initiatives focus on standardising care across regions. This aims to reduce postcode lotteries in healthcare provision.

Business and Industry Insights

The public sector plays a crucial role in shaping the business landscape and supporting various industries. It provides essential resources, policies, and infrastructure to foster economic growth and development.

Government's Role in Business Development

The government actively supports business development through various initiatives. It offers financial incentives to encourage investment and job creation. These may include tax breaks, grants, and low-interest loans.

Public sector agencies also provide training programmes to enhance workforce skills. They focus on areas like digital literacy, management, and technical expertise.

Infrastructure development is another key area. The government invests in transport networks, broadband, and energy systems to create a conducive business environment.

Regulatory frameworks are established to ensure fair competition and protect consumer interests. These rules help maintain a stable market and promote innovation.

Industry-Specific Public Sector Support Mechanisms

Different industries receive tailored support from the public sector. In manufacturing, the government might offer research and development funding to boost innovation and competitiveness.

For the technology sector, public-private partnerships are common. These collaborations aim to develop cutting-edge solutions and attract global talent.

In agriculture, subsidies and crop insurance programmes help farmers manage risks and maintain food security.

The tourism industry benefits from promotional campaigns and infrastructure development in key destinations.

Healthcare receives support through public research funding and workforce training initiatives.

Public sector data is often shared to help businesses make informed decisions and identify market opportunities.

Digital and Innovative Landscape

The public sector is embracing digital technologies to enhance services and drive regional growth. This shift impacts how governments engage with the digital economy and deliver public services through innovative means.

Digital Economy and Public Sector Engagement

Digital government initiatives are reshaping public services. The UK is testing a performance assessment system with real-time data dashboards for decision-making. This approach aims to create a more efficient and user-friendly public sector.

Public bodies are working to bridge the private-public 'digital divide'. They're striving to match the seamless digital experiences people get from private companies.

Regional growth is supported through local innovation ecosystems. These connect businesses with national programmes and specialist facilities. Public-private partnerships are key to this strategy.

Impact of Science and Technology on Public Services

Science and technology are transforming public service delivery. Digital Catapult partners with trade bodies to link innovative companies with sector needs.

Investment in digital skills and infrastructure is crucial. It enables the public sector to harness new technologies effectively.

Data analytics and AI are improving decision-making in government. They help predict needs and tailor services more precisely.

Innovation in public services is leading to more personalised and responsive offerings. This includes everything from healthcare apps to smart city initiatives.

Environmental Considerations

Regional public sector data insights play a crucial role in addressing environmental challenges. These insights inform policy decisions and drive sustainable development efforts across the UK.

Sustainable Development and Public Sector Contributions

Public sector data helps track progress towards sustainability goals. It allows local authorities to measure key environmental indicators like air quality, waste management, and green space coverage.

Many councils use this data to create targeted policies. For example, some areas have used location data to improve recycling rates and reduce landfill waste.

Regional data also supports conservation efforts. It helps identify habitats at risk and guides protection measures. This information is vital for preserving biodiversity and natural resources.

The Role of Public Investment in Energy and Environment

Public investment in environmental data collection and analysis is essential. It enables better decision-making on energy and climate issues.

Many local governments use this data to plan renewable energy projects. They can identify optimal locations for wind farms or solar panels based on geographical and climate information.

Environmental data also guides investments in flood defences and climate adaptation. It helps predict areas at risk and allocate resources effectively.

Data analytics tools are increasingly used to process complex environmental data. These tools help extract actionable insights, supporting evidence-based environmental policies at the regional level.

Taxation and Public Policy

Taxation plays a crucial role in shaping regional development and economic growth across the UK. It impacts revenue allocation and influences public investment decisions.

Tax Revenue and Allocation Summary

The UK government collects taxes from various sources and allocates them to different regions. Corporation Tax receipts are a significant contributor to public finances. Their regional apportionment has been revised since 2016.

Tax revenue distribution varies across UK nations and English regions. This affects the resources available for public services and infrastructure projects in each area.

The Office for National Statistics (ONS) publishes yearly reports on regional public sector finances. These reports provide detailed insights into regional tax collection and expenditure patterns.

Evaluating Taxation Impact on Regional Development

Taxation policies can significantly influence regional economic growth. Higher tax rates may discourage investment in certain areas, while tax incentives can attract businesses and boost local economies.

The government uses tax measures to promote regional development. These may include lower corporate tax rates or special allowances for businesses in underdeveloped regions.

Policymakers must balance the need for tax revenue with the goal of stimulating regional growth. They often analyse data on regional public sector finances to inform their decisions.

Evaluating the impact of taxation on regional development requires comprehensive data analysis. The ONS and other agencies work to improve the quality and granularity of this data.

International Comparisons and Standards

The UK's public sector finances are shaped by international standards and frameworks. These guide data collection, reporting, and analysis across regions and countries. Key influences include OECD benchmarks and EU statistical practices.

UK Public Finance in the Context of OECD

The UK aligns its public sector financial reporting with OECD guidelines. This allows for meaningful comparisons with other developed economies. The OECD publishes yearly reports on member countries' fiscal health.

These reports examine:

- Government debt levels

- Budget deficits

- Public spending as a percentage of GDP

The UK's performance is measured against OECD averages. This benchmarking helps policymakers identify areas for improvement in regional public finances.

Adhering to EU Code of Practice and NUTS Framework

Despite Brexit, the UK still follows many EU statistical standards. The European Statistics Code of Practice ensures high-quality data across Europe. It sets principles for official statistics production and dissemination.

The UK also uses the Nomenclature of Territorial Units for Statistics (NUTS) framework. NUTS divides the UK into regions for statistical purposes. This system enables:

- Consistent regional data collection

- Comparable analysis of economic performance

- Targeted allocation of EU structural funds

By maintaining these standards, the UK ensures its regional public sector data remains internationally comparable and robust.

Statistical Methods and Accuracy

The Office for National Statistics (ONS) uses robust methods to produce accurate public sector finance statistics. These methods are subject to quality checks and ongoing improvements.

The Office for National Statistics' Approach to Data

The ONS collects data from various government departments and agencies to compile public sector finance statistics. They use standardised methods to ensure consistency across regions.

The ONS employs statistical techniques to estimate missing data and account for timing differences. This helps provide a complete picture of public finances.

Quality checks are performed at each stage of data processing. The ONS reviews historical data and revises figures when new information becomes available.

Strengths, Limitations and Quality Assurance

A key strength of ONS statistics is their comprehensive coverage of public sector activities. The data undergo rigorous quality assurance to ensure accuracy.

However, some limitations exist. Regional breakdowns can be less precise than national figures due to data availability issues.

The ONS is transparent about strengths and limitations of their statistics. They publish quality reports alongside data releases.

Ongoing improvements are made to address limitations. The ONS works with data suppliers to enhance the quality and timeliness of regional statistics.

Data Dissemination and Tools

Regional public sector data insights rely heavily on effective dissemination methods and tools. These enable stakeholders to access, understand, and utilise financial information for decision-making purposes.

Public Access to Regional Financial Reports

Regional authorities provide public access to financial reports through various channels. Online portals serve as the primary platform for distributing these documents. Many councils publish quarterly and annual reports on their websites.

Open data initiatives have gained traction, with some regions offering downloadable datasets in machine-readable formats. This approach allows researchers and analysts to perform their own examinations.

Some authorities have implemented interactive dashboards. These tools let users explore specific aspects of regional finances in detail.

To enhance transparency, certain regions host public meetings where financial reports are presented and discussed. These events often include question-and-answer sessions with finance officials.

Visualisation and Interpretation of Financial Data

Visual representations play a crucial role in making complex financial data more digestible. Data visualisation tools help transform raw numbers into meaningful insights.

Many regions employ interactive charts and graphs to illustrate budget allocations, expenditure trends, and revenue sources. These visuals often allow users to filter data by department or time period.

Geospatial mapping tools are increasingly used to show regional variations in spending or service delivery. These maps can highlight areas of high investment or potential resource gaps.

Some authorities provide accompanying commentary to aid interpretation. These explanations help contextualise the data and highlight key trends or anomalies.

Advanced analytics tools are being adopted to forecast future financial scenarios. These predictive models assist in long-term planning and risk assessment.

Events and Public Engagement

Public sector data collection and usage have been shaped by key events and public involvement. These activities have increased transparency and helped align data practices with citizens' needs and concerns.

Key Events Influencing Public Sector Data Collection

The Public Engagement in Data Research Initiative (PEDRI) has played a crucial role in promoting public involvement in data research. This sector-wide partnership brings together organisations working with data and statistics to generate policy-informing insights.

PEDRI has launched efforts to establish Best Practice Standards for Public Involvement and Engagement in data research. These standards aim to ensure that research programmes are built on a foundation of public trust.

The DARE UK programme joined PEDRI, committing to exemplify best practices in public involvement with data-driven research. This partnership highlights the growing importance of public engagement in the data ecosystem.

Engaging the Public Through Inclusive Discussions

Public engagement events have become essential for fostering dialogue between researchers and citizens. These events allow the public to voice their concerns and interests regarding data usage.

PEDRI organises regular events to facilitate discussions between data researchers and the public. These gatherings help researchers understand public perspectives on data collection and usage.

Public consultations have been conducted to gather insights on involvement and engagement practices in data research. These consultations aim to ensure that research is developed and conducted in a way that builds and retains public trust.

Organisations involved in PEDRI recognise their duty to listen to the public and involve them in decisions about data projects. This approach helps ensure that data research aligns with public needs and concerns.

Frequently Asked Questions

Regional public sector data offers valuable insights into financial transparency, efficiency, and policymaking. Key areas of focus include analysing finances, interpreting revenue data, and identifying patterns in financial records.

How can regional public sector data be utilised to improve financial transparency?

Public sector data and insights can boost financial transparency. Governments can share detailed spending reports online. This allows citizens to see how tax money is used.

Regular audits and open data portals help track budgets. These tools let people compare planned versus actual spending.

What methods are effective for analysing country and regional public sector finances?

Trend analysis helps spot changes in spending over time. Comparing data across regions shows differences in financial management.

Data analytics tools can find patterns in large datasets. These reveal insights about budget allocation and spending efficiency.

What are the challenges faced in collecting and interpreting public sector revenue data?

Data quality issues can make analysis tricky. Some records may be incomplete or use different formats.

Privacy concerns limit access to certain data. Balancing transparency with data protection is an ongoing challenge.

What are some significant patterns observed in public sector financial records over recent years?

Many regions show increased spending on healthcare and technology. This reflects changing priorities and needs.

Some areas have reduced administrative costs through digital services. This shift aims to improve efficiency and save money.

How does public sector data impact policymaking at the regional level?

Data-driven decisions help target resources where they're most needed. For example, education funding might increase in areas with low literacy rates.

Public sector insights guide policy changes. They show which programmes are working and where improvements are needed.

What are key indicators of efficiency in public sector services as revealed by regional data?

Service delivery times often indicate efficiency. Shorter waiting times for healthcare or permits suggest good performance.

Cost per user of public services is another key measure. Lower costs while maintaining quality show efficient resource use.