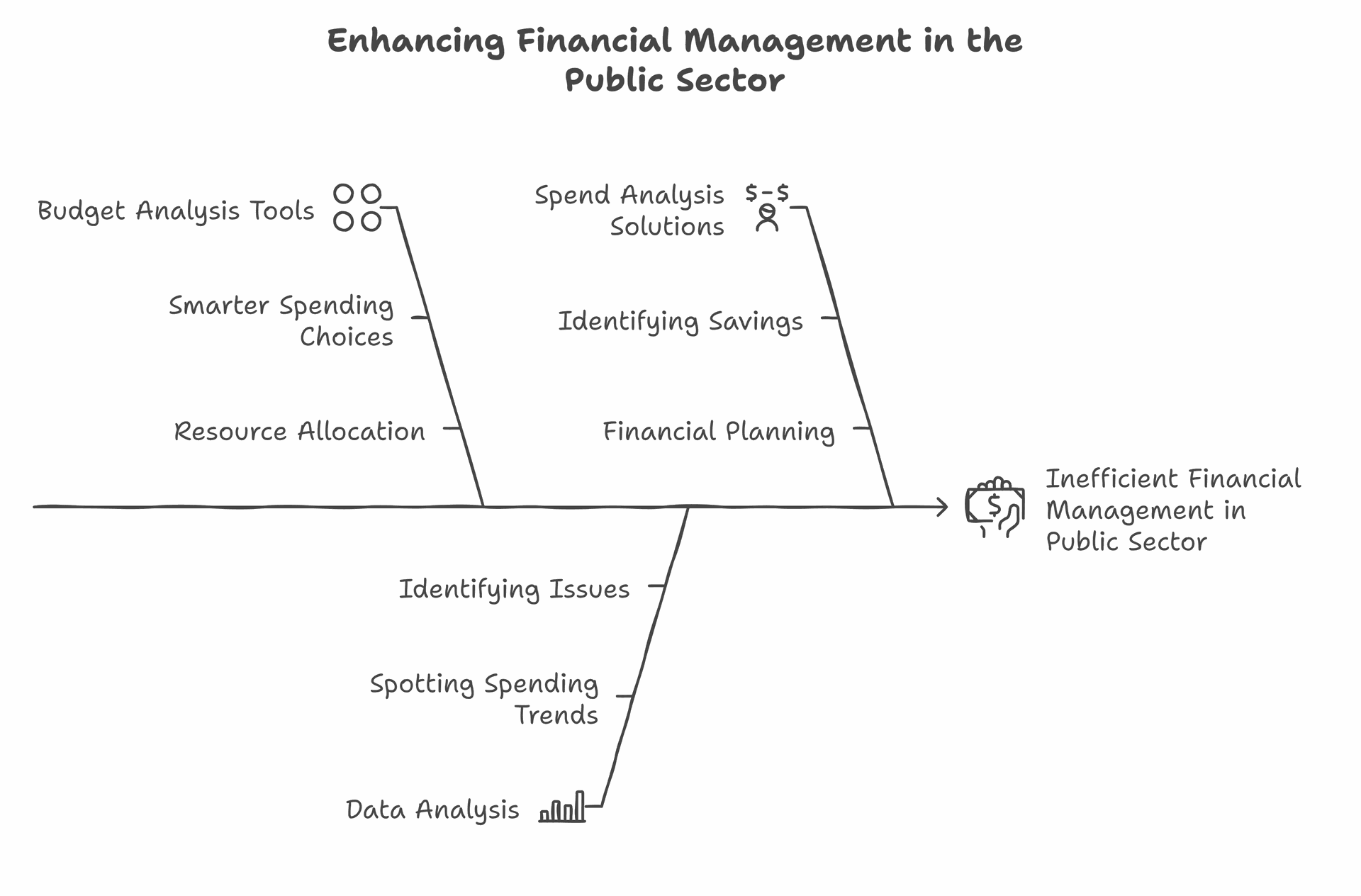

Public sector organisations face unique challenges in managing their finances. Tracking and analysing spending trends is crucial for making informed decisions and ensuring efficient use of public funds. Tools for budget analysis help government agencies make better choices about spending and resource allocation.

Modern technology has made it easier to examine public sector spending patterns. Data analysis tools allow finance leaders to spot unusual spending, look into specific costs, and reduce waste. These tools give a full picture of budgets and trends across an entire organisation.

Spend analysis solutions are changing how the public sector looks at its finances. They show where money is going and help find new ways to save. This information lets agencies plan better and use resources more wisely.

Key Takeaways

- Budget analysis tools help public sector organisations make smarter spending choices

- Data analysis gives finance leaders a clear view of spending trends and potential issues

- Spend analysis solutions help agencies find savings and plan their finances better

Overview of Public Sector Spending

Public sector spending involves complex financial management and allocation of resources. Recent years have seen shifts in spending priorities and trends across government organisations.

Understanding Public Sector Finance

Public sector finance covers the money spent by government bodies to provide services and infrastructure. This includes spending on healthcare, education, defence, and other public services.

Government departments must carefully budget and track their expenditures. They use financial tools to analyse spending patterns and ensure efficient use of taxpayer funds.

Public spending data helps inform policy decisions. It allows officials to identify areas that may need more or less funding.

Transparency is key in public finance. Many governments now publish detailed spending reports for public scrutiny.

Recent Trends in Public Spending

The COVID-19 pandemic significantly impacted public spending patterns. Many countries increased healthcare and economic support budgets.

Digital transformation has been a growing focus. Governments are investing in technology to improve service delivery and reduce costs long-term.

Climate change initiatives have seen increased funding. This includes investments in renewable energy and environmental protection programmes.

Recent statistics show shifts in spending priorities. Some areas have seen budget cuts while others have expanded.

Ageing populations in many countries are driving higher pension and healthcare costs. This demographic trend is shaping long-term spending plans.

Importance of Analysing Spending Trends

Analysing spending trends in public sector organisations is vital for good governance and effective resource management. It helps guide policy decisions and ensures taxpayer money is used wisely.

Benefits of Financial Transparency

Financial transparency is key to building trust between the government and citizens. When spending data is open and clear, it allows the public to see how their tax money is being used. This can lead to:

• Better accountability of public officials

• Increased public participation in budget discussions

• Reduced risk of fraud and corruption

Transparent spending analysis also helps identify areas where costs can be cut. This allows for more efficient use of public funds. Governments can spot wasteful spending and redirect money to more important areas.

By comparing spending across different departments, officials can find best practices. This leads to smarter budget decisions and improved public services.

Impact on Development and Innovation

Careful spending analysis drives development and innovation in the public sector. When officials understand spending patterns, they can make smarter choices about where to invest.

This analysis helps:

• Identify areas that need more funding

• Spot opportunities for new projects

• Guide long-term planning efforts

By looking at past spending, governments can predict future trends. This allows them to prepare for upcoming needs and challenges. It also helps them spot areas where new technologies or methods could save money.

Spending analysis can reveal gaps in current services. This knowledge can spark innovation as officials look for new ways to meet public needs. It can also highlight successful programmes that could be expanded.

Technological Tools for Financial Analysis

Modern technology offers powerful solutions for analysing public sector spending. These tools enable detailed financial insights and data-driven decision-making.

Software and Applications

Specialised software streamlines budget analysis in government organisations. Financial analysis tools like Excel and Tableau help process complex datasets. Excel's formulas and pivot tables organise financial data efficiently. Tableau creates interactive visualisations to spot trends.

Government-specific applications exist too. These tools often integrate with existing systems. They offer features like:

- Multi-year budget forecasting

- Performance metric tracking

- Automated report generation

Cloud-based solutions are gaining popularity. They allow real-time collaboration and remote access to financial data.

Data Analytics and Business Intelligence

Advanced analytics transforms raw financial data into actionable insights. Machine learning algorithms can detect spending anomalies and predict future trends. This helps identify areas for cost savings or reallocation.

Business intelligence (BI) platforms consolidate data from various sources. They create comprehensive dashboards for decision-makers. Key features include:

- Customisable reports

- Data visualisation tools

- Predictive analytics

BI tools enable public sector leaders to make informed financial decisions. They provide a clear view of budget performance across departments.

Methodologies for Spending Analysis

Spending analysis in public sector organisations involves various approaches to examine expenditure patterns and trends. These methods help officials make informed decisions about resource allocation and budgeting.

Qualitative vs Quantitative Approaches

Qualitative approaches focus on non-numerical data to understand spending behaviours. These methods include interviews with department heads, surveys of staff, and reviews of procurement policies. Such techniques provide context and insights into why certain spending decisions are made.

Quantitative methods, on the other hand, rely on numerical data and statistical analysis. Tools such as variance analysis, ratio analysis, and trend analysis are common. These techniques help identify patterns in expenditure over time.

Many organisations use a mix of both approaches. For example, they might analyse spending data using quantitative methods, then conduct interviews to understand the reasons behind the trends they've identified.

Case Studies and Best Practices

Case studies offer valuable insights into successful spending analysis strategies. For instance, a UK local council might examine how another council reduced its IT costs through better procurement practices.

Best practices often emerge from these studies. Common recommendations include:

- Regular spending reviews

- Use of specialised spend analysis software

- Clear categorisation of expenses

- Benchmarking against similar organisations

Research and publications from government bodies and think tanks often highlight these best practices. They provide guidance on implementing effective spending analysis methodologies in public sector settings.

Education and Training in Public Finance Management

Proper education and training are vital for effective public finance management. They equip professionals with essential skills to handle complex financial systems and make informed decisions.

Curriculum Development

Public financial management courses at the graduate level focus on key areas. These include:

• Budgeting

• Cost allocation

• Forecasting

• Operating within constraints

• Microsoft Excel proficiency

Some programmes also cover cost-benefit analysis and performance measurement. These topics help students grasp the full scope of public finance.

Universities work with government agencies to design relevant curricula. This ensures graduates are ready for real-world challenges in the public sector.

Professional Development Programmes

Ongoing training is crucial for public finance professionals. Many organisations offer certificates and workshops to keep skills current.

Popular topics include:

• New budgeting techniques

• Financial reporting standards

• Ethical considerations

These programmes often use case studies and hands-on exercises. This approach helps participants apply concepts to their daily work.

Some courses focus on specific roles, like budget analysts or auditors. Others provide a broader overview for managers and policymakers.

Sector-Specific Spending Trends

Public sector spending varies across different areas. Key sectors like healthcare, education, and infrastructure show distinct patterns in budget allocation and expenditure over time.

Healthcare Expenditure Analysis

The NHS budget has seen steady increases in recent years. In 2023, the UK spent £190.3 billion on healthcare, up 4% from 2022.

Hospital funding takes the largest share, around 45% of the total budget. Primary care services receive about 20%, while mental health gets 13%.

Ageing populations drive higher spending on elderly care and chronic diseases. New medical technologies also push costs up.

Key trends:

- Rising pharmaceutical expenses

- Shift towards preventive care

- Increased mental health funding

- Growing investment in digital health solutions

Educational Funding Trends

UK education spending has fluctuated in recent years. In 2023, it stood at £103 billion, about 4.5% of GDP.

Primary and secondary education receive the bulk of funding, around 70%. Higher education gets about 20%, with the rest going to early years and adult education.

There's a growing focus on STEM subjects, with extra funding for science and technology programmes. Special needs education is also seeing increased investment.

Recent initiatives:

- Expansion of free school meals

- Boost in apprenticeship funding

- Increased support for disadvantaged students

- Investment in digital learning resources

Investment in Science and Energy

The UK aims to be a scientific superpower. Research and development spending reached 2.4% of GDP in 2024, up from 1.7% in 2020.

Energy sector investment is shifting towards renewables. In 2023, £10.9 billion was invested in clean energy projects.

Nuclear power remains a priority, with new plants planned. Hydrogen and carbon capture technologies are also receiving significant funding.

Key areas of focus:

- Quantum computing research

- Artificial intelligence development

- Fusion energy projects

- Space technology and satellite systems

Transport and Infrastructure Spending

Transport spending in the UK hit £29.4 billion in 2023. Major projects like HS2 and road improvements account for a large portion of this budget.

There's a growing emphasis on sustainable transport. Electric vehicle charging infrastructure saw a £1.3 billion investment in 2023.

Public transport funding is increasing, with aims to improve bus and rail services across the country.

Notable trends:

- Smart city technology adoption

- Cycling infrastructure expansion

- Rail electrification projects

- Investment in autonomous vehicle research

Environmental Conservation Financing

Environmental spending has grown significantly. In 2023, the UK allocated £6.2 billion to environmental protection.

Climate change mitigation receives the largest share, about 40% of the budget. Biodiversity protection and waste management are other key areas.

There's increasing investment in flood defences, with £5.2 billion planned over six years from 2021.

Key initiatives:

- Reforestation programmes

- Marine conservation zones

- Air quality improvement schemes

- Circular economy projects

Public sector analysts use tools like variance analysis and trend analysis to track these spending patterns. This helps ensure efficient use of resources across all sectors.

Role of International Trade and Economic Development

International trade shapes public sector spending and economic growth strategies. It impacts government budgets and influences policy decisions aimed at fostering development.

Global Trade Influences on Public Expenditure

Trade patterns affect how governments allocate resources. Open economies often spend more on social programmes to cushion citizens from global market fluctuations. This can lead to higher public expenditure on unemployment benefits and job retraining schemes.

Customs duties and tariffs are key revenue sources for many nations. As trade agreements reduce these, governments may need to find new funding streams. This could mean restructuring tax systems or cutting certain budget areas.

Global economic trends can prompt shifts in public spending priorities. For instance, nations may boost infrastructure investment to enhance export competitiveness. They might also increase funding for education to develop a skilled workforce for high-value industries.

Economic Strategies for Sustainable Growth

Countries use various tools to leverage trade for development. Aid for Trade programmes help developing nations build trade-related skills and infrastructure. These initiatives can improve a country's ability to participate in global markets.

Trade policy analysis is crucial for informed decision-making. Governments use data on tariffs and non-tariff measures to assess market access and plan economic strategies. This information helps shape policies that promote sustainable growth.

Balancing trade openness with domestic industry protection is a key challenge. Governments must weigh the benefits of foreign investment against the need to nurture local businesses. This often involves targeted subsidies or temporary trade barriers.

Future Directions in Public Sector Spending

Public sector organisations will see major shifts in how they manage and analyse spending. New technologies and approaches will reshape financial planning and oversight in government agencies.

Predictive Models for Spending

Advanced analytics will transform public sector budgeting. Machine learning algorithms will forecast spending needs with greater accuracy. These tools will analyse historical data and economic indicators to predict future costs.

Agencies will use AI to spot spending anomalies and inefficiencies. This will help prevent waste and fraud. Predictive models will also improve long-term financial planning.

Real-time dashboards will give officials instant insights into spending patterns. This will allow for faster and more informed decision-making. Agencies can quickly adjust budgets based on emerging trends.

Innovative Funding Mechanisms

Public-private partnerships will grow in importance. These collaborations will help fund large infrastructure projects. They'll also drive innovation in public services.

Social impact bonds will gain traction. These allow private investors to fund social programmes. The government only pays if the programmes meet specific targets.

Crowdfunding may play a bigger role in local government projects. This could increase community engagement in public spending decisions.

Blockchain technology could revolutionise how agencies track and manage funds. It offers enhanced security and transparency in financial transactions.

Governance and Policy Implications

New spending tools will require updated governance frameworks. Policies must balance innovation with accountability. This includes guidelines for data privacy and algorithmic fairness in predictive models.

Increased transparency will be crucial. The public will expect easy access to spending data. Agencies may need to publish more detailed financial reports.

Cost-benefit analysis will become more sophisticated. This will help justify spending decisions to the public. It will also ensure efficient use of taxpayer money.

Training programmes will be needed. Staff must learn to use new financial tools effectively. This will help maximise the benefits of technological advancements in public sector finance.

Frequently Asked Questions

Public sector spending analysis involves various tools and techniques to track expenditure patterns and trends. Governments use different methodologies to categorise and monitor spending across departments and time periods.

What methodologies are employed to analyse government procurement spending patterns?

Governments use several methods to examine procurement spending. Variance analysis, ratio analysis, and trend analysis are common tools. These help identify changes in spending over time and across categories.

Cost-benefit analysis is also used to assess the value of different expenditures. Programme evaluation looks at the outcomes of specific spending initiatives.

How do public spending statistics reveal trends in government expenditure?

Public spending statistics show changes in government spending over many years. They track key areas like current expenditure and net investment.

These figures help analysts spot long-term trends in public finances. They can reveal shifts in spending priorities or responses to economic changes.

Can the Whole of Government Accounts be utilised to monitor spending variations across different periods?

The Whole of Government Accounts provide a comprehensive view of public finances. They can be used to compare spending across different years.

These accounts show how spending changes in various areas. Analysts can use them to identify trends in specific departments or types of expenditure.

What types of visual representations are most effective for illustrating trends in public sector spending?

Charts and graphs are useful for showing spending trends. Line graphs can display changes over time clearly.

Bar charts work well to compare spending across different categories. Pie charts can show the proportion of total spending in various areas.

In what ways does the Government Expenditure Report provide insights into fiscal policy changes and trends?

The Government Expenditure Report offers detailed information on public spending. It breaks down expenditure by department and category.

This report helps identify shifts in fiscal policy. It shows where the government is increasing or decreasing spending over time.

How is spending categorised and tracked by different government departments for analytical purposes?

Government departments often use detailed classification systems to categorise spending. These may include functional categories like health or education.

Departments also track spending by economic type, such as wages or capital investments. This detailed tracking allows for in-depth analysis of spending patterns.