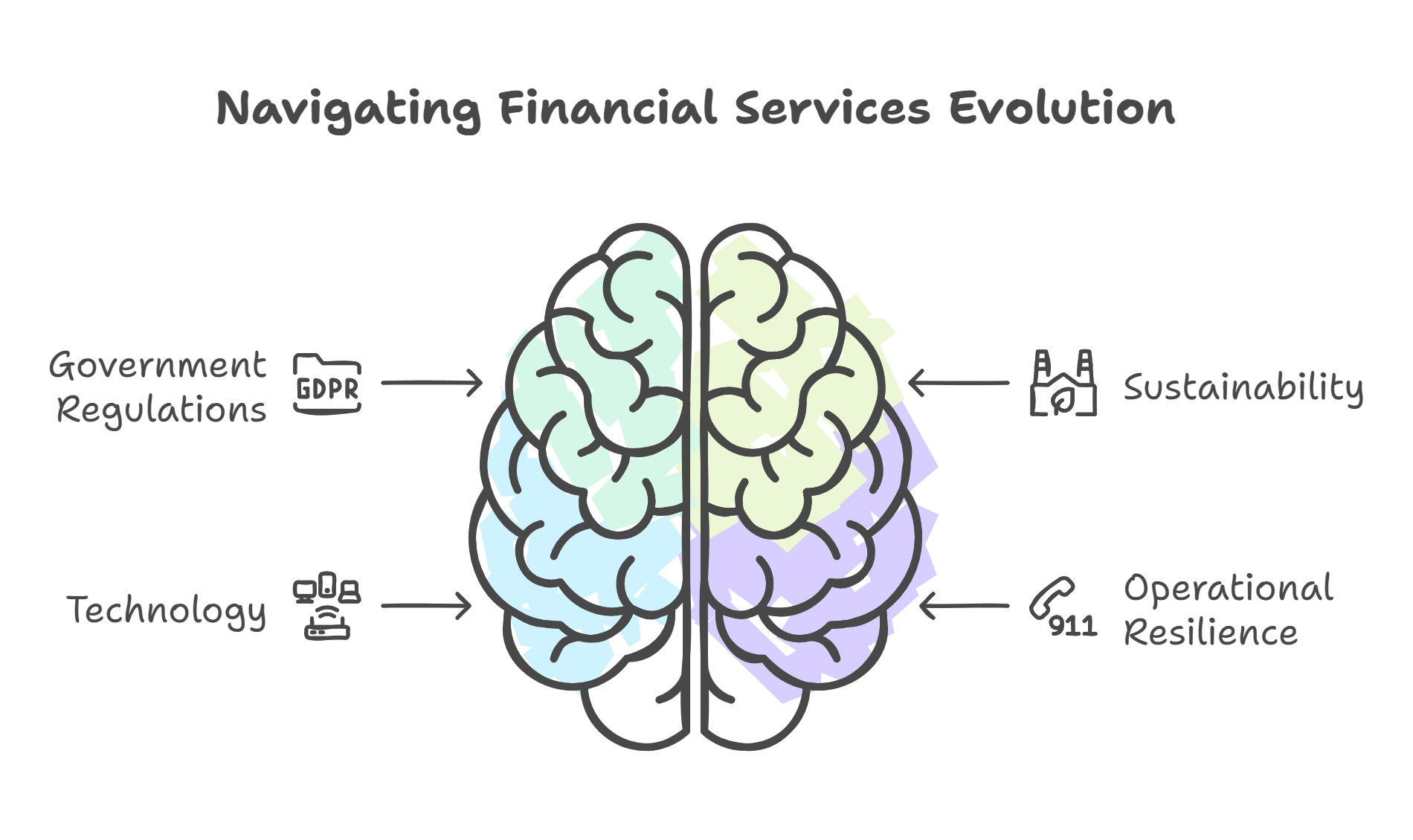

Government contracts play a crucial role in shaping the financial services sector. Recent trends point to increased regulatory scrutiny and a push for sustainability. Financial firms must adapt to these changes to remain competitive and compliant.

The UK financial services industry faces new challenges and opportunities as government policies evolve. Regulators continue to tighten expectations despite economic pressures. This shift impacts how firms operate and engage with clients.

Technology and operational resilience are becoming key focus areas for government contracts. Financial institutions need to invest in robust systems to meet new standards. These changes aim to protect consumers and strengthen the sector's overall stability.

Key Takeaways

- Government regulations are reshaping the financial services landscape

- Sustainability and technology are driving new contract requirements

- Financial firms must adapt to maintain competitiveness and compliance

Regulatory Landscape Shaping Financial Services

The regulatory landscape for financial services is evolving rapidly. Brexit, new consumer protection rules, and the Financial Conduct Authority's initiatives are reshaping the industry.

Brexit Implications and the Financial Services and Markets Act 2000

Brexit has significantly impacted UK financial regulations. The Financial Services and Markets Act 2000 has been amended to reflect the UK's departure from the EU.

These changes have led to a divergence in regulatory frameworks between the UK and EU. Financial firms now face the challenge of navigating slightly different regimes across both jurisdictions.

The UK government is taking steps to modernise financial regulations post-Brexit. This includes updates to the Building Societies Act, with changes to funding limit calculations and governance requirements.

Emerging Regulations on Consumer Protection

Consumer protection is a key focus of new financial regulations. The Financial Conduct Authority (FCA) has introduced a Consumer Duty, which sets higher standards for firms.

This new duty requires financial services providers to:

- Act in good faith

- Avoid causing foreseeable harm to customers

- Enable and support customers to pursue their financial objectives

The Consumer Duty aims to improve outcomes for retail customers. It places greater responsibility on firms to ensure their products and services meet consumer needs.

Financial Conduct Authority's Role in Shaping Trends

The FCA plays a crucial role in shaping regulatory trends. It is focusing on several key areas to improve the financial services sector.

Market data access and cost are high on the FCA's agenda. The regulator is developing consolidated tape frameworks to enhance transparency.

The FCA is also prioritising:

- Operational resilience of financial firms

- Cybersecurity risk management

- Effective risk reporting to stakeholders

These priorities aim to create a more robust and secure financial system. Firms must adapt to meet these evolving regulatory expectations.

Sustainable Finance and ESG Compliance

Financial firms face growing pressure to adopt sustainable practices and meet ESG standards. This shift impacts risk management, reporting requirements, and regulatory compliance across the industry.

Economic Implications of Greener Financial Services

Sustainable finance is reshaping the financial sector. Banks and investment firms are developing new green products and services to meet client demand. This includes green bonds, sustainable investment funds, and eco-friendly lending programmes.

The transition brings both opportunities and challenges. Firms that adapt quickly can gain market share and improve their reputation. However, the shift requires significant investment in new systems and expertise.

ESG factors now influence credit decisions and risk assessments. This affects lending practices and investment strategies across the industry. Firms must balance financial returns with environmental and social impacts.

Anti-greenwashing Rule and Industry Response

Regulators are cracking down on greenwashing in financial services. The anti-greenwashing rule aims to prevent misleading claims about sustainability.

Firms must now provide clear evidence to support any green marketing claims. This includes detailed information on ESG criteria and investment strategies.

The industry is responding by improving transparency and data quality. Many firms are investing in better ESG reporting tools and third-party verification.

Compliance teams are working to ensure all marketing materials meet the new standards. This often requires close collaboration with product development and marketing departments.

Reporting Greenhouse Gas Emissions: Practices and Pitfalls

Financial firms increasingly need to report their own greenhouse gas emissions and those of their investment portfolios. This presents significant challenges in data collection and analysis.

Best practices include:

- Using standardised reporting frameworks like the Task Force on Climate-related Financial Disclosures (TCFD)

- Investing in robust data management systems

- Engaging with clients and investee companies to improve data quality

Common pitfalls to avoid:

- Relying too heavily on estimates or incomplete data

- Failing to account for Scope 3 emissions in investment portfolios

- Not providing context or explanations for emissions data

Firms must strike a balance between comprehensive reporting and manageable data collection processes.

Technological Advancements and Operational Resilience

New technologies are reshaping how financial institutions manage risks and ensure business continuity. These innovations aim to enhance operational resilience and cybersecurity while transforming service delivery.

Artificial Intelligence and Machine Learning in Risk Management

AI and machine learning are revolutionising risk management in financial services. These technologies enable more accurate fraud detection and credit scoring. They also improve regulatory compliance by automating monitoring and reporting.

Banks now use AI to analyse vast amounts of data and identify potential risks in real-time. This allows for faster, more informed decision-making. Machine learning algorithms can detect subtle patterns that humans might miss, enhancing overall risk assessment.

Some institutions are implementing AI-powered chatbots for customer service. These tools can handle routine queries, freeing up staff to focus on more complex issues. This improves operational efficiency and customer satisfaction.

Cybersecurity and the Strengthening of Cyber Resilience

Cyber resilience has become a top priority for financial institutions. The Digital Operational Resilience Act (DORA) in the EU sets new standards for ICT risk management.

Financial firms are investing heavily in advanced threat detection systems. These use AI to identify and respond to cyber threats in real-time. Multi-factor authentication and biometric security measures are becoming standard practice.

Cloud computing is enhancing data backup and recovery capabilities. This ensures business continuity in the event of a cyber attack or system failure. Regular penetration testing and vulnerability assessments help identify and address potential weaknesses.

Impact of Fintech Innovations on Financial Services

Fintech innovations are transforming traditional financial services. Mobile banking apps and digital wallets are becoming the norm, offering convenience and 24/7 access to financial services.

Blockchain technology is being explored for secure, transparent transactions. Some banks are testing blockchain for cross-border payments and trade finance. This could reduce costs and increase efficiency.

Robo-advisors are gaining popularity in wealth management. These AI-powered platforms offer automated investment advice at a lower cost than traditional financial advisors. Open banking initiatives are fostering innovation and competition in the sector.

Inclusion and Diversity Initiatives

Diversity and inclusion efforts are reshaping the financial services sector. These initiatives aim to create more representative workplaces and drive economic growth through varied perspectives.

The Importance of Diversity in Corporate Leadership

Diverse leadership teams bring fresh ideas and better decision-making to financial firms. Studies show that companies with varied top management often perform better financially. Many organisations now set targets for gender and ethnic diversity on their boards.

Some firms use mentoring programmes to support underrepresented groups. Others focus on inclusive hiring practices. These might include blind CV reviews or diverse interview panels.

Regulators are taking notice too. The Financial Conduct Authority is looking at diversity strategies in the sector. They want firms to improve their diversity at all levels.

Evolving Strategies for Inclusive Growth in Financial Services

Financial services companies are broadening their view of diversity. It's no longer just about gender or race. Firms now consider factors like:

- Neurodiversity

- Social mobility

- Cognitive diversity

Some companies use data analytics to track progress. They measure hiring, promotions, and retention across different groups. This helps them spot areas for improvement.

Training plays a big role too. Many firms offer unconscious bias workshops. Others focus on creating inclusive cultures where all staff feel valued.

The Inclusion at Work Panel suggests ways to boost workplace diversity. Their ideas could shape future policies in the sector.

Market Dynamics and Economic Indicators

The financial services sector faces significant shifts due to evolving market forces and economic conditions. These changes are reshaping investment strategies, cryptocurrency adoption, and growth projections.

Cryptocurrency Trends and the Rise of Fiat-backed Stablecoins

Cryptocurrencies continue to influence financial markets, with fiat-backed stablecoins gaining traction. These digital assets offer stability by pegging their value to traditional currencies.

Major banks and financial institutions are exploring stablecoin integration to streamline cross-border transactions. This trend is driven by the need for faster, more cost-effective payment solutions.

Regulatory bodies are increasing scrutiny of stablecoins, aiming to ensure consumer protection and financial stability. This oversight may lead to new compliance requirements for issuers and users.

Assessing the Impact of the Cost of Living Crisis on Investment

The ongoing cost of living crisis is altering investment patterns across the UK. Households are prioritising essential expenses, leading to reduced discretionary spending and investment capacity.

• Shift towards lower-risk investments • Increased demand for inflation-protected securities • Growing interest in ethical and sustainable investment options

Financial advisors are adapting their strategies to help clients navigate this challenging economic landscape. They're focusing on portfolio diversification and long-term financial planning.

The crisis is also spurring innovation in financial products tailored to help consumers manage rising costs and protect their savings.

Projections for Economic Uncertainty and Growth

Economic uncertainty remains a key concern for the financial services sector. Factors contributing to this include:

- Geopolitical tensions

- Inflationary pressures

- Supply chain disruptions

Despite these challenges, some sectors are showing resilience and potential for growth. Tech and green energy industries are attracting significant investment, driven by innovation and sustainability goals.

Economists project modest GDP growth for 2024, with the potential for improvement in the latter half of the year. This cautious optimism is tempered by ongoing global economic pressures.

Financial institutions are strengthening their risk management strategies to weather potential economic downturns. This includes stress testing and scenario planning for various economic outcomes.

Strategic Considerations for Financial Enterprises

Financial firms face new challenges in today's complex market. They must adapt to changing regulations and global competition while managing critical partnerships.

The Role of Critical Third Parties in Financial Ecosystems

Critical third parties play a vital role in financial services. These include technology providers, data processors, and outsourced operations. Firms rely on them for essential functions.

Financial enterprises must carefully vet and monitor these partners. This helps manage risks and ensure service quality. Strong contracts and oversight are key.

Regulators are paying more attention to these relationships. They want to make sure third parties don't pose risks to financial stability. Firms need robust plans to handle any disruptions from critical partners.

Adapting to a Competitive Global Environment

Financial centres worldwide are vying for business. London, New York, Singapore, and others compete fiercely. Firms must choose their locations wisely.

To stay competitive, companies need to invest in technology. This includes areas like artificial intelligence and blockchain. These tools can improve efficiency and customer service.

Talent is crucial in this environment. Firms must attract and keep skilled workers. This might mean offering flexible work arrangements or better training.

Regulatory changes can affect competitiveness. Companies need to stay informed about rules in different markets. They should be ready to adapt quickly to new requirements.

Insights and Analytics: Leading Thought Leadership

Data-driven insights are reshaping government contracting in financial services. Analytics tools help agencies make smarter decisions and improve outcomes.

Deloitte Insights Team's Contributions to Strategic Decision Making

The Deloitte Insights Team plays a key role in shaping government trends. Their research informs public sector leaders on emerging issues in financial services contracting.

The team's work covers critical areas like:

• Digital transformation in government operations

• Data analytics for improved service delivery

• Cybersecurity in financial systems

Their reports highlight how agencies can use data to:

- Reduce fraud and waste

- Enhance regulatory compliance

- Streamline procurement processes

By analysing vast amounts of data, the Deloitte Insights Team helps identify patterns and opportunities. This allows government bodies to make more informed choices about financial services contracts.

The team's thought leadership extends beyond just reporting facts. They provide actionable recommendations to drive innovation in public sector contracting.

Frequently Asked Questions

The financial services industry faces significant changes in 2024. New risks, regulations, and market trends are shaping the sector's future. Government contracts play a crucial role in these developments.

What are the emerging risks to be aware of in financial services for 2024?

Financial services firms must stay vigilant about cyber security threats. These risks continue to evolve and pose significant challenges.

Regulatory compliance remains a top concern. Firms need to adapt to changing rules and guidelines quickly.

Economic uncertainty is another key risk. Market volatility and potential downturns could impact financial stability.

How will upcoming regulations affect the financial services industry in the near future?

New regulations aim to enhance consumer protection and market integrity. Financial institutions will need to adjust their practices accordingly.

Data privacy laws are becoming stricter. This will require firms to revamp their data handling and storage processes.

Sustainability regulations are on the rise. Financial services companies must integrate environmental considerations into their operations.

What challenges does the financial services job market face in 2024?

The job market is experiencing a skills gap. There's high demand for professionals with expertise in emerging technologies.

Remote work continues to reshape employment practices. Firms must balance flexibility with team cohesion and productivity.

Automation is changing job roles. Some positions may become obsolete while new ones emerge.

Which key trends will shape the financial services industry in 2025?

Digital transformation will accelerate. More firms will adopt AI, blockchain, and cloud technologies.

Personalised financial services will grow. Companies will use data analytics to tailor products to individual customer needs.

Sustainable finance will gain prominence. Green investments and ESG considerations will become mainstream.

What is the anticipated impact of current government contracts on the future of financial services?

Government contracts are driving innovation in financial technology. This includes improvements in digital payment systems and fraud detection.

Public-private partnerships are expanding. These collaborations are fostering new approaches to financial inclusion and literacy.

Contracts are promoting greater transparency. Financial institutions are adopting more open reporting practices.

How are financial institutions adapting to the latest regulatory changes in the markets?

Banks are investing heavily in compliance technology. This helps them stay ahead of complex regulatory requirements.

Many firms are creating dedicated regulatory response teams. These groups focus on interpreting and implementing new rules.

Training programmes are being enhanced. Staff at all levels are receiving updates on regulatory changes and their implications.