Private research data in the UK plays a crucial role in helping suppliers understand market trends and customer needs. Companies rely on this information to make informed decisions and stay competitive. The UK's research sector is valued at £7 billion and is the largest supplier of research and insight in Europe.

Suppliers can access various types of data through specialised research firms and government initiatives. This includes consumer behaviour insights, industry-specific trends, and economic forecasts. The UK Business Data Survey 2024 found that 72% of businesses handle different kinds of data to support their operations.

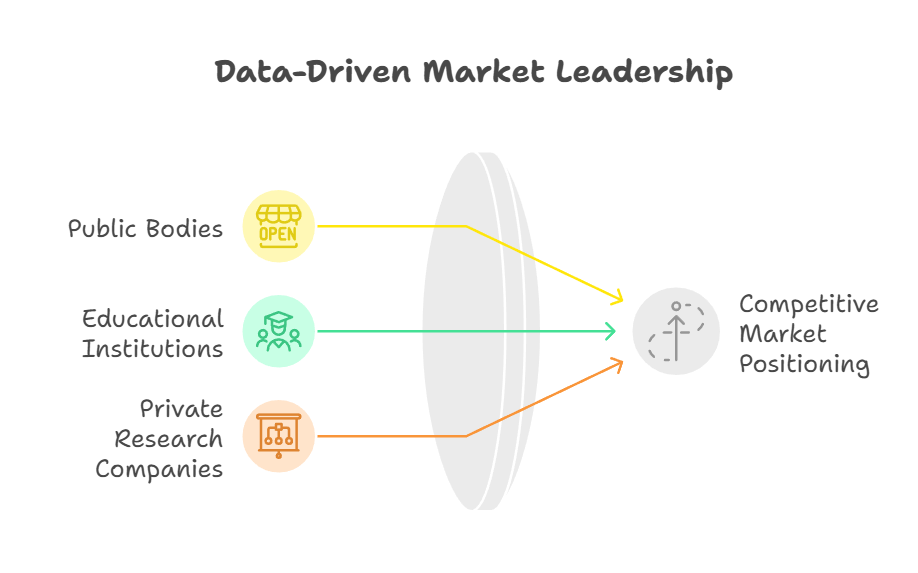

To obtain research data, suppliers can engage with public bodies, collaborate with educational institutions, or work with private research companies. The Crown Commercial Service offers a platform to connect suppliers with relevant research providers, making it easier to find the right data sources for specific needs.

Key Takeaways

- The UK research sector is a £7 billion industry and leads Europe in research and insight provision

- 72% of UK businesses use various types of data to support their operations

- Suppliers can access research data through public bodies, educational institutions, and private research companies

Overview of UK Private Research Data

Types of Data Available

Private research firms in the UK collect and analyze a wide range of data to provide insights to suppliers. This includes consumer surveys, market sizing studies, competitive intelligence, and industry forecasts. Many firms specialize in particular sectors like retail, healthcare, or financial services.

Key Data Providers

Some of the largest private research companies operating in the UK include Kantar, Ipsos MORI, and YouGov. These firms employ teams of analysts and use advanced methodologies to gather and interpret data. Government agencies like the Office for National Statistics also produce valuable economic and demographic data that suppliers can access.

Data Collection Methods

Research companies utilize various techniques to collect data, such as online surveys, focus groups, in-depth interviews, and behavioral analytics. Many leverage new technologies like mobile apps and social media listening to gather real-time consumer insights. Ethical data collection practices are closely regulated in the UK.

Identifying Key Suppliers of Research Data

Leading Market Research Firms

Kantar, Ipsos MORI, and YouGov are among the top market research companies in the UK, providing a wide range of data and insights to suppliers across industries. These firms have large panels of research participants and advanced analytics capabilities.

Specialist Research Providers

Many niche research firms focus on specific sectors or research methodologies. For example, Mintel specializes in consumer goods research, while Frost & Sullivan covers technology markets. Suppliers can find specialist providers aligned with their particular data needs.

Government Data Sources

Public sector organizations like the Office for National Statistics produce valuable economic and demographic data that suppliers can access. The UK Research and Innovation agency also facilitates access to publicly-funded research data.

Engagement with Public Bodies for Research Data

Government Open Data Initiatives

The UK government has launched several open data initiatives to make public sector information more accessible. Suppliers can access datasets on topics like population demographics, business statistics, and public spending through portals like data.gov.uk.

Research Collaborations

Many public bodies are open to research collaborations with private companies. This allows suppliers to access specialized government data and expertise while contributing industry insights. Proper data sharing agreements are typically required.

Procurement of Research Services

Public sector organizations regularly commission research from private suppliers through competitive tendering processes. This provides opportunities for research firms to deliver insights to government while accessing public datasets.

Collaborations with Educational Institutions

University Research Partnerships

Many UK universities have dedicated research units that collaborate with industry. Suppliers can partner with academics to access cutting-edge research methodologies and tap into student talent for data collection and analysis projects.

Knowledge Transfer Partnerships

The Knowledge Transfer Partnership scheme facilitates collaborations between businesses and universities. This allows suppliers to embed research expertise within their organizations through joint projects with academic institutions.

Student Research Projects

Suppliers can propose research topics for student dissertations or work placement projects. This provides access to motivated researchers and fresh perspectives at a lower cost than commercial research.

Sector-Specific Data Insights

Retail and Consumer Goods

Research firms like Kantar and Nielsen provide detailed insights on consumer purchasing behaviors, brand perceptions, and retail sales trends. This data is crucial for suppliers in the fast-moving consumer goods sector

Overview of UK Private Research Data

The UK research sector is a major player in the global market. It's valued at £7 billion and is the largest supplier of research and insight in Europe.

Private research data in the UK covers a wide range of industries and sectors. The Standard Industrial Classification (SIC) system helps organise this data by categorising businesses based on their main activities.

Market research is a key component of the UK's private research landscape. It provides valuable insights into consumer behaviour, market trends, and business opportunities.

Suppliers play a crucial role in the research ecosystem. They collect, analyse, and provide data to businesses, government agencies, and other organisations.

The UK economy benefits greatly from private research data. It informs decision-making, drives innovation, and helps businesses stay competitive in a rapidly changing market.

Data access is a key consideration in the private research sector. Efforts are being made to develop frameworks for private sector access to public sector data, balancing the needs of industry with public interest.

Quality and accuracy are paramount in private research data. Many suppliers use advanced technologies and methodologies to ensure the reliability of their data.

Identifying Key Suppliers

Finding the right suppliers is crucial for UK companies. This process involves careful evaluation, regional analysis, and industry-specific insights. Here's what businesses need to know:

Supplier Evaluation Criteria

UK firms should assess potential suppliers based on several key factors. Price is important, but it's not the only consideration. Quality of goods and services matters greatly. Reliability in delivery times can make or break a supply chain.

Financial stability is another vital aspect. Companies want suppliers who will be around for the long haul. A supplier's track record with other clients can offer valuable insights.

Innovation capabilities are increasingly important. Suppliers who can offer new solutions or adapt to changing needs are highly prized.

Lastly, compliance with UK regulations and ethical standards is non-negotiable. This includes areas like environmental practices and labour laws.

Regional Supplier Analysis

The UK has diverse regional economies, each with its own strengths in supplying goods and services. London and the South East are hubs for financial and professional services suppliers. The Midlands, with its strong manufacturing base, is ideal for industrial suppliers.

Scotland is known for its energy sector suppliers, particularly in renewables. Northern Ireland has a growing tech scene, offering innovative digital service providers.

Wales has strengths in aerospace and automotive supply chains. The North of England is seeing a resurgence in advanced manufacturing and tech suppliers.

Understanding these regional specialities can help UK companies find the best suppliers for their needs.

Industry-Specific Supplier Insights

Different industries have unique requirements for their suppliers. In the UK's thriving fintech sector, suppliers must meet strict data security and regulatory standards.

For the automotive industry, suppliers need to adapt to the shift towards electric vehicles. This means providing components and technology for this new era of transport.

In the healthcare sector, suppliers must meet rigorous quality control standards. The ability to provide specialised medical equipment and pharmaceuticals is crucial.

The UK's creative industries, including film and gaming, need suppliers who can offer cutting-edge technology and specialised services. This might include visual effects companies or motion capture specialists.

Engagement with Public Bodies

Engaging with public bodies in the UK requires understanding procurement processes, forming partnerships, and adhering to legal requirements. Suppliers must navigate complex systems to work effectively with government entities.

Procurement Processes

The UK public sector uses specific procurement methods. Suppliers need to know these to win contracts.

Public Interest Publishers can access data on public spending across various buyer types. This helps firms understand market trends.

Suppliers should familiarise themselves with frameworks and tender procedures. The government often uses e-procurement systems for transparency.

Pre-procurement engagement is allowed. The government encourages talking to potential suppliers before formal processes begin. This can lead to better outcomes.

Public Sector Partnerships

Forming partnerships with public bodies can be valuable for suppliers. It often leads to long-term relationships and repeat business.

Suppliers should aim to understand the unique needs of different public entities. This includes central government departments, local authorities, and NHS trusts.

Government marketing databases can help suppliers identify potential partners. These tools provide contact information for key decision-makers.

Building trust is crucial. Suppliers should demonstrate reliability and value for money in their proposals and delivery.

Compliance and Legal Considerations

Working with public bodies requires strict adherence to regulations. Suppliers must comply with procurement laws and ethical standards.

The Sourcing Playbook outlines best practices for public sector contracting. Suppliers should familiarise themselves with this guidance.

Data protection is critical. Suppliers handling public data must comply with GDPR and other relevant legislation.

Transparency is key. Public spending data is often published, so suppliers should be prepared for scrutiny of their contracts.

Suppliers with significant public sector revenue may face additional reporting requirements. This applies to those deriving over 50% of income from public contracts.

Collaborations with Educational Institutions

UK private research suppliers often partner with educational institutions to drive innovation and knowledge exchange. These collaborations span university research projects and school outreach programmes, fostering academic-industry links.

University Research Projects

Private research suppliers frequently collaborate with universities on cutting-edge projects. These partnerships leverage academic expertise and industry resources to tackle complex challenges. Research focus areas typically include emerging technologies, sustainability, and healthcare advancements.

Many suppliers provide funding, equipment, and real-world data to support university studies. In return, they gain access to pioneering research and talented graduates. Joint research centres are common, bringing together academics and industry professionals in shared lab spaces.

Universities benefit from these collaborations by securing additional funding and enhancing their research impact. Students often participate in internships or placements with partner companies, gaining valuable industry experience.

School Outreach Initiatives

Private research suppliers also engage with primary and secondary schools to promote STEM education. These outreach programmes aim to inspire the next generation of scientists and researchers.

Typical activities include:

- Hands-on workshops led by industry professionals

- Career talks and mentoring sessions

- Donation of lab equipment to schools

- Sponsorship of science fairs and competitions

Many suppliers offer work experience placements for older students, providing insight into research careers. Some firms collaborate with teachers to develop curriculum-aligned materials that showcase real-world applications of scientific concepts.

These initiatives help build a skilled workforce pipeline for the research sector. They also improve public understanding of scientific research and its societal benefits.

Sector-Specific Data Insights

UK private research data provides crucial insights across various industries. These sector-specific analyses offer valuable information for suppliers and businesses to make informed decisions.

Healthcare Sector Analysis

The UK healthcare sector is a key area for research data. NHS spending on private providers has seen significant growth in recent years.

Private healthcare companies are investing heavily in data analytics to improve patient outcomes. This includes using AI for diagnosis and treatment planning.

Pharmaceutical research data shows a focus on personalised medicine. Clinical trial data indicates a rise in studies for rare diseases and gene therapies.

Mental health services have seen increased demand, with data showing a 30% rise in referrals since 2020. Telemedicine adoption has grown by 200% in the past three years.

Environmental Sector Trends

Environmental research data reveals a surge in green technology investments. The UK's renewable energy sector has grown by 15% annually since 2018.

Carbon emissions data shows a 10% reduction in the industrial sector over the past five years. However, transport emissions remain a challenge.

Water quality data indicates improvements in river systems, with a 25% decrease in pollution incidents. Biodiversity studies show positive trends in urban green spaces.

Waste management data highlights a 40% increase in recycling rates across UK households. The circular economy concept is gaining traction in manufacturing sectors.

Technology and Engineering Data

The UK tech sector continues to attract significant investment. Data shows a 20% year-on-year increase in startup funding.

AI and machine learning adoption has grown by 35% across various industries. Cybersecurity spending has doubled in the past three years.

Engineering data reveals a skills gap, with a 15% shortage in qualified professionals. Robotics and automation have seen a 25% uptake in manufacturing processes.

5G technology rollout data shows 60% coverage across the UK. IoT device adoption has increased by 50% in smart city initiatives.

Food Industry Statistics

The UK food industry has seen a shift towards plant-based products. Market data shows a 30% growth in vegan food sales annually.

Food waste reduction efforts have led to a 15% decrease in household waste. Organic food sales have increased by 10% year-on-year.

Supply chain data reveals a 20% increase in local sourcing. Nutritional labelling compliance has improved by 35% across packaged foods.

Food safety incidents have decreased by 25% due to improved traceability systems. Online grocery sales have grown by 40% since 2020.

Legal and Accountancy Sector Overview

The legal sector has seen a 25% increase in the use of AI for document review. Remote court hearings have risen by 300% since 2020.

Accountancy firms report a 40% uptake in cloud-based financial software. Blockchain technology is being explored for audit processes.

Legal tech startups have attracted £500 million in investment over the past two years. Data privacy consultancy services have grown by 50% annually.

Accountancy data shows a 30% increase in demand for sustainability reporting services. Fraud detection systems have improved accuracy by 20%.

Agriculture Sector Profile

UK agriculture data shows a 10% increase in precision farming techniques. Drone technology adoption has grown by 45% for crop monitoring.

Organic farming has expanded to cover 5% of total agricultural land. Vertical farming initiatives have seen a 60% growth in urban areas.

Livestock data indicates a 15% reduction in antibiotic use. Crop yield data shows a 20% improvement due to AI-driven farming methods.

Agri-tech investments have reached £1 billion over the past five years. Sustainable water management systems have been implemented on 30% of farms.

Supporting Small Businesses and Startups

The UK government and research organisations provide vital support for small businesses and start-ups. This includes funding opportunities, mentorship programmes, and data-driven insights to help new ventures thrive in a competitive landscape.

Start-Up Ecosystem Research

UK Research and Innovation (UKRI) plays a crucial role in fostering the start-up ecosystem. They conduct comprehensive studies on market trends, funding patterns, and sector-specific challenges.

These research initiatives help identify gaps in support and inform policy decisions. Start-ups benefit from access to valuable data on consumer behaviour, technological advancements, and industry disruptions.

UKRI also facilitates collaborations between academia and start-ups. This partnership allows new businesses to tap into cutting-edge research and expertise.

Growth Opportunities for SMEs

Small and medium-sized enterprises (SMEs) form the backbone of the UK economy. The government offers various programmes to support their growth and development.

Key initiatives include:

- Procurement opportunities: Simplified processes to bid for government contracts

- Financial support: Grants, loans, and tax incentives for innovation and expansion

- Skills development: Training programmes to enhance business capabilities

Innovate UK provides targeted support for SMEs looking to commercialise their innovations. This includes funding for research and development, as well as guidance on intellectual property protection.

SMEs can also access expert advice on scaling operations, entering new markets, and adopting digital technologies to boost productivity.

Data Use and Governance

The UK has strict rules for handling private research data. These regulations aim to protect personal information and ensure ethical use of data by suppliers.

Data Protection Regulations

The UK data governance landscape is shaped by key laws. The Data Protection Act 2018 and UK GDPR set the standards for data use. These laws require suppliers to handle data carefully and securely.

Suppliers must get clear consent to use personal data. They need to tell people how they'll use their information. This includes details about cookies on websites.

Data must be kept safe from breaches. Suppliers have to report any data leaks quickly. They also need to delete data when it's no longer needed.

Ethical Use of Research Data

Ethical data use goes beyond just following the law. It's about doing what's right with people's information.

Suppliers should think about fairness when using data. This means not using information in ways that could harm people. For example, insurance companies shouldn't use health data to unfairly deny cover.

Transparency is key. Suppliers should be open about how they use data. They should make it easy for people to see what data they have and how it's used.

It's also important to check data quality. Bad data can lead to wrong decisions. Suppliers need to make sure their research data is accurate and up-to-date.

Insuring Research Data

Protecting valuable research data through insurance is crucial for UK organisations. It helps manage risks and provides financial safeguards against data loss or breaches.

Risk Management for Data Projects

Data projects face many risks. These include cyber attacks, hardware failures, and human error. To manage these risks, organisations should:

- Identify critical data assets

- Assess potential threats

- Implement security measures

- Create backup and recovery plans

Regular risk assessments are key. They help spot weak points in data protection. Organisations should also train staff on data handling best practices.

Strong access controls limit who can view sensitive data. Encryption adds an extra layer of protection. It makes data unreadable if stolen.

Insurance Products for Data Assets

Specialised insurance covers data-related risks. Key products include:

- Cyber liability insurance

- Data breach coverage

- Business interruption insurance

- Errors and omissions policies

Cyber liability insurance protects against hacking and data theft. It often covers legal fees and notification costs after a breach.

Data breach coverage helps with recovery costs. This can include credit monitoring for affected parties.

Business interruption insurance covers lost income if data loss halts operations. Errors and omissions policies protect against claims of negligence in data handling.

UK public sector bodies should consider tailored policies. These address unique risks in handling sensitive government data.

Conclusion

UK private research data for suppliers offers valuable insights into government spending patterns and priorities. The information reveals key trends in public-private partnerships and research funding allocation.

Several major IT and construction firms dominate as top government suppliers. This concentration highlights the importance of technology and infrastructure in public sector projects.

The UK government aims to boost domestic R&D investment to 2.4% of GDP by 2027. This target underscores a commitment to innovation and scientific advancement.

UK Research and Innovation (UKRI) now oversees research funding across multiple councils. This consolidation may streamline processes and enhance coordination in allocating resources.

Data foundations and AI adoption in the private sector remain areas of focus. Improving these could drive innovation and efficiency across industries.

Transparency in government contracting continues to evolve. Published transaction data allows for greater scrutiny of public spending with private providers.

As the landscape of UK research and development evolves, ongoing analysis of private sector data will be crucial. It will inform policy decisions and shape future partnerships between public and private entities.

Frequently Asked Questions

Private research data suppliers in the UK face various considerations around ethics, regulations and best practices. The following questions address key aspects of handling consumer data, ensuring reliability and working with reputable firms in this space.

What are the top-rated suppliers providing private research data in the UK?

Several firms are highly regarded for private research data in the UK. These include Kantar, Ipsos MORI and YouGov. Each offers extensive consumer panels and advanced analytics capabilities.

Nielsen and GfK also maintain strong reputations in the market research industry. Their data spans retail, media and consumer behaviour insights.

How does the Market Research Society Code of Conduct impact the handling of UK research data?

The Market Research Society Code of Conduct provides guidelines for ethical data handling. It requires researchers to protect respondent anonymity and obtain informed consent.

The Code also mandates transparency about data collection methods. Researchers must clearly explain how data will be used and stored.

Which companies are considered leaders in market research within the UK?

Kantar and Ipsos MORI are widely recognised as market research leaders in the UK. They offer comprehensive services across various sectors.

YouGov is known for its online panel and political polling. Mintel specialises in consumer and market intelligence reports.

What are the key ethical considerations when using consumer data in the UK?

Data privacy is a crucial ethical concern. Researchers must comply with UK GDPR regulations to protect personal information.

Informed consent is essential. Participants should understand how their data will be used. Researchers should also avoid collecting unnecessary sensitive data.

In what ways can the Consumer Data Research Centre contribute to private UK research?

The Consumer Data Research Centre provides access to retail and consumer datasets. These can enhance private research projects with additional context.

The centre offers training in data analysis techniques. This helps researchers make the most of complex consumer datasets.

What methods are employed by UK private research firms to ensure data accuracy and reliability?

UK research firms use rigorous sampling methods to ensure representative data. They often employ statistical weighting to correct for any biases.

Many firms conduct quality checks and due diligence on data sources. This helps maintain high standards of accuracy and reliability.

Firms may also use multiple data collection methods to cross-verify findings. This triangulation approach improves overall data quality.