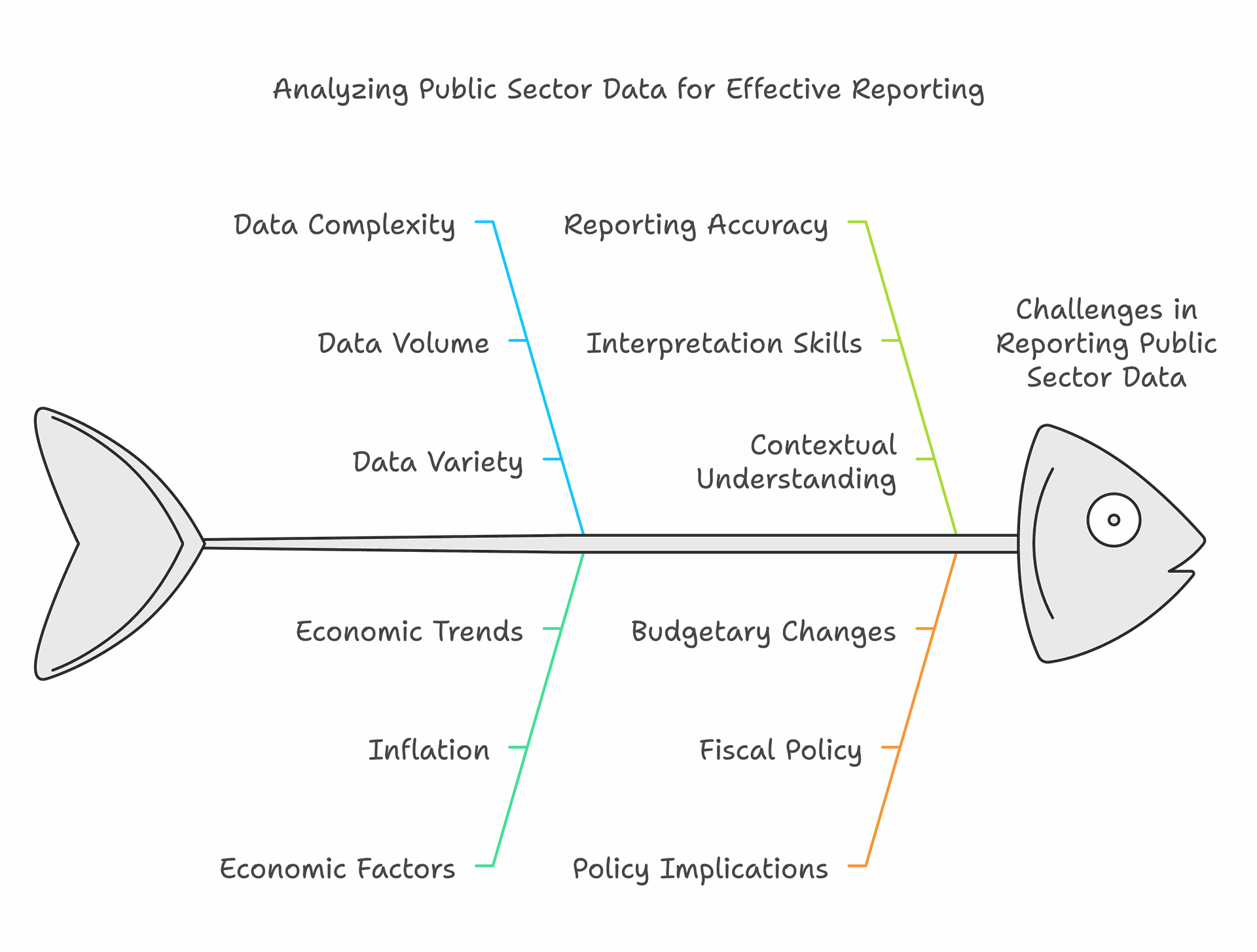

Public sector data offers valuable insights into government spending patterns and priorities. Media reports often rely on this information to inform the public about how taxpayer money is used. The UK government publishes detailed public spending statistics that cover various sectors, including health, education, and defence.

Analysing this data allows journalists to identify trends and highlight areas of significant expenditure or budget changes. For example, recent figures show an increase in public sector debt interest payments. This type of information can spark important discussions about fiscal policy and economic management.

Using public sector data effectively requires understanding its context and limitations. Journalists must carefully interpret the numbers and consider factors like inflation or changes in accounting methods. By doing so, they can produce accurate and meaningful reports that contribute to public discourse on government spending.

Key Takeaways

- Public sector data provides crucial information on government spending across various sectors

- Media reports use this data to inform the public and spark discussions on fiscal policies

- Accurate interpretation of public spending data is essential for meaningful reporting

Understanding Public Sector Finances

Public sector finances involve complex systems of income and spending. They shape government policies and affect the lives of citizens.

Components of Public Sector Expenditure

Public sector expenditure includes several key parts. Total managed expenditure covers all government spending. This breaks down into two main categories:

- Annually managed expenditure (AME)

- Departmental expenditure limits (DEL)

AME changes based on demand and economic factors. It covers areas like social benefits and debt interest. DEL is set in advance for each government department. It funds day-to-day services and investment.

Central government spending makes up a large portion of public expenditure. But it's not the whole picture. Local government spending also plays a key role in public services.

Assessing Financial Year Statements

The financial year for UK public sector bodies runs from 1 April to 31 March. This differs from the calendar year used by many private companies.

At the end of each financial year, public bodies publish their accounts. These statements show:

- Income received

- Money spent

- Assets and liabilities

Analysing these reports helps track how public money is used. It allows for comparisons between years and different parts of the public sector.

Distinguishing Between Types of Spending

Public sector spending falls into different categories. Understanding these helps make sense of government finances.

Current spending covers day-to-day costs. This includes:

- Wages for public sector workers

- Running costs of services

- Social security payments

Capital spending is money used for investment. It pays for:

- New buildings

- Roads and infrastructure

- Equipment and technology

The balance between current and capital spending can affect long-term economic growth. It's a key focus in budget planning and financial reporting.

Sources of Public Sector Data

The UK government provides several reliable sources for public sector spending data. These sources offer detailed financial information that journalists and researchers can use for accurate reporting.

Office for National Statistics

The Office for National Statistics (ONS) is a key provider of public sector finance data. It publishes monthly statistics on government borrowing, debt, and spending.

The ONS website offers downloadable datasets and interactive tools. These allow users to analyse trends in public expenditure over time.

ONS data is widely respected for its accuracy and impartiality. It covers all levels of government, from local councils to central departments.

National Accounts and Statistics

National Accounts provide a comprehensive view of the UK economy. They include detailed breakdowns of public sector spending by function and department.

The ONS uses data from various government sources to compile these accounts. This ensures a complete picture of public finances.

Key publications include the Blue Book and the Pink Book. These annual reports offer in-depth analysis of government expenditure and revenue.

HM Treasury Publications

HM Treasury releases regular updates on public spending. These include the Budget, Spending Reviews, and financial statements.

The Treasury's OSCAR database is a valuable resource. It provides detailed, up-to-date information on departmental spending.

Treasury publications often include forecasts and policy explanations. This context can be crucial for understanding spending decisions.

Journalists can find monthly and annual reports on the Treasury website. These cover areas like tax receipts, borrowing, and departmental budgets.

Sectoral Analysis of Public Spending

Public spending data reveals how the government allocates resources across different sectors. This analysis helps identify priorities and trends in areas like health, education, defence, and infrastructure.

Health and Social Security Expenditure

The UK government spends a large portion of its budget on health and social security. Public sector expenditure on health services has been increasing steadily. This includes funding for the NHS, public health programmes, and medical research.

Social security spending covers pensions, unemployment benefits, and disability support. The ageing population has led to higher pension costs.

Key areas of health spending:

- Hospital services

- Primary care

- Mental health support

- Prescription drugs

Social security expenditure focuses on:

- State pensions

- Universal Credit

- Disability benefits

- Child support

Education and Innovation Investments

Education is a major focus of public spending, covering primary, secondary, and higher education. The government also invests in research and innovation to boost economic growth.

Education spending includes:

- Teacher salaries

- School buildings and equipment

- University funding

- Adult education programmes

Innovation investments support:

- Scientific research grants

- Technology development

- Startup incubators

- Skills training initiatives

These investments aim to improve the UK's competitiveness in the global economy. The government often partners with universities and private companies on innovation projects.

Defence and Security Budgeting

Defence spending is a significant part of the UK budget. It covers military personnel, equipment, and operations. Security budgeting includes funding for intelligence services and counter-terrorism efforts.

Major defence spending areas:

- Armed forces salaries

- Military equipment and weapons

- Naval vessels and aircraft

- Overseas operations

Security budgeting covers:

- MI5, MI6, and GCHQ

- Border security

- Cybersecurity initiatives

- Counter-terrorism programmes

The UK aims to meet NATO's target of spending 2% of GDP on defence. This commitment influences budget allocations and long-term planning.

Infrastructure and Transport Spending

Public investment in infrastructure and transport is crucial for economic growth. This includes roads, railways, airports, and digital networks. The government also funds public transport services and maintenance of existing infrastructure.

Key infrastructure projects often include:

- High-speed rail networks

- Motorway expansions

- Airport upgrades

- Broadband rollout

Transport spending covers:

- Bus and rail subsidies

- Road maintenance

- Cycling and walking initiatives

- Electric vehicle charging points

These investments aim to improve connectivity, reduce congestion, and support sustainable transport options. The government often uses public-private partnerships to finance large infrastructure projects.

Economic Impact of Public Spending

Public spending significantly affects a nation's economy. It influences GDP, debt levels, inflation, employment, and development. These factors are closely linked and can have far-reaching effects on a country's economic health.

Effect on GDP and National Debt

Public spending plays a key role in shaping GDP and national debt. When the government spends more, it can boost economic activity and increase GDP. This happens through direct purchases and investments in areas like infrastructure and education.

But higher spending can also lead to more debt. The UK government must borrow money to fund spending that exceeds tax revenue. This adds to the national debt, which requires interest payments.

Over time, large debts can slow economic growth. They may lead to higher taxes or reduced spending in other areas to cover interest costs.

Public Spending and Inflation

Government spending can impact inflation rates. When public spending increases rapidly, it can lead to higher demand for goods and services. This extra demand can push prices up, causing inflation.

The Bank of England aims to keep inflation at 2%. Too much public spending can make this goal harder to achieve. On the flip side, well-targeted spending can help manage inflation during economic downturns.

Pensions are a big part of public spending. As the population ages, pension costs rise. This can put pressure on budgets and potentially fuel inflation if not managed carefully.

Employment and Development Correlations

Public spending has strong links to employment and development. Government jobs make up a large part of the workforce. When public spending rises, it often creates more jobs in areas like healthcare, education, and infrastructure.

Investment in infrastructure projects can boost employment in the short term and support long-term economic growth. This spending helps build roads, schools, and hospitals, which are vital for development.

Public spending on education and training can improve workforce skills. This leads to higher productivity and can attract more business investment. In turn, this can create a positive cycle of job creation and economic growth.

Budgeting and Financial Planning

The UK government uses structured processes and frameworks to plan public spending. These help manage finances and set goals for the future.

The Spending Review Process

The spending review is a key part of UK public sector budgeting. It sets out how the government will fund public services over several years. The Treasury leads this process, working with departments to decide funding.

Spending reviews look at the whole of government spending. They set budgets for each department. The reviews also set out policy priorities and reforms.

The process involves:

- Forecasting future revenues and costs

- Setting spending limits for departments

- Agreeing on major projects and investments

Spending reviews usually cover 3-4 years. This gives departments more certainty for long-term planning.

Fiscal Frameworks and Targets

The UK uses fiscal frameworks to guide budgeting decisions. These set rules for managing public finances. The main goals are to control debt and deficits.

Key parts of the fiscal framework include:

- Budget responsibility rules

- Debt and deficit targets

- Limits on borrowing

The Office for Budget Responsibility (OBR) checks if the government is meeting its targets. It produces independent forecasts of public finances.

Fiscal targets help build trust in the UK's economic management. They aim to keep public finances stable over time.

Transparency and Accountability

Transparency and accountability are key pillars of good governance in the public sector. They help build trust between governments and citizens by providing insight into how public funds are used.

Public Access to Spending Data

Transparency in public spending allows citizens to see how their tax money is used. Governments publish financial reports and budgets online for easy access.

Open data portals let people explore spending details. These often include interactive tools for analysing trends.

Some countries have laws requiring the release of financial information. The UK's Freedom of Information Act is one example.

Regular audits help ensure accuracy in reported figures. Independent bodies like the National Audit Office review government accounts.

Transparency Declarations and Practices

Many public bodies issue transparency declarations. These outline their commitment to openness and how they'll achieve it.

The Code of Practice for Statistics sets standards for publishing official data. It ensures information is trustworthy, high quality, and of public value.

Governance structures support transparency efforts. Audit committees oversee financial reporting and risk management.

Some organisations appoint transparency officers. They champion open practices and handle information requests.

Regular performance reports show progress on transparency goals. These might include metrics on data releases and public engagement.

Policy Implications and Recommendations

Using public sector data for media reports on spending has significant impacts on policy decisions and fiscal management. Proper evaluation and sustainable strategies are key to improving governance and resilience in public expenditure.

Evaluating Public Expenditure Efficiency

Performance information use is crucial for assessing public spending effectiveness. Governments should adopt clear metrics to measure outcomes against investments.

Regular audits can identify areas of waste or inefficiency. These findings should be made public to boost transparency and accountability.

Data-driven decision-making helps allocate resources more effectively. Policymakers can use spending data to identify high-impact programmes and cut underperforming ones.

Benchmarking against similar jurisdictions can reveal best practices. This comparison allows for learning from successful policies elsewhere.

Strategies for Sustainable Investing

Long-term planning is essential for sustainable public spending. Governments should consider future needs and environmental impacts when making investment decisions.

Green budgeting can help align fiscal policies with environmental goals. This approach factors in climate risks and opportunities when allocating funds.

Public-private partnerships can leverage private sector expertise and capital. These collaborations can improve project delivery and spread financial risks.

Investing in resilient infrastructure supports long-term sustainability. This includes climate-proofing assets and developing adaptive technologies.

Digital transformation can enhance service delivery efficiency. Modernising systems reduces costs and improves citizen experiences.

Frequently Asked Questions

Public sector financial data provides valuable insights for investigative journalism and economic analysis. Journalists can uncover spending patterns and potential discrepancies through careful examination of government expenditure records.

How can public sector financial data be leveraged for investigative journalism?

Journalists can use public spending data to track trends and identify anomalies. They might compare spending across different departments or time periods to spot unusual patterns.

Cross-referencing financial records with other public documents can reveal connections between spending decisions and policy outcomes.

What are common methods for analysing government expenditure data?

Data visualisation tools help journalists present complex financial information in an accessible format. Spreadsheet analysis allows for sorting and filtering large datasets to find relevant information.

Statistical methods like regression analysis can identify correlations between different spending categories or economic indicators.

In what ways does public sector spend impact economic forecasts?

Government spending influences GDP calculations directly. Large infrastructure projects or changes in public sector wages can have ripple effects throughout the economy.

Economists use public expenditure data to predict future economic trends and assess the impact of fiscal policies.

How can discrepancies in reported government spending be identified?

Journalists can compare data from different sources, such as departmental reports and central government accounts. Unexpected variations in spending between similar periods or departments may warrant further investigation.

Fact-checking against official budget documents and parliamentary records can help verify reported figures.

What role does Freedom of Information play in obtaining government financial data for reporting?

Freedom of Information requests allow journalists to access detailed financial records not readily available to the public. This can include specific contract details or internal spending reports.

FOI requests can be particularly useful for investigating areas of government spending that lack transparency.

What ethical considerations must be taken into account when using public data in media reports?

Journalists must ensure they accurately represent financial data and provide proper context. Misinterpreting complex financial information can lead to misleading reports.

Protecting individual privacy is crucial when reporting on public sector spending, especially when dealing with salary information or small-scale local projects.