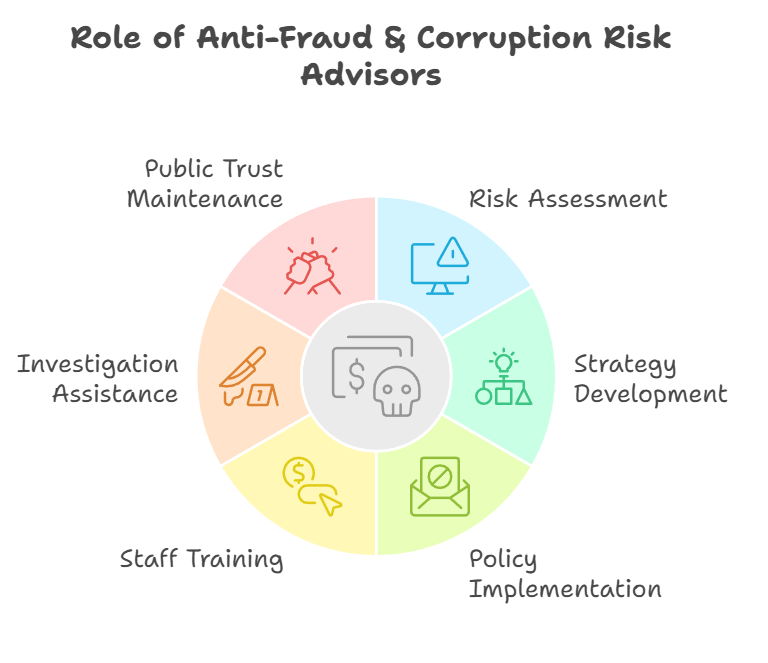

Public sector organisations face ongoing challenges in safeguarding funds and resources from fraud and corruption. An Anti-Fraud & Corruption Risk Advisor plays a crucial role in helping these entities protect public assets and maintain trust. These specialists work to assess risks, develop strategies, and implement measures to prevent and detect fraudulent activities within government agencies and publicly-funded bodies.

These advisors bring a wealth of knowledge to the table, combining expertise in financial systems, legal frameworks, and risk management. They help organisations create robust policies, conduct thorough risk assessments, and train staff to recognise warning signs. By doing so, they strengthen the public sector's defences against fraud and corruption.

The work of Anti-Fraud & Corruption Risk Advisors extends beyond prevention. They also assist in investigating suspected cases and advise on how to respond effectively when issues arise. Their efforts contribute to maintaining public trust and ensuring that vital resources are used as intended for the benefit of communities.

Key Takeaways

- Anti-Fraud & Corruption Risk Advisors protect public funds through risk assessment and prevention strategies

- These specialists combine financial, legal, and risk management expertise to strengthen organisational defences

- Their work helps maintain public trust and ensures resources are used as intended for community benefit

Understanding The Anti-Fraud & Corruption Risk Advisor (Public Sector) Role

The Anti-Fraud & Corruption Risk Advisor plays a crucial role in safeguarding public resources and maintaining trust in government institutions. This role requires expertise in risk assessment, policy implementation, and stakeholder engagement.

Core Responsibilities In The Public Sector

Anti-Fraud & Corruption Risk Advisors are tasked with developing and implementing effective standards for countering fraud and corruption within public sector organisations. They conduct thorough risk assessments to identify vulnerabilities and design tailored strategies to mitigate these risks.

Key responsibilities include:

- Developing and maintaining anti-fraud policies and procedures

- Conducting fraud risk assessments across departments

- Providing training and awareness programmes for staff

- Investigating suspected cases of fraud or corruption

- Liaising with law enforcement agencies when necessary

The advisor also works closely with the counter fraud function to ensure a coordinated approach to fraud prevention and detection. They may collaborate with the Public Sector Fraud Authority to align with national strategies and best practices.

Relevant Policy And Regulatory Context

Anti-Fraud & Corruption Risk Advisors must stay abreast of relevant legislation and guidelines. They ensure their organisation's practices align with government standards for countering fraud, bribery and corruption.

Important policies and regulations include:

- The Bribery Act 2010

- The Fraud Act 2006

- Public sector internal audit standards

- CIPFA Code of Practice on Managing the Risk of Fraud and Corruption

Advisors must also consider sector-specific regulations and guidelines that may impact their organisation's fraud risk profile.

Typical Stakeholders And Decision-Making Processes

Anti-Fraud & Corruption Risk Advisors interact with a wide range of stakeholders across the public sector. They work closely with senior leadership teams to embed a culture of integrity and accountability throughout the organisation.

Key stakeholders typically include:

- Board members and executive leadership

- Internal audit teams

- Finance departments

- Human resources

- Legal counsel

- External auditors and regulators

The advisor plays a crucial role in decision-making processes related to fraud risk management. They provide expert advice to inform policy decisions, resource allocation, and strategic planning. Their recommendations often shape the organisation's approach to fraud prevention and detection.

Key Qualities and Areas of Expertise

Anti-Fraud & Corruption Risk Advisors in the public sector require a unique blend of skills and knowledge. They must possess deep technical expertise, strong institutional understanding, and the ability to adapt to complex challenges.

Technical/Subject-Matter Expertise

Counter fraud professionals need extensive knowledge of fraud detection and prevention techniques. They should be well-versed in risk assessment methodologies and data analytics tools.

Expertise in relevant laws and regulations is crucial. This includes understanding anti-corruption legislation and public sector financial rules.

Strong analytical skills are essential for identifying patterns and anomalies in financial data. Proficiency in using specialised software for fraud detection is highly valued.

Knowledge of emerging fraud trends and tactics is vital. Advisors must stay updated on new schemes and countermeasures.

Institutional Knowledge and Networks

A deep understanding of public sector structures and processes is key. Advisors should be familiar with government departments and their specific fraud risks.

Networking skills are crucial for building relationships across agencies. This facilitates information sharing and collaborative anti-fraud efforts.

Knowledge of public sector fraud standards and best practices is important. Advisors should be able to guide organisations in implementing effective fraud prevention measures.

Understanding of procurement processes and contract management is valuable. These areas are often vulnerable to fraud and corruption.

Adaptability and Problem-Solving Skills

The ability to think creatively is essential when tackling complex fraud cases. Advisors must develop innovative solutions to emerging threats.

Strong problem-solving skills help in designing effective anti-fraud strategies. This includes the ability to analyse complex situations and propose practical solutions.

Flexibility is key, as fraud tactics constantly evolve. Advisors must be able to quickly adapt their approaches to new challenges.

Critical thinking skills are crucial for evaluating evidence and making sound judgements. This is particularly important when investigating suspected fraud cases.

Strategic Value to External Organisations

Anti-Fraud & Corruption Risk Advisors offer crucial expertise to public sector entities. They help safeguard resources, enhance transparency, and bolster trust in government institutions.

Navigating Complex Procurement and Funding

Risk advisors guide organisations through intricate procurement processes. They help identify potential fraud risks in tendering and contract award procedures.

These experts develop counter fraud measures tailored to each organisation's needs. They assess supplier relationships and flag suspicious patterns or conflicts of interest.

For funding allocations, advisors create robust verification systems. They ensure grants and subsidies reach intended beneficiaries. This approach minimises the risk of misuse or diversion of public funds.

Risk advisors also train staff to spot red flags in financial transactions. They build capacity within organisations to maintain vigilance against fraud and corruption.

Policy and Market Foresight

Advisors stay ahead of emerging fraud trends and regulatory changes. They analyse market dynamics to predict potential vulnerabilities in public sector operations.

They contribute to shaping counter fraud strategies at the policy level. This involves recommending legislative updates to close loopholes and strengthen deterrence.

Advisors conduct horizon scanning to identify new fraud risks from technological advancements. They assess the impact of digital transformation on public sector integrity.

Their insights help organisations adapt proactively to evolving threats. This foresight enables the development of preventive measures before new fraud schemes take root.

Enhancing Credibility and Compliance

Risk advisors boost an organisation's reputation for integrity. They implement robust anti-fraud frameworks that align with international best practices.

These experts ensure compliance with anti-corruption laws and regulations. They conduct regular audits and assessments to identify gaps in existing controls.

Advisors help organisations demonstrate transparency and accountability to stakeholders. This includes developing clear reporting mechanisms for suspected fraud or corruption.

By fostering a culture of integrity, advisors enhance public trust in government institutions. They help create an environment where ethical behaviour is the norm.

Leveraging Public Sector Data and Insights

Risk advisors harness the power of data analytics to detect fraud patterns. They use advanced tools to sift through vast amounts of public sector information.

These experts develop risk scoring models to flag suspicious transactions. They create dashboards for real-time monitoring of high-risk areas.

Advisors facilitate information sharing between different government departments. This collaborative approach helps identify cross-cutting fraud schemes.

By analysing trends, advisors provide valuable insights for resource allocation. They help target anti-fraud efforts where they will have the most impact, ensuring efficient use of public funds.

Practical Outcomes and Applications

Anti-Fraud & Corruption Risk Advisors in the public sector drive tangible results through strategic initiatives and targeted interventions. Their work leads to improved systems, enhanced vigilance, and more effective use of resources to combat fraud.

Product Development and Service Enhancement

Risk advisors help create robust anti-fraud tools and services. They design secure digital platforms to detect suspicious activities. These experts develop fraud risk assessment frameworks tailored for public bodies.

Risk advisors craft training programmes to boost staff awareness. They create guidelines for ethical conduct and reporting mechanisms. Their input shapes policies on procurement and financial controls.

These professionals also refine existing anti-fraud measures. They analyse past incidents to identify weak points. This analysis informs upgrades to security protocols and monitoring systems.

Go-To-Market and Engagement Strategies

Advisors plan targeted outreach to key stakeholders. They organise workshops for department heads and finance teams. These sessions highlight fraud risks and prevention strategies.

They develop clear communication plans. These explain anti-fraud measures to staff and the public. Advisors create user-friendly guides and online resources.

Collaboration is crucial. Advisors forge partnerships with law enforcement and regulatory bodies. They establish networks for sharing intelligence on emerging fraud threats.

Public awareness campaigns form part of their strategy. These educate citizens on how to spot and report fraud. Such initiatives help create a culture of vigilance.

Long-Term Sustainability and Growth

Risk advisors focus on building lasting anti-fraud capabilities. They help establish dedicated anti-fraud units within organisations. These units receive ongoing training and support.

Advisors promote a professional counter-fraud standard across the public sector. This ensures consistent skills and practices.

They advocate for sustained funding for anti-fraud efforts. Advisors present business cases showing the long-term benefits of investment.

Knowledge transfer is key. Advisors create systems to capture and share best practices. They mentor junior staff to build the next generation of experts.

Measuring Impact and ROI

Advisors develop metrics to gauge the effectiveness of anti-fraud measures. They track key indicators such as:

- Number of fraud attempts detected and prevented

- Financial losses averted

- Successful prosecutions

- Staff compliance with anti-fraud protocols

They conduct regular audits and assessments. These reveal areas for improvement and validate successful strategies.

Cost-benefit analyses demonstrate the value of anti-fraud work. Advisors quantify savings from prevented fraud and recovered funds.

They also measure indirect benefits. These include improved public trust and operational efficiency. Such data helps secure continued support for anti-fraud initiatives.

Frequently Asked Questions

Anti-fraud and corruption risk advisors in the public sector play a crucial role in safeguarding integrity. Their qualifications, responsibilities, and ethical frameworks are key to effective risk management and maintaining public trust.

What qualifications are necessary to become an Anti-Fraud & Corruption Risk Advisor in the Public Sector?

Aspiring advisors typically need a bachelor's degree in accounting, finance, or a related field. Professional certifications like the Certified Fraud Examiner (CFE) are highly valued.

Experience in auditing, investigations, or risk management is often required. Strong analytical skills and knowledge of anti-corruption laws are essential.

How does one navigate the application process for Civil Service roles specialising in fraud and corruption risk?

Candidates should regularly check the Civil Service Jobs website for openings. Applications often require a CV and a personal statement highlighting relevant skills and experience.

Successful applicants may undergo security vetting. Preparing for competency-based interviews is crucial, focusing on integrity and analytical abilities.

What are the key functions and responsibilities of a Criminal Investigator within HMRC?

HMRC Criminal Investigators gather evidence of tax fraud and financial crimes. They conduct interviews, analyse financial records, and prepare case files for prosecution.

Investigators often work closely with other agencies and must maintain strict confidentiality. They may be required to testify in court proceedings.

Can you detail the ethical frameworks that guide Public Sector professionals in managing corruption risks?

The Civil Service Code outlines core values of integrity, honesty, objectivity, and impartiality. Public sector professionals must adhere to these principles in all their work.

The Nolan Principles of Public Life provide additional guidance on ethical behaviour. These include selflessness, accountability, and leadership.

In the context of government functional standards, how is fraud risk typically assessed and mitigated?

Fraud risk assessment involves identifying vulnerabilities in systems and processes. Regular audits and data analytics help detect anomalies and potential fraud indicators.

Mitigation strategies include implementing robust internal controls, segregation of duties, and regular staff training. The Public Sector Fraud Authority provides guidance on best practices.

What are the common indicators of corruption that Risk Advisors should be vigilant of in public institutions?

Red flags include unexplained wealth of officials, unusual bidding patterns in procurement processes, and frequent sole-source contracts. Lack of transparency in decision-making is also a concern.

Advisors should watch for conflicts of interest, nepotism in hiring practices, and resistance to audits or investigations. Whistleblower reports can provide valuable insights into potential corruption.