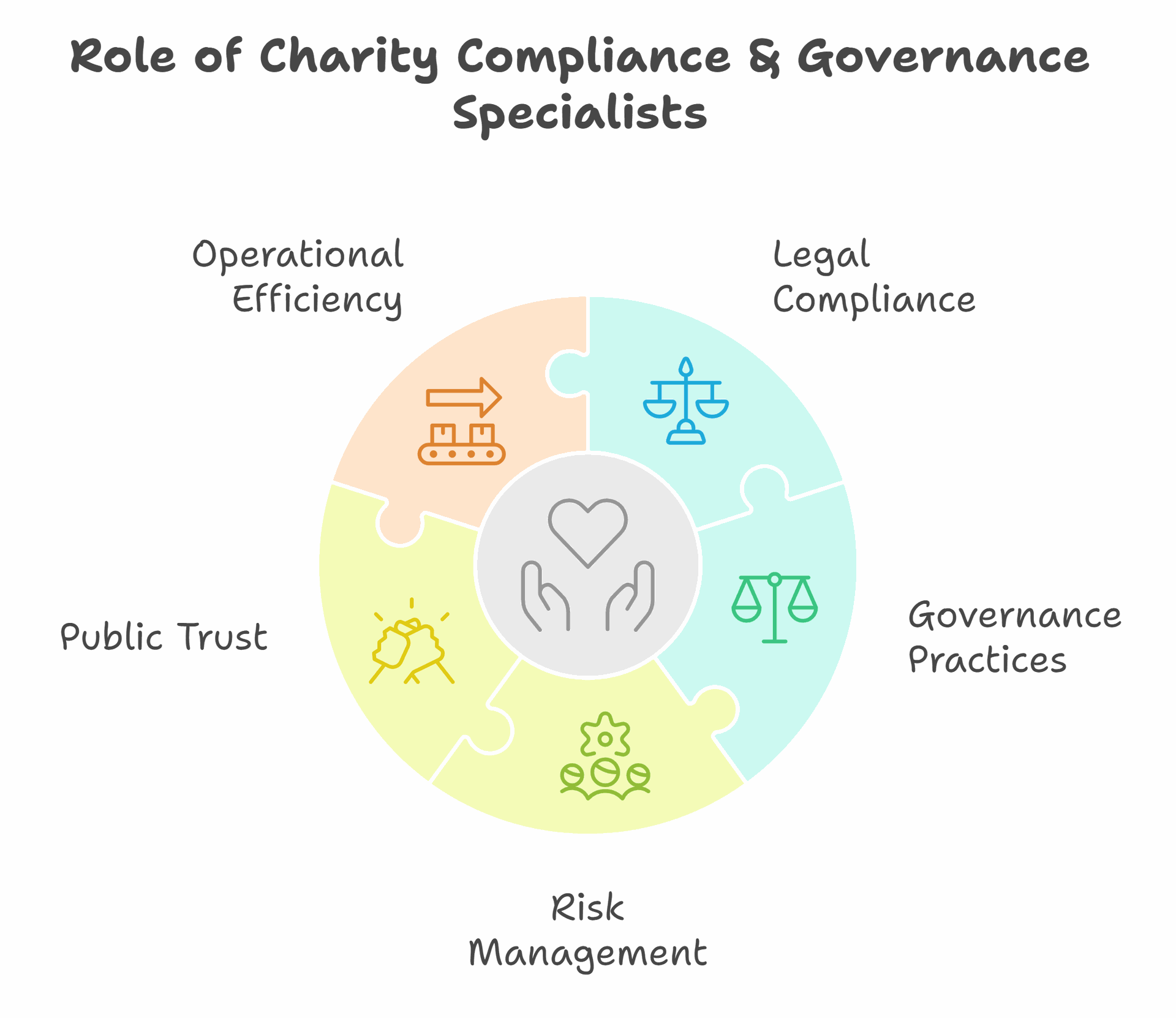

Charities play a vital role in society, but they must navigate complex regulations to stay compliant. A Charity Compliance & Governance Specialist helps organisations meet these legal requirements while achieving their goals. These experts ensure charities follow proper governance practices, manage risks effectively, and maintain public trust.

Charities need effective processes for managing governance and regulatory risks. This includes having clear questions for trustees and audit committees. A specialist in this field can guide charities through these processes, helping them create robust governance structures and policies.

The role of a Charity Compliance & Governance Specialist is crucial for both large and small organisations. They help charities deliver their mission while staying compliant with ever-changing regulations. By focusing on good governance, these experts enable charities to operate efficiently and ethically.

Key Takeaways

- Charity Compliance & Governance Specialists ensure organisations meet legal requirements and maintain public trust

- These experts help develop effective processes for managing governance and regulatory risks

- Good governance practices enable charities to operate efficiently and ethically while achieving their mission

Understanding the Charity Compliance & Governance Specialist (Nonprofit Regulator) Role

A Charity Compliance & Governance Specialist plays a vital role in ensuring charities and non-profit organisations operate within legal and ethical frameworks. This role involves overseeing regulatory compliance, developing governance policies, and managing stakeholder relationships.

Core Responsibilities in the Public Sector

The specialist's primary duty is to safeguard public trust in charities. They develop and implement governance policies to ensure organisations fulfil their charitable purposes. This includes:

- Monitoring financial management and resource allocation

- Ensuring compliance with charity law and regulations

- Conducting risk assessments and implementing mitigation strategies

- Advising trustees on their legal duties and responsibilities

Specialists also review charity governing documents to ensure they align with current regulations. They may investigate complaints and take action against non-compliant charities when necessary.

Relevant Policy and Regulatory Context

Charity Compliance & Governance Specialists must have a deep understanding of:

- The Charities Act and related legislation

- The Charity Governance Code

- Fundraising regulations and best practices

- Data protection laws (GDPR)

- Financial reporting standards for charities

They stay updated on changes in charity law and regulatory requirements. This knowledge helps them guide charities in maintaining compliance and adopting best practices in governance.

Typical Stakeholders and Decision-Making Processes

Charity Compliance & Governance Specialists interact with various stakeholders:

- Charity trustees and board members

- Charity Commission officials

- Legal advisors and accountants

- Beneficiaries and donors

- Other regulatory bodies (e.g., Fundraising Regulator)

They participate in decision-making processes by:

- Providing expert advice to charity boards

- Contributing to policy development at regulatory bodies

- Collaborating with legal teams on complex compliance issues

Effective governance requires balancing stakeholder interests while ensuring charities fulfil their missions ethically and efficiently.

Key Qualities and Areas of Expertise

Charity compliance and governance specialists need a unique blend of skills and knowledge. These experts must stay up-to-date on complex regulations while building strong networks and solving tricky problems.

Technical/Subject-Matter Expertise

A strong grasp of charity governance is vital. This includes knowing the laws, rules, and best practices that guide charities. Experts must understand:

- Charity law and regulations

- Financial management and reporting

- Risk assessment and management

- Data protection and privacy laws

They should be able to create and review governance policies. This helps charities follow the rules and work well. Specialists often give trustee training to help boards do their jobs better.

Institutional Knowledge and Networks

Knowing how charities work is key. Experts should grasp:

- Charity structures and how they run

- Roles of trustees, chief executives, and staff

- How different types of charities operate

Building a wide network is crucial. This includes:

- Other compliance experts

- Charity leaders and trustees

- Regulators and policymakers

These links help specialists stay informed and share knowledge. They can also spot trends and upcoming changes in the sector.

Adaptability and Problem-Solving Skills

The charity world changes fast. Experts must:

- Keep learning and growing their skills

- Adapt to new laws and best practices

- Find creative solutions to complex issues

They should be able to:

- Spot risks before they become big problems

- Help charities fix governance issues

- Give clear, practical advice to boards and staff

Good communication is essential. Experts must explain complex ideas in simple terms to help charities improve their work.

Strategic Value to External Organisations

A Charity Compliance & Governance Specialist brings vital expertise to external organisations. Their skills help navigate complex regulations and enhance operational effectiveness.

Navigating Complex Procurement and Funding

Specialists help organisations secure funding and manage procurement. They ensure compliance with strict rules on spending and reporting. This expertise is crucial for:

- Meeting donor requirements

- Adhering to grant conditions

- Managing public sector contracts

Specialists guide charities through complex regulatory frameworks. They help create robust financial controls and planning processes. This reduces the risk of funding loss or contract breaches.

Policy and Market Foresight

These experts keep organisations ahead of regulatory changes. They analyse policy trends and market shifts. This insight helps charities:

- Adapt strategies to new laws

- Spot emerging funding opportunities

- Prepare for sector-wide changes

Specialists often have links to regulatory bodies. This gives charities early warning of new rules on GDPR, equality, and financial reporting.

Enhancing Credibility and Compliance

A governance specialist boosts an organisation's reputation. They ensure charities meet high standards of:

- Financial management

- Data protection

- Health and safety

- Cyber security

This effective governance builds trust with donors, beneficiaries, and regulators. It reduces the risk of scandals or legal issues that could harm the charity's image.

Leveraging Public Sector Data and Insights

Specialists help charities use public sector data effectively. They can:

- Interpret government statistics

- Access useful datasets

- Apply insights to improve services

This skill is vital for charities working with local councils or the NHS. It helps target services where they're most needed. It also supports bids for public sector contracts by showing evidence of impact.

Practical Outcomes and Applications

Charity compliance and governance specialists play a vital role in shaping nonprofit operations. Their work leads to tangible benefits across many areas of an organisation.

Product Development and Service Enhancement

Specialists help charities improve their offerings through best practice guidance. They ensure programmes align with regulatory requirements and ethical standards. This can lead to more effective services that better meet beneficiary needs.

Compliance experts also aid in developing robust policies and procedures. These help charities operate more efficiently and reduce risks. Clear guidelines on issues like safeguarding and data protection enhance service quality.

Specialists may advise on charity mergers to expand reach. They guide organisations through legal and practical aspects of joining forces. This can result in stronger, more impactful services for beneficiaries.

Go-to-Market and Engagement Strategies

Governance specialists assist charities in crafting transparent communication strategies. They ensure annual reports accurately reflect the charity's work and impact. This builds trust with donors, beneficiaries, and the public.

They advise on ethical fundraising practices that comply with regulations. This helps charities engage supporters effectively while avoiding reputational risks.

Experts guide charities on digital engagement, ensuring online activities meet legal requirements. This can include advice on data protection, online fundraising, and social media use.

Long-Term Sustainability and Growth

Governance specialists support charities in developing robust financial management systems. They advise on proper use of funds and investment strategies to ensure long-term viability.

Experts guide charities through the incorporation process when appropriate. This can provide legal protection and open up new funding opportunities.

They help establish strong governance structures, including effective boards. This leads to better decision-making and oversight, supporting sustainable growth.

Specialists promote a culture of continuous improvement. They encourage regular reviews of policies and practices to keep pace with changing regulations and sector best practices.

Measuring Impact and ROI

Compliance experts help charities develop meaningful performance indicators. These measure both compliance with regulations and social impact achieved.

They guide organisations in creating robust impact measurement frameworks. This helps charities demonstrate their value to funders and stakeholders.

Specialists advise on collecting and analysing data ethically and effectively. This supports evidence-based decision-making and helps charities improve their services over time.

They assist in developing comprehensive reporting systems. These showcase the charity's impact while meeting regulatory requirements, enhancing transparency and accountability.

Frequently Asked Questions

Charity governance and compliance involve key responsibilities and practices. Regulatory bodies play a crucial role in overseeing charitable organisations. Trustees must uphold good practices to maintain public trust.

Who holds the accountability for governance within charitable entities?

The trustees of a charity are accountable for its governance. They must ensure the charity follows its governing document and complies with charity law.

Trustees make important decisions about the charity's activities and finances. They are responsible for managing risks and protecting the charity's assets.

What are the core responsibilities of the Charity Commission?

The Charity Commission regulates charities in England and Wales. It keeps a register of charities and provides guidance on charity law.

The Commission investigates mismanagement and abuse in charities. It has powers to act if charities break the law or fail to meet their legal obligations.

How does a charity ensure compliance with regulatory requirements?

Charities must submit annual returns and accounts to the Charity Commission. They should follow the Charities Governance Code, which sets out minimum standards for effective management.

Charities must report serious incidents to the Commission. They should also comply with data protection laws and fundraising regulations.

What are the key differences between the various charity regulators in the UK?

The Charity Commission regulates charities in England and Wales. Scotland has its own regulator, the Office of the Scottish Charity Regulator (OSCR).

In Northern Ireland, the Charity Commission for Northern Ireland (CCNI) oversees charities. Each regulator has its own rules and reporting requirements.

How can trustees uphold good governance practices in a charity?

Trustees should attend regular meetings and ask important questions about the charity's activities. They must understand their legal duties and responsibilities.

Good governance includes managing conflicts of interest and ensuring financial controls are in place. Trustees should review the charity's performance and risks regularly.

What steps should a charity take to maintain transparency and public trust?

Charities should publish clear, accurate information about their activities and finances. They must be open about how they use donations and funding.

Maintaining good records and responding promptly to queries helps build trust. Charities should also have clear policies on safeguarding and whistleblowing.