Public housing finance managers play a crucial role in housing associations across England and Wales. These professionals oversee the financial health of organisations that provide affordable homes to thousands of people. They work to ensure that housing associations can meet their social objectives while remaining financially viable.

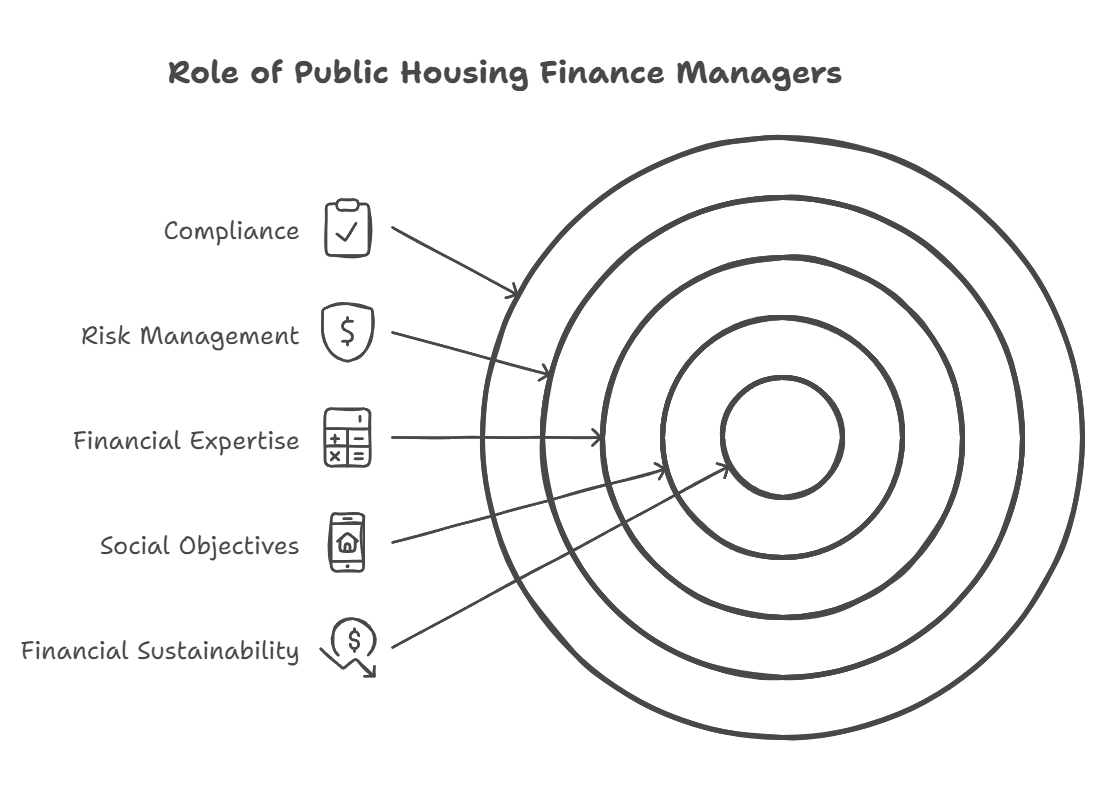

Public housing finance managers need a unique blend of financial expertise and understanding of the social housing sector. They must balance the need for financial sustainability with the goal of providing quality, affordable housing. This role requires skills in budgeting, financial planning, risk management, and compliance with housing regulations.

Housing associations face many challenges, including changes in government policy, funding cuts, and increasing demand for affordable homes. Finance managers must navigate these issues while maintaining the association's financial stability. They also work closely with other departments to support the organisation's overall mission and strategic goals.

Key Takeaways

- Public housing finance managers balance financial sustainability with social objectives

- The role requires expertise in finance, risk management, and housing regulations

- Finance managers help housing associations navigate challenges and support strategic goals

Understanding the Public Housing Finance Manager (Housing Association) Role

Public Housing Finance Managers play a crucial role in housing associations. They oversee financial operations, ensure regulatory compliance, and work with various stakeholders to support social housing initiatives.

Core Responsibilities in the Public Sector

Public Housing Finance Managers handle a range of financial duties. They create and manage budgets for housing associations, tracking income from rents and other sources. These managers also oversee financial forecasts and planning.

A key task is maintaining accurate accounts and financial records. This includes preparing reports for board members and regulators. Finance managers must ensure value for money in all operations.

They often lead finance teams and work closely with housing management staff. Their role extends to supporting tenancy sustainment efforts and managing financial risks.

Relevant Policy and Regulatory Context

Finance managers must stay up-to-date with housing sector policies and regulations. This includes understanding rent caps, the Right to Buy scheme, and decent home standards.

They need to know social housing finance structures and how they impact budgets. Changes in government policy can affect funding and financial planning.

Regulatory bodies set rules for financial management in housing associations. Finance managers ensure compliance with these rules. They also help shape responses to the broader housing crisis.

Typical Stakeholders and Decision-Making Processes

Finance managers interact with many stakeholders. They work closely with housing association boards and senior leadership teams. Regular meetings help guide financial strategy and decision-making.

External stakeholders include banks, auditors, and regulatory bodies. Finance managers provide them with required financial information and reports.

Tenants are key stakeholders too. Finance managers help balance tenant needs with financial stability. They may be involved in decisions about rent levels and service charges.

Local councils and government agencies are also important. Finance managers often liaise with them on funding and policy matters. This helps support social housing and home ownership initiatives.

Key Qualities and Areas of Expertise

Public housing finance managers need a diverse set of skills and knowledge to excel in their roles. They must combine financial acumen with a deep understanding of the housing sector and its unique challenges.

Technical/Subject-Matter Expertise

Finance managers in housing associations must have strong financial skills. They need to understand development finance, revenue income, and asset management. Knowledge of accounting principles, budgeting, and financial analysis is crucial.

They should be well-versed in treasury management and risk assessment. This includes managing cash flow, investments, and debt.

Expertise in taxation is vital. Finance managers must navigate corporation tax rules and ensure compliance with UK tax laws.

Familiarity with pensions and insurance is also important. They need to manage these areas to protect the association's interests.

Institutional Knowledge and Networks

Understanding the housing sector's governance structure is key. Finance managers work closely with housing association boards and must grasp their role in decision-making.

They should be familiar with sector-specific resources like the housing finance manual and CIPFA's TISonline.

Building networks within the sector is valuable. Connections with UK Finance and other housing associations can provide insights and support.

Knowledge of best practices in social housing finance is crucial. This helps in benchmarking and improving financial processes.

Adaptability and Problem-Solving Skills

Finance managers must adapt to changing regulations and market conditions. They need to stay updated on housing policy changes and their financial implications.

Problem-solving skills are essential. They often face complex financial challenges unique to the social housing sector.

Leadership abilities are important. Finance managers guide their teams and work with other departments to achieve financial goals.

They should be able to communicate financial information clearly to non-finance staff and board members.

Creativity in financial planning helps balance social objectives with financial stability. This skill is particularly important in the non-profit housing sector.

Strategic Value to External Organisations

Public Housing Finance Managers offer crucial expertise to external organisations. They provide valuable insights on funding, compliance, and market trends that can shape strategic decisions.

Navigating Complex Procurement and Funding

Public Housing Finance Managers excel in guiding external organisations through intricate procurement and funding processes. They help secure development finance and manage relationships with local authorities. These experts understand the nuances of government funding schemes and can advise on:

- Optimal funding sources for specific projects

- Compliance with procurement regulations

- Risk assessment in funding applications

Their knowledge of wholesale funding options and innovative financial products is invaluable. They can structure deals that balance risk and return, ensuring project viability.

Policy and Market Foresight

Finance Managers in housing associations possess a deep understanding of government policy and market trends. This foresight is crucial for external organisations planning long-term investments or partnerships in the sector.

Key areas of expertise include:

• Welfare reform impacts

• Regulatory changes affecting housing

• Market demand forecasts

They offer thought leadership on emerging issues, helping partners anticipate and adapt to shifts in the housing landscape. This knowledge aids in strategic planning and risk mitigation for external stakeholders.

Enhancing Credibility and Compliance

Public Housing Finance Managers boost the credibility of external organisations working in the sector. They ensure operations align with regulatory standards and legislation.

Their expertise covers:

- Financial reporting best practices

- Governance frameworks

- Compliance with National Housing Federation guidelines

By partnering with these professionals, external organisations can demonstrate a commitment to transparency and ethical practices. This enhances trust with regulators, investors, and the public.

Leveraging Public Sector Data and Insights

Finance Managers in housing associations have unique access to public sector data and insights. They can interpret this information to benefit external partners in several ways:

- Identifying market gaps and opportunities

- Benchmarking performance against sector standards

- Forecasting demographic trends affecting housing demand

This data-driven approach supports evidence-based decision-making for external organisations. It can inform investment strategies, product development, and service delivery models in the housing sector.

Practical Outcomes and Applications

Public housing finance managers in housing associations play a crucial role in shaping financial strategies and outcomes. Their work impacts various aspects of affordable housing provision and management.

Product Development and Service Enhancement

Housing finance managers contribute to developing new financial products and services. They analyse market trends and tenant needs to create affordable housing options. These may include shared ownership schemes or flexible rent models.

Finance managers also work on improving existing services. They might develop payment plans for tenants facing financial difficulties. This helps prevent arrears and maintains stable revenue income.

By staying up-to-date with regulations, finance managers ensure compliance with HMRC rules. This includes proper handling of PAYE/NIC for employees and contractors.

Go-to-Market and Engagement Strategies

Effective engagement strategies are vital for housing associations. Finance managers collaborate with marketing teams to promote new housing schemes. They provide accurate financial information for promotional materials.

They also develop strategies to engage with potential tenants and buyers. This might involve creating easy-to-understand guides on affordability and eligibility criteria.

Finance managers play a key role in stakeholder engagement. They present financial reports to boards and investors, demonstrating the association's financial health and growth potential.

Long-Term Sustainability and Growth

Long-term planning is crucial for housing associations. Finance managers forecast future income and expenditure, considering factors like the apprenticeship levy and construction industry scheme (CIS).

They develop strategies for sustainable growth, such as:

- Diversifying income streams

- Optimising asset management

- Exploring partnerships with private developers

Finance managers also assess the impact of policy changes, such as IR35 and off-payroll working rules. They ensure the association adapts to maintain financial stability.

Measuring Impact and ROI

Measuring impact is essential for housing associations. Finance managers develop key performance indicators (KPIs) to assess financial health and social impact.

They might track:

- Occupancy rates

- Rent collection efficiency

- Tenant satisfaction scores

- Cost per unit of housing provided

ROI calculations help justify investments in new projects or services. Finance managers analyse data to demonstrate value for money to stakeholders.

They also evaluate the effectiveness of different housing models. This informs decisions on future developments and helps optimise the use of resources.

Frequently Asked Questions

Finance managers in housing associations play a crucial role in the social housing sector. Their work involves complex financial tasks, strategic planning, and collaboration with various departments.

How does one become a Finance Manager within a Housing Association?

To become a Finance Manager in a housing association, one typically needs a strong background in accounting and finance. A relevant degree and professional qualifications like ACCA or CIMA are often required. Experience in the social housing sector is valuable.

What are the typical responsibilities of a Finance Director in the housing sector?

A Finance Director in housing oversees budgeting, financial reporting, and risk management. They work closely with the board to set financial strategy and ensure compliance with regulations. Managing funding for new developments is also a key part of their role.

What qualifications are necessary for a career in Housing Finance?

Qualifications for housing finance careers often include accounting certifications like ACA, ACCA, or CIMA. A degree in finance, economics, or business is beneficial. Some roles may require specific housing qualifications or experience.

How does financial management in social housing differ from other sectors?

Social housing finance involves unique challenges like managing government grants and navigating complex regulations. There's a strong focus on balancing social objectives with financial sustainability. Risk management is particularly important due to the sector's social impact.

What are the career prospects for a Finance Manager in the public housing industry?

Career prospects in public housing finance are generally good. As the sector grows, there's demand for skilled finance professionals. Opportunities exist to progress to senior roles like Finance Director or even CEO of housing associations.

In what ways does an Area Housing Manager interface with housing finances?

Area Housing Managers often work with finance teams on rent collection, maintenance budgets, and local spending decisions. They provide valuable input for financial planning based on their on-the-ground knowledge of housing needs and challenges.