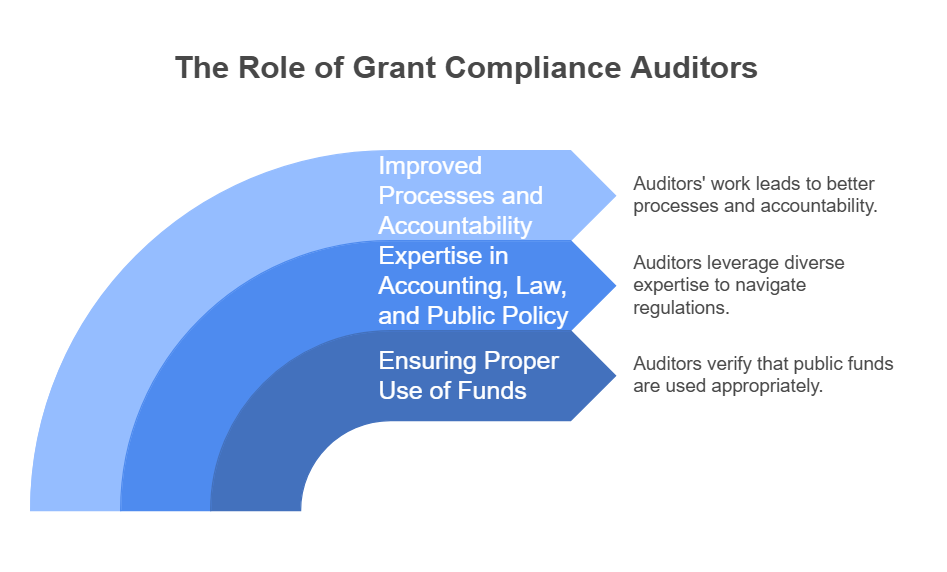

Public sector grant compliance auditors play a vital role in ensuring transparency and accountability in government spending. These professionals scrutinise how public funds are used, verifying that organisations follow proper procedures and regulations when utilising grant money. Their work helps maintain public trust and supports efficient use of taxpayer resources.

Grant compliance auditors provide crucial assurance that public funds are being used appropriately and effectively. They review financial records, assess internal controls, and evaluate compliance with grant terms and conditions. This helps prevent fraud, waste, and mismanagement of public resources. Their expertise spans accounting, law, and public policy, allowing them to navigate complex regulatory frameworks.

These auditors often work for government agencies or independent firms that provide audit services to the public sector. Their findings can lead to improved processes, better resource allocation, and enhanced accountability. By identifying areas for improvement, they help public sector organisations strengthen their grant management practices and achieve better outcomes for the communities they serve.

Key Takeaways

- Grant compliance auditors ensure proper use of public funds and help prevent mismanagement

- They possess expertise in accounting, law, and public policy to navigate complex regulations

- Their work leads to improved processes and enhanced accountability in public sector organisations

Understanding the Public Sector Grant Compliance Auditor Role

Public sector grant compliance auditors play a crucial role in ensuring accountability and proper use of grant funding. They examine grant administration and management processes to verify compliance with regulations and grant agreements.

Core Responsibilities in the Public Sector

Grant compliance auditors review financial records, policies, and procedures to assess if grantees are following the terms of their grant agreements. They check if funds are being used for their intended purposes and if proper documentation is maintained.

These auditors conduct detailed examinations of grant programmes to evaluate efficiency and effectiveness. They may perform on-site visits to inspect project progress and verify reported information.

A key part of their job is to identify any misuse of funds or non-compliance issues. They then provide recommendations for corrective actions and improvements in grant management processes.

Relevant Policy and Regulatory Context

Grant compliance auditors must have a thorough understanding of relevant laws, regulations, and policies governing public sector grants. This includes knowledge of specific grant programme requirements and general government accounting standards.

They need to stay up-to-date with changes in grant regulations and audit standards. This ensures their audits remain relevant and effective in the evolving public sector landscape.

Auditors often refer to guidance from oversight bodies and professional organisations to inform their work. They may use standardised audit procedures and checklists tailored to specific grant programmes.

Typical Stakeholders and Decision-Making Processes

Grant compliance auditors interact with various stakeholders throughout the audit process. These include:

- Grantors (government agencies providing funds)

- Grantees (organisations receiving and using grant funds)

- Programme managers

- Finance departments

- External oversight bodies

Auditors gather information from these stakeholders to gain insights into grant administration and identify potential risk areas. They may conduct interviews, review reports, and analyse financial data.

The audit findings and recommendations are typically presented to senior management and decision-makers. These reports help inform future grant-making decisions and improvements to grant management processes.

Key Qualities and Areas of Expertise

Public sector grant compliance auditors need specific skills and knowledge to excel in their role. These professionals must possess technical expertise, institutional understanding, and adaptability to navigate complex auditing challenges effectively.

Technical/Subject-Matter Expertise

Grant compliance auditors require a strong foundation in auditing principles and practices. They must be well-versed in financial controls, risk management, and fraud prevention techniques. Knowledge of relevant laws, regulations, and grant requirements is crucial.

Auditors should have a keen eye for detail and the ability to analyse complex financial data. They must understand how to plan engagements, assess internal controls, and identify potential non-compliance issues.

Proficiency in audit software and data analysis tools is essential. Auditors should stay current with industry standards and best practices through continuous professional development.

Institutional Knowledge and Networks

Effective grant compliance auditors possess a deep understanding of public sector operations and governance structures. They should be familiar with the unique challenges and constraints faced by government agencies and grant recipients.

Building strong professional networks within the public sector is vital. These connections help auditors stay informed about policy changes, emerging risks, and industry trends.

Auditors must navigate complex organisational hierarchies and communicate effectively with stakeholders at all levels. They should be able to explain audit findings clearly and provide practical recommendations for improvement.

Adaptability and Problem-Solving Skills

Public sector grant compliance auditors must be flexible and resourceful. They often encounter unique situations that require creative problem-solving approaches.

Strong analytical skills are essential for identifying patterns, anomalies, and potential fraud indicators in grant data. Auditors should be able to think critically and consider multiple perspectives when evaluating compliance issues.

Effective communication is crucial, as auditors must convey complex findings to diverse audiences. They should be able to adapt their communication style to suit different stakeholders, from technical experts to non-financial personnel.

Auditors must remain objective and maintain professional scepticism throughout their work. They should be prepared to handle challenging situations, such as potential fraud or serious non-compliance, with integrity and professionalism.

Strategic Value to External Organisations

Public sector grant compliance auditors offer crucial benefits to external organisations. They help navigate complex processes, provide valuable insights, and enhance credibility through rigorous compliance measures.

Navigating Complex Procurement and Funding

Grant compliance auditors help external organisations navigate the intricate world of public sector procurement and funding. They guide entities through the maze of regulations and requirements, ensuring they meet all necessary criteria. These experts assist in:

• Interpreting complex grant guidelines

• Preparing thorough and accurate grant applications

• Developing robust financial management systems

By leveraging their expertise, organisations can avoid costly mistakes and increase their chances of securing valuable public funds. This support is especially critical for smaller entities or those new to public sector funding processes.

Policy and Market Foresight

Compliance auditors provide external organisations with valuable insights into policy trends and market dynamics within the public sector. They offer:

• Analysis of upcoming policy changes

• Forecasts of funding priorities

• Identification of emerging opportunities

This foresight allows organisations to align their strategies with government objectives, positioning themselves favourably for future funding rounds. It also helps them adapt to changing regulatory landscapes, ensuring they remain compliant and competitive in the public sector marketplace.

Enhancing Credibility and Compliance

External organisations can significantly boost their credibility by working with public sector grant compliance auditors. These professionals help:

• Implement robust internal controls

• Ensure transparent financial reporting

• Maintain accurate record-keeping systems

By demonstrating strong compliance practices, organisations can build trust with public sector bodies and local authorities. This enhanced credibility can lead to:

- Increased chances of winning future grants

- Improved relationships with funding bodies

- Reduced risk of reputational damage

Compliance auditors also help safeguard against cyber security threats, protecting sensitive data and further bolstering an organisation's reputation.

Leveraging Public Sector Data and Insights

Grant compliance auditors provide external organisations with access to valuable public sector data and insights. They help organisations:

• Analyse public spending patterns

• Identify sector-specific funding trends

• Benchmark against similar organisations

This information enables more informed decision-making and strategic planning. Organisations can tailor their approaches based on real-world data, increasing their chances of success in securing public funds.

Auditors also assist in interpreting complex public sector reports, translating dense information into actionable insights. This knowledge can be particularly valuable for organisations looking to expand their involvement in public services or NHS projects.

Practical Outcomes and Applications

Public sector grant compliance auditors play a vital role in ensuring proper use of funds and improving programme effectiveness. Their work leads to better financial management, enhanced accountability, and more impactful grant programmes.

Product Development and Service Enhancement

Grant compliance audits help identify areas for improvement in grant-funded products and services. Auditors review financial statements and project outcomes to assess effectiveness. This often reveals opportunities to:

• Refine project goals and objectives

• Streamline processes and reduce waste

• Improve data collection and reporting

• Enhance quality control measures

By highlighting strengths and weaknesses, audits enable grantees to develop more robust products and services. For example, an audit might uncover the need for better tracking of service delivery metrics. This could lead to implementing new software or training staff on data collection methods.

Go-to-Market and Engagement Strategies

Audit findings can inform how organisations engage with stakeholders and market their grant-funded initiatives. Key areas of focus include:

• Improving communication with funders

• Enhancing transparency in reporting

• Developing more effective outreach strategies

• Tailoring services to meet community needs

Auditors may recommend changes to increase programme visibility or boost participation rates. This might involve creating clearer marketing materials or adjusting service delivery models to better reach target populations.

Long-Term Sustainability and Growth

Grant compliance audits play a crucial role in ensuring long-term programme viability. They help organisations:

• Identify potential funding gaps

• Develop more accurate budgets

• Improve financial management practices

• Plan for programme expansion or replication

By reviewing financial statements and grant management processes, auditors can spot inefficiencies and risks. This enables grantees to make informed decisions about future growth and sustainability.

Measuring Impact and ROI

Auditors help organisations develop robust methods for measuring programme impact and return on investment (ROI). This involves:

• Establishing clear performance indicators

• Implementing effective data collection systems

• Analysing outcomes against programme goals

• Comparing results to similar initiatives

By improving impact measurement, audits enable grantees to demonstrate value to funders and stakeholders. This can lead to increased support and funding for successful programmes. It also helps identify areas where resources might be better allocated for maximum impact.

Frequently Asked Questions

Public sector grant compliance auditors play a vital role in ensuring proper use of government funds. Their work involves specific responsibilities, qualifications, and duties that contribute to transparency and accountability in public finance.

What are the primary responsibilities of a public sector auditor?

Public sector auditors examine grant administration and management to ensure controls are working effectively. They review financial records, assess compliance with regulations, and identify potential risks or inefficiencies.

These professionals also provide recommendations for improving grant processes and internal controls. Their work helps maintain public trust in government spending and use of taxpayer funds.

How does one prepare for a compliance audit in the public sector?

Preparation for a compliance audit involves gathering relevant documents and records. This includes grant agreements, financial statements, and reports on programme activities.

Organisations should review their internal controls and processes before the audit. Staff training on audit procedures and grant requirements can also be helpful.

What qualifications are necessary to become a grant auditor?

Grant auditors typically need a bachelor's degree in accounting, finance, or a related field. Many positions require a certified public accountant (CPA) qualification.

Experience in auditing, accounting, or grant management is often necessary. Strong analytical skills and attention to detail are crucial for success in this role.

What are the typical duties involved in grant compliance auditing?

Grant compliance auditors review financial records and reports to ensure accuracy. They check that grant funds are used for approved purposes and within budget limits.

These professionals also assess compliance with grant terms and regulations. They may conduct interviews with staff and review programme activities to verify proper grant implementation.

What does a compliance audit checklist typically include?

A compliance audit checklist often includes verification of financial records and reports. It may cover review of grant agreement terms and conditions to ensure adherence.

The checklist might also include assessment of internal controls, procurement practices, and programme outcomes. Verification of proper documentation for all grant-related activities is usually part of the process.

What are the benefits of a career in public sector audit?

A career in public sector audit offers the chance to contribute to government transparency and accountability. It provides opportunities to work on diverse projects and gain insight into various public programmes.

The role often offers job stability and competitive benefits. There are also opportunities for professional growth and advancement within government agencies or audit firms.