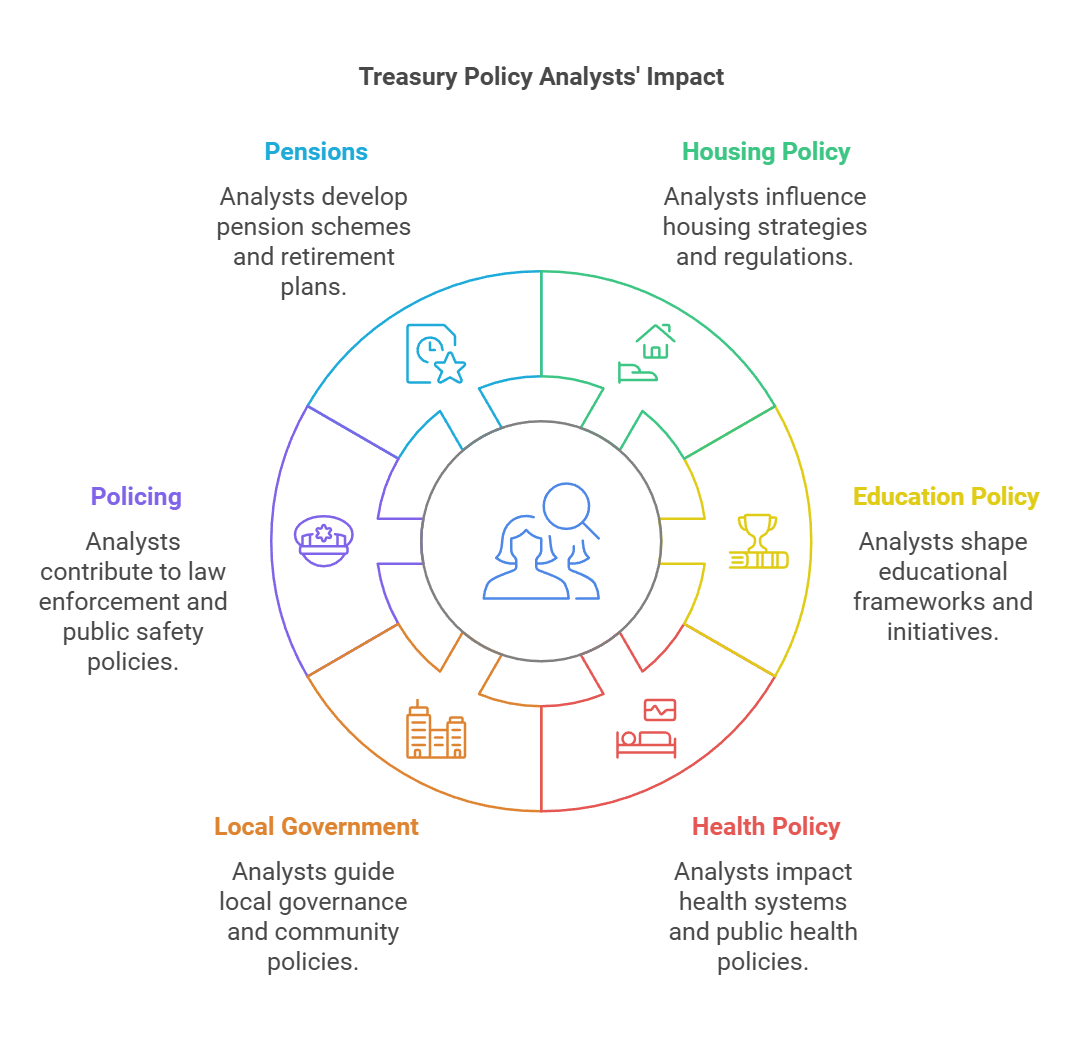

Treasury Policy Analysts play a crucial role in shaping the UK's economic policies. These professionals work at the heart of government, tackling complex issues that affect millions of people. They use their analytical skills to craft policies on housing, education, health, and more, making a real impact on everyday life in Britain.

Working for HM Treasury offers a unique blend of high-profile policy thinking and detailed analysis. Policy Analysts get to work on important policy areas such as local government, policing, and pensions. This role suits those who enjoy using their analytical abilities to develop strategies and narratives that guide government decision-making.

The Treasury offers development opportunities for Policy Analysts in both London and Darlington offices. Graduates can start their policy careers here, gaining valuable experience at the centre of government. The role provides a chance to work on cross-cutting policy issues while honing analytical skills.

Key Takeaways

- Treasury Policy Analysts shape economic policies affecting health, education, and local government

- The role combines high-level policy work with detailed analysis across various sectors

- HM Treasury offers development opportunities for Policy Analysts in London and Darlington

Understanding The Treasury Policy Analyst Role

Treasury Policy Analysts play a crucial role in shaping the UK's financial policies. They work at the heart of government, providing expert advice and analysis to guide economic decisions.

Core Responsibilities in the Public Sector

Treasury Policy Analysts focus on public spending and financial policy. They examine complex economic issues and propose solutions to support the UK economy. Key tasks include:

• Analysing economic data and trends

• Preparing reports and briefings for senior officials

• Evaluating policy options and their potential impacts

• Collaborating with other government departments

These professionals must ensure all recommendations offer value for money. They often work on time-sensitive projects that require quick, accurate analysis.

Relevant Policy and Regulatory Context

Policy Analysts must stay up-to-date with UK and global economic policies. They need a deep understanding of:

• Fiscal and monetary policy

• Financial regulations and legislation

• Public sector budgeting processes

• International economic agreements

HM Treasury operates within a complex regulatory framework. Analysts must navigate these rules while developing innovative policy solutions.

Typical Stakeholders and Decision-Making Processes

Treasury Policy Analysts interact with a wide range of stakeholders. These include:

• Ministers and senior civil servants

• Other government departments

• Financial institutions

• Think tanks and academic experts

Decision-making often involves presenting analysis to senior officials. Analysts must clearly communicate complex ideas to non-experts. They participate in policy discussions and help shape the final recommendations.

The role requires strong diplomatic skills. Analysts must balance different viewpoints and build consensus around policy decisions.

Key Qualities and Areas of Expertise

Treasury Policy Analysts need a mix of technical knowledge, institutional understanding, and problem-solving skills. These qualities help them navigate complex financial issues and contribute to effective policy-making.

Technical/Subject-Matter Expertise

Policy Analysts at HM Treasury must have strong analytical skills to tackle complex economic and financial issues. They should be well-versed in economic theory, public finance, and statistical analysis.

Expertise in specific policy areas like housing, education, or pensions is valuable. Analysts often work on important policy areas that affect daily life in the UK.

Strong writing and communication skills are essential. Analysts must present complex ideas clearly to both experts and non-specialists.

Institutional Knowledge and Networks

Understanding how HM Treasury operates within the broader government is crucial. Analysts should be familiar with the decision-making processes and key stakeholders.

Building strong networks across departments helps in gathering information and coordinating policy efforts. Analysts often work with teams from various government bodies.

Knowledge of parliamentary procedures and policy thinking is important for effective policy development and implementation.

Adaptability and Problem-Solving Skills

The ability to adapt to changing priorities is key. Policy Analysts must be flexible and able to switch between different policy areas as needed.

Strong problem-solving skills are essential. Analysts often face complex issues that require innovative solutions and creative thinking.

They should be comfortable working under pressure and meeting tight deadlines. The fast-paced nature of treasury work demands quick thinking and efficiency.

HM Treasury values diverse and inclusive work environments. Analysts should be able to work effectively in teams with people from various backgrounds.

Strategic Value To External Organisations

Treasury Policy Analysts provide crucial expertise to external organisations in navigating complex financial landscapes. Their insights help shape policy decisions, enhance compliance, and unlock valuable public sector data.

Navigating Complex Procurement And Funding

Treasury Policy Analysts offer vital guidance to external organisations on government procurement processes. They help businesses understand intricate bidding procedures and funding opportunities. This expertise enables companies to craft competitive proposals and secure valuable contracts.

Analysts also provide clarity on public spending strategies, helping organisations align their offerings with government priorities. By decoding Treasury policies, they assist in identifying potential funding streams for various projects.

Their knowledge of financial regulations proves invaluable when navigating grant applications. Analysts can highlight key requirements and pitfalls, increasing the chances of successful bids.

Policy And Market Foresight

Treasury Policy Analysts offer external organisations a window into future government initiatives. Their deep understanding of economic trends and policy directions helps businesses plan strategically.

By interpreting Treasury objectives, analysts can forecast potential market shifts. This foresight allows companies to adapt their products or services to meet emerging needs.

Analysts also provide insights into upcoming regulatory changes. This knowledge helps organisations prepare for new compliance requirements well in advance.

Their expertise in economic modelling can assist in predicting the impact of policy changes on specific industries. This information is crucial for long-term business planning and investment decisions.

Enhancing Credibility And Compliance

Treasury Policy Analysts play a key role in boosting the credibility of external organisations. They ensure that financial reports and projections align with government standards and expectations.

By guiding companies through complex tax regulations, analysts help maintain compliance. This expertise minimises the risk of costly errors or penalties.

Analysts also assist in preparing documentation for government audits or reviews. Their insider knowledge ensures that submissions meet all necessary criteria.

Their understanding of Treasury values helps organisations demonstrate alignment with government priorities. This can be crucial when seeking partnerships or funding opportunities.

Leveraging Public Sector Data And Insights

Treasury Policy Analysts provide external organisations with access to valuable public sector data. They help interpret complex datasets, revealing trends and opportunities that might otherwise be overlooked.

By explaining the context behind government statistics, analysts enable more informed decision-making. This can be particularly useful for businesses looking to enter new markets or expand existing operations.

Analysts also facilitate connections between private sector needs and public sector resources. They can identify potential collaborations that benefit both sides.

Their expertise in economic growth strategies helps organisations align their goals with broader national objectives. This alignment can open doors to new opportunities and partnerships.

Practical Outcomes and Applications

Treasury Policy Analysts shape economic policies and influence financial decisions. Their work leads to tangible results that affect government operations and public welfare.

Product Development and Service Enhancement

Treasury Policy Analysts play a key role in developing new financial products and enhancing existing services. They analyse market trends and economic data to identify areas for improvement. Their insights help create more efficient tax systems and streamlined public spending processes.

These analysts often work on innovative policy areas such as housing, education, and health. They may propose new funding models for public services or design incentives to boost business innovation. Their recommendations can lead to more effective government programmes and better value for taxpayers' money.

By collaborating with various departments, analysts ensure that new policies align with broader economic goals. This approach helps create cohesive strategies that address multiple challenges simultaneously.

Go-to-Market and Engagement Strategies

Policy Analysts develop strategies to implement new policies and engage stakeholders. They craft clear communication plans to explain complex economic decisions to the public and other government bodies.

These professionals often prepare briefings for ministers and senior officials. They help track and respond to cost-of-living issues, working closely with policy teams and parliamentary branches. This ensures that government responses are timely and well-informed.

Analysts may also design public consultations to gather feedback on proposed policies. They use this input to refine strategies and build public support for new initiatives. Their work helps bridge the gap between policymakers and the general public.

Long-Term Sustainability and Growth

Treasury Policy Analysts focus on creating sustainable economic growth. They assess long-term trends and potential risks to the UK economy. This foresight helps shape policies that promote stability and resilience.

These professionals work to achieve strong and sustainable economic growth. They may analyse the impact of global events on the UK's financial outlook or propose measures to boost productivity.

Analysts often study demographic shifts and technological changes. They use these insights to develop policies that prepare the economy for future challenges. Their work helps ensure that government strategies remain relevant and effective in a changing world.

Measuring Impact and ROI

Policy Analysts develop methods to measure the impact of economic policies. They create metrics to assess return on investment (ROI) for government programmes. This helps ensure that public funds are used effectively.

These professionals use data analysis tools to track policy outcomes. They may study employment rates, GDP growth, or inflation figures to gauge the success of economic initiatives. Their findings help guide future policy decisions and improve existing programmes.

Analysts often collaborate with statisticians and economists to develop robust evaluation frameworks. They ensure that policy assessments are based on solid evidence and sound methodology. This approach enhances the credibility of government economic strategies.

Frequently Asked Questions

Policy Analyst roles at HM Treasury involve crucial responsibilities and offer unique career opportunities. The position requires specific qualifications and skills, fitting within the broader civil service structure.

What are the primary responsibilities of a Policy Analyst at HM Treasury?

Policy Analysts at HM Treasury work on important policy areas like housing, education, and health. They simplify complex thoughts and processes, using clear language to explain policies.

These analysts track and support the department in responding to cost-of-living issues. They work closely with policy teams, private offices, and the parliamentary branch.

Can you outline the career progression opportunities within HM Treasury for a Policy Analyst?

HM Treasury offers a Graduate Development Programme for Policy Advisers. This programme includes two 18-month placements, allowing analysts to develop expertise in specific policy areas.

Career progression can lead to Senior Adviser roles. The Treasury provides opportunities to work on various policy areas, supporting professional growth.

How does the remuneration for a Treasury Policy Analyst at HM Treasury compare within the UK sector?

HM Treasury offers competitive salaries for Policy Analysts. While exact figures vary, the remuneration is typically in line with other civil service roles.

The total package often includes benefits such as pension schemes and flexible working arrangements.

What are the qualifications and skills required to become a Policy Analyst at HM Treasury?

Policy Analysts need strong analytical skills and the ability to simplify complex information. A relevant degree is often required, though specific subject areas may vary.

The application process includes online tests, such as a situational judgement test (SJT) and written questions. These assess candidates' problem-solving and communication skills.

How does working for HM Treasury as a Policy Analyst fit within the wider civil service framework?

HM Treasury is a key department within the UK civil service. Policy Analysts here play a crucial role in shaping national economic policy.

Unlike the broader Civil Service Fast Stream, the Treasury's Graduate Programme is department-specific. This allows analysts to focus on Treasury-related policy areas.

What feedback do employees typically give regarding their experience working at HM Treasury?

Employees often appreciate the opportunity to work on policies that directly impact UK citizens. They value the chance to develop expertise in specific policy areas.

Some find the work challenging but rewarding. The collaborative environment and opportunities for professional development are frequently mentioned positives.